An Immediate Needs Annuity is a financial product that provides guaranteed income for life. It’s a type of annuity that pays out a stream of income immediately upon purchase, making it a valuable tool for retirees or individuals seeking a steady stream of income.

Unlike other types of annuities, an immediate needs annuity doesn’t have an accumulation period, meaning you begin receiving payments right away. This can be a major advantage for those who need income now and don’t want to wait for their savings to grow.

Immediate needs annuities are designed to provide financial security and peace of mind. They offer a guaranteed income stream that can help cover essential expenses, such as housing, healthcare, and food. The payments are typically fixed for life, providing a stable source of income that isn’t subject to market fluctuations.

Calculating the future value of an annuity due is a bit different than a regular annuity. Learn more about calculating annuity due future value.

However, it’s important to understand the potential downsides of these annuities, such as the impact of interest rate changes on payouts and limitations on withdrawing funds.

What is an Immediate Needs Annuity?

An immediate needs annuity, also known as a single premium immediate annuity (SPIA), is a type of annuity that provides guaranteed income payments starting immediately after the purchase. This type of annuity is designed for individuals who need a reliable source of income right away, such as retirees or those who are facing unexpected financial challenges.

Want to figure out how much your regular payments will grow into over time? You can use an ordinary annuity calculator to see the future value of your investment.

Defining an Immediate Needs Annuity and Its Purpose

An immediate needs annuity is a financial product that allows you to convert a lump sum of money into a stream of guaranteed income payments. This income stream is typically for life, meaning that you will receive regular payments for as long as you live.

Annuity payments are designed to provide a stream of income in the future. Learn more about annuity future value and how it can benefit you.

The purpose of an immediate needs annuity is to provide financial security and peace of mind by ensuring a consistent income stream during retirement or in times of need.

Understanding the annuity formula is key to calculating your potential returns. Learn how to use it for accurate financial planning.

Differentiating Immediate Needs Annuities from Other Annuity Types

Immediate needs annuities differ from other types of annuities in several key ways. Firstly, they are designed to provide income payments immediately, while other annuities, such as deferred annuities, may have a waiting period before payments begin. Secondly, immediate needs annuities are typically purchased with a lump sum payment, whereas other annuities may allow for periodic contributions.

Want to know how your variable annuity benefit base is determined? Understanding the variable annuity benefit base is crucial for planning your retirement.

Lastly, immediate needs annuities usually have a fixed interest rate, whereas other annuities may offer variable interest rates that fluctuate with market conditions.

Explaining How an Immediate Needs Annuity Works

The process of purchasing an immediate needs annuity is straightforward. You simply provide an insurance company with a lump sum of money, and in return, they agree to make regular income payments to you for the rest of your life.

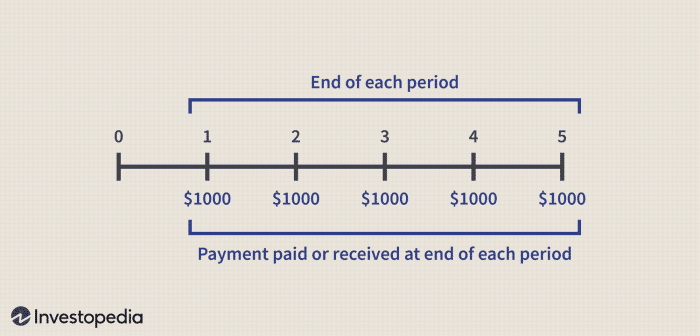

The amount of the income payments is determined by several factors, including the size of your lump sum, your age, and the prevailing interest rates. The income payments can be structured in various ways, such as monthly, quarterly, or annually, and can be adjusted for inflation.

Annuity calculations can seem complex, but they’re actually pretty straightforward. This guide on calculating an annuity breaks down the process for you.

Benefits of an Immediate Needs Annuity

Immediate needs annuities offer several benefits for individuals seeking immediate income. These benefits make them a valuable financial tool for retirement planning, managing unexpected expenses, and ensuring financial security.

Federal employees can receive an annuity through the FERS program. This guide on calculating a federal annuity can help you understand how it works.

Guaranteed Income for Life

The most significant benefit of an immediate needs annuity is the guarantee of income payments for life. Once you purchase an immediate needs annuity, you can rest assured that you will receive regular income payments, regardless of how long you live.

This eliminates the risk of outliving your savings and provides peace of mind, knowing that you will have a steady income stream throughout your retirement years.

Tax Benefits

Immediate needs annuities offer tax benefits, as the income payments are generally taxed as ordinary income. However, the principal amount you paid for the annuity is not taxed until you start receiving payments. This can be advantageous for individuals who want to minimize their tax liability in retirement.

Drawbacks of an Immediate Needs Annuity

While immediate needs annuities offer significant benefits, it’s important to consider the potential drawbacks before making a decision. These drawbacks can impact the overall value and suitability of an immediate needs annuity for your financial situation.

Variable annuities offer a way to potentially grow your income over time. Find out more about variable annuity income.

Impact of Interest Rate Changes

Immediate needs annuities typically have fixed interest rates, meaning that the income payments are determined at the time of purchase and do not change with market fluctuations. If interest rates rise after you purchase an annuity, you may receive lower income payments than you would have if you had purchased the annuity at a later date when interest rates were higher.

Conversely, if interest rates fall, your income payments may be higher than they would have been if you had purchased the annuity at a later date when interest rates were lower.

If you need to withdraw money from your variable annuity, you may be able to request a hardship withdrawal. Learn about the requirements and potential implications.

Limitations on Withdrawing Funds

Immediate needs annuities are generally designed to provide a steady stream of income, and withdrawing funds from the annuity before the end of the term may be limited or subject to penalties. This lack of flexibility can be a drawback for individuals who may need access to their funds for unforeseen circumstances.

Edward Jones offers an annuity calculator to help you explore your options. Check it out to see how annuities might fit into your financial plan.

Who is an Immediate Needs Annuity Suitable For?

Immediate needs annuities are suitable for individuals who need a reliable source of income immediately, such as retirees or those facing unexpected financial challenges. They are also a good option for individuals who want to protect their principal from market volatility and guarantee a steady income stream for life.

Need to calculate the annuity factor for your financial planning? Excel can help! Learn more about calculating annuity factors in Excel.

Suitability for Different Financial Situations

Immediate needs annuities can be a suitable financial tool for various situations, including:

- Retirement planning:Individuals approaching retirement who need a guaranteed income stream to supplement their retirement savings.

- Unexpected expenses:Individuals facing unexpected expenses, such as medical bills or home repairs, who need a reliable source of income to cover these costs.

- Long-term care planning:Individuals concerned about funding long-term care expenses in the future.

- Legacy planning:Individuals who want to ensure that their loved ones receive a guaranteed income stream after their death.

Table of Individuals Who May Benefit, An Immediate Needs Annuity

| Individual | Financial Situation | Benefit of Immediate Needs Annuity |

|---|---|---|

| Retiree | Seeking a guaranteed income stream to supplement retirement savings. | Provides a reliable source of income for life, eliminating the risk of outliving savings. |

| Individual with unexpected expenses | Facing medical bills or home repairs. | Provides immediate income to cover unexpected costs. |

| Individual planning for long-term care | Concerned about funding long-term care expenses. | Provides a guaranteed income stream to cover long-term care costs. |

| Individual with legacy planning goals | Wanting to ensure their loved ones receive a guaranteed income stream. | Provides a guaranteed income stream for beneficiaries after the individual’s death. |

How to Choose an Immediate Needs Annuity

Choosing an immediate needs annuity that aligns with your needs and goals is crucial for maximizing its benefits. Carefully considering the following factors will help you make an informed decision.

Comparing Annuity Providers and Offerings

It is essential to compare different annuity providers and their offerings before making a decision. Consider factors such as interest rates, fees, payment options, and the provider’s financial stability. Look for providers with a strong track record and a reputation for providing excellent customer service.

Evaluating Key Factors

When evaluating an immediate needs annuity, consider the following key factors:

- Interest rates:Compare interest rates offered by different providers to ensure you receive the highest possible income payments.

- Fees:Understand the fees associated with the annuity, such as administrative fees, surrender charges, and death benefits. These fees can impact the overall return on your investment.

- Payment options:Choose payment options that best suit your needs, such as monthly, quarterly, or annual payments. You can also consider options for adjusting payments for inflation.

- Death benefits:Some immediate needs annuities offer death benefits, which provide a lump sum payment to your beneficiaries upon your death. Consider the value of this benefit and its impact on your overall financial planning.

Illustrative Examples of Immediate Needs Annuity Usage

Immediate needs annuities can be used in various ways to meet different financial goals. The following examples demonstrate how this type of annuity can be a valuable tool for retirement planning, managing unexpected expenses, and ensuring financial security.

Retiree Using an Immediate Needs Annuity to Supplement Income

Imagine a retiree named John who has $200,000 in savings. He wants to supplement his retirement income with a guaranteed income stream. John purchases an immediate needs annuity with his savings, which provides him with a monthly income payment of $1,500 for life.

Wondering about variable annuity issue ages? Check out this information on variable annuity issue ages , including those over 90.

This guaranteed income stream provides John with peace of mind, knowing that he will have a steady income to cover his living expenses during retirement.

Want to know how much your annuity is growing? You can calculate annuity growth to track your progress.

Funding Long-Term Care Expenses

Sarah is a 65-year-old woman who is concerned about funding long-term care expenses in the future. She purchases an immediate needs annuity with $100,000, which provides her with a monthly income payment of $800 for life. This income stream can help cover the cost of long-term care services, such as assisted living or nursing home care, if needed.

An immediate annuity plan is a great way to start receiving payments right away. Learn more about what an immediate annuity plan is and how it works.

Impact of an Immediate Needs Annuity on Financial Planning

A couple named David and Mary, both in their late 50s, are planning for retirement. They have a significant amount of savings but are concerned about market volatility. They decide to purchase an immediate needs annuity with a portion of their savings, which provides them with a guaranteed income stream of $2,000 per month.

This income stream provides them with financial security, knowing that they will have a steady source of income to cover their living expenses during retirement, regardless of market fluctuations.

Final Summary: An Immediate Needs Annuity

An Immediate Needs Annuity can be a valuable financial tool for individuals seeking guaranteed income for life. While it offers advantages like guaranteed payments and tax benefits, it’s crucial to carefully consider the potential drawbacks, such as the impact of interest rate changes and limitations on withdrawals.

By understanding the pros and cons and carefully evaluating your financial needs and goals, you can determine if an immediate needs annuity is the right choice for you.

Quick FAQs

What is the minimum amount I need to invest in an immediate needs annuity?

The minimum investment amount for an immediate needs annuity varies depending on the insurance company and the type of annuity. It’s best to contact different providers to compare their minimum investment requirements.

Curious about when your variable annuity will mature? Check out this guide on variable annuity maturity dates for a better understanding.

Can I withdraw my principal investment from an immediate needs annuity?

Generally, you cannot withdraw your principal investment from an immediate needs annuity. However, some annuities may offer limited withdrawal options, which could come with penalties.

How do interest rate changes affect my annuity payments?

Interest rate changes can impact the amount of your annuity payments. If interest rates rise, your payments may be lower than initially anticipated. Conversely, if interest rates fall, your payments may be higher.

What are the tax implications of an immediate needs annuity?

The tax implications of an immediate needs annuity depend on the type of annuity and how it’s structured. It’s best to consult with a tax professional to understand the tax implications of your specific annuity.