Annuity 600 000 2024 – Annuity 600,000 2024 delves into the world of annuities, exploring their potential as a retirement planning tool. This comprehensive guide examines the intricacies of annuities, from their fundamental concepts to their practical applications in securing financial stability during retirement.

It’s important to understand how annuities are taxed under the Income Tax Act. This can help you plan for your future income and expenses.

This guide explores the different types of annuities available, their growth potential, and the factors that influence their value. It provides insights into the advantages and disadvantages of annuities, offering a balanced perspective on their role in retirement planning.

Understanding Annuities

An annuity is a financial product that provides a stream of regular payments for a set period of time. It’s often used as a retirement planning tool, but can also be used for other purposes such as income generation, legacy planning, and even long-term care.

The 2000 Mortality Table is used to calculate annuity payments. It’s important to understand how this table affects your potential payouts.

Types of Annuities

Annuities come in various forms, each with its own features and risks. Some common types include:

- Fixed Annuities:These offer a guaranteed rate of return, providing predictable income payments. The downside is that the returns may not keep pace with inflation, eroding the purchasing power of your payments.

- Variable Annuities:These tie the returns to the performance of underlying investments, offering the potential for higher returns but also greater risk. The value of your annuity can fluctuate, potentially leading to lower payouts.

- Indexed Annuities:These link the returns to the performance of a specific index, such as the S&P 500. They offer potential growth with some protection against losses, but the returns may be limited.

Advantages and Disadvantages of Annuities

Annuities offer both advantages and disadvantages as a retirement planning tool.

A $10,000 per month annuity can provide a significant source of income in retirement. This can help you maintain your lifestyle and achieve your financial goals.

| Advantages | Disadvantages |

|---|---|

| Guaranteed income stream | Potential for low returns |

| Longevity protection | Limited access to funds |

| Tax-deferred growth | High fees and surrender charges |

Annuity Payments and Growth

The amount of annuity payments depends on several factors, including the principal amount invested, the interest rate, and the payout period.

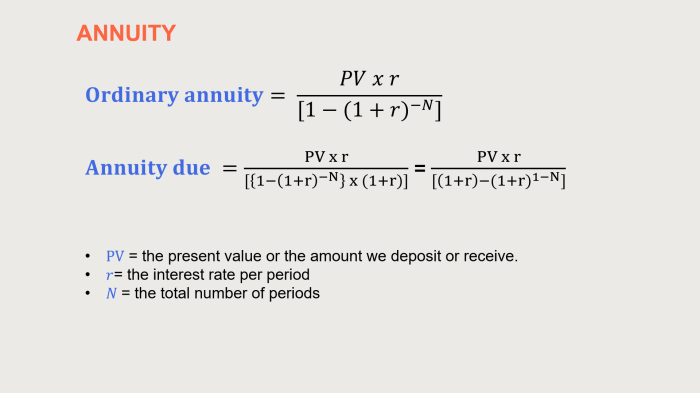

Calculating Annuity Payments

Annuity payments are calculated using a formula that considers the present value of the annuity, the interest rate, and the number of periods. For example, a $600,000 annuity with a 5% interest rate and a 20-year payout period would generate monthly payments of approximately $4,250.

When planning for retirement, you might be faced with a choice: take a lump sum or opt for an annuity ? Both options have their pros and cons, and the best choice depends on your individual circumstances.

Annuity Growth Over Time

The value of an annuity can grow over time, depending on the interest rate and the length of the payout period. For instance, a $600,000 annuity with a 5% interest rate and a 20-year payout period would grow to approximately $1,320,000 by the end of the payout period.

A 5-year annuity payout can provide a steady stream of income for a set period. This can be a good option for those who need a predictable income source for a specific timeframe.

However, if the interest rate were lower, say 3%, the annuity would only grow to approximately $970,000.

In simple terms, an annuity is a financial product that provides a stream of payments over a set period of time. This can be a valuable tool for retirement planning.

Impact of Inflation

Inflation can erode the purchasing power of annuity payments. For example, if the inflation rate is 3% per year, the purchasing power of a $4,250 monthly payment will be reduced to $3,280 in real terms after 10 years.

An index annuity is a type of annuity that links its payouts to the performance of a specific market index, offering potential for growth while providing some protection against market losses.

Annuity Options and Considerations

Annuities offer various options for utilizing your funds, depending on your needs and preferences.

For those living in Hong Kong, annuities can be a valuable retirement planning tool. They offer a guaranteed income stream, providing financial security in your later years.

Annuity Utilization Options, Annuity 600 000 2024

- Lump-Sum Payments:You can receive the entire annuity value as a lump sum, providing flexibility to use the funds as you see fit.

- Monthly Income Streams:You can receive regular monthly payments for a set period, providing a predictable source of income.

- Combination of Payments:You can choose a combination of lump-sum payments and monthly income streams, allowing you to balance flexibility with income security.

Factors to Consider

When choosing an annuity, several factors are crucial to consider:

- Investment Goals:What are your financial goals for the annuity, such as retirement income, legacy planning, or long-term care?

- Risk Tolerance:How comfortable are you with market fluctuations and potential losses?

- Time Horizon:How long do you need the annuity to provide income, and how long are you willing to wait for your investment to grow?

Tax Implications

The tax implications of annuities vary depending on the type of annuity chosen. Generally, the growth of annuity funds is tax-deferred, meaning you won’t pay taxes on the earnings until you start withdrawing them. However, withdrawals are typically taxed as ordinary income.

Annuity in Retirement Planning

Annuities can play a significant role in retirement planning, providing a reliable source of income and protecting against longevity risk.

Role of Annuities in Retirement Planning

- Income Generation:Annuities provide a steady stream of income that can supplement other retirement income sources, such as Social Security and pensions.

- Longevity Protection:Annuities can help ensure that you have a reliable income stream for as long as you live, protecting against the risk of outliving your savings.

- Estate Planning:Annuities can be used to provide income for beneficiaries after your death, helping to ensure that your loved ones are financially secure.

Integrating Annuities into Retirement Plans

Annuities can be integrated into a comprehensive retirement plan by diversifying your income sources and providing a safety net for your financial security. For example, you might allocate a portion of your retirement savings to a fixed annuity to guarantee a stable income stream, while investing the rest in a variable annuity for potential growth.

Understanding how annuities work as a payment is crucial when considering this investment strategy. It’s essential to know the terms and conditions to make an informed decision.

Benefits and Drawbacks of Using Annuities as a Primary Source of Retirement Income

While annuities can provide a reliable source of retirement income, it’s important to consider both the benefits and drawbacks before relying on them as your primary income source.

| Benefits | Drawbacks |

|---|---|

| Guaranteed income stream | Potential for low returns |

| Longevity protection | Limited access to funds |

| Tax-deferred growth | High fees and surrender charges |

Annuity Market Trends and Regulations: Annuity 600 000 2024

The annuity market is constantly evolving, influenced by factors such as interest rates, product offerings, and regulatory changes.

A annuity certain is a type of annuity that guarantees payments for a fixed period, regardless of your lifespan. It’s a good option for those seeking predictable income.

Current State of the Annuity Market

The annuity market has been experiencing a period of low interest rates, which has led to lower returns for fixed annuities. However, there has been an increase in demand for variable and indexed annuities, as investors seek higher potential returns.

Impact of Legislation and Regulations

Recent legislation and regulatory changes have impacted annuity products and consumer choices. For example, the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 introduced new regulations for the annuity industry, including enhanced consumer protection measures and stricter capital requirements for insurance companies.

Risks and Opportunities

Investing in annuities carries both risks and opportunities. It’s important to understand the potential risks, such as low returns, limited access to funds, and high fees, before making an investment decision. However, annuities can also offer opportunities for guaranteed income, longevity protection, and tax-deferred growth.

End of Discussion

By understanding the complexities of annuities, individuals can make informed decisions about their retirement planning strategies. This guide provides a roadmap for navigating the world of annuities, empowering readers to make informed choices about their financial future.

Top FAQs

What is the minimum amount required to purchase an annuity?

There is no set minimum amount required to purchase an annuity. The minimum amount typically varies depending on the specific annuity product and the issuing insurance company.

How can I calculate the estimated monthly payments from an annuity?

Dreaming of a comfortable retirement? Imagine receiving annuity payments of $1 million per year. While it may seem like a far-off dream, annuities can help you achieve your financial goals.

You can use online annuity calculators or consult with a financial advisor to determine the estimated monthly payments from an annuity. The calculations will factor in the annuity amount, interest rate, and payout period.

Are annuity payments taxable?

A contingent annuity is a type of annuity that pays out only if a specific event occurs, such as the death of the annuitant. It’s a good option for those looking for a specific outcome.

Yes, annuity payments are generally taxable as ordinary income. However, the tax treatment of annuity payments can vary depending on the type of annuity and other factors.

What are the risks associated with investing in annuities?

Risks associated with annuities can include potential loss of principal, limited liquidity, and potential for lower returns compared to other investments.

Did you know that there are a variety of career opportunities available in the annuity industry? From financial advisors to actuaries, there are plenty of options for those looking to work in this field.

Can I withdraw my money from an annuity before retirement?

Looking to invest your IRA in a secure, guaranteed return? A fixed annuity might be a good option for you. These annuities offer a steady stream of income, making them ideal for those seeking financial stability in retirement.

You may be able to withdraw money from an annuity before retirement, but there may be penalties or fees associated with early withdrawals.

Annuity payments can be a great way to supplement your income in retirement. Learn more about how annuities are considered ordinary income for tax purposes.