Annuity Calculator Based On Life Expectancy 2024: Planning for a Secure Future, this guide delves into the crucial role life expectancy plays in securing your financial future. As we navigate an era of evolving healthcare and lifestyle trends, understanding how long we may live is essential for making informed retirement planning decisions.

Annuity products are complex, so it’s helpful to have a general understanding of how they work. For a comprehensive overview of annuities, you can check out Annuity General 2024.

Annuity calculators, utilizing the latest life expectancy data, offer a powerful tool for projecting future income needs and ensuring a comfortable retirement.

Thinking about investing $300,000 in an annuity? There are various types of annuities available, each with its own features and potential benefits. You can learn more about annuities for $300,000 on Annuity 300k 2024.

This comprehensive guide explores the intricacies of annuity calculators, taking into account the latest life expectancy trends and their impact on retirement planning. We will discuss the different types of annuities, their calculation methods, and how to utilize these calculators effectively.

Annuity payments are often calculated based on mortality tables. You can find more information about the 2000 Mortality Table on Annuity 2000 Mortality Table 2024.

Furthermore, we will examine key factors to consider when choosing an annuity, including the annuity provider, contract terms, and tax implications.

There are different types of annuities, each with its own features and benefits. If you’re looking for information about a specific type of annuity, you can find more details on 9 Annuity 2024.

Introduction to Annuity Calculators

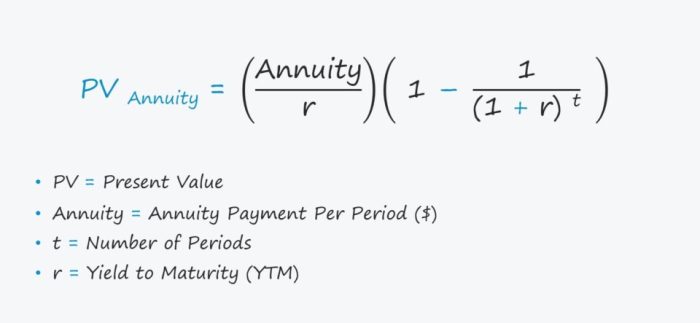

Annuity calculators are powerful tools that help individuals estimate and plan for their future financial needs, particularly during retirement. They work by calculating the amount of income an annuity can provide based on factors like the initial investment, interest rates, and the individual’s life expectancy.

If you’re looking for an annuity that provides a specific rate of return, you might be interested in a 7% annuity. To learn more about 7% annuity returns, you can visit 7 Annuity Return 2024.

The Role of Life Expectancy in Annuity Calculations, Annuity Calculator Based On Life Expectancy 2024

Life expectancy plays a crucial role in annuity calculations. It determines the duration for which the annuity payments will be made. A longer life expectancy means the annuity payments will need to stretch over a longer period, potentially requiring a larger initial investment or a lower payout amount to ensure sustainability.

Annuities can be a valuable tool for retirement planning, but it’s important to choose the right type of annuity for your needs. You can find more information about annuities on Annuity M 2024.

Factors Influencing Life Expectancy

Several factors contribute to an individual’s life expectancy. These include:

- Genetics:Family history and inherited traits can influence longevity.

- Lifestyle:Factors like diet, exercise, smoking habits, and alcohol consumption significantly impact health and life expectancy.

- Healthcare:Access to quality healthcare, preventive screenings, and medical advancements contribute to longer life spans.

- Socioeconomic Factors:Income level, education, and access to resources can influence health outcomes and life expectancy.

Life Expectancy Trends in 2024

Life expectancy trends in 2024 continue to be influenced by a combination of factors, including advancements in healthcare, lifestyle changes, and socioeconomic conditions.

Annuity certain is a type of annuity that provides guaranteed payments for a specific period. If you’re interested in learning more about this type of annuity, you can find additional information on Annuity Certain Is An Example Of 2024.

Key Factors Impacting Life Expectancy Trends

- Healthcare Advancements:Ongoing research and development in medicine and technology have led to improved treatments for various diseases, contributing to longer life spans.

- Lifestyle Changes:Increased awareness of healthy living, including better nutrition, exercise, and smoking cessation, has positively impacted life expectancy.

- Socioeconomic Factors:Factors like income inequality, access to healthcare, and environmental conditions can impact life expectancy across different demographics and regions.

Life Expectancy Trends Across Demographics and Regions

Life expectancy trends vary across different demographics and regions. For instance, life expectancy is generally higher in developed countries with advanced healthcare systems and higher living standards. However, disparities exist within countries based on socioeconomic factors and access to healthcare.

Annuity products can be a complex subject, and it’s often helpful to have a clear understanding of the key concepts. You can find a series of multiple-choice questions about annuities on Annuity Is Mcq 2024.

Types of Annuities and Their Calculation Methods

Annuities come in various types, each with its own calculation method and features. Understanding these differences is crucial for choosing the right annuity for individual needs.

Types of Annuities

- Fixed Annuities:These annuities provide a guaranteed fixed payment for life, regardless of market fluctuations. The calculation is based on a fixed interest rate and the initial investment amount.

- Variable Annuities:These annuities offer payments that fluctuate based on the performance of underlying investments. The calculation involves considering the initial investment, investment growth, and the chosen investment options.

- Immediate Annuities:Payments begin immediately after the initial investment is made. The calculation involves determining the present value of the future payments based on the interest rate and the chosen payment frequency.

- Deferred Annuities:Payments begin at a future date, allowing the investment to grow over time. The calculation involves considering the initial investment, interest rate, and the time period until the payments start.

Key Variables Affecting Annuity Calculations

Several key variables influence annuity calculations, including:

- Interest Rates:The interest rate applied to the annuity determines the growth of the investment and the amount of the payments.

- Investment Growth:For variable annuities, the growth of the underlying investments directly affects the payment amount.

- Payment Frequency:The frequency of annuity payments (e.g., monthly, quarterly, annually) influences the total amount received over the annuity term.

Using Annuity Calculators Based on Life Expectancy

Annuity calculators simplify the process of estimating future income from annuities. They provide a clear picture of how much income an annuity can generate based on various factors, including life expectancy.

It’s important to understand how annuities are treated under the Income Tax Act. You can find more information on this topic by visiting Annuity Under Income Tax Act 2024.

Step-by-Step Guide to Using an Annuity Calculator

- Choose an Annuity Calculator:Select a reputable online calculator or software that offers a user-friendly interface and accurate calculations.

- Input Your Information:Provide the necessary information, such as the initial investment amount, desired payment frequency, and your estimated life expectancy.

- Select Annuity Type:Choose the type of annuity you are considering (fixed, variable, immediate, deferred) to ensure accurate calculations.

- Review the Results:The calculator will provide an estimated monthly or annual payment amount based on the inputs you provided.

Inputting Life Expectancy Data

Most annuity calculators allow you to input your life expectancy either directly as a number or by selecting from a range of age brackets. It is essential to use a realistic estimate based on your health, lifestyle, and family history.

When planning for retirement, you might wonder whether an annuity is a better choice than a drawdown strategy. Both have their own advantages and disadvantages, and the best option for you will depend on your individual circumstances. You can learn more about the pros and cons of each approach by visiting Is Annuity Better Than Drawdown 2024.

Considering Personal Financial Goals and Risk Tolerance

When using an annuity calculator, it is crucial to consider your personal financial goals and risk tolerance. If you have a high risk tolerance, you might choose a variable annuity with the potential for higher returns but also greater volatility.

Annuity products are becoming increasingly popular as people seek out reliable income streams during retirement. If you’re curious about whether an annuity qualifies for tax advantages in 2024, you can find more information on Annuity Is Qualified 2024.

Conversely, a fixed annuity might be more suitable for individuals seeking guaranteed income and lower risk.

If you’re considering an annuity, you might want to compare different annuity providers and their offerings. You can find information about different annuity providers on Annuity Leads 2024.

Factors to Consider When Choosing an Annuity

Choosing the right annuity involves careful consideration of various factors to ensure it aligns with your financial goals and risk tolerance.

While annuities offer potential benefits, it’s important to be aware of potential issues that might arise. You can find a comprehensive overview of these issues on Annuity Issues 2024.

Key Factors to Consider

- Annuity Provider:Research and compare different annuity providers to evaluate their financial stability, track record, and customer service.

- Contract Terms:Carefully review the contract terms, including the interest rate, payment frequency, and any fees or charges associated with the annuity.

- Tax Implications:Understand the tax implications of annuity payments, as they may be subject to income tax depending on the type of annuity.

Potential Benefits and Drawbacks of Annuities

Annuities offer potential benefits, such as guaranteed income, tax-deferred growth, and protection against market fluctuations. However, they also have drawbacks, including limited access to funds, potential penalties for early withdrawals, and potential for lower returns compared to other investments.

Comparing Annuity Options

It is essential to compare different annuity options available in the market, considering factors like interest rates, fees, and the features offered by each provider. Consult with a financial advisor to discuss your individual needs and make an informed decision.

If you’re looking for an annuity that provides a guaranteed return, you might be interested in a 6% annuity. However, it’s crucial to understand the terms and conditions before committing. To learn more about this type of annuity, visit 6 Percent Annuity 2024.

Illustrative Examples of Annuity Calculations

Here are some illustrative examples of annuity calculations based on varying life expectancies and other relevant factors:

| Scenario | Initial Investment | Life Expectancy | Interest Rate | Estimated Monthly Payment |

|---|---|---|---|---|

| Scenario 1 | $100,000 | 20 years | 4% | $605 |

| Scenario 2 | $100,000 | 25 years | 4% | $490 |

| Scenario 3 | $100,000 | 30 years | 4% | $410 |

These examples demonstrate how a longer life expectancy can lead to lower monthly payments for the same initial investment and interest rate. This highlights the importance of considering life expectancy when planning for retirement income.

Concluding Remarks: Annuity Calculator Based On Life Expectancy 2024

By embracing the insights provided by annuity calculators based on life expectancy, individuals can gain a clearer picture of their financial needs and make informed decisions about their retirement planning. Whether you are just starting to think about retirement or are nearing your golden years, understanding the role of life expectancy in annuity calculations is crucial for securing a comfortable and fulfilling future.

This guide serves as a starting point for your journey, providing valuable information and tools to help you make informed choices about your retirement savings.

Questions and Answers

How do annuity calculators work?

Annuity calculators utilize a complex set of algorithms that factor in your age, gender, health status, and life expectancy to project future income streams from an annuity. They consider various variables such as interest rates, investment growth, and payment frequency to provide an estimated payout.

What are the benefits of using an annuity calculator?

One common question is whether an annuity is the same as an IRA. The answer is not so simple, and depends on the specific type of annuity and IRA you are considering. For more information, you can check out Is Annuity Same As Ira 2024.

Annuity calculators provide valuable insights into your potential retirement income, helping you assess if your savings are sufficient. They also allow you to explore different annuity options and compare their payouts based on your unique circumstances.

Can I use an annuity calculator for free?

Yes, many online resources offer free annuity calculators. However, it’s essential to choose reputable sources and verify the accuracy of the calculations. Consulting with a financial advisor can also provide personalized guidance and ensure you are making informed decisions.

What factors can affect my life expectancy?

Life expectancy is influenced by a multitude of factors, including genetics, lifestyle choices, access to healthcare, socioeconomic conditions, and environmental factors. It’s important to maintain a healthy lifestyle, manage chronic conditions, and stay informed about health advancements.