Annuity Calculator CNN 2024 is your comprehensive guide to understanding and utilizing annuities for retirement planning. This tool provides a clear and straightforward way to explore the potential benefits of annuities, allowing you to make informed decisions about your financial future.

Annuity contracts can be complex, so it’s important to understand the basics before making any decisions. Annuity Is Variable 2024 is a great place to start, as it explains the different types of annuities and their potential benefits. You can also use online tools to get Annuity Quotes 2024 to compare rates and features.

Annuities, essentially financial contracts, offer a guaranteed stream of income for a specific period. This income can be crucial for ensuring a secure retirement, especially in an era of uncertain market conditions. Annuity calculators, like those featured on CNN, help you visualize how different annuity options might impact your retirement income.

Understanding Annuities

Annuities are financial products that provide a stream of regular payments over a set period of time. They are often used to provide a steady income stream during retirement, but they can also be used for other purposes, such as funding college expenses or providing income protection in case of disability.

If you’re considering an annuity, you might also be wondering about how it compares to an IRA. Annuity V Ira 2024 will help you understand the differences between these two retirement savings options. Is Annuity Income Capital Gains 2024 explains how annuity income is taxed, which can be helpful when making your decision.

Types of Annuities

There are many different types of annuities, each with its own features and benefits. Here are some of the most common types:

- Fixed annuitiesprovide a guaranteed rate of return, meaning that the payments you receive will not fluctuate. This type of annuity is typically best for people who are looking for stability and predictability.

- Variable annuitiesoffer the potential for higher returns, but they also come with more risk. The payments you receive will depend on the performance of the underlying investments.

- Immediate annuitiesbegin paying out immediately after you purchase them. This type of annuity is often used to provide income during retirement.

- Deferred annuitiesstart paying out at a later date, such as when you reach retirement age. This type of annuity can be used to save for retirement or other long-term goals.

Examples of Annuity Use

Annuities can be beneficial in a variety of situations. Here are a few examples:

- Retirement income:Annuities can provide a steady stream of income during retirement, helping you to cover your living expenses and maintain your lifestyle.

- Income protection:Annuities can provide income protection in case of disability or death. This can help to ensure that your loved ones are financially secure.

- College savings:Annuities can be used to save for college expenses. This can help you to reduce the financial burden of higher education.

How Annuity Calculators Work

Annuity calculators are online tools that can help you estimate the payments you will receive from an annuity. They take into account various factors, such as the amount of your initial investment, the interest rate, and the length of the payout period.

Annuity contracts can be part of a larger financial plan, such as the National Pension System (NPS). Annuity Nps 2024 explains how annuities fit into the NPS. 5 Annuity 2024 provides a list of five different types of annuities that you might consider.

Key Inputs and Outputs

Annuity calculators typically require you to input the following information:

- Principal amount:The amount of money you plan to invest in the annuity.

- Interest rate:The annual interest rate that the annuity will earn.

- Payment period:The length of time over which you will receive payments.

- Payment frequency:How often you will receive payments (e.g., monthly, annually).

Based on these inputs, the calculator will then provide you with an estimate of the following:

- Total payments:The total amount of money you will receive over the payout period.

- Monthly payments:The amount of money you will receive each month.

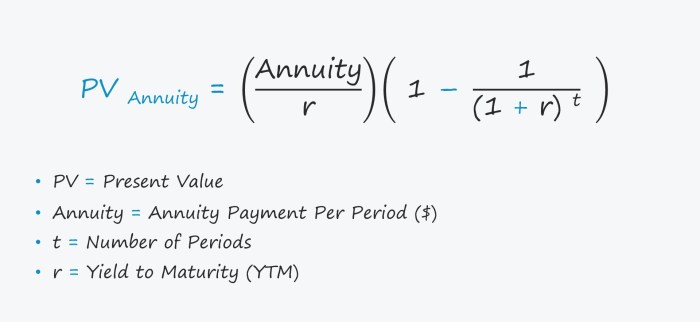

- Present value:The current value of the annuity, taking into account the future payments and interest rate.

Factors Affecting Calculations

Several factors can affect the results of an annuity calculation, including:

- Interest rates:Higher interest rates will generally lead to higher annuity payments.

- Payment periods:Longer payment periods will generally lead to lower monthly payments, but higher total payments.

- Life expectancy:If you have a longer life expectancy, you may receive more annuity payments over your lifetime.

Using an Annuity Calculator

Using an annuity calculator is relatively simple. Most calculators have a user-friendly interface and require you to enter only a few basic pieces of information. Here are the general steps:

- Find a reputable annuity calculator online.There are many free annuity calculators available on the web.

- Enter the required information.This typically includes the principal amount, interest rate, payment period, and payment frequency.

- Review the results.The calculator will provide you with an estimate of your annuity payments and other relevant information.

The Role of CNN in Annuity Coverage

CNN has been a prominent source of news and information on a wide range of financial topics, including annuities. In recent years, CNN has published numerous articles and reports that explore the complexities of annuities and their role in retirement planning.

When calculating the potential income from an annuity, it’s helpful to have a good understanding of the different factors involved. Calculating Annuity 2024 provides a guide to the process, while Annuity 1000 Per Month 2024 gives you a specific example to work with.

1 An Annuity Is 2024 provides a basic overview of what an annuity is and how it works.

CNN’s Annuity Coverage

CNN’s coverage of annuities has focused on various aspects, including:

- Types of annuities:CNN has provided detailed explanations of different annuity types, highlighting their features, benefits, and risks.

- Annuity trends:CNN has reported on emerging trends in the annuity market, such as the growing popularity of variable annuities and the impact of interest rate changes on annuity products.

- Annuity regulations:CNN has covered developments in annuity regulations, including changes to the rules governing the sale and distribution of annuities.

- Annuity scams:CNN has warned consumers about annuity scams, providing tips on how to avoid fraudulent schemes.

Key Trends and Insights

Through its coverage, CNN has highlighted several key trends and insights regarding annuities:

- Increased demand for guaranteed income:CNN has reported on the growing demand for annuities among retirees who are seeking guaranteed income streams.

- The importance of financial planning:CNN has emphasized the importance of incorporating annuities into a comprehensive financial plan.

- The need for consumer education:CNN has recognized the need for greater consumer education about annuities, particularly regarding the risks and complexities associated with these products.

The Importance of Financial Planning

Financial planning is crucial for achieving your financial goals, especially during retirement. A well-structured financial plan can help you make informed decisions about your savings, investments, and spending, ensuring you have enough resources to live comfortably throughout your retirement years.

Incorporating Annuities into a Financial Plan, Annuity Calculator Cnn 2024

Annuities can play a valuable role in a comprehensive financial plan. They can help you achieve a variety of retirement planning objectives, such as:

- Generating a steady income stream:Annuities can provide a reliable source of income during retirement, helping you to cover your living expenses.

- Protecting against outliving your savings:Annuities can provide a guaranteed income stream for life, helping to ensure that you don’t run out of money in retirement.

- Passing on wealth to heirs:Some annuities offer death benefits that can be passed on to your beneficiaries.

Tips for Using Annuities in Retirement Planning

If you are considering using annuities in your retirement planning, here are some tips:

- Consult with a financial advisor:A financial advisor can help you determine if an annuity is right for you and can recommend the best type of annuity for your needs and circumstances.

- Understand the terms and conditions:Carefully review the terms and conditions of any annuity contract before you sign it.

- Consider the risks:Annuities can involve risks, such as the potential for low returns or the loss of your principal. It is important to weigh the risks and rewards before investing in an annuity.

- Shop around:Compare annuity products from different providers to find the best rates and terms.

Current Trends in Annuity Markets

The annuity market is constantly evolving, driven by factors such as interest rates, economic conditions, and consumer demand. Recent trends in the annuity market include:

Emerging Trends

- Growth of variable annuities:Variable annuities have gained popularity in recent years, driven by their potential for higher returns. However, these products also come with more risk.

- Increased focus on guaranteed income:Consumers are increasingly seeking annuities that provide guaranteed income streams, particularly in a low-interest rate environment.

- Innovation in annuity products:Insurers are developing new and innovative annuity products to meet the evolving needs of consumers. These products may offer features such as longevity protection or the ability to withdraw a portion of your principal.

Impact of Interest Rates and Economic Conditions

Interest rates and economic conditions can have a significant impact on annuity products. For example, rising interest rates can lead to higher annuity payments, while economic uncertainty can make consumers more cautious about investing in annuities.

New and Innovative Annuity Products

Several new and innovative annuity products have emerged in recent years, including:

- Indexed annuities:These annuities offer returns that are linked to the performance of a specific index, such as the S&P 500.

- Guaranteed lifetime withdrawal benefits (GLWBs):These annuities provide a guaranteed minimum income stream for life, even if the underlying investments lose value.

- Income annuities:These annuities provide a guaranteed income stream for life, but you give up ownership of the principal.

Risks and Considerations: Annuity Calculator Cnn 2024

While annuities can provide a valuable source of income during retirement, they also come with certain risks and considerations that you should be aware of.

Annuity contracts can sometimes be structured like a loan. Annuity Is Loan 2024 explains how this works, and Annuity Due Is 2024 highlights the differences between an annuity due and an ordinary annuity. Annuity Which Is Best 2024 can help you compare different types of annuities to find the one that best fits your needs.

Potential Risks

- Low returns:Annuities may not provide high returns, especially in a low-interest rate environment.

- Loss of principal:Some annuities, such as variable annuities, involve the risk of losing your principal investment.

- Fees and expenses:Annuities can have high fees and expenses, which can reduce your overall returns.

- Liquidity:Annuities are generally illiquid, meaning that you may not be able to easily access your money if you need it.

- Inflation risk:The purchasing power of your annuity payments may erode over time due to inflation.

Importance of Understanding Terms and Conditions

It is crucial to understand the terms and conditions of any annuity contract before you sign it. This includes understanding the following:

- The type of annuity:Make sure you understand the features and benefits of the specific type of annuity you are considering.

- The interest rate:Understand how the interest rate will be calculated and how it may fluctuate over time.

- The payment period:Understand the length of time over which you will receive payments.

- Fees and expenses:Understand all the fees and expenses associated with the annuity.

- Death benefits:Understand any death benefits that may be available with the annuity.

Choosing the Right Annuity

Choosing the right annuity for your needs and circumstances can be a complex process. Here are some factors to consider:

- Your financial goals:What are you trying to achieve with the annuity? Are you seeking a guaranteed income stream, protection against outliving your savings, or a way to pass on wealth to your heirs?

- Your risk tolerance:How much risk are you willing to take with your investment? Variable annuities offer the potential for higher returns, but they also come with more risk.

- Your time horizon:How long do you plan to live off the annuity payments? If you have a longer time horizon, you may be able to afford to take on more risk.

- Your age and health:Your age and health can affect your life expectancy, which can impact the length of time you will receive annuity payments.

Resources and Tools

There are a number of resources available to help you learn more about annuities and make informed decisions about whether they are right for you.

Annuity contracts are often tied to life insurance products. Annuity Is A Life Insurance Product That 2024 explains this connection in detail. Annuity Unit Is 2024 provides information about the units used in annuity calculations. Annuity 3 Year Rates 2024 gives you an idea of the current rates for 3-year annuities.

Reputable Sources for Information

- Financial Industry Regulatory Authority (FINRA):FINRA is a self-regulatory organization for the securities industry. It provides a wealth of information on annuities, including investor alerts and educational materials.

- National Association of Insurance Commissioners (NAIC):The NAIC is a non-profit organization that represents insurance commissioners in the United States. It provides information on insurance products, including annuities.

- The Securities and Exchange Commission (SEC):The SEC is the federal agency responsible for regulating the securities industry. It provides information on annuities, including investor protection tips.

Online Annuity Calculators

Many online annuity calculators are available to help you estimate the payments you will receive from an annuity. Some popular annuity calculators include:

- Bankrate.com:Bankrate.com offers a free annuity calculator that allows you to compare different annuity products.

- Annuity.org:Annuity.org provides a comprehensive annuity calculator that takes into account a variety of factors, such as your age, life expectancy, and risk tolerance.

- Investopedia:Investopedia offers a free annuity calculator that allows you to estimate the payments you will receive from a fixed or variable annuity.

Professional Financial Advice

If you are considering using annuities in your retirement planning, it is important to seek professional financial advice. A financial advisor can help you determine if an annuity is right for you and can recommend the best type of annuity for your needs and circumstances.

Last Point

As you delve deeper into the world of annuities, remember that seeking professional financial advice is essential. An expert can help you tailor a retirement plan that aligns with your individual needs and goals, ensuring you make the most of your savings and investments.

With a well-crafted plan and a solid understanding of annuities, you can approach retirement with confidence and financial security.

Questions Often Asked

How accurate are annuity calculators?

Annuity calculators are based on specific assumptions and may not always reflect actual outcomes. It’s crucial to consult with a financial advisor for personalized guidance.

Are annuities suitable for everyone?

Annuities are not a one-size-fits-all solution. They can be beneficial for some individuals but may not be suitable for others. A financial advisor can help you determine if annuities are right for your specific situation.

What are the main risks associated with annuities?

Annuities can carry risks, such as the potential for lower returns than other investments, limitations on access to funds, and the risk of the insurance company failing.