Annuity 60000 2024 – Annuity $60,000 2024: Imagine receiving a guaranteed annual income stream of $60,000 throughout your retirement years. This intriguing prospect, offered by annuities, has captivated many seeking financial security in their golden years. But what exactly are annuities, and how can they help you navigate the complexities of retirement planning?

This guide delves into the world of annuities, exploring their advantages, drawbacks, and potential impact on your future financial well-being.

Annuities, in essence, are financial contracts that provide a stream of regular payments over a set period, typically for life. They come in various forms, each offering unique features and benefits. For instance, fixed annuities guarantee a specific rate of return, while variable annuities offer the potential for higher returns but also carry more risk.

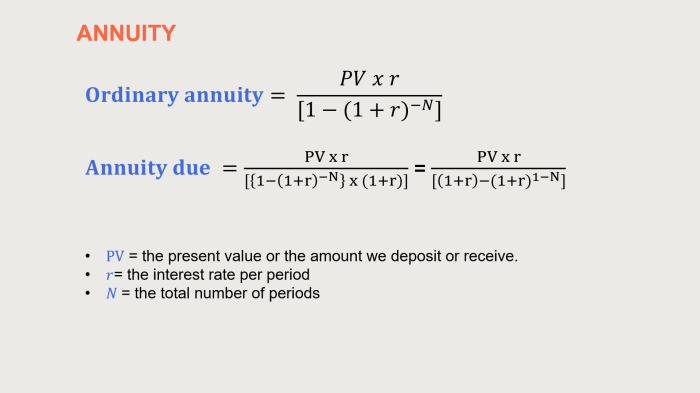

The formula for calculating annuity loans can be helpful for understanding the financial terms involved. You can find more information about Annuity Loan Formula 2024 to understand the specifics.

Understanding the nuances of these different types is crucial to selecting the annuity that best aligns with your individual needs and risk tolerance.

Annuity drawdown refers to the process of withdrawing funds from an annuity. You can learn more about this process by reading about Is Annuity Drawdown 2024.

Understanding Annuities

An annuity is a financial product that provides a stream of regular payments for a specified period of time. It is designed to provide a steady source of income, particularly during retirement. Annuities are typically purchased with a lump sum of money, and the insurance company then makes regular payments to the annuitant (the person who owns the annuity) for a set period, either for life or for a specific number of years.

Types of Annuities

Annuities come in various forms, each with its own unique characteristics and features. Here are some common types:

- Fixed Annuities:These annuities guarantee a fixed rate of return, ensuring predictable payments throughout the contract period. However, the return may not keep pace with inflation, potentially reducing the purchasing power of the payments over time.

- Variable Annuities:These annuities invest in a portfolio of assets, such as stocks or bonds, with the potential for higher returns but also a greater risk of losing principal. The payments vary depending on the performance of the underlying investments.

- Immediate Annuities:Payments begin immediately after the purchase of the annuity, making them ideal for those seeking immediate income. They are often used to supplement retirement income or to cover essential expenses.

- Deferred Annuities:Payments are delayed until a future date, typically at retirement. This allows individuals to accumulate funds over time and receive payments later when they need them most.

Advantages and Disadvantages of Annuities

Annuities offer both potential benefits and drawbacks. It’s crucial to weigh these factors carefully before deciding if an annuity is right for you.

Annuity payments can be subject to taxation. You can learn more about Annuity Is Taxable Or Not 2024 to understand the tax implications.

- Advantages:

- Guaranteed Income: Annuities provide a predictable and guaranteed stream of income, offering peace of mind during retirement.

- Protection from Outliving Savings: Annuities can ensure a lifetime of income, eliminating the risk of outliving your savings.

- Tax-Deferred Growth: In some cases, annuity earnings grow tax-deferred, potentially reducing your tax liability.

- Disadvantages:

- Limited Liquidity: Accessing your annuity funds before the designated start date may be restricted or subject to penalties.

- Potential for Lower Returns: Fixed annuities may offer lower returns compared to other investments, potentially leading to lower income over time.

- High Fees: Annuities can come with significant fees, including surrender charges and administrative expenses, which can eat into your returns.

Annuity Payments of $60,000

Receiving a $60,000 annual annuity payment can provide a significant boost to your retirement income. However, it’s essential to consider the potential impact of inflation and tax implications.

Potential Benefits of $60,000 Annuity Payments

A $60,000 annual annuity payment can provide a substantial source of income, potentially covering essential expenses such as housing, healthcare, and travel. It can also provide financial security and peace of mind, knowing that you have a steady stream of income to rely on.

Thinking about a $50,000 annuity? There are many factors to consider, and you may want to explore information about Annuity 50k 2024 to understand the details.

Impact of Inflation

Inflation can erode the purchasing power of your $60,000 annuity payments over time. If inflation is high, the same amount of money will buy fewer goods and services in the future. It’s important to consider the potential impact of inflation when planning your retirement income.

The “annuity number” refers to the unique identifier assigned to each annuity contract. You can find more information about Annuity Number 2024 to understand how this number is used.

Tax Implications

Annuity payments are generally taxed as ordinary income. The portion of each payment that represents a return of your principal investment is tax-free, but the remaining portion is taxable as income. Understanding the tax implications of annuity payments is crucial for planning your retirement finances.

The question of whether an annuity is good or bad depends on your individual circumstances and financial goals. You can find information about Annuity Is Good Or Bad 2024 to help you make an informed decision.

Annuities in 2024

The annuity market is constantly evolving, influenced by factors such as interest rates, inflation, and economic conditions. Understanding the current economic climate and its potential impact on annuity rates is crucial for making informed decisions.

Annuity value calculators are useful tools for estimating potential payouts. You can use an Annuity Value Calculator 2024 to get an idea of how much income you might receive from an annuity. This can help you make informed decisions about your retirement planning.

Economic Climate and Annuity Rates

Interest rates and inflation play a significant role in determining annuity payouts. When interest rates are low, annuity rates tend to be lower as well, reflecting the lower returns that insurance companies can earn on their investments. Conversely, higher interest rates can lead to higher annuity payouts.

Deciding whether to purchase an annuity is a significant financial decision. You can find information about Is Getting An Annuity Worth It 2024 to weigh the pros and cons.

Inflation can also impact annuity rates, as insurance companies need to factor in the erosion of purchasing power over time.

A fixed annuity can be a valuable addition to your IRA retirement portfolio. You can find more information about Fixed Annuity In Ira 2024 to explore this option.

Trends and Changes in the Annuity Market

The annuity market is expected to continue evolving in 2024. Some potential trends include:

- Increased Demand for Guaranteed Income:As people live longer and face growing retirement expenses, the demand for guaranteed income streams is likely to increase. This could lead to greater interest in annuities, particularly fixed annuities that offer predictable payments.

- Growth of Variable Annuities:Variable annuities may become more popular as investors seek higher returns in a low-interest-rate environment. However, these annuities also carry greater risk.

- Innovation in Annuity Products:Insurance companies are continually developing new annuity products to meet evolving consumer needs. This could include annuities with features such as longevity protection or income riders.

Planning for Retirement with Annuities

Annuities can be a valuable tool for planning your retirement income, but it’s essential to choose the right annuity for your individual needs and financial goals.

Determining whether annuity income is considered earned income can be important for tax purposes. You can learn more about Is Annuity Earned Income 2024 to understand the implications.

Annuity Options and Features

Here is a table illustrating different annuity options and their associated features:

| Annuity Type | Payment Amount | Duration | Guarantees | Other Features |

|---|---|---|---|---|

| Fixed Annuity | Fixed and guaranteed | Lifetime or specific period | Guaranteed interest rate, principal protection | May offer death benefits |

| Variable Annuity | Varies based on investment performance | Lifetime or specific period | No guaranteed interest rate, potential for principal loss | May offer investment options, death benefits |

| Immediate Annuity | Begins immediately after purchase | Lifetime or specific period | May offer guaranteed income, death benefits | Suitable for immediate income needs |

| Deferred Annuity | Begins at a future date | Lifetime or specific period | May offer guaranteed income, death benefits | Suitable for long-term savings |

Steps Involved in Purchasing an Annuity

The following flowchart Artikels the steps involved in purchasing an annuity:

- Step 1: Determine Your Retirement Income Needs:Assess your expenses, desired lifestyle, and longevity expectations to determine how much income you’ll need in retirement.

- Step 2: Research Different Annuity Options:Explore various annuity types, their features, and associated fees to find the best fit for your goals.

- Step 3: Consult with a Financial Advisor:Seek professional advice from a qualified financial advisor to discuss your specific situation and make informed decisions.

- Step 4: Choose an Annuity Provider:Select a reputable insurance company with a strong financial track record and competitive annuity rates.

- Step 5: Purchase the Annuity:Complete the necessary paperwork and make the initial investment to secure your annuity contract.

Tips for Choosing the Right Annuity

- Consider Your Risk Tolerance:Fixed annuities offer guaranteed income but lower potential returns, while variable annuities have the potential for higher returns but also greater risk.

- Evaluate Your Income Needs:Determine how much income you’ll need in retirement and choose an annuity that provides sufficient coverage.

- Compare Fees and Charges:Carefully review the fees associated with different annuity products, including surrender charges and administrative expenses.

- Seek Professional Advice:Consult with a financial advisor to get personalized guidance and ensure you make informed decisions.

Alternatives to Annuities: Annuity 60000 2024

Annuities are not the only option for generating retirement income. Several other strategies can help you achieve your financial goals. It’s important to compare and contrast annuities with these alternatives to make the best decision for your situation.

Setting up an annuity beneficiary is an important step in estate planning. If you choose to have an Annuity Beneficiary Is A Trust 2024 , you can ensure your assets are distributed according to your wishes.

401(k)s and IRAs

401(k)s and IRAs are employer-sponsored and individual retirement accounts, respectively. They offer tax-deferred growth and potential tax-free withdrawals at retirement. However, these accounts require active investment management and don’t guarantee a stream of income.

A single payment annuity can be a good option if you’re looking for a guaranteed income stream. You can learn more about this type of annuity by reading about Annuity Is Single Payment 2024.

Social Security

Social Security provides a safety net for retirees, offering a monthly income stream based on your lifetime earnings. However, Social Security benefits are generally not enough to cover all retirement expenses, and they are subject to inflation.

Annuity vs. IRA is a common topic for those planning for retirement. You can find more information about Annuity Vs Ira 2024 to compare these financial instruments.

Comparing Retirement Income Options, Annuity 60000 2024

Here is a table comparing the key features of different retirement income options:

| Option | Guaranteed Income | Investment Management | Tax Advantages | Liquidity | Other Features |

|---|---|---|---|---|---|

| Annuities | Yes (for fixed annuities) | Managed by insurance company | Tax-deferred growth, potentially tax-free withdrawals | Limited | May offer death benefits, longevity protection |

| 401(k)s and IRAs | No | Self-directed | Tax-deferred growth, potentially tax-free withdrawals | Limited before retirement | May offer employer matching contributions |

| Social Security | Yes | Managed by government | Taxable income | Not applicable | Provides a safety net for retirees |

End of Discussion

As we navigate the ever-changing landscape of retirement planning, annuities present a compelling option for those seeking guaranteed income and long-term financial stability. While they offer unique advantages, it’s essential to carefully consider the potential drawbacks and explore alternative retirement income strategies to make an informed decision.

Annuity contracts from 2021 are still relevant, but you might want to review the current landscape by exploring information about Annuity 2021 2024.

By understanding the complexities of annuities and their role in retirement planning, you can make choices that empower you to achieve your financial goals and enjoy a secure and fulfilling retirement.

FAQ

What are the tax implications of annuity payments?

Understanding whether an annuity is a licensed product is crucial for informed decision-making. You can find information about Is Annuity Lic 2024 to clarify this aspect.

The tax treatment of annuity payments depends on the type of annuity and how it was funded. Generally, a portion of each payment is considered a return of your principal (which is not taxable), and the remaining portion is considered taxable income.

It’s important to consult with a tax professional to understand the specific tax implications of your annuity.

How do I choose the right annuity for my needs?

Choosing the right annuity requires careful consideration of your individual financial goals, risk tolerance, and time horizon. Factors to consider include the type of annuity (fixed, variable, immediate, deferred), the payment amount, the duration of payments, and any guarantees offered.

Consulting with a financial advisor can help you make an informed decision.

Are there any fees associated with annuities?

Yes, most annuities involve fees, such as administrative fees, mortality and expense charges, and surrender charges (penalties for withdrawing funds early). It’s essential to understand these fees and their impact on your overall returns before investing in an annuity.