Annuity Calculator Edward Jones 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Understanding annuities is crucial for anyone seeking a secure retirement, and Edward Jones offers a comprehensive range of annuity products to meet your individual needs.

Annuities can be classified as either qualified or nonqualified. If you’re curious about the different types of annuities, you can read more about Is An Annuity Qualified Or Nonqualified 2024. This article will explain the distinction between qualified and nonqualified annuities.

This calculator empowers you to explore different scenarios, visualize potential outcomes, and make informed decisions about your financial future.

From defining annuities and their purpose to explaining the different types available, this guide provides a thorough overview of the subject. It delves into the advantages and disadvantages of annuities, highlights Edward Jones’s offerings, and discusses the key factors to consider when choosing an annuity.

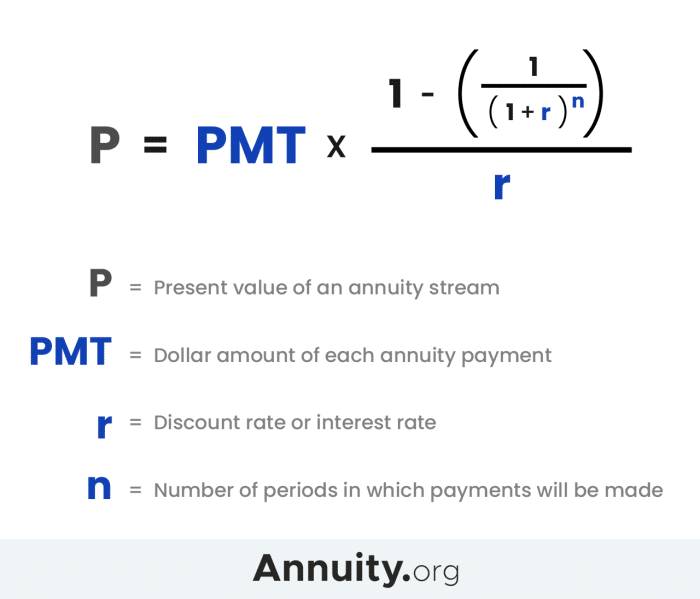

Annuities can be calculated using specific formulas. If you’re interested in learning about the formulas used to calculate annuities, you can find more information on Formula Annuity Certain 2024. This article will discuss the formulas used to calculate annuity payments.

You’ll also discover alternative investment options and learn how to use an annuity calculator effectively.

Annuities are often associated with life insurance, and they can be a valuable tool for retirement planning. If you’re interested in learning more about how annuities relate to life insurance, you can check out An Annuity Is A Life Insurance Product That 2024.

This article will explain the connection between annuities and life insurance.

Introduction to Annuities

An annuity is a financial product that provides a stream of regular payments over a set period of time. It is often used as a retirement income strategy, but can also be used for other purposes, such as saving for a child’s education or providing a guaranteed income stream for a loved one.

One common question people have about annuities is whether they are taxable. If you’re curious about the tax implications of annuities, you can find more information on Is Annuity From Lic Taxable 2024. This article will discuss the taxability of annuities and how it works.

Annuities are offered by insurance companies and can be a valuable tool for individuals seeking to secure their financial future.

Annuities are designed to provide a steady stream of income over a set period. If you’re interested in learning more about the nature of annuity payments, you can read about An Annuity Is A Stream Of 2024. This article will explain how annuities work and the nature of their payments.

Types of Annuities

There are various types of annuities available, each with its own features and benefits. The most common types include:

- Fixed Annuities:These provide a guaranteed interest rate for a specific period, ensuring predictable income payments. They offer stability and protection against market fluctuations.

- Variable Annuities:These offer the potential for higher returns, but also carry higher risk. The interest rate and payments are linked to the performance of underlying investments, such as stocks or mutual funds.

- Immediate Annuities:Payments begin immediately after the purchase of the annuity. These are suitable for those seeking an immediate income stream.

- Deferred Annuities:Payments are delayed until a later date, allowing for growth potential before income begins. These are often used for retirement savings.

Advantages and Disadvantages of Annuities

Annuities offer several advantages, including:

- Guaranteed Income:Fixed annuities provide guaranteed income payments, offering financial security and peace of mind.

- Tax-Deferred Growth:Earnings within an annuity grow tax-deferred, potentially leading to greater accumulation over time.

- Protection from Market Volatility:Fixed annuities offer protection against market fluctuations, providing stability during periods of economic uncertainty.

However, annuities also have some disadvantages, including:

- Limited Liquidity:Accessing funds within an annuity can be restricted, potentially limiting flexibility.

- Fees and Expenses:Annuities typically involve fees and expenses, which can impact returns.

- Potential for Lower Returns:Fixed annuities may offer lower returns compared to other investment options.

Edward Jones and Annuity Products

Edward Jones is a well-established financial services firm known for its personalized approach to investing. The company offers a range of annuity products designed to meet diverse financial needs. Their annuity offerings are characterized by:

Key Features of Edward Jones Annuities, Annuity Calculator Edward Jones 2024

- Variety of Options:Edward Jones provides a selection of fixed, variable, and indexed annuities, catering to different risk tolerances and investment goals.

- Competitive Rates:Edward Jones strives to offer competitive interest rates and investment options within its annuity products.

- Experienced Financial Advisors:Edward Jones financial advisors are highly trained and experienced in guiding clients through annuity choices, ensuring informed decision-making.

- Personalized Service:Edward Jones emphasizes a personalized approach, working closely with clients to understand their financial goals and develop customized annuity solutions.

Benefits of Choosing Edward Jones for Annuities

Choosing Edward Jones for annuity products offers several advantages:

- Trustworthy Reputation:Edward Jones has a strong reputation for integrity and financial stability, providing confidence in their annuity offerings.

- Comprehensive Financial Planning:Edward Jones financial advisors can provide comprehensive financial planning, incorporating annuities as part of a holistic strategy.

- Long-Term Relationships:Edward Jones focuses on building long-term relationships with clients, providing ongoing support and guidance throughout their financial journey.

Using an Annuity Calculator

An annuity calculator is a valuable tool that helps estimate the potential income stream from an annuity based on various factors, such as the initial investment amount, interest rate, and payment period. This tool can provide insights into the future value of an annuity and its potential impact on your retirement planning.

Many people are curious about how annuities compare to other retirement savings options like 401(k)s. If you’re interested in learning more about the differences between annuities and 401(k)s, you can read more about Is Annuity Better Than 401k 2024.

This article will compare the two options and discuss their advantages and disadvantages.

Functionality of an Annuity Calculator

An annuity calculator typically requires inputting the following information:

- Investment Amount:The initial amount you plan to invest in the annuity.

- Interest Rate:The annual interest rate offered by the annuity.

- Payment Period:The duration of the annuity, either in years or months.

- Payment Frequency:How often you would like to receive payments (e.g., monthly, quarterly, annually).

Based on this information, the calculator projects the estimated future value of the annuity and the potential income stream you can expect to receive.

The interest rate is a crucial factor in annuity calculations. If you’re interested in learning how to calculate the interest rate for an annuity, you can find information on Calculating Annuity Interest Rate 2024. This article will provide a guide to calculating the interest rate for annuities.

Step-by-Step Guide to Using an Annuity Calculator

- Identify your investment amount:Determine the initial amount you plan to invest in the annuity.

- Choose an interest rate:Research and select an interest rate based on the type of annuity you are considering.

- Specify the payment period:Define the duration of the annuity, either in years or months.

- Select a payment frequency:Decide how often you want to receive payments (e.g., monthly, quarterly, annually).

- Input the data into the calculator:Enter the relevant information into the annuity calculator.

- Review the results:Analyze the projected future value and income stream to understand the potential benefits of the annuity.

Examples of Annuity Calculator Scenarios

Here are some examples of how an annuity calculator can be used in different scenarios:

- Retirement planning:Calculate the potential income stream from an annuity to supplement your retirement savings.

- Long-term care:Estimate the income stream from an annuity to cover potential long-term care expenses.

- Estate planning:Determine the potential income stream from an annuity to provide for beneficiaries after your passing.

Factors to Consider When Choosing an Annuity: Annuity Calculator Edward Jones 2024

Selecting the right annuity involves careful consideration of several factors that align with your individual circumstances and financial goals. These factors include:

Key Factors to Consider

- Financial Goals and Risk Tolerance:Define your financial goals and assess your risk tolerance to determine the appropriate annuity type and investment strategy.

- Age and Expected Lifespan:Consider your age and expected lifespan to choose an annuity that aligns with your income needs throughout your retirement years.

- Current Interest Rate Environment:Evaluate the current interest rate environment to assess the potential returns offered by different annuity types.

- Fees and Charges:Carefully review the fees and charges associated with the annuity to understand their impact on your overall returns.

How These Factors Influence Your Decision

Understanding these factors is crucial for making informed annuity decisions. For instance, if you are risk-averse and seeking guaranteed income, a fixed annuity might be suitable. However, if you are comfortable with some risk and seek higher potential returns, a variable annuity could be an option.

Additionally, considering your age and expected lifespan can help you choose an annuity with a payment period that aligns with your income needs throughout retirement.

As mentioned earlier, annuities are often linked to life insurance. If you’re wondering whether an annuity is a type of life insurance, you can find the answer on Is Annuity Life Insurance 2024. This article will discuss the relationship between annuities and life insurance.

Alternatives to Annuities

While annuities can be a valuable tool for retirement planning, there are alternative investment options that may also be suitable. These alternatives offer different risk-reward profiles and should be considered alongside annuities.

The discount factor is an important concept in annuity calculations. If you’re interested in learning how to calculate the discount factor, you can find information on Calculate Annuity Discount Factor 2024. This article will provide a step-by-step guide to calculating the discount factor.

Alternative Investment Options

- Traditional IRAs and Roth IRAs:These retirement savings accounts offer tax advantages and flexibility in investment choices.

- 401(k)s and 403(b)s:Employer-sponsored retirement plans that offer tax advantages and potential employer matching contributions.

- Stocks and Bonds:Investing in stocks and bonds can provide potential for growth and income, but also involves market risk.

- Real Estate:Investing in real estate can offer potential for appreciation and rental income, but also requires significant capital and management.

Comparing Alternatives to Annuities

Each alternative investment option has its own advantages and disadvantages. Traditional IRAs and Roth IRAs offer tax benefits and flexibility, while 401(k)s and 403(b)s provide potential employer matching contributions. Stocks and bonds offer potential for growth but carry market risk, while real estate can provide appreciation and income but requires significant capital and management.

It’s important to understand the distinction between annuities and life insurance. If you’re wondering about the similarities and differences between these two financial products, you can check out Is Annuity The Same As Life Insurance 2024. This article will provide a clear explanation of how annuities and life insurance differ.

Annuities, on the other hand, offer guaranteed income and protection from market volatility but may have limited liquidity and higher fees.

One of the key features of annuities is that they provide income. If you’re wondering about the income-generating aspects of annuities, you can find more information on Annuity Is Income 2024. This article will discuss how annuities generate income and their role in retirement planning.

Pros and Cons of Each Option

When considering alternatives to annuities, it’s important to weigh the pros and cons of each option. For example, traditional IRAs and Roth IRAs offer tax advantages and flexibility, but they don’t provide guaranteed income or protection from market volatility. Stocks and bonds offer potential for growth but carry market risk, while real estate can provide appreciation and income but requires significant capital and management.

Annuity is a financial product that provides a stream of regular payments for a set period of time. If you’re curious about how annuities work, you can learn more about Annuity Is Ordinary 2024. This can help you understand the basics of annuities, including how they work and what types of annuities are available.

Annuities offer guaranteed income and protection from market volatility but may have limited liquidity and higher fees.

Annuities can be a component of retirement plans, and they can be integrated with 401(k)s. If you’re interested in learning more about how annuities work within 401(k)s, you can check out Annuity 401k 2024. This article will provide information about annuities and their role in 401(k) plans.

Illustrative Examples

To illustrate the potential outcomes of different annuity scenarios, consider the following examples:

| Scenario | Investment Amount | Interest Rate | Time Horizon | Payment Option | Projected Outcome |

|---|---|---|---|---|---|

| Scenario 1 | $100,000 | 4% | 20 years | Monthly | Estimated monthly payment of $600 |

| Scenario 2 | $200,000 | 5% | 15 years | Quarterly | Estimated quarterly payment of $4,000 |

| Scenario 3 | $50,000 | 3% | 10 years | Annually | Estimated annual payment of $6,000 |

These examples demonstrate how varying investment amounts, interest rates, time horizons, and payment options can influence the projected outcomes of annuities. It’s important to note that these are just illustrative examples and actual results may vary based on individual circumstances and market conditions.

When considering an annuity, it’s essential to get quotes from different providers to compare options. If you’re looking for annuity quotes, you can visit Annuity Quotes 2024 for information and resources.

Consult with a Financial Advisor

Before making any investment decisions, it is crucial to consult with a qualified financial advisor. A financial advisor can provide personalized guidance and help you determine the best annuity solution for your individual needs and circumstances.

How a Financial Advisor Can Help

A financial advisor can:

- Assess your financial goals:Understand your financial objectives and retirement planning needs.

- Evaluate your risk tolerance:Determine your comfort level with investment risk.

- Review your overall financial situation:Analyze your income, expenses, assets, and liabilities.

- Compare different annuity options:Present a range of annuity products that align with your goals and risk tolerance.

- Provide ongoing support and guidance:Offer ongoing support and guidance as your financial needs evolve.

Role of Edward Jones Financial Advisors

Edward Jones financial advisors are dedicated to providing personalized financial advice and guidance. They can help you understand the complexities of annuities, explore different options, and make informed decisions that align with your financial goals.

Closing Summary

As you navigate the world of annuities, remember that seeking professional guidance is essential. A financial advisor from Edward Jones can help you determine the best annuity solution for your specific needs and goals. By combining the power of an annuity calculator with the expertise of a financial advisor, you can confidently create a personalized retirement plan that sets you up for a secure and comfortable future.

Essential Questionnaire

Is the Annuity Calculator Edward Jones 2024 free to use?

Yes, the annuity calculator is free to use and readily accessible on Edward Jones’s website.

What is the minimum investment amount required for an Edward Jones annuity?

The minimum investment amount varies depending on the specific annuity product you choose. It’s best to consult with an Edward Jones financial advisor to determine the minimum investment for your desired annuity.

What are the potential risks associated with annuities?

Like any investment, annuities carry some risks. The value of variable annuities can fluctuate, and fixed annuities may not keep pace with inflation. It’s crucial to carefully consider your risk tolerance before making any decisions.

To understand how annuities work, it’s important to know what they are. An annuity is essentially a contract that provides a series of payments over a period of time. If you’re wondering about the definition of an annuity, you can read more about Annuity What Is The Meaning 2024.

This article will explain the meaning of an annuity and its key features.