Immediate Annuity Calculator India: Planning for a secure retirement involves making smart financial decisions, and immediate annuities can play a crucial role. This calculator empowers you to explore how immediate annuities can provide a steady stream of income during your golden years, helping you understand the potential benefits and make informed choices for your future.

Understanding the time frame for your annuity is crucial. Calculate Annuity Years 2024 can help you determine the duration of your payments. For a comprehensive overview of your annuity, Annuity Statement Is 2024 provides detailed information on your current status.

Immediate annuities are a type of insurance product that guarantees a fixed stream of income for life. In India, they have gained popularity as a way to ensure a regular income stream during retirement, especially for those looking for predictable and reliable financial support.

Understanding Immediate Annuities in India: Immediate Annuity Calculator India

An immediate annuity is a type of insurance product that provides a guaranteed stream of income for life. In India, immediate annuities are becoming increasingly popular as a way to secure retirement income and protect against longevity risk. This article will delve into the intricacies of immediate annuities in India, exploring their features, benefits, and considerations for potential investors.

Variable annuities can be complex, but understanding the different types available is crucial. Life Incl Variable Annuity (0214) 2024 provides insights into a specific type of variable annuity. By researching these different options, you can make informed decisions that align with your financial goals.

Concept of Immediate Annuities in India

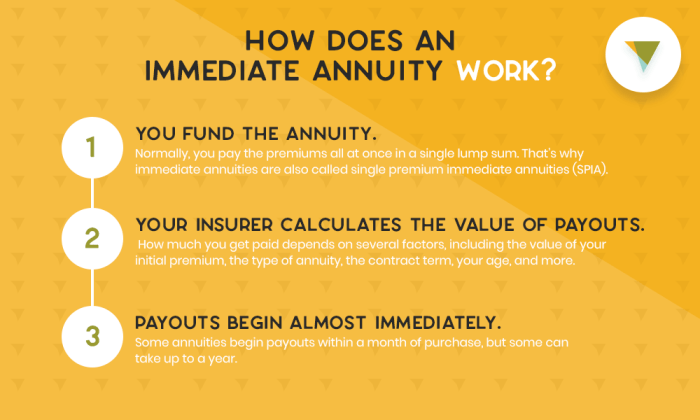

Immediate annuities are contracts where an individual makes a lump-sum payment to an insurance company in exchange for a guaranteed stream of regular payments, starting immediately. These payments can be monthly, quarterly, semi-annually, or annually, and continue for the rest of the annuitant’s life.

When choosing a variable annuity, selecting the right company is essential. Variable Annuity Companies 2024 provides a list of reputable companies offering these financial products. For a more specific look at variable annuities offered by life insurance companies, Variable Annuity Life Insurance Company 2024 provides detailed information on their offerings.

The amount of each payment is determined by factors such as the lump-sum amount invested, the annuitant’s age, and the chosen payout option. Immediate annuities offer a guaranteed income stream, making them a popular choice for individuals seeking financial security in retirement.

Key Features and Benefits of Immediate Annuities

- Guaranteed Income Stream:Immediate annuities provide a guaranteed stream of income for life, eliminating the risk of outliving your savings.

- Longevity Protection:They help mitigate the risk of living longer than expected and running out of retirement funds.

- Tax Advantages:In India, annuity payments are generally taxed as income, but the lump-sum investment is typically tax-deductible under Section 80C of the Income Tax Act, 1961.

- Flexibility:Immediate annuities offer a variety of payout options, allowing individuals to tailor the income stream to their specific needs.

Types of Immediate Annuities Available in India

- Single Premium Immediate Annuity (SPIA):This is the most common type of immediate annuity, where a single lump-sum payment is made in exchange for regular income payments.

- Deferred Annuity:These annuities provide income payments starting at a future date, allowing individuals to accumulate funds before receiving income.

- Joint Life Annuity:This type of annuity provides income payments for as long as either of two individuals is alive. It is often used by couples to ensure a continuous income stream even after the death of one partner.

- Variable Annuity:This annuity offers income payments that are linked to the performance of underlying investments. The payments can fluctuate based on market conditions, but they have the potential for higher returns.

How Immediate Annuities Work

Understanding the process of purchasing and receiving payments from an immediate annuity is crucial for making informed decisions. Here’s a breakdown of the mechanics involved:

Purchasing an Immediate Annuity

- Choose an Annuity Provider:Select a reputable insurance company that offers immediate annuities. Compare different providers based on their financial stability, payout options, and fees.

- Determine Your Annuity Amount:Decide on the lump-sum amount you want to invest in the annuity. This amount will determine the size of your regular income payments.

- Select a Payout Option:Choose from various payout options, such as a fixed monthly payment, a variable payment, or a combination of both. Each option has its own advantages and disadvantages.

- Complete the Application:Fill out the necessary paperwork and provide the required documentation to the insurance company.

- Receive Your Payments:Once the application is approved, the insurance company will start making regular payments to you, typically on a monthly basis.

Annuity Payment Calculation

The amount of each annuity payment is determined by a complex formula that considers various factors, including:

- Lump-Sum Amount:The larger the lump-sum investment, the higher the annuity payments.

- Annuitant’s Age:Younger annuitants generally receive smaller payments than older annuitants because they are expected to live longer.

- Interest Rates:The prevailing interest rates at the time of purchase can impact the annuity payments.

- Payout Option:The chosen payout option, such as a fixed or variable payment, will also affect the payment amount.

Payout Options for Immediate Annuities

Immediate annuities offer various payout options to suit different financial goals and risk tolerances. Some common options include:

- Fixed Annuity:Provides a guaranteed fixed payment for life, ensuring predictable income.

- Variable Annuity:Offers payments that fluctuate based on the performance of underlying investments, potentially leading to higher returns but also carrying more risk.

- Guaranteed Minimum Income:Provides a minimum guaranteed payment for life, while offering the potential for higher returns based on market performance.

- Life Annuity:Payments continue for the lifetime of the annuitant, with no payments to beneficiaries after death.

- Period Certain Annuity:Payments are guaranteed for a specified period, even if the annuitant dies before the period ends.

- Joint Life Annuity:Payments continue for as long as either of two individuals is alive, often used by couples.

Factors to Consider When Choosing an Immediate Annuity

Choosing the right immediate annuity requires careful consideration of various factors to ensure it aligns with your financial goals and risk tolerance. Here are some key aspects to evaluate:

Financial Goals and Risk Tolerance

Before purchasing an immediate annuity, it’s essential to assess your financial goals and risk tolerance. Consider your desired income level, your investment horizon, and your overall financial situation. If you’re risk-averse and prioritize guaranteed income, a fixed annuity might be suitable.

However, if you’re willing to take on more risk for the potential of higher returns, a variable annuity might be a better option.

Key Factors to Compare When Choosing an Annuity Provider

- Financial Strength:Choose a provider with a strong financial track record and a high credit rating to ensure the security of your investment.

- Fees and Charges:Compare the fees and charges associated with different annuities, including administrative fees, surrender charges, and mortality and expense charges.

- Payout Options:Evaluate the available payout options and choose the one that best meets your income needs and risk tolerance.

- Customer Service:Look for a provider with a reputation for excellent customer service and responsiveness to inquiries.

Tax Implications of Immediate Annuities in India, Immediate Annuity Calculator India

In India, annuity payments are generally taxed as income. However, the lump-sum investment made in an immediate annuity is typically tax-deductible under Section 80C of the Income Tax Act, 1961. It’s essential to consult with a tax advisor to understand the specific tax implications of immediate annuities in your individual circumstances.

Knowing how to calculate your annuity is essential for making informed financial decisions. How To Calculate Annuity Calculator 2024 provides helpful tools and resources to guide you through the process. You can also explore the trends in the variable annuity market by checking out Variable Annuity Sales 2019 2024 to see how the market has evolved.

Advantages and Disadvantages of Immediate Annuities

Immediate annuities offer several advantages for retirement income, but they also come with potential drawbacks. Weighing these pros and cons is crucial before making a decision.

Advantages of Immediate Annuities for Retirement Income

- Guaranteed Income Stream:Provides a predictable and reliable income stream for life, eliminating the risk of outliving your savings.

- Longevity Protection:Helps mitigate the risk of living longer than expected and running out of retirement funds.

- Tax Advantages:The lump-sum investment is often tax-deductible, and the annuity payments are taxed as income, providing potential tax benefits.

- Simplicity:Immediate annuities are relatively simple to understand and manage, providing a straightforward way to secure retirement income.

Potential Drawbacks and Risks Associated with Immediate Annuities

- Irreversible Investment:Once you purchase an immediate annuity, it’s difficult to access the lump-sum investment or change the payout option.

- Limited Flexibility:The income stream is fixed, limiting your ability to adjust your spending based on changing circumstances.

- Potential for Lower Returns:The returns from immediate annuities may be lower than those from other investments, especially during periods of high inflation.

- Risk of Annuity Provider Failure:While unlikely, there’s a risk that the insurance company providing the annuity could fail, putting your income stream at risk.

Comparing Immediate Annuities with Other Retirement Income Options

Immediate annuities should be considered alongside other retirement income options, such as traditional pensions, retirement savings accounts (like EPF and NPS), and other investments. Comparing the advantages and disadvantages of each option can help you choose the best strategy for your specific needs and goals.

Using an Immediate Annuity Calculator

An immediate annuity calculator is a valuable tool for estimating your potential annuity payments and exploring different payout options. These calculators can help you make informed decisions by providing a clear picture of your future income stream.

Purpose of an Immediate Annuity Calculator

Immediate annuity calculators allow you to input your desired investment amount, age, and payout options to estimate the amount of your regular annuity payments. They can also show you how your payments would change based on different scenarios, such as varying interest rates or payout periods.

Annuity payments often begin at a specific age, and understanding the regulations surrounding this is important. Annuity 70 1/2 2024 explains the rules surrounding annuity payments at age 70 1/2. For those looking to incorporate variable annuities into their retirement savings, 401k Variable Annuity 2024 provides information on how to do so.

Step-by-Step Guide on How to Use an Immediate Annuity Calculator

- Input Your Information:Enter your desired investment amount, age, and chosen payout option.

- Select a Provider:If the calculator allows, choose the annuity provider you’re considering.

- View Your Results:The calculator will display your estimated monthly or annual annuity payments based on your inputs.

- Explore Different Scenarios:Experiment with different investment amounts, ages, and payout options to see how your payments would change.

Table Showcasing Key Inputs and Outputs of an Immediate Annuity Calculator

| Input | Output |

|---|---|

| Investment Amount | Estimated Monthly/Annual Payments |

| Annuitant’s Age | Estimated Monthly/Annual Payments |

| Payout Option (Fixed, Variable, etc.) | Estimated Monthly/Annual Payments |

| Interest Rate | Estimated Monthly/Annual Payments |

| Payout Period (Lifetime, Period Certain, etc.) | Estimated Total Annuity Payments |

Finding an Immediate Annuity Provider in India

Choosing the right annuity provider is crucial for ensuring the security of your retirement income. Here’s a guide to finding reputable providers and making informed decisions.

If you’re using a financial calculator to calculate your annuity, Calculate Annuity With Ba Ii Plus 2024 provides specific instructions for the BA II Plus model. You can also find information on calculating the number of periods for your annuity by visiting Annuity Number Of Periods Calculator 2024.

Reputable Immediate Annuity Providers in India

Several reputable insurance companies in India offer immediate annuities. Research and compare different providers based on their financial strength, payout options, fees, and customer service. Some well-known providers include:

- Life Insurance Corporation of India (LIC)

- SBI Life Insurance

- HDFC Life Insurance

- ICICI Prudential Life Insurance

- Max Life Insurance

Resources for Comparing Annuity Quotes and Features

Several online resources can help you compare annuity quotes and features from different providers. These platforms allow you to enter your desired investment amount, age, and payout options to receive personalized quotes from multiple insurers. Some popular resources include:

- Policybazaar

- BankBazaar

- MyInsuranceClub

Selecting the Right Annuity Provider

When selecting an annuity provider, consider the following factors:

- Financial Strength:Choose a provider with a strong financial track record and a high credit rating.

- Payout Options:Select a provider that offers a variety of payout options to suit your income needs and risk tolerance.

- Fees and Charges:Compare the fees and charges associated with different annuities to ensure you’re getting a competitive deal.

- Customer Service:Look for a provider with a reputation for excellent customer service and responsiveness to inquiries.

Ending Remarks

With the Immediate Annuity Calculator India, you can delve into the world of annuities and understand their potential to supplement your retirement income. Remember, it’s essential to consult with a financial advisor to determine if an immediate annuity aligns with your individual financial goals and risk tolerance.

Top FAQs

What is the minimum investment amount for an immediate annuity in India?

The minimum investment amount for an immediate annuity can vary depending on the insurer and the type of annuity. It’s best to check with individual providers for their specific requirements.

When considering variable annuities, understanding the options available is key. Variable Annuity Exchange 2024 offers valuable information about the process of exchanging your annuity. It’s also important to be aware of the details surrounding Variable Annuity Death Claim 2024 to ensure your beneficiaries are properly taken care of.

How do taxes affect immediate annuity payments in India?

If you’re looking to understand how to calculate your annuity in 2024, you’ve come to the right place. Calculate Annuity Lic 2024 provides a comprehensive guide to help you determine the amount you can expect to receive. You can also learn about specific annuity amounts, such as Annuity 2 Million 2024 to see if it aligns with your financial goals.

Annuity payments are generally taxed as income in India. The specific tax implications can depend on factors like your age and the type of annuity. It’s crucial to consult with a tax advisor to understand the tax implications of your specific situation.

Can I withdraw my principal investment from an immediate annuity?

In general, immediate annuities are designed to provide a guaranteed stream of income for life. You typically cannot withdraw the principal investment. However, some annuities may offer limited withdrawal options, so it’s essential to review the terms and conditions of the specific annuity.

What happens to my annuity payments if I die before receiving all the payments?

Most immediate annuities have a death benefit feature. If you die before receiving all the payments, a lump sum or a reduced stream of payments may be paid to your beneficiary, as Artikeld in the annuity contract.