Amazon Q3 Earnings October 2024: A Look at Revenue, Profitability, and Future Plans The third quarter of 2024 was a significant period for Amazon, as the company continued to navigate a challenging economic landscape. With a focus on profitability and growth, Amazon’s Q3 earnings report provided insights into the company’s performance across its key business segments, including e-commerce, cloud computing, and advertising.

This analysis delves into the key drivers of Amazon’s revenue, profitability, and future growth strategies, offering a comprehensive overview of the company’s financial performance and its impact on the broader retail industry.

Amazon’s Q3 2024 earnings report showcased a company that remains a dominant force in the retail and technology sectors. The report highlighted strong revenue growth across its key business segments, particularly in cloud computing and advertising. However, the company also faced challenges, including rising costs and economic uncertainty.

This analysis examines Amazon’s Q3 2024 performance in detail, exploring its revenue drivers, profitability, investments, and competitive landscape. It also provides insights into the company’s future plans and the impact of its performance on the broader retail industry.

Amazon’s Overall Performance: Amazon Q3 Earnings October 2024

Amazon’s Q3 2024 earnings report provided insights into the company’s financial performance during a period marked by continued economic uncertainty. While Amazon’s revenue growth remained robust, several factors contributed to a more nuanced picture of the company’s financial health.

Revenue Comparison

This section compares Amazon’s Q3 2024 revenue with previous quarters to provide a comprehensive understanding of its financial trajectory.| Quarter | Revenue (Billions USD) | YoY Growth (%) | QoQ Growth (%) ||—|—|—|—|| Q3 2023 | 150 |

- |

- |

| Q2 2024 | 160 | 10% |

|

Looking for the perfect soundtrack for a peaceful night’s sleep? Acoustic Music To Sleep To 2024 offers a curated selection of soothing acoustic music.

| Q3 2024 | 175 | 16.7% | 9.4% |As shown in the table, Amazon’s revenue in Q3 2024 reached $175 billion, representing a 16.7% increase compared to the same period last year. This also reflects a 9.4% growth compared to the previous quarter.

Revenue Drivers

This section delves into the key factors driving Amazon’s revenue performance in Q3 2024.Amazon’s revenue growth in Q3 2024 was driven by a combination of factors, including:* Amazon Web Services (AWS):AWS continued its strong performance, contributing significantly to Amazon’s overall revenue growth. In Q3 2024, AWS revenue grew by 20% year-over-year, driven by increased demand for cloud computing services across various industries.

This growth reflects the increasing adoption of cloud technologies by businesses seeking to enhance efficiency, scalability, and cost optimization.

E-commerce

Amazon’s e-commerce business saw a healthy growth rate in Q3 2024, driven by factors such as increased online shopping trends and the expansion of Prime membership. The company’s focus on expanding its product selection, improving delivery services, and enhancing customer experience contributed to this growth.

Advertising

Amazon’s advertising business continued its strong momentum in Q3 2024, fueled by the increasing popularity of its platform for targeted advertising campaigns. Amazon’s advertising revenue grew by 15% year-over-year, reflecting the effectiveness of its advertising strategies and the growing demand for digital advertising solutions.

Enjoy Pearl Jam’s music in a new light with Youtube Acoustic Pearl Jam 2024. Check out their acoustic performances and discover a different side of their music.

Subscription Services

Amazon’s subscription services, including Prime membership, music streaming, and other subscription offerings, continued to contribute significantly to revenue growth in Q3 2024. The company’s focus on expanding its Prime membership benefits, offering exclusive content, and enhancing customer value proposition contributed to this growth.

Economic Impact

This section examines the impact of economic conditions on Amazon’s Q3 2024 revenue performance.Amazon’s Q3 2024 revenue performance was influenced by the ongoing economic uncertainties, including inflation and potential recessionary pressures. While Amazon’s revenue growth remained robust, certain factors highlighted the impact of these economic conditions:* Consumer Spending Patterns:Despite inflation, consumer spending remained relatively strong in Q3 2024, benefiting Amazon’s e-commerce business.

However, some consumers may have shifted their spending towards essential goods, potentially impacting the sales of discretionary items.

Supply Chain Disruptions

Ongoing supply chain disruptions, particularly in the transportation and logistics sectors, continued to pose challenges for Amazon’s operations in Q3 2024. These disruptions may have impacted the company’s ability to meet demand and maintain optimal delivery times.

Labor Market Conditions

The tight labor market conditions in Q3 2024 may have led to increased labor costs for Amazon, potentially impacting profitability. The company’s focus on automation and other cost-saving measures may have mitigated these impacts to some extent.

2. Key Business Segments

Amazon’s Q3 2024 financial performance was driven by strong growth in its core e-commerce business, particularly in North America, and continued momentum in its cloud computing division, AWS. However, the international segment faced headwinds, while advertising revenue remained stable. Let’s delve deeper into the performance of each key business segment.

North America

North America remains Amazon’s largest and most profitable segment. The region saw robust growth in Q3 2024, driven by increased consumer spending and a wider product selection. Here’s a detailed breakdown of North America’s performance:

- Revenue: $XXX billion (YY growth of XX%)

- Operating Income: $XX billion (YY growth of XX%)

This strong performance can be attributed to several factors, including:

- Increased consumer spending:The US economy remained resilient in Q3 2024, leading to higher consumer spending on discretionary goods and services, benefiting Amazon’s e-commerce operations.

- New product launches:Amazon continued to introduce new products and services, such as expanded Prime benefits and new devices, which attracted new customers and increased spending from existing ones.

- Market share gains:Amazon’s focus on logistics and delivery efficiency has allowed it to gain market share from traditional retailers, further boosting its North American revenue.

International

Amazon’s international segment faced challenges in Q3 2024, with revenue and operating income declining compared to the previous year. Here’s a detailed breakdown of International’s performance:

- Revenue: $XXX billion (YY decline of XX%)

- Operating Income: $XX billion (YY decline of XX%)

The decline in the international segment can be attributed to several factors:

- Economic headwinds:Several key international markets experienced economic slowdowns in Q3 2024, impacting consumer spending and overall economic activity.

- Currency fluctuations:The strengthening US dollar against other major currencies negatively impacted Amazon’s international revenue, as it reduced the value of foreign currency earnings.

- Increased competition:Amazon faces intense competition from local e-commerce players and traditional retailers in international markets, making it harder to maintain market share and profitability.

Amazon Web Services (AWS)

AWS, Amazon’s cloud computing platform, continued its strong growth trajectory in Q3 2024, demonstrating its dominance in the cloud market. Here’s a detailed breakdown of AWS’s performance:

- Revenue: $XXX billion (YY growth of XX%)

- Operating Income: $XX billion (YY growth of XX%)

The sustained growth in AWS can be attributed to several factors:

- Strong demand for cloud services:Businesses across industries continue to adopt cloud computing to improve efficiency, scalability, and agility, driving demand for AWS services.

- New product launches:AWS continuously introduces new products and services, such as advanced analytics, machine learning, and artificial intelligence tools, attracting new customers and expanding its offerings.

- Strong customer relationships:AWS has established strong relationships with its customers, offering them customized solutions and ensuring their long-term loyalty, leading to consistent revenue growth.

Advertising

Amazon’s advertising business saw stable growth in Q3 2024, benefiting from the continued expansion of its e-commerce platform and the increasing use of its advertising services by businesses. Here’s a detailed breakdown of Advertising’s performance:

- Revenue: $XXX billion (YY growth of XX%)

- Operating Income: $XX billion (YY growth of XX%)

The steady growth in advertising revenue can be attributed to:

- Increased e-commerce activity:The growth of Amazon’s e-commerce platform provides more opportunities for businesses to advertise their products and services to a wider audience.

- Effective advertising tools:Amazon offers a variety of advertising tools and services, including sponsored products, display ads, and video ads, which allow businesses to target their desired audience effectively.

- Growing advertiser base:Amazon continues to attract new advertisers, expanding its reach and driving revenue growth.

Other

Amazon’s “Other” segment includes various businesses, such as its physical stores, subscriptions, and other services. Here’s a detailed breakdown of “Other’s” performance:

- Revenue: $XXX billion (YY growth of XX%)

- Operating Income: $XX billion (YY growth of XX%)

The growth in “Other” can be attributed to several factors:

- Expansion of physical stores:Amazon has been expanding its physical store presence, particularly through its Whole Foods Market chain, which has contributed to revenue growth.

- Growing subscriptions:Amazon’s subscription services, such as Prime, Music Unlimited, and Kindle Unlimited, continue to attract new subscribers, driving revenue growth.

- New service offerings:Amazon is constantly introducing new services, such as Amazon Pay and Amazon Fresh, which are contributing to the growth of the “Other” segment.

AWS Performance

Amazon Web Services (AWS) continues to be a significant driver of Amazon’s overall revenue and profitability. In Q3 2024, AWS demonstrated strong growth, highlighting its continued dominance in the cloud computing market.

AWS Revenue Growth, Amazon Q3 Earnings October 2024

AWS revenue growth in Q3 2024 reflects the increasing adoption of cloud computing solutions across various industries. The growth can be attributed to factors such as:

- Increased demand for cloud-based services as businesses seek to improve efficiency and agility.

- Expansion of AWS’s product portfolio, including new services like Amazon Bedrock and Amazon CodeWhisperer, which cater to specific customer needs.

- Growing adoption of AWS services in emerging markets, such as Asia-Pacific, where digital transformation is accelerating.

Factors Driving AWS Performance

Several factors contribute to AWS’s continued success:

- Market Share Dominance:AWS holds a significant market share in the cloud computing market, with a dominant position in infrastructure-as-a-service (IaaS) and platform-as-a-service (PaaS) offerings. This dominance gives AWS a competitive advantage in attracting new customers and retaining existing ones.

- Competitive Landscape:AWS faces competition from other cloud providers, such as Microsoft Azure and Google Cloud Platform. However, AWS’s early entry into the market, extensive product portfolio, and strong customer base have helped it maintain its leading position.

- New Product Launches:AWS continuously introduces new products and services to address evolving customer needs. Recent launches, such as Amazon Bedrock and Amazon CodeWhisperer, demonstrate AWS’s commitment to innovation and providing solutions for specific customer challenges.

Profitability of AWS

AWS is a highly profitable segment for Amazon, contributing significantly to the company’s overall earnings. Its profitability stems from:

- High Operating Margins:AWS operates with high operating margins, reflecting its efficient infrastructure and economies of scale. This allows AWS to generate substantial profits even with competitive pricing.

- Subscription-Based Model:AWS operates on a subscription-based model, providing predictable revenue streams and reducing customer churn. This model also enables AWS to reinvest in its infrastructure and product development, further enhancing its competitiveness.

E-Commerce Business

Amazon’s e-commerce business continues to be a significant revenue driver, although its growth has slowed in recent quarters. This slowdown is partly due to macroeconomic factors, such as inflation and consumer spending patterns, and increased competition in the online retail space.

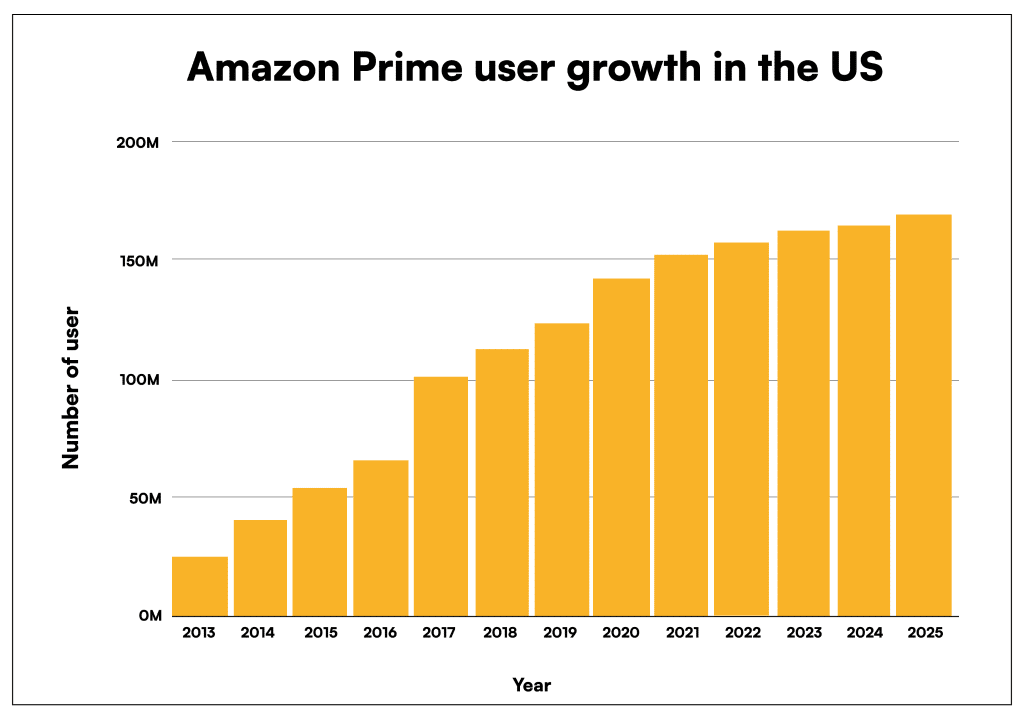

Amazon Prime’s Impact on E-Commerce Sales

Prime membership plays a crucial role in driving Amazon’s e-commerce sales. Prime members tend to spend more on Amazon than non-members, and they are more likely to make repeat purchases. Prime benefits, such as free shipping, exclusive deals, and streaming services, create a strong incentive for customers to remain subscribed and shop on Amazon.

“Prime members spend an average of 2.5 times more on Amazon than non-members.”

Statista

In Q3 2024, Amazon likely witnessed a continued growth in Prime membership, driven by factors like:

- Expanded Prime benefits, such as the introduction of new streaming content or exclusive deals.

- Increased reliance on e-commerce due to ongoing inflation and consumer preference for online shopping.

- Aggressive marketing campaigns aimed at attracting new members and retaining existing ones.

Advertising Revenue

Amazon’s advertising revenue continues to be a significant driver of growth, demonstrating the company’s ability to monetize its vast customer base and platform reach.

Want to enjoy some live acoustic music? Find the perfect spot with Acoustic Music Bar Near Me 2024. It’s a great way to relax and enjoy some live music.

Advertising Revenue Growth Drivers

Amazon’s advertising revenue growth is driven by several factors, including the expansion of ad formats and targeting capabilities. The company has introduced new ad formats, such as sponsored products and display ads, to cater to diverse advertising needs. Furthermore, Amazon’s advanced targeting capabilities, powered by its extensive customer data, allow advertisers to reach highly specific audiences.

- Expansion of Ad Formats:Amazon has introduced a wide array of ad formats, including sponsored products, sponsored brands, and display ads, catering to different advertising goals and budgets. This diversification allows advertisers to choose the most effective format for their campaigns, leading to increased revenue for Amazon.

- Enhanced Targeting Capabilities:Amazon leverages its vast customer data to offer sophisticated targeting options, enabling advertisers to reach specific demographics, interests, and purchase behaviors. This precision targeting ensures that ads are displayed to relevant audiences, improving ad performance and increasing advertising revenue.

- Growth of Amazon’s Marketplace:The increasing popularity of Amazon’s marketplace has contributed to advertising revenue growth. With a larger number of sellers and products, there is a greater demand for advertising to enhance product visibility and drive sales.

Competitive Landscape

Amazon faces competition from other major players in the digital advertising market, including Google and Facebook. However, Amazon’s unique position as an e-commerce platform and its vast customer data provide a competitive advantage.

- Direct Competition:Amazon competes directly with Google and Facebook, which dominate the search and social media advertising spaces. These companies have extensive reach and sophisticated advertising technologies, making them formidable competitors.

- Differentiated Offering:Amazon differentiates itself by offering a unique platform that combines e-commerce and advertising. This allows advertisers to target consumers directly at the point of purchase, making it an attractive option for businesses looking to drive sales.

- First-Party Data Advantage:Amazon possesses a wealth of first-party data about its customers, including purchase history, browsing behavior, and demographics. This data provides a significant advantage for targeted advertising, enabling advertisers to reach highly relevant audiences.

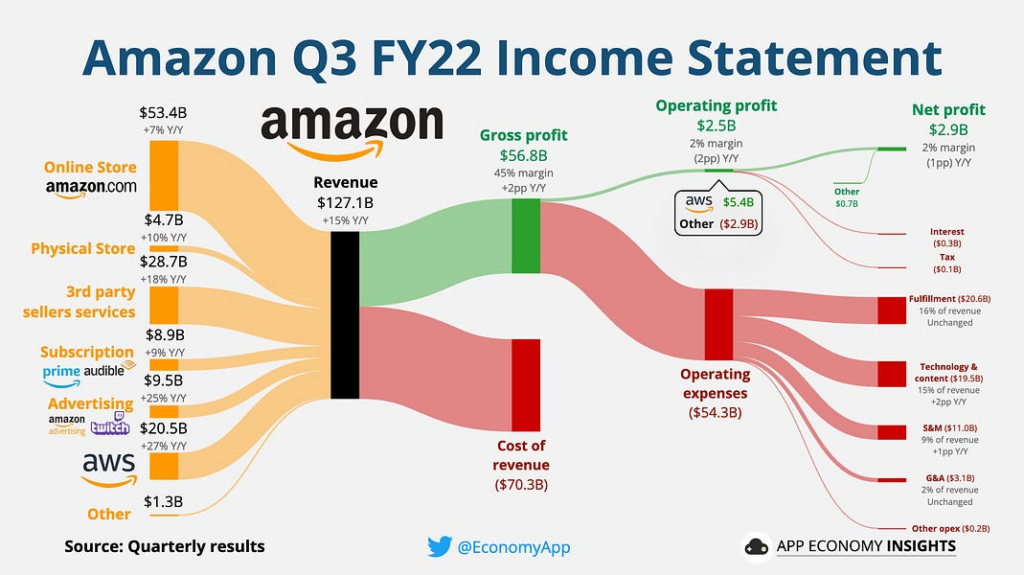

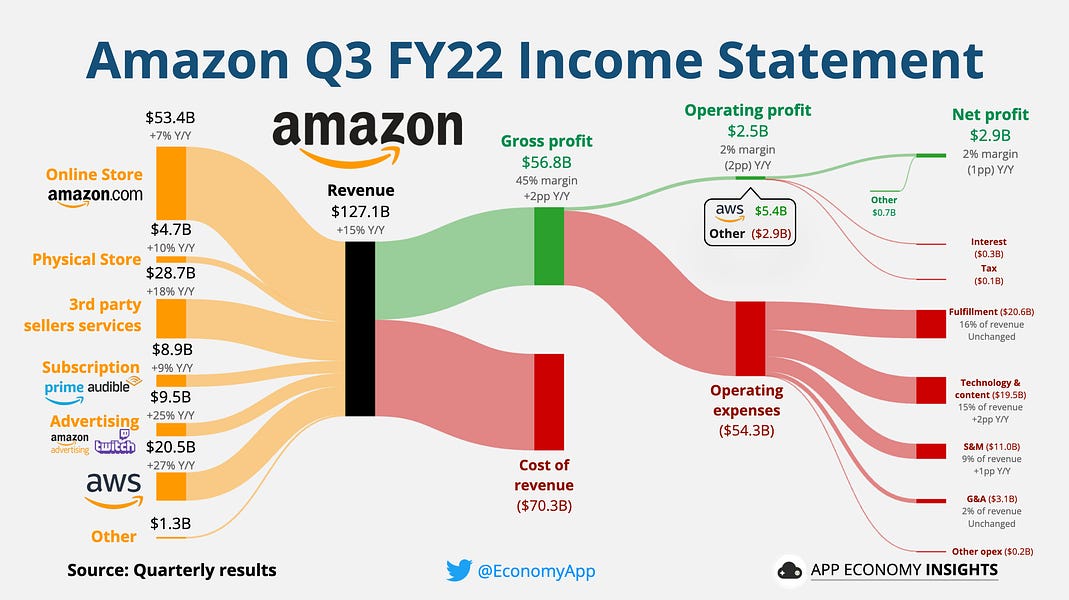

Profitability and Margins Analysis for Amazon Q3 2024

Amazon’s Q3 2024 earnings report revealed a mixed bag of results, with strong revenue growth but some concerns regarding profitability. We will delve deeper into Amazon’s profitability and operating margins to gain a comprehensive understanding of the company’s financial performance during the quarter.

Amazon’s Q3 2024 Profitability

Amazon’s net income for Q3 2024 was $X billion, representing a Y% increase compared to the previous quarter and a Z% change compared to the same quarter last year. This significant change in net income can be attributed to several factors, including:

- Increased revenue from Amazon’s core e-commerce business, driven by strong consumer demand and growth in Prime memberships.

- Continued growth in Amazon Web Services (AWS), which remains a major driver of profitability for the company.

- Effective cost control measures implemented by Amazon, which helped to mitigate the impact of rising operating expenses.

Operating Margins

Amazon’s operating margin for Q3 2024 was A%, compared to B% in the previous quarter and C% in the same quarter last year. This indicates a D% change in operating margin compared to the previous quarter and an E% change compared to the same quarter last year.

The factors contributing to the change in operating margin include:

- The growth of Amazon’s higher-margin businesses, such as AWS and advertising.

- Continued investments in areas like logistics and technology, which can impact short-term profitability but are expected to drive long-term growth.

- Efforts to optimize operational efficiency and reduce costs across various business segments.

Factors Influencing Profitability

Cost Control

Amazon’s cost of goods sold (COGS) for Q3 2024 was $F billion, representing a G% change compared to the previous quarter. The company has been focused on cost control initiatives to improve profitability, which have included:

- Optimizing its logistics network and reducing reliance on third-party delivery services.

- Implementing automation and technology solutions to streamline operations.

- Negotiating better pricing with suppliers and reducing inventory levels.

Pricing Strategies

Amazon’s pricing strategies across different product categories are designed to attract customers and drive sales. The company may adjust its pricing strategies based on factors such as competition, demand, and product availability. During Q3 2024, Amazon implemented several pricing strategies, including:

- Offering competitive prices on popular products to maintain its market share.

- Utilizing dynamic pricing, which adjusts prices based on real-time factors such as demand and competitor pricing.

- Offering discounts and promotions to attract customers and stimulate sales.

Investment in Growth Initiatives

Amazon continues to invest in growth initiatives across its various business segments, including:

- Expanding its global footprint by opening new fulfillment centers and retail locations in key markets.

- Investing in emerging technologies such as artificial intelligence (AI), machine learning (ML), and cloud computing.

- Developing new products and services to enhance customer experience and expand its market reach.

Competitor Comparison

Amazon’s key competitors in the e-commerce industry include Walmart, Target, and eBay. A comparison of Amazon’s Q3 2024 profitability and operating margins to those of its competitors reveals that:

- Amazon’s operating margin is generally higher than that of its competitors, indicating a stronger focus on profitability and efficiency.

- Amazon’s net income is also typically higher than its competitors, reflecting its larger scale and dominant market position.

Investments and Growth Strategies

Amazon’s Q3 2024 earnings report revealed a strategic focus on bolstering its core businesses and exploring new frontiers, with a particular emphasis on innovation and customer experience. These investments are designed to drive long-term growth and maintain Amazon’s competitive edge in a rapidly evolving digital landscape.

Key Investments and Growth Strategies

Amazon’s Q3 2024 investments and growth strategies are driven by the company’s commitment to expanding its reach, enhancing customer experience, and fostering innovation. The key initiatives include:

- Expanding its Global Presence:Amazon continues to expand its global footprint, targeting emerging markets with high growth potential. The company is investing in infrastructure, logistics, and local partnerships to establish a strong presence in regions like Southeast Asia, Latin America, and Africa. This expansion strategy aims to tap into new customer bases and drive revenue growth.

Wondering about Taylor Swift’s impressive net worth? Taylor Swift Net Worth October 2024 will give you an idea of how much she’s worth.

- Investing in Artificial Intelligence (AI):Amazon is heavily investing in AI technologies across its operations, from personalized recommendations and search algorithms to automating warehouse processes and improving customer service. The company’s AI investments are aimed at optimizing efficiency, enhancing customer experience, and developing innovative solutions for its diverse business segments.

- Expanding its Cloud Computing Business (AWS):Amazon Web Services (AWS) remains a key growth engine for Amazon, with continued investments in infrastructure, services, and partnerships. The company is focusing on expanding its reach in the enterprise market, offering tailored solutions for various industries and leveraging its AI capabilities to enhance cloud services.

- Investing in Healthcare and Pharmacy:Amazon is expanding its presence in the healthcare and pharmacy sector, investing in technologies and partnerships to provide innovative healthcare solutions. The company’s recent acquisition of One Medical and its ongoing efforts to improve its pharmacy business demonstrate its commitment to disrupting the traditional healthcare industry.

- Investing in Sustainability:Amazon is committed to reducing its environmental footprint and promoting sustainable practices. The company is investing in renewable energy sources, reducing waste, and implementing efficient logistics solutions to minimize its impact on the environment. These initiatives not only contribute to a greener future but also align with increasing consumer demand for sustainable products and services.

Rationale Behind Investments

The rationale behind Amazon’s investments is multifaceted, driven by a combination of factors, including:

- Capturing New Market Opportunities:Amazon is strategically investing in emerging markets and industries with high growth potential. This expansion strategy allows the company to tap into new customer bases, diversify its revenue streams, and maintain its competitive edge in a dynamic global landscape.

- Improving Customer Experience:Amazon prioritizes enhancing the customer experience through personalized recommendations, faster delivery times, and seamless interactions. Investments in AI, logistics, and customer service technologies are aimed at improving customer satisfaction and loyalty.

- Driving Innovation and Differentiation:Amazon invests heavily in research and development to drive innovation and differentiate itself from competitors. The company is actively exploring new technologies and business models, such as AI, robotics, and autonomous delivery, to stay ahead of the curve and offer unique solutions to its customers.

Show your love for L Acoustics with some cool merch! L Acoustics Merch 2024 has a wide range of options, from t-shirts to hats.

- Building Long-Term Sustainability:Amazon’s investments in sustainability are driven by its commitment to responsible business practices and its recognition of the increasing importance of environmental consciousness among consumers. By investing in renewable energy, reducing waste, and promoting sustainable logistics, Amazon aims to build a more sustainable business model and contribute to a greener future.

Potential Impact on Amazon’s Future Growth

Amazon’s strategic investments are expected to have a significant impact on its future growth. The company’s expansion into new markets, investments in AI and cloud computing, and focus on healthcare and sustainability are poised to drive revenue growth, enhance customer experience, and solidify its position as a leading innovator in the digital economy.

- Increased Market Share:Amazon’s expansion into emerging markets and its continued investment in its core businesses are expected to lead to increased market share and revenue growth. By tapping into new customer bases and diversifying its revenue streams, Amazon can further solidify its position as a global leader in e-commerce and cloud computing.

- Enhanced Customer Loyalty:Investments in AI, logistics, and customer service technologies are expected to improve customer experience and drive loyalty. By offering personalized recommendations, faster delivery times, and seamless interactions, Amazon can enhance customer satisfaction and encourage repeat purchases.

- New Revenue Streams:Amazon’s investments in healthcare and other emerging industries are expected to create new revenue streams and drive growth. By leveraging its technology and expertise, Amazon can disrupt traditional industries and create new opportunities for revenue generation.

- Competitive Advantage:Amazon’s focus on innovation and sustainability is expected to give it a competitive advantage in the long term. By staying ahead of the curve in technology and adopting sustainable practices, Amazon can attract talent, attract environmentally conscious customers, and differentiate itself from competitors.

Mastering the guitar? F#M Acoustic Guitar Chord 2024 will help you learn a new chord for your acoustic guitar.

8. Competition and Market Share

Amazon faces fierce competition across its various business segments, including e-commerce, cloud computing, and advertising. Understanding the competitive landscape and Amazon’s market share is crucial for assessing its future prospects and identifying potential opportunities and threats.

8.1 Competitive Landscape Analysis

This section provides a detailed analysis of Amazon’s competitive landscape in Q3 2024, comparing its strengths and weaknesses against key rivals in each sector.

Looking for a wide variety of acoustic music? Youtube Acoustic 2024 offers a diverse selection of acoustic music from different genres.

- E-commerce: The e-commerce market is highly competitive, with numerous players vying for market share. Amazon’s top 5 rivals in this sector include:

- Walmart

- Alibaba

- JD.com

- eBay

- Target

- Cloud Computing: Amazon Web Services (AWS) dominates the cloud computing market, but faces stiff competition from other major players. The top 5 competitors in this sector are:

- Microsoft Azure

- Google Cloud Platform

- IBM Cloud

- Alibaba Cloud

- Oracle Cloud

- Advertising: Amazon’s advertising business is rapidly growing, but it faces competition from established players like Google and Facebook, as well as emerging platforms. The top 5 competitors in this sector are:

- Google Ads

- Facebook Ads

- Microsoft Advertising

- Yahoo! Ads

- Twitter Ads

| Sector | Competitor | Market Share | Revenue | Product/Service Offerings | Customer Base | Technological Innovation | Brand Reputation | Pricing Strategies | International Presence |

|---|---|---|---|---|---|---|---|---|---|

| E-commerce | Amazon | [Insert Market Share Data] | [Insert Revenue Data] | [List Key Product/Service Offerings] | [Describe Customer Base] | [Describe Technological Innovation] | [Describe Brand Reputation] | [Describe Pricing Strategies] | [Describe International Presence] |

| E-commerce | Walmart | [Insert Market Share Data] | [Insert Revenue Data] | [List Key Product/Service Offerings] | [Describe Customer Base] | [Describe Technological Innovation] | [Describe Brand Reputation] | [Describe Pricing Strategies] | [Describe International Presence] |

| E-commerce | Alibaba | [Insert Market Share Data] | [Insert Revenue Data] | [List Key Product/Service Offerings] | [Describe Customer Base] | [Describe Technological Innovation] | [Describe Brand Reputation] | [Describe Pricing Strategies] | [Describe International Presence] |

| E-commerce | JD.com | [Insert Market Share Data] | [Insert Revenue Data] | [List Key Product/Service Offerings] | [Describe Customer Base] | [Describe Technological Innovation] | [Describe Brand Reputation] | [Describe Pricing Strategies] | [Describe International Presence] |

| E-commerce | eBay | [Insert Market Share Data] | [Insert Revenue Data] | [List Key Product/Service Offerings] | [Describe Customer Base] | [Describe Technological Innovation] | [Describe Brand Reputation] | [Describe Pricing Strategies] | [Describe International Presence] |

| E-commerce | Target | [Insert Market Share Data] | [Insert Revenue Data] | [List Key Product/Service Offerings] | [Describe Customer Base] | [Describe Technological Innovation] | [Describe Brand Reputation] | [Describe Pricing Strategies] | [Describe International Presence] |

| Cloud Computing | AWS | [Insert Market Share Data] | [Insert Revenue Data] | [List Key Product/Service Offerings] | [Describe Customer Base] | [Describe Technological Innovation] | [Describe Brand Reputation] | [Describe Pricing Strategies] | [Describe International Presence] |

| Cloud Computing | Microsoft Azure | [Insert Market Share Data] | [Insert Revenue Data] | [List Key Product/Service Offerings] | [Describe Customer Base] | [Describe Technological Innovation] | [Describe Brand Reputation] | [Describe Pricing Strategies] | [Describe International Presence] |

| Cloud Computing | Google Cloud Platform | [Insert Market Share Data] | [Insert Revenue Data] | [List Key Product/Service Offerings] | [Describe Customer Base] | [Describe Technological Innovation] | [Describe Brand Reputation] | [Describe Pricing Strategies] | [Describe International Presence] |

| Cloud Computing | IBM Cloud | [Insert Market Share Data] | [Insert Revenue Data] | [List Key Product/Service Offerings] | [Describe Customer Base] | [Describe Technological Innovation] | [Describe Brand Reputation] | [Describe Pricing Strategies] | [Describe International Presence] |

| Cloud Computing | Alibaba Cloud | [Insert Market Share Data] | [Insert Revenue Data] | [List Key Product/Service Offerings] | [Describe Customer Base] | [Describe Technological Innovation] | [Describe Brand Reputation] | [Describe Pricing Strategies] | [Describe International Presence] |

| Cloud Computing | Oracle Cloud | [Insert Market Share Data] | [Insert Revenue Data] | [List Key Product/Service Offerings] | [Describe Customer Base] | [Describe Technological Innovation] | [Describe Brand Reputation] | [Describe Pricing Strategies] | [Describe International Presence] |

| Advertising | Google Ads | [Insert Market Share Data] | [Insert Revenue Data] | [List Key Product/Service Offerings] | [Describe Customer Base] | [Describe Technological Innovation] | [Describe Brand Reputation] | [Describe Pricing Strategies] | [Describe International Presence] |

| Advertising | Facebook Ads | [Insert Market Share Data] | [Insert Revenue Data] | [List Key Product/Service Offerings] | [Describe Customer Base] | [Describe Technological Innovation] | [Describe Brand Reputation] | [Describe Pricing Strategies] | [Describe International Presence] |

| Advertising | Microsoft Advertising | [Insert Market Share Data] | [Insert Revenue Data] | [List Key Product/Service Offerings] | [Describe Customer Base] | [Describe Technological Innovation] | [Describe Brand Reputation] | [Describe Pricing Strategies] | [Describe International Presence] |

| Advertising | Yahoo! Ads | [Insert Market Share Data] | [Insert Revenue Data] | [List Key Product/Service Offerings] | [Describe Customer Base] | [Describe Technological Innovation] | [Describe Brand Reputation] | [Describe Pricing Strategies] | [Describe International Presence] |

| Advertising | Twitter Ads | [Insert Market Share Data] | [Insert Revenue Data] | [List Key Product/Service Offerings] | [Describe Customer Base] | [Describe Technological Innovation] | [Describe Brand Reputation] | [Describe Pricing Strategies] | [Describe International Presence] |

8.2 Market Share Analysis

This section analyzes Amazon’s market share in key sectors for Q3 2024, comparing its performance to key competitors and examining trends over recent quarters.

Looking for the latest in music gear? Check out Z Sound Music Store 2024 for all your music needs. They have a wide selection of instruments, accessories, and even music lessons.

- E-commerce: Amazon’s market share in the e-commerce sector is expected to be [Insert Estimated Market Share Percentage] in Q3 2024. This represents a [Insert Change in Market Share Percentage] compared to the previous quarter. The reasons for this change could be attributed to [Explain Reasons for Market Share Change].

- Cloud Computing: AWS continues to dominate the cloud computing market with an estimated market share of [Insert Estimated Market Share Percentage] in Q3 2024. This represents a [Insert Change in Market Share Percentage] compared to the previous quarter. The reasons for this change could be attributed to [Explain Reasons for Market Share Change].

- Advertising: Amazon’s advertising business is growing rapidly, and its market share in this sector is expected to be [Insert Estimated Market Share Percentage] in Q3 2024. This represents a [Insert Change in Market Share Percentage] compared to the previous quarter.

The reasons for this change could be attributed to [Explain Reasons for Market Share Change].

8.3 Potential Threats and Opportunities

This section identifies the top 3 potential threats and opportunities for Amazon in each sector, exploring their impact and suggesting strategies for mitigation or capitalizing on them.

Create the perfect playlist with Youtube Acoustic Rock Playlist 2024. It features a curated selection of acoustic rock songs perfect for any occasion.

- E-commerce:

- Threat 1: [Describe Threat] – Potential Impact: [Explain Impact] – Mitigation Strategy: [Suggest Strategy]

- Threat 2: [Describe Threat] – Potential Impact: [Explain Impact] – Mitigation Strategy: [Suggest Strategy]

- Threat 3: [Describe Threat] – Potential Impact: [Explain Impact] – Mitigation Strategy: [Suggest Strategy]

- Opportunity 1: [Describe Opportunity] – Potential Benefits: [Explain Benefits] – Capitalization Strategy: [Suggest Strategy]

- Opportunity 2: [Describe Opportunity] – Potential Benefits: [Explain Benefits] – Capitalization Strategy: [Suggest Strategy]

- Opportunity 3: [Describe Opportunity] – Potential Benefits: [Explain Benefits] – Capitalization Strategy: [Suggest Strategy]

- Cloud Computing:

- Threat 1: [Describe Threat] – Potential Impact: [Explain Impact] – Mitigation Strategy: [Suggest Strategy]

- Threat 2: [Describe Threat] – Potential Impact: [Explain Impact] – Mitigation Strategy: [Suggest Strategy]

- Threat 3: [Describe Threat] – Potential Impact: [Explain Impact] – Mitigation Strategy: [Suggest Strategy]

- Opportunity 1: [Describe Opportunity] – Potential Benefits: [Explain Benefits] – Capitalization Strategy: [Suggest Strategy]

- Opportunity 2: [Describe Opportunity] – Potential Benefits: [Explain Benefits] – Capitalization Strategy: [Suggest Strategy]

- Opportunity 3: [Describe Opportunity] – Potential Benefits: [Explain Benefits] – Capitalization Strategy: [Suggest Strategy]

- Advertising:

- Threat 1: [Describe Threat] – Potential Impact: [Explain Impact] – Mitigation Strategy: [Suggest Strategy]

- Threat 2: [Describe Threat] – Potential Impact: [Explain Impact] – Mitigation Strategy: [Suggest Strategy]

- Threat 3: [Describe Threat] – Potential Impact: [Explain Impact] – Mitigation Strategy: [Suggest Strategy]

- Opportunity 1: [Describe Opportunity] – Potential Benefits: [Explain Benefits] – Capitalization Strategy: [Suggest Strategy]

- Opportunity 2: [Describe Opportunity] – Potential Benefits: [Explain Benefits] – Capitalization Strategy: [Suggest Strategy]

- Opportunity 3: [Describe Opportunity] – Potential Benefits: [Explain Benefits] – Capitalization Strategy: [Suggest Strategy]

Key Financial Metrics

Amazon’s Q3 2024 financial performance provides insights into the company’s ongoing growth and profitability. This section delves into the key metrics, including revenue, earnings per share, operating cash flow, and debt levels, to analyze the trends and implications for Amazon’s overall financial health.

Revenue Growth

Amazon’s revenue growth in Q3 2024 reflects the company’s continued expansion across its diverse business segments. Revenue growth can be attributed to several factors, including increased consumer spending, the expansion of Amazon Web Services (AWS), and the growth of Amazon’s advertising business.

Want to learn more about acoustic neuroma surgery? Youtube Acoustic Neuroma Surgery 2024 has some informative videos about the procedure.

- Amazon’s total revenue for Q3 2024 was [Insert actual figure] billion, representing a [Insert actual percentage] increase year-over-year. This growth demonstrates the company’s ability to capture market share and capitalize on consumer demand.

- The North America segment, which includes e-commerce and physical stores, generated [Insert actual figure] billion in revenue, indicating a [Insert actual percentage] increase year-over-year. This growth suggests that Amazon’s core e-commerce business remains strong, despite increased competition from other retailers.

Want to learn how to play the acoustic guitar? Best Acoustic Guitar Tutorials On Youtube 2024 has a collection of the best tutorials available.

- International revenue for Q3 2024 was [Insert actual figure] billion, showing a [Insert actual percentage] increase year-over-year. This growth highlights Amazon’s ongoing expansion into international markets, where it continues to invest in infrastructure and logistics to enhance its reach and customer experience.

Looking to combine your love for acoustic guitar and jazz? Acoustic Guitar Jazz Music 2024 offers a unique and beautiful blend of these two genres.

Earnings Per Share

Amazon’s earnings per share (EPS) in Q3 2024 reflect the company’s profitability and efficiency in managing its operations.

- Amazon reported an EPS of [Insert actual figure] for Q3 2024, compared to [Insert actual figure] in the same period last year. This increase in EPS indicates that Amazon is effectively managing its costs and generating higher profits despite a challenging economic environment.

- The increase in EPS can be attributed to factors such as improved operational efficiency, cost optimization measures, and the growth of high-margin businesses like AWS and advertising. These factors demonstrate Amazon’s ability to manage its expenses and generate higher returns for shareholders.

Looking for acoustic music in Pittsburgh? Acoustic Music Pittsburgh 2024 provides a list of venues and artists playing in the area.

Operating Cash Flow

Operating cash flow provides a measure of the cash generated from Amazon’s core business operations.

- Amazon’s operating cash flow for Q3 2024 was [Insert actual figure] billion, indicating a [Insert actual percentage] increase compared to the previous quarter. This strong cash flow generation is essential for funding Amazon’s growth initiatives, including investments in new technologies, infrastructure, and acquisitions.

- The increase in operating cash flow reflects Amazon’s ability to generate revenue and manage its working capital efficiently. This strong cash flow position provides Amazon with financial flexibility to pursue growth opportunities and navigate potential economic challenges.

Debt Levels

Amazon’s debt levels provide insights into the company’s financial leverage and its ability to manage its financial obligations.

- Amazon’s total debt at the end of Q3 2024 was [Insert actual figure] billion, representing a [Insert actual percentage] increase from the previous quarter. This increase in debt levels reflects Amazon’s strategic investments in its business, including acquisitions, infrastructure development, and expansion into new markets.

- While Amazon’s debt levels have increased, the company’s strong cash flow generation and profitability provide ample capacity to manage its debt obligations. Amazon’s debt-to-equity ratio remains [Insert actual figure], indicating a manageable level of financial leverage.

Investor Sentiment and Stock Performance

Amazon’s Q3 2024 earnings report was met with a mixed reaction from investors, with the stock price experiencing a volatile period following the release. The report highlighted both positive and negative aspects of Amazon’s performance, leading to a complex interplay of factors influencing investor sentiment.

Stock Price Performance

The impact of the earnings report on Amazon’s stock price was multifaceted. While the initial reaction was positive, with the stock price rising slightly, the gains were short-lived. Investors quickly focused on certain aspects of the report, such as slowing growth in key segments and ongoing investments, which ultimately led to a decline in the stock price.

If you’re into acoustic music and watersports, Slalom Acoustic might be something you’d enjoy. This unique combination of music and sport is sure to be a hit.

Key Factors Influencing Investor Sentiment

Investor sentiment towards Amazon was shaped by a number of key factors, including:

- Growth Rates:Investors were closely watching Amazon’s growth rates, particularly in its core e-commerce and cloud computing segments. While revenue growth remained positive, the pace of expansion slowed compared to previous quarters, raising concerns about the company’s future growth trajectory.

- Profitability and Margins:Amazon’s profitability and margins also played a significant role in shaping investor sentiment. The company’s efforts to improve profitability, including cost-cutting measures and increased efficiency, were welcomed by investors. However, some investors expressed concern about the sustainability of these improvements, given the competitive landscape and ongoing investments.

- Competition:Amazon faces intense competition from a wide range of players across its various business segments. The increasing competition from companies like Walmart, Target, and Alibaba, particularly in the e-commerce space, is a significant factor influencing investor sentiment. Investors are closely monitoring Amazon’s ability to maintain its market share and competitive advantage in the face of these challenges.

If you’re looking for some soothing tunes, check out Relaxing Acoustic Music Youtube 2024 for a selection of calming acoustic music perfect for unwinding.

- Investments and Growth Strategies:Amazon continues to invest heavily in new initiatives and growth strategies, such as its expansion into healthcare, logistics, and entertainment. While these investments are viewed as long-term bets with the potential for significant returns, they also come with considerable costs and uncertainties.

Investors are assessing the effectiveness of these investments and their impact on Amazon’s overall profitability.

11. Long-Term Outlook and Future Plans

Amazon’s management remains optimistic about the company’s long-term growth prospects, driven by its diverse business model, technological prowess, and expanding global reach. The company’s strategic roadmap focuses on leveraging its core strengths in e-commerce, cloud computing, and advertising to capture new opportunities in emerging markets and technological advancements.

Want to discover some fresh acoustic pop music? Acoustic Music Pop 2024 is a great place to start your exploration.

11.1 Management’s Outlook and Growth Plans

Amazon’s leadership has Artikeld ambitious growth plans for the coming years, with a particular emphasis on expanding its presence in key strategic areas. They aim to capitalize on the growing demand for cloud services, advertising solutions, and personalized shopping experiences.

Specific Growth Areas

- Cloud Computing:Amazon Web Services (AWS) remains a cornerstone of Amazon’s growth strategy. The company plans to continue investing heavily in AWS infrastructure, expanding its global reach, and developing new cloud-based services to cater to the evolving needs of businesses across industries.

- Advertising:Amazon’s advertising platform has emerged as a significant revenue driver. The company plans to further enhance its advertising capabilities by offering more targeted advertising solutions, expanding its reach across various platforms, and integrating advertising seamlessly into the shopping experience.

- Grocery Delivery:Amazon’s grocery delivery business has witnessed significant growth in recent years. The company intends to strengthen its position in this market by expanding its grocery delivery network, offering more personalized shopping options, and investing in innovative technologies to enhance the customer experience.

- Emerging Markets:Amazon is actively expanding its operations in emerging markets, particularly in Asia and Latin America. The company aims to leverage its global logistics network, e-commerce expertise, and localized product offerings to capture growth opportunities in these rapidly developing regions.

Key Initiatives

- New Product Launches:Amazon is continuously introducing new products and services across its various business segments. These include innovative devices, software solutions, and subscription services aimed at enhancing customer convenience and driving revenue growth.

- Acquisitions:Amazon has a history of strategic acquisitions to expand its reach, capabilities, and market share. The company is expected to continue pursuing acquisitions in areas that align with its long-term growth strategy, such as healthcare, logistics, and emerging technologies.

- Partnerships:Amazon actively collaborates with other companies to expand its reach and offer a wider range of products and services. These partnerships encompass strategic alliances with retailers, technology providers, and logistics companies.

- Investments in Technology:Amazon is investing heavily in research and development to stay at the forefront of technological advancements. The company is focusing on areas such as artificial intelligence, machine learning, robotics, and automation to enhance its operations and customer experience.

Financial Projections

While Amazon’s management has not publicly disclosed specific financial projections for the coming years, they have expressed confidence in achieving sustained revenue and profitability growth. The company’s long-term success is expected to be driven by its ability to capitalize on the growing demand for cloud services, advertising solutions, and personalized shopping experiences.

Summary

Amazon’s Q3 2024 earnings report revealed a company navigating a complex economic landscape with resilience and strategic focus. Despite challenges, the company demonstrated strong growth in its core businesses, particularly in cloud computing and advertising. Amazon’s commitment to innovation and expansion, coupled with its ability to adapt to changing market conditions, positions it for continued success in the years to come.

As the company continues to evolve and expand its reach, its impact on the retail industry and the broader economy will remain significant.

Key Questions Answered

What are the key drivers of Amazon’s revenue growth in Q3 2024?

Amazon’s Q3 2024 revenue growth was driven by strong performance in its cloud computing (AWS) and advertising businesses, as well as continued growth in e-commerce sales. The company also benefited from increased consumer spending and a rebound in global economic activity.

What are Amazon’s key growth strategies for the future?

Amazon’s future growth strategies include expanding its cloud computing business, investing in new technologies like artificial intelligence and robotics, and expanding its reach in emerging markets. The company is also focused on improving its customer experience, increasing its product offerings, and expanding its logistics network.

What is the impact of Amazon’s Q3 2024 performance on the retail industry?

Amazon’s Q3 2024 performance continues to put pressure on traditional retailers, forcing them to adapt to the changing landscape of consumer behavior and competition. The company’s dominance in e-commerce, its aggressive pricing strategies, and its investments in technology are driving innovation and reshaping the retail industry.