Annuity 401k Rollover 2024 sets the stage for a deeper exploration of how to potentially secure your retirement future. This strategy involves converting your 401(k) savings into an annuity, offering a guaranteed income stream and potential tax advantages. The decision to roll over your 401(k) into an annuity is a significant one, requiring careful consideration of your individual financial goals and risk tolerance.

The definition of an annuity can vary depending on the context. You can find more information about the definition of an annuity in 2024 on the web.

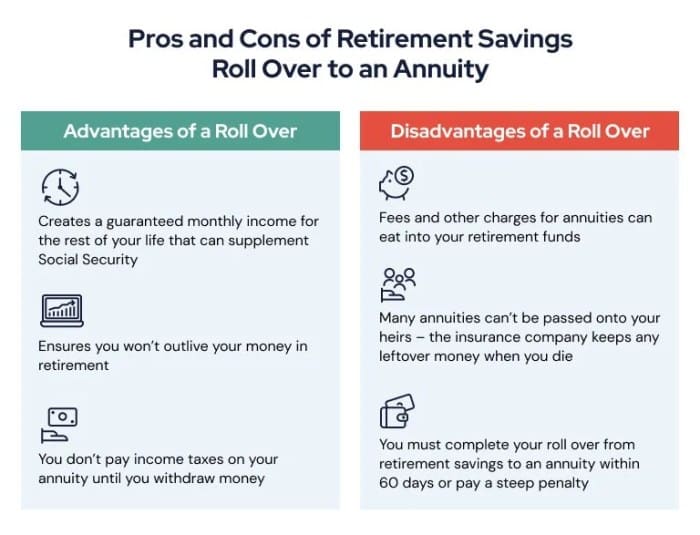

We’ll delve into the benefits and drawbacks of this approach, exploring the various types of annuities available, and providing a roadmap for making an informed decision. Whether you’re nearing retirement or just starting to plan for your future, understanding the nuances of annuity rollovers is crucial for making the most of your hard-earned savings.

Many people consider annuities as a way to supplement their income during retirement. You might be interested in learning about annuities that pay out $2,000 per month in 2024.

Understanding Annuity 401(k) Rollovers

An annuity 401(k) rollover involves transferring your retirement savings from your employer-sponsored 401(k) plan to an annuity contract. This strategy can offer a variety of benefits, including guaranteed income streams, tax advantages, and protection against market volatility.

Annuity rates can vary significantly depending on a number of factors. If you’re considering purchasing an annuity in the UK, it’s a good idea to compare annuity rates in the UK for 2024.

What is an Annuity 401(k) Rollover?

An annuity 401(k) rollover allows you to transfer your retirement savings from your employer-sponsored 401(k) plan to an annuity contract. This contract guarantees you a stream of income during retirement, providing financial security and stability.

When you purchase an annuity, you’re essentially buying a promise of future payments. This brings up the question of whose life is covered by the annuity in 2024 ?

Types of Annuities for 401(k) Rollovers

There are several types of annuities that you can choose from for your 401(k) rollover. Each type offers unique features and benefits, so it’s essential to understand your options before making a decision.

- Fixed Annuities:These annuities provide a guaranteed rate of return, ensuring a predictable income stream. They offer stability and protection against market fluctuations but may not keep pace with inflation.

- Variable Annuities:These annuities invest your money in sub-accounts, offering the potential for higher returns but also exposing you to market risk. They may be suitable for individuals with a higher risk tolerance and a longer investment horizon.

- Indexed Annuities:These annuities offer a guaranteed minimum return linked to a specific market index, such as the S&P 500. They provide a balance between potential growth and protection against significant losses.

Tax Implications of Traditional vs. Roth 401(k) Rollover

The tax implications of rolling over your 401(k) to an annuity depend on whether you have a traditional or Roth 401(k) plan.

Annuities are primarily designed to provide a predictable income stream. To learn more about the purposes of annuities, check out information about how annuities are used in 2024.

- Traditional 401(k) Rollover:You will not pay taxes on the rollover amount until you begin withdrawing from the annuity in retirement. However, your withdrawals will be taxed as ordinary income.

- Roth 401(k) Rollover:You have already paid taxes on the contributions to your Roth 401(k). Therefore, your annuity withdrawals will be tax-free in retirement.

The Benefits of Rolling Over Your 401(k) into an Annuity in 2024

Rolling over your 401(k) into an annuity in 2024 can provide several benefits, particularly for those seeking a guaranteed income stream and protection against market volatility.

Annuities can be structured in various ways, including as term annuities. To learn more about term annuities, check out information about term annuities in 2024.

Guaranteed Income Streams

Annuities offer a guaranteed income stream for life, providing financial security and peace of mind during retirement. This is especially valuable for individuals who want to avoid outliving their savings.

Annuities can also be used to provide financial security for health-related expenses. For instance, you might consider an annuity to help with long-term care costs. You can find more information about annuities and health in 2024.

Tax Advantages

Annuities offer tax advantages, depending on the type of annuity and your individual circumstances. For example, a traditional annuity allows you to defer taxes on your investment growth until you begin receiving payments in retirement.

Annuity contracts are often confused with life insurance policies. To understand the differences between these two, check out information about annuities and life insurance in 2024.

Protection Against Market Volatility

Annuities can help protect your retirement savings from market fluctuations. Fixed annuities provide a guaranteed rate of return, while indexed annuities offer a minimum return linked to a market index. This can be beneficial in times of economic uncertainty.

Annuities can be part of a qualified retirement plan, such as a 401(k) or IRA. To learn more about the qualifications of annuities for retirement plans, check out information about qualified annuities in 2024.

Other Retirement Savings Options, Annuity 401k Rollover 2024

While rolling over your 401(k) into an annuity can be beneficial, it’s important to compare it to other retirement savings options available in 2024, such as:

- Individual Retirement Accounts (IRAs):IRAs offer tax advantages and flexibility in investment choices, but they don’t provide guaranteed income streams.

- Annuities within a 401(k):Some 401(k) plans offer the option of purchasing an annuity directly within the plan. This can provide similar benefits to a rollover but may have different investment options and fees.

Factors to Consider Before Rolling Over Your 401(k) into an Annuity: Annuity 401k Rollover 2024

Before deciding to roll over your 401(k) into an annuity, it’s essential to consider several factors to ensure it aligns with your financial goals and risk tolerance.

The annuity market in New Zealand is active, with a range of annuity options available. You can find more information about annuities in New Zealand for 2024.

Age and Risk Tolerance

Your age and risk tolerance play a significant role in determining whether an annuity is suitable for you. Younger individuals with a longer investment horizon may prefer investments with higher growth potential, while older individuals seeking a guaranteed income stream may find annuities more attractive.

In India, annuities are subject to taxation. To learn more about the tax implications of annuities, check out information about annuities and taxes in India for 2024.

Financial Goals

Consider your financial goals and how an annuity can help you achieve them. For example, if you’re aiming for a specific income level in retirement, an annuity can provide a reliable source of income.

Annuity is a financial concept that has its roots in English. You can find more information about the meaning of annuity in Tamil for 2024.

Potential Downsides and Risks

Annuities also have potential downsides and risks that you should be aware of:

- Surrender Charges:Some annuities have surrender charges that apply if you withdraw your money before a certain period. This can limit your access to your funds if you need them before retirement.

- Limitations on Withdrawals:Annuities may have restrictions on how much you can withdraw each year, especially in the early years of the contract.

Step-by-Step Guide

If you’re considering an annuity 401(k) rollover, it’s crucial to consult with a financial advisor to discuss your options and ensure it aligns with your financial goals.

A perpetual annuity is one that continues indefinitely. However, are there any perpetual annuities available in 2024 ?

- Consult with a Financial Advisor:A financial advisor can help you understand the different types of annuities, assess your risk tolerance, and determine if an annuity rollover is suitable for you.

- Research Annuity Providers:Compare different annuity providers based on their fees, investment options, and customer service.

- Choose an Annuity:Select an annuity that meets your needs and financial goals, considering the type of annuity, payout options, and any surrender charges.

- Complete the Rollover Process:Follow the instructions provided by your previous 401(k) plan and the annuity provider to complete the rollover process.

How to Roll Over Your 401(k) into an Annuity

Rolling over your 401(k) into an annuity involves transferring your retirement savings from your employer-sponsored plan to an annuity contract. This process typically involves several steps and paperwork.

The UK annuity market is quite active, and there are a number of different types of annuities available. If you’re interested in learning more about the UK annuity market, you can find information on annuities in the UK for 2024.

Steps to Roll Over Your 401(k)

- Contact Your 401(k) Plan Administrator:Request a distribution form or rollover instructions from your 401(k) plan administrator.

- Choose an Annuity Provider:Research and select an annuity provider that offers the type of annuity you desire and meets your financial goals.

- Complete the Rollover Form:Fill out the rollover form provided by your 401(k) plan administrator, including the annuity provider’s information and the amount you wish to roll over.

- Submit the Form:Submit the completed rollover form to your 401(k) plan administrator. They will process the transfer and send your funds to the annuity provider.

- Open an Annuity Contract:Once your funds are transferred, you will need to open an annuity contract with the chosen provider.

Common Scenarios for 401(k) Rollover

- Leaving Employment:When you leave your job, you may have the option to roll over your 401(k) into an annuity to maintain tax advantages and control over your retirement savings.

- Seeking Guaranteed Income:Individuals who desire a guaranteed income stream in retirement may choose to roll over their 401(k) into an annuity to ensure financial security.

- Protecting Against Market Risk:If you’re concerned about market volatility, an annuity can provide protection and a guaranteed return.

Resources and Tools

Several resources and tools can help you navigate the 401(k) rollover process, including:

- Financial Advisors:Consult with a financial advisor to get personalized guidance and ensure you make informed decisions.

- Annuity Provider Websites:Many annuity providers offer online tools and calculators to help you estimate annuity payments and compare different options.

- IRS Publication 590:The IRS Publication 590 provides detailed information about retirement plans, including rollovers and tax implications.

Real-World Examples and Case Studies

| Name | Age | Financial Goals | Annuity Type | Outcome |

|---|---|---|---|---|

| Sarah | 62 | Guaranteed income for life | Fixed annuity | Sarah received a guaranteed monthly income of $2,500 for life, providing financial security and peace of mind. |

| John | 55 | Protection against market volatility | Indexed annuity | John’s annuity provided a guaranteed minimum return linked to the S&P 500, protecting his savings from significant market losses. |

| Emily | 68 | Tax-free withdrawals in retirement | Roth annuity | Emily enjoyed tax-free withdrawals from her Roth annuity, allowing her to maximize her retirement income. |

| David | 70 | Legacy planning for his family | Variable annuity with death benefit | David’s annuity included a death benefit that passed on a portion of his investment to his family, ensuring their financial well-being. |

Final Thoughts

Annuity 401k rollovers can be a powerful tool for retirement planning, but they’re not a one-size-fits-all solution. By carefully evaluating your individual circumstances, consulting with a financial advisor, and understanding the potential risks and rewards, you can make an informed decision that aligns with your long-term financial goals.

Remember, taking the time to research and plan is essential for maximizing your retirement security.

An annuity is a financial product that provides a stream of regular payments over a set period of time. You might be wondering, what exactly is an annuity in 2024? An annuity can be a valuable tool for retirement planning, as it provides a predictable income stream.

Answers to Common Questions

Is it always better to roll over my 401(k) into an annuity?

No, it’s not always the best option. It depends on your individual circumstances, risk tolerance, and financial goals. Consulting with a financial advisor is recommended.

What are the tax implications of rolling over a 401(k) into an annuity?

The tax implications depend on whether you have a traditional or Roth 401(k) and the type of annuity you choose. It’s essential to consult with a tax professional for specific guidance.

How long does it take to roll over a 401(k) into an annuity?

The timeframe varies depending on the specific process and paperwork involved. It’s best to allow several weeks to ensure a smooth transition.