An Annuity Is A Life Insurance Product That 2024: A Comprehensive Guide. Annuities are often viewed as a complex financial instrument, but their core purpose is simple: to provide a steady stream of income for a set period of time or for life.

An annuity is a series of regular payments that can be a valuable financial tool for individuals seeking a guaranteed income stream. Annuity Is A Series Of 2024 can be used for a variety of purposes, including retirement planning, income supplementation, and long-term care.

In 2024, with a shifting economic landscape and evolving retirement needs, annuities are gaining renewed attention as a potential tool for securing financial stability.

The increasing popularity of avatar creation raises important ethical considerations, particularly regarding privacy, identity, and representation. Dollify 2024: Ethical Considerations of Avatar Creation prompts us to think about how we use and share our digital identities in a responsible and respectful manner.

This guide delves into the multifaceted world of annuities, exploring their relationship with life insurance, their diverse types, and the key considerations for making informed decisions. We’ll examine the current market trends, regulatory changes, and the future outlook for annuities in the coming years.

Dollify 2024 takes avatar creation to a new level of realism, allowing users to craft highly detailed and personalized representations of themselves. Dollify 2024: Creating Realistic Avatars is a popular tool for social media, gaming, and other online activities, offering a fun and expressive way to connect with others.

By understanding the nuances of this financial product, you can determine if an annuity is a suitable fit for your individual financial goals and aspirations.

Understanding Annuities

Annuities are financial products that provide a stream of regular payments, often for a specific period or for life. They are commonly used for retirement planning, but can also serve other financial goals. Let’s delve into the intricacies of annuities and their various applications.

An annuity can be a valuable retirement vehicle, providing a steady income stream throughout your golden years. Annuity Is A Voluntary Retirement Vehicle 2024 can help you achieve financial security and peace of mind during your retirement, ensuring you have the resources you need to enjoy your well-deserved time off.

What is an Annuity?

In essence, an annuity is a contract between you and an insurance company. You make a lump-sum payment or a series of payments, and in return, the insurance company agrees to make regular payments to you, starting at a predetermined date.

These payments can be made for a fixed period, for life, or for a combination of both.

Dollify 2024 brings several exciting new features and improvements, making it even more powerful and user-friendly than ever before. Dollify 2024: What’s New and Different includes enhanced customization options, new avatar styles, and improved performance, ensuring a smooth and enjoyable creative experience.

How Annuities Work

The core concept behind annuities is simple: you exchange a lump sum or a series of payments for a guaranteed stream of income. The amount of the payments you receive depends on several factors, including the size of your initial investment, the type of annuity you choose, and the interest rate guaranteed by the insurance company.

Google Tasks is a versatile tool that can be used to manage tasks effectively in a business setting. Google Tasks 2024: Google Tasks for Businesses allows businesses to assign tasks, track progress, and collaborate efficiently, streamlining workflows and improving productivity.

Types of Annuities

Annuities come in various forms, each offering different features and risk profiles. Understanding these types is crucial to choosing the right annuity for your needs.

- Fixed Annuities:These provide a guaranteed interest rate and a fixed stream of payments. They are less risky than variable annuities, but they may not keep pace with inflation.

- Variable Annuities:These allow you to invest your money in sub-accounts that fluctuate in value based on the performance of the underlying investments. They offer the potential for higher returns, but also carry more risk.

- Indexed Annuities:These link their returns to the performance of a specific market index, such as the S&P 500. They offer the potential for growth without the downside risk of a complete market crash.

Benefits and Drawbacks of Annuities, An Annuity Is A Life Insurance Product That 2024

Like any financial product, annuities have both advantages and disadvantages. It’s essential to weigh these carefully before making a decision.

Quizlet is a popular online learning platform that offers a variety of tools for studying and memorizing information. An Annuity Is Quizlet 2024 can be used to learn about annuities, including their different types, benefits, and risks.

- Benefits:Guaranteed income, tax-deferred growth, protection from market fluctuations, potential for higher returns.

- Drawbacks:High fees, limited access to funds, potential for lower returns than other investments, surrender charges.

Real-Life Scenarios

Annuities can be valuable tools for achieving various financial goals.

The new Snapdragon 2024 chip is designed to bring powerful performance to budget phones, making them more capable than ever before. Snapdragon 2024 for budget phones promises to deliver a smooth and efficient user experience, even for demanding tasks like gaming and video editing.

- Retirement Income:Annuities can provide a steady stream of income during retirement, ensuring financial security. For instance, a retiree could use a fixed annuity to supplement their Social Security benefits.

- Estate Planning:Annuities can be used to create a legacy for loved ones. For example, a person could purchase an annuity that pays out to their beneficiaries after their death.

- Long-Term Care:Annuities can help cover the costs of long-term care, providing peace of mind in case of unexpected health issues.

Annuities and Life Insurance

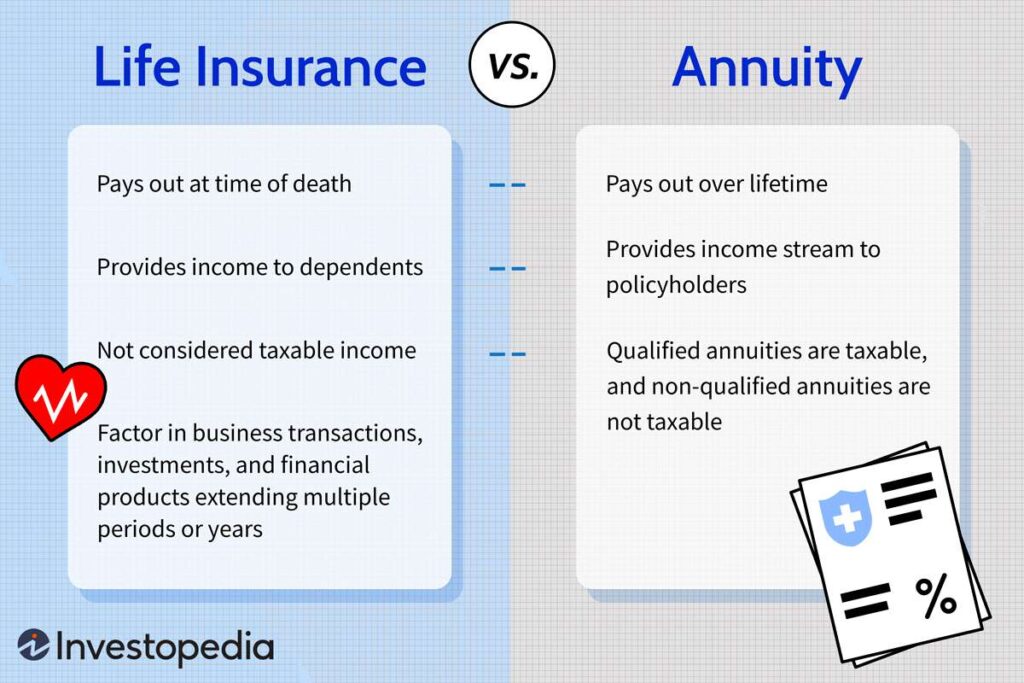

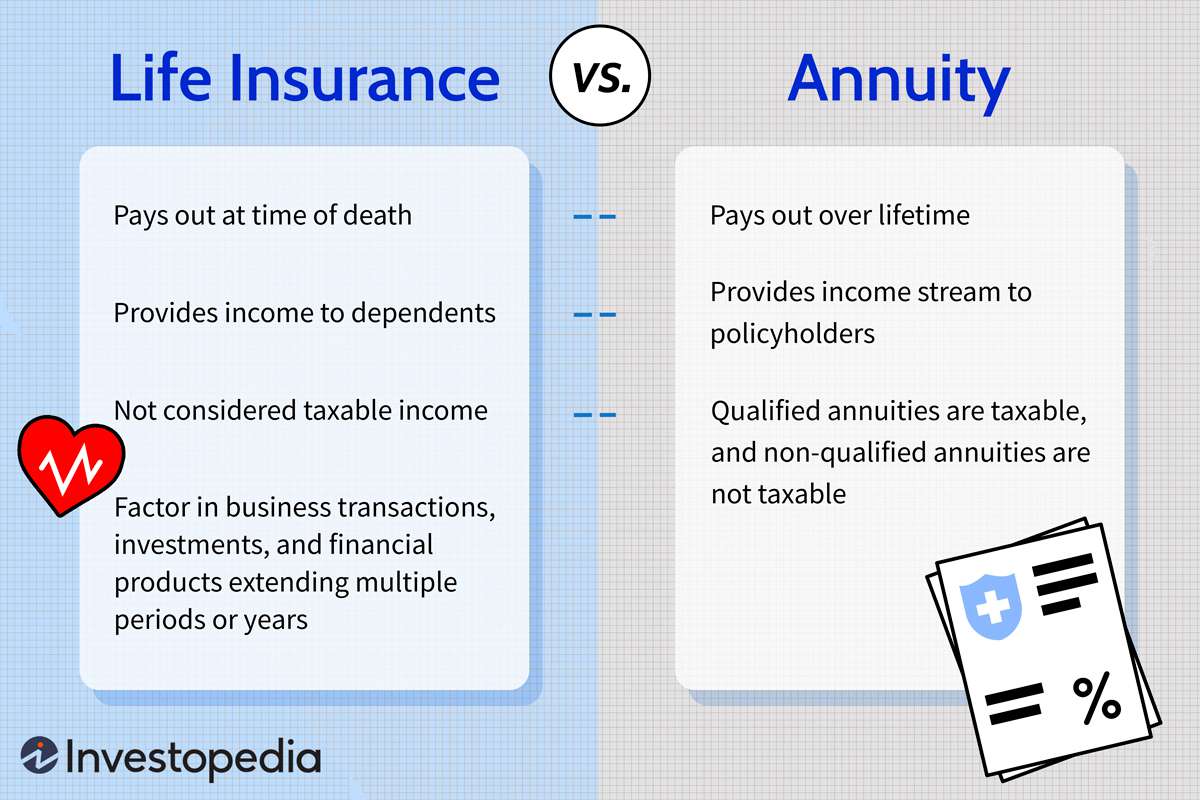

While often perceived as separate, annuities and life insurance share a connection, particularly when it comes to retirement planning and legacy creation. Let’s explore their relationship and how they can complement each other.

Pushbullet is a versatile tool that allows you to remotely control your computer from your phone or tablet. Pushbullet 2024: How to use Pushbullet for remote control of your computer can be used to send files, notifications, and even control your keyboard and mouse, making it a handy tool for productivity and convenience.

Relationship Between Annuities and Life Insurance

Both annuities and life insurance are products offered by insurance companies. They both involve a contract where you pay premiums in exchange for financial protection. However, their primary functions differ significantly.

An annuity is a financial product that provides a stream of regular payments over a set period of time. An Annuity Is A Series Of 2024 can be a valuable tool for retirement planning, providing a steady income source during your golden years.

Comparison and Contrast

Here’s a table comparing the features and functions of annuities and life insurance:

| Feature | Annuities | Life Insurance |

|---|---|---|

| Purpose | Provide a stream of income | Provide a death benefit |

| Payment Structure | Regular payments to the annuitant | Lump-sum payment to beneficiaries upon death |

| Investment Growth | Potentially tax-deferred growth | No investment growth, but premiums may accrue interest |

| Risk Profile | Variable annuities carry investment risk | Generally considered less risky |

Complementary Roles

Annuities and life insurance can work together to create a comprehensive financial plan. For example, a person could use life insurance to cover their final expenses and provide a lump sum to their beneficiaries, while an annuity could provide them with a steady stream of income during retirement.

Google Tasks is a simple yet powerful task management tool that can be incredibly useful for students. Google Tasks 2024: Google Tasks for Students allows students to create, organize, and prioritize their assignments, deadlines, and other tasks, ensuring they stay on track and manage their time effectively.

When Annuities Might Be Better

In certain situations, an annuity might be a more suitable choice than life insurance. For example:

- Guaranteed Income:If you need a guaranteed stream of income during retirement, an annuity can provide that certainty.

- Long-Term Care:Annuities can help cover the costs of long-term care, which life insurance typically doesn’t cover.

- Estate Planning:Annuities can be used to create a legacy for loved ones, similar to life insurance, but with the added benefit of potential investment growth.

Key Considerations for Annuities

Before purchasing an annuity, it’s crucial to carefully consider several factors to ensure it aligns with your financial goals and risk tolerance.

Factors to Consider

- Your Financial Goals:What are you hoping to achieve with an annuity? Retirement income, estate planning, or long-term care?

- Time Horizon:How long do you need the annuity to last? This will influence the type of annuity you choose.

- Risk Tolerance:How comfortable are you with market fluctuations? This will determine whether a fixed or variable annuity is more appropriate.

- Fees and Charges:Annuities can come with various fees, including surrender charges, administrative fees, and mortality and expense charges. Understand these fees before making a decision.

Understanding the Contract

Read the annuity contract carefully and understand the terms and conditions. Pay close attention to the following:

- Interest Rate:What interest rate is guaranteed by the insurance company?

- Payment Schedule:How often will you receive payments?

- Surrender Charges:What are the penalties for withdrawing funds before a certain period?

- Death Benefit:What happens to the annuity if you die before the payments are fully received?

Risk Tolerance and Investment Goals

Your risk tolerance and investment goals should guide your annuity selection. If you’re risk-averse, a fixed annuity might be a better choice. However, if you’re willing to take on more risk for the potential for higher returns, a variable annuity could be suitable.

Choosing the Right Provider

Select a reputable and financially sound insurance company with a strong track record. Consider factors like the company’s financial stability, customer service, and product offerings.

Annuities in 2024

The annuity market is constantly evolving, influenced by economic conditions, regulatory changes, and emerging innovations. Let’s examine the current landscape and anticipate future trends.

Market Trends and Regulatory Changes

The annuity market is currently facing several challenges, including low interest rates and increased regulatory scrutiny. These factors are impacting annuity pricing and product design. However, some new products are emerging, such as longevity annuities, designed to address the growing need for income security in retirement.

The new Snapdragon 2024 chip boasts impressive battery life and efficiency, thanks to its optimized power management system. Snapdragon 2024 battery life and efficiency allows users to enjoy extended usage time without worrying about frequent charging, making it a great choice for users who are always on the go.

Impact of Economic Conditions

Economic conditions play a significant role in annuity performance. For example, during periods of low interest rates, fixed annuities may offer lower returns. Conversely, during periods of economic growth, variable annuities may perform well. It’s crucial to understand how economic conditions could affect your annuity’s performance.

Android WebView 202 offers enhanced capabilities for mobile development, allowing developers to integrate web content seamlessly into their apps. Android WebView 202 for mobile development improves performance, security, and user experience, making it an essential tool for building modern mobile applications.

Innovations and Developments

The annuity industry is constantly innovating to meet the evolving needs of consumers. Some recent developments include:

- Longevity Annuities:These annuities provide income for a long period, often starting later in life, designed to address the increasing life expectancy of retirees.

- Variable Annuities with Guaranteed Minimum Income Benefits (GMIBs):These offer a guaranteed minimum income stream even if the underlying investments perform poorly.

- Annuities with Living Benefits:These provide benefits while you’re still alive, such as long-term care protection or income guarantees.

Future Outlook

The future of annuities is uncertain, but it’s likely that the industry will continue to evolve to meet the needs of an aging population. Innovations in product design, such as longevity annuities and annuities with living benefits, are expected to gain popularity.

It’s essential to stay informed about these developments and choose products that align with your long-term financial goals.

Android WebView 202 brings a significant update for enterprise use, offering improved security and performance for businesses. Android WebView 202 for enterprise use allows businesses to integrate web content seamlessly into their apps, enhancing user experience and streamlining operations.

Practical Applications of Annuities: An Annuity Is A Life Insurance Product That 2024

Annuities can be valuable tools for achieving various financial goals. Let’s explore some practical applications and real-world examples.

Glovo, the popular delivery app, offers a range of payment methods for your convenience, including credit cards, mobile wallets, and cash on delivery. Glovo app payment methods and security features also prioritize security with features like secure payment gateways and data encryption to protect your personal information.

Uses of Annuities

| Use | Description |

|---|---|

| Retirement Income | Provides a guaranteed stream of income during retirement, ensuring financial security. |

| Estate Planning | Creates a legacy for loved ones by providing a death benefit or a stream of income to beneficiaries. |

| Long-Term Care | Helps cover the costs of long-term care, providing financial protection in case of unexpected health issues. |

| Income Protection | Provides a guaranteed income stream for a specific period, protecting against unexpected job loss or financial hardship. |

Real-World Examples

- Retirement Income:A retiree could purchase a fixed annuity to provide a guaranteed stream of income for life, supplementing their Social Security benefits and other retirement savings.

- Estate Planning:A person could purchase an annuity that pays out to their beneficiaries after their death, creating a legacy and ensuring their loved ones are financially secure.

- Long-Term Care:An individual concerned about the rising costs of long-term care could purchase an annuity that provides a benefit if they require long-term care services.

Tips and Strategies

- Consult with a Financial Advisor:A financial advisor can help you determine if an annuity is right for you and guide you through the selection process.

- Shop Around:Compare quotes from different insurance companies to find the best rates and terms.

- Understand the Fees:Be aware of the fees associated with annuities and factor them into your decision-making process.

- Diversify Your Investments:Annuities should be part of a diversified investment portfolio, not your sole source of income or retirement savings.

Final Summary

As you navigate the complex world of financial planning, annuities can offer a valuable tool for securing your future. By carefully considering your individual needs, risk tolerance, and investment goals, you can determine if an annuity is the right choice for you.

Whether you’re seeking retirement income, estate planning solutions, or long-term care protection, understanding the various types of annuities and their benefits can empower you to make informed decisions that align with your financial aspirations. Remember to consult with a qualified financial advisor to ensure you’re making the best choices for your unique circumstances.

Question Bank

What is the difference between a fixed annuity and a variable annuity?

A fixed annuity provides a guaranteed rate of return, while a variable annuity’s returns are tied to the performance of underlying investments. Fixed annuities offer more predictable income, while variable annuities offer the potential for higher returns but also carry more risk.

How do I choose the right annuity provider?

Consider factors like the provider’s financial stability, reputation, and customer service. Research their track record, fees, and the terms and conditions of their annuity contracts.

Can I withdraw money from an annuity before retirement?

Most annuities allow for withdrawals, but there may be penalties for early withdrawals. It’s important to review the terms and conditions of your specific annuity contract.