Annuity Basis Is 2024: In a world where retirement planning is paramount, annuities have emerged as a cornerstone of financial security. This guide delves into the intricacies of annuities, exploring their fundamental principles, current market trends, and essential considerations for making informed decisions.

The Snapdragon 2024 is designed to power foldable phones, offering the performance and durability needed for these innovative devices. You can learn more about the Snapdragon 2024’s features for foldable phones in Snapdragon 2024 for foldable phones , which explores its capabilities in this exciting new category.

We’ll examine the different types of annuities available, analyze the impact of prevailing interest rates on annuity returns, and highlight crucial factors to consider when choosing an annuity that aligns with your individual financial goals and risk tolerance. From understanding the complexities of annuity taxation to exploring alternative retirement savings options, this comprehensive guide equips you with the knowledge necessary to navigate the world of annuities with confidence.

An annuity is a financial product that provides a stream of income payments over a set period of time. You can learn more about the specifics of annuities and how they work in An Annuity Is Defined As 2024 , which explains the key features and benefits of annuities in detail.

Annuity Basics

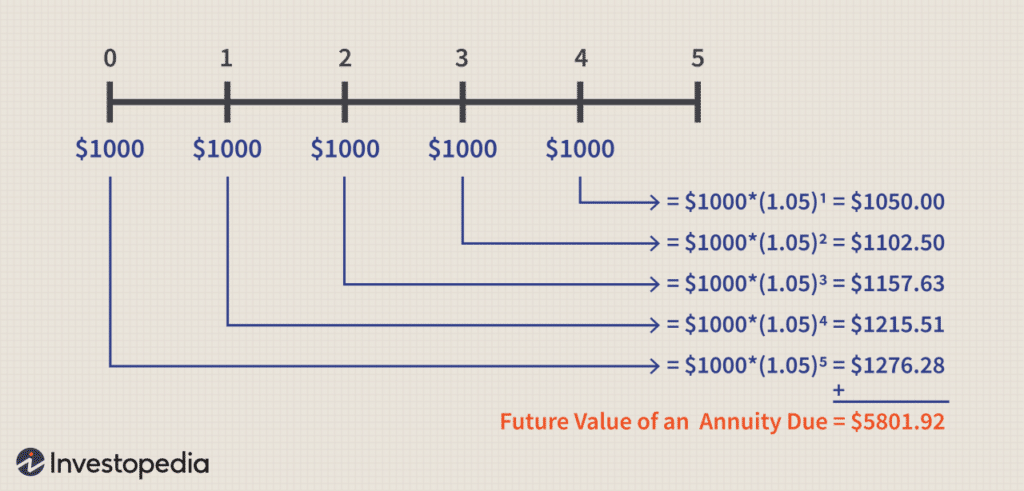

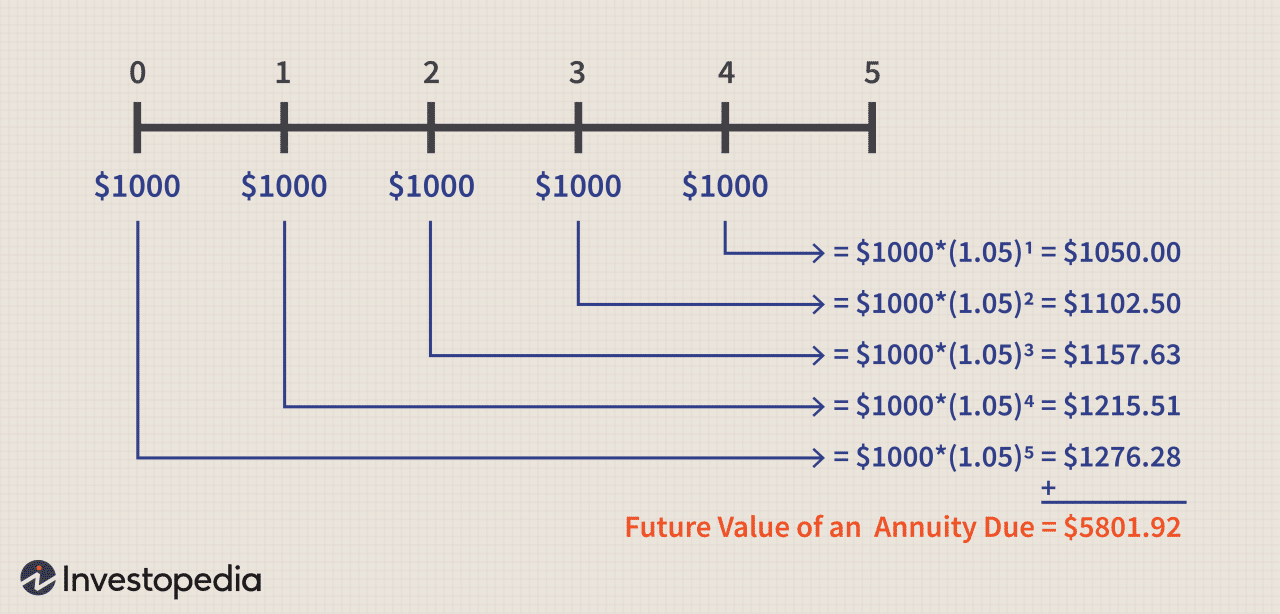

An annuity is a financial product that provides a stream of regular payments for a specific period of time. It is often used as a retirement income strategy, but can also be used for other purposes, such as funding a college education or providing income for a surviving spouse.

Monetizing your Android app can be a rewarding experience. There are various strategies you can employ to generate revenue, such as in-app purchases, subscriptions, and advertising. If you’re looking to explore the different monetization options, check out How to monetize an Android app in 2024 for a detailed guide.

Key Features of Annuities

Annuities have several key features that make them unique investment vehicles:

- Guaranteed Payments:Annuities typically offer guaranteed payments, meaning that you are assured of receiving a certain amount of income for a set period of time.

- Longevity Protection:Annuities can help protect against outliving your savings, as they provide a stream of income for as long as you live.

- Tax-Deferred Growth:In many cases, annuity earnings grow tax-deferred, meaning that you won’t have to pay taxes on them until you start receiving payments.

- Customization Options:Annuities come in a variety of forms, allowing you to choose an option that best suits your individual needs and financial goals.

Types of Annuities

There are several different types of annuities, each with its own unique characteristics:

- Fixed Annuities:These annuities offer a guaranteed interest rate for a set period of time. This provides a predictable stream of income, but the growth potential is limited.

- Variable Annuities:These annuities invest your money in a portfolio of securities, such as stocks and bonds. The payments you receive can fluctuate based on the performance of the underlying investments.

- Immediate Annuities:These annuities start paying out immediately after you purchase them. They are often used by individuals who want to convert a lump sum of money into a stream of income.

- Deferred Annuities:These annuities start paying out at a later date, such as retirement. They are often used by individuals who want to save for retirement and grow their savings tax-deferred.

Benefits and Drawbacks of Annuities

Annuities can offer several benefits, but it is important to understand the potential drawbacks as well:

Benefits:

- Guaranteed Income:Fixed annuities provide a guaranteed stream of income, which can be helpful for individuals who want to ensure they have a steady source of income in retirement.

- Longevity Protection:Annuities can help protect against outliving your savings, as they provide a stream of income for as long as you live.

- Tax-Deferred Growth:In many cases, annuity earnings grow tax-deferred, meaning that you won’t have to pay taxes on them until you start receiving payments.

- Flexibility:Annuities offer a variety of customization options, allowing you to choose an option that best suits your individual needs and financial goals.

Drawbacks:

- Limited Growth Potential:Fixed annuities offer a guaranteed interest rate, but the growth potential is limited compared to other investments.

- Fees and Charges:Annuities can come with various fees and charges, which can reduce your overall returns.

- Lack of Liquidity:It can be difficult to access your money early from an annuity, especially if you need it before the payout period begins.

- Complexity:Annuities can be complex financial products, and it is important to understand the terms and conditions of the contract before you purchase one.

Annuity Rates in 2024

Annuity rates are influenced by a number of factors, including interest rates, inflation, and the overall health of the economy. In 2024, interest rates are expected to remain relatively low, which could put downward pressure on annuity rates. However, inflation is also a factor to consider, as it can erode the purchasing power of your annuity payments.

Glovo is a popular delivery app that connects businesses with customers. If you’re a restaurant owner or business owner, you can utilize Glovo’s features to reach a wider audience and increase your sales. You can learn more about Glovo’s features for businesses in Glovo app features for restaurant owners and businesses , which highlights the key benefits of using the app.

Factors Influencing Annuity Rates

Here are some key factors that can affect annuity rates:

- Interest Rates:Annuity rates are typically tied to prevailing interest rates. When interest rates rise, annuity rates tend to increase as well, and vice versa.

- Inflation:Inflation can erode the purchasing power of your annuity payments. To compensate for inflation, annuity providers may offer higher rates.

- Mortality Rates:Annuity providers factor in mortality rates when setting rates. If people are living longer, annuity providers may need to offer higher rates to ensure they have enough funds to pay out benefits.

- Competition:Competition among annuity providers can also affect rates. When there is more competition, providers may offer higher rates to attract customers.

Comparing Annuity Rates

It is important to compare annuity rates from different financial institutions before making a decision. You can use online tools or consult with a financial advisor to get quotes from multiple providers.

The Snapdragon 2024 and Snapdragon 8 Gen 3 are both powerful processors that offer impressive performance. But which one is right for you? You can find a comprehensive comparison of the two processors in Snapdragon 2024 vs Snapdragon 8 Gen 3 , which breaks down their key features and specifications.

When comparing rates, be sure to consider the following factors:

- The type of annuity:Different types of annuities have different rates, so it is important to compare rates for the same type of annuity.

- The length of the payout period:Longer payout periods typically have higher rates, as the annuity provider needs to compensate for the longer period of payments.

- The age of the annuitant:Older annuitants typically have higher rates, as they are expected to live longer.

- Fees and charges:Be sure to compare fees and charges associated with different annuities, as these can vary significantly.

Factors to Consider When Choosing an Annuity

Choosing the right annuity can be a complex decision, as there are many factors to consider. Here are some key things to think about:

Financial Goals

What are your financial goals for purchasing an annuity? Are you looking for guaranteed income in retirement, longevity protection, or tax-deferred growth? Your financial goals will help you narrow down your choices and determine the type of annuity that is right for you.

Dollify 2024 is a fun and easy way to create unique and expressive avatars. You can customize your avatar’s features, clothing, and accessories to create a truly personalized representation of yourself. If you’re looking to make your online presence more engaging, check out Dollify 2024: Creating Unique and Expressive Avatars and start creating your own unique avatar today.

Risk Tolerance

How much risk are you willing to take? Fixed annuities offer a guaranteed interest rate, but the growth potential is limited. Variable annuities invest your money in a portfolio of securities, which can fluctuate in value. Your risk tolerance will help you determine the level of risk you are comfortable with.

Pushbullet is a popular tool for syncing your devices and managing notifications. While it offers convenience, it also has some drawbacks. You can find a detailed analysis of the pros and cons of Pushbullet in Pushbullet 2024: What are the pros and cons of using Pushbullet?

, which helps you decide if it’s the right tool for you.

Time Horizon

How long do you need the annuity to last? If you are looking for a short-term income stream, an immediate annuity may be a good choice. If you are saving for retirement, a deferred annuity may be more suitable.

Google Tasks is a simple and effective task management tool that can help you stay organized and on top of your to-do list. If you’re looking for a comprehensive guide on how to use Google Tasks effectively, check out Google Tasks 2024: How to Use Google Tasks Effectively for tips and tricks.

Terms and Conditions

It is crucial to carefully review the terms and conditions of the annuity contract before you purchase one. This includes understanding the fees and charges, the payout period, and the withdrawal provisions.

An annuity is a financial product that provides a stream of income payments over a set period of time. It can be a valuable tool for retirement planning and ensuring a steady income stream. You can learn more about the specifics of annuities and how they work in An Annuity Is 2024 , which provides a detailed explanation of this financial product.

Professional Financial Advice, Annuity Basis Is 2024

Consulting with a qualified financial advisor can be helpful when choosing an annuity. An advisor can help you understand the different types of annuities available, assess your risk tolerance, and develop a personalized financial plan.

The Snapdragon 2024 is specifically designed to power flagship phones, offering top-tier performance and features. You can learn more about the Snapdragon 2024’s capabilities for flagship phones in Snapdragon 2024 for flagship phones , which highlights its key features and benefits.

Annuity Taxation and Regulations: Annuity Basis Is 2024

Annuities are subject to certain tax rules and regulations. Understanding these rules can help you make informed decisions about your annuity choices and minimize your tax liability.

Choosing between an annuity and a 401k can be a tough decision. Both have their pros and cons, and the best choice for you will depend on your individual circumstances. To help you decide, you can explore Is Annuity Better Than 401k 2024 , which provides a detailed comparison of the two retirement savings options.

Taxation of Annuity Payments

Annuity payments are typically taxed as ordinary income. This means that the portion of each payment that represents earnings is taxed at your ordinary income tax rate. The portion of each payment that represents your original investment is not taxed.

The Snapdragon 2024 is also making its way into laptops, bringing powerful performance and long battery life to these devices. You can learn more about the Snapdragon 2024’s capabilities for laptops in Snapdragon 2024 for laptops , which explores its potential in this growing market.

However, it is important to note that the IRS uses a specific method to determine the taxable portion of each payment, which can be complex.

The Snapdragon 2024 boasts impressive 5G connectivity, enabling lightning-fast speeds and reliable network performance. This makes it ideal for users who need to stay connected and download large files quickly. You can learn more about the 5G capabilities of the Snapdragon 2024 in Snapdragon 2024 5G connectivity , which details its performance and features.

Tax Implications

Here are some tax implications to consider when purchasing an annuity:

- Early Withdrawals:If you withdraw money from an annuity before the payout period begins, you may have to pay a penalty in addition to taxes.

- Death Benefits:If you die before you start receiving annuity payments, your beneficiary will typically receive the full value of the annuity, which may be subject to income tax.

- State Taxes:Some states may also impose taxes on annuity payments.

Regulations and Legal Considerations

Annuities are regulated by both federal and state governments. The Securities and Exchange Commission (SEC) regulates variable annuities, while the Department of Labor (DOL) regulates annuities offered in employer-sponsored retirement plans.

It is important to understand the legal considerations surrounding annuities, such as the right to cancel a contract within a certain period of time and the rules governing withdrawals and death benefits.

Annuity Alternatives

Annuities are not the only retirement savings option available. There are other investment vehicles that you may want to consider, such as traditional IRAs, Roth IRAs, and 401(k) plans.

Dollify 2024 has evolved to create more realistic avatars. With advanced features and customization options, you can now create avatars that look even more like you. To explore the possibilities of realistic avatars, check out Dollify 2024: Creating Realistic Avatars and see how you can create a digital twin.

Comparison of Annuity Alternatives

| Investment Option | Benefits | Drawbacks |

|---|---|---|

| Traditional IRA | Tax-deductible contributions, tax-deferred growth | Required minimum distributions (RMDs) in retirement, taxes on withdrawals |

| Roth IRA | Tax-free withdrawals in retirement, no RMDs | Contributions are not tax-deductible, income limits for contributions |

| 401(k) Plan | Employer matching contributions, tax-deferred growth | Limited investment options, potential vesting requirements |

| Annuity | Guaranteed income, longevity protection, tax-deferred growth | Limited growth potential, fees and charges, lack of liquidity |

When Annuities Might Be a Suitable Choice

Annuities can be a suitable choice for individuals who:

- Want guaranteed income in retirement

- Are concerned about outliving their savings

- Prefer a predictable stream of income

Pros and Cons of Each Alternative

Each retirement savings option has its own unique pros and cons. It is important to carefully consider your individual needs and financial goals before making a decision.

Concluding Remarks

As you embark on your retirement planning journey, remember that annuities can play a vital role in securing your financial future. By understanding the nuances of annuity contracts, staying abreast of market fluctuations, and seeking professional advice when needed, you can harness the power of annuities to build a solid foundation for a comfortable and fulfilling retirement.

FAQ Insights

What is the difference between a fixed and a variable annuity?

A fixed annuity offers a guaranteed rate of return, while a variable annuity’s return is tied to the performance of underlying investments.

How do I choose the right annuity for my needs?

Consider your financial goals, risk tolerance, and time horizon. Consult with a financial advisor for personalized guidance.

Are annuity payments taxable?

Yes, annuity payments are generally taxable as ordinary income. However, there may be tax-advantaged options depending on the type of annuity.

Google Tasks is a powerful tool for managing your tasks and improving your productivity. With its simple interface and integration with other Google services, it can help you stay organized and achieve your goals. You can find a comprehensive guide on how to use Google Tasks effectively in Google Tasks 2024: A Comprehensive Guide for Productivity , which covers everything from basic usage to advanced tips and tricks.