Different Types Of Variable Annuities 2024 offer a unique blend of investment potential and guaranteed income, making them a compelling option for those seeking to grow their wealth while protecting their future. Variable annuities, unlike traditional fixed annuities, allow investors to participate in the growth of the stock market through a variety of investment options, such as mutual funds and exchange-traded funds (ETFs).

This flexibility, however, comes with inherent risks, as the value of the annuity can fluctuate with market performance. This guide explores the different types of variable annuities available in 2024, their key characteristics, and the factors to consider when deciding if this type of investment is right for you.

Annuities are primarily used to provide a steady income stream during retirement. An Annuity Is Primarily Used To Provide 2024 delves into the primary purpose of annuities and how they can contribute to your retirement security.

Variable annuities have evolved significantly over the years, adapting to meet the changing needs of investors. Today, they offer a range of features and benefits, including tax-deferred growth, guaranteed income options, and death benefits. However, it’s crucial to understand the nuances of each type of variable annuity, the fees associated with them, and the potential risks before making an investment decision.

Introduction to Variable Annuities

Variable annuities are a type of insurance product that combines investment features with death benefit and income guarantees. They offer investors the potential for growth through investment in a variety of sub-accounts, while also providing some protection against market volatility and longevity risk.

For investors seeking potential growth while mitigating risk, a variable annuity with downside protection might be attractive. Variable Annuity With Downside Protection 2024 delves into the features and benefits of this specific type of annuity.

Variable annuities first emerged in the 1950s as a way to offer investors a way to participate in the stock market while still receiving some protection against market downturns. They have evolved significantly over the years, with the introduction of features such as living benefit riders and guaranteed minimum death benefits.

Transparency is essential when choosing a variable annuity. A Variable Annuity Disclosure Is Required To Contain 2024 clarifies the information that should be included in the disclosure document, ensuring you make informed decisions.

Today, variable annuities are a complex financial product that can be suitable for a variety of investors, depending on their risk tolerance, investment goals, and financial circumstances.

If you’re tech-savvy, you might find an annuity calculator useful. Annuity Calculator Visual Basic 2024 explores the creation of an annuity calculator using Visual Basic, allowing you to personalize your calculations.

Advantages and Disadvantages of Variable Annuities, Different Types Of Variable Annuities 2024

Variable annuities offer several advantages over other investment options, including:

- Potential for growth:Variable annuities allow investors to participate in the growth of the stock market through their investment in sub-accounts.

- Tax deferral:Earnings on variable annuities are not taxed until they are withdrawn, which can be a significant advantage for long-term investors.

- Death benefit:Variable annuities typically provide a death benefit, which guarantees a minimum payout to beneficiaries upon the death of the annuitant.

- Income guarantees:Some variable annuities offer income guarantees, which provide a guaranteed stream of income in retirement.

However, variable annuities also have some disadvantages, including:

- High fees:Variable annuities are typically more expensive than other investment options, such as mutual funds or ETFs.

- Complexity:Variable annuities are complex products that can be difficult to understand.

- Risk:The value of variable annuities is tied to the performance of the underlying investments, so they carry investment risk.

- Surrender charges:Variable annuities typically have surrender charges that apply if the annuity is withdrawn before a certain period of time.

Types of Variable Annuities

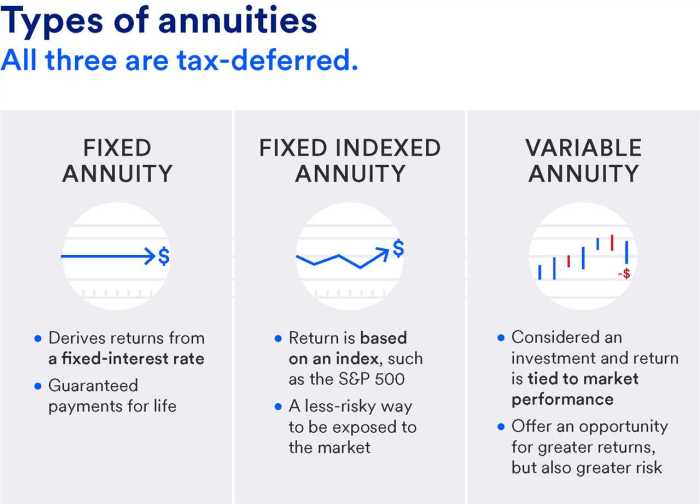

Variable annuities are classified into different types based on their features and investment options. Here are some of the most common types of variable annuities available in 2024:

Types of Variable Annuities

| Type | Key Characteristics | Suitability |

|---|---|---|

| Traditional Variable Annuity | – Offers investment growth potential through sub-accounts

|

Suitable for investors with a long-term investment horizon and a moderate to high risk tolerance. |

| Indexed Variable Annuity | – Linked to the performance of a specific index, such as the S&P 500

Before committing to an annuity, it’s wise to evaluate its value. Annuity Is The Value Of 2024 helps you understand how to assess the worth of an annuity and compare different options.

|

Suitable for investors seeking potential growth with some downside protection. |

| Fixed Indexed Annuity | – Provides a guaranteed minimum return based on the performance of a specific index

|

Suitable for investors seeking guaranteed returns and downside protection. |

| Variable Annuity with Guaranteed Minimum Withdrawal Benefit (GMWB) | – Provides a guaranteed minimum withdrawal amount each year

|

Suitable for investors seeking guaranteed income in retirement. |

The suitability of each type of variable annuity depends on individual investment goals, risk tolerance, and financial circumstances. It is essential to consult with a financial advisor to determine the best type of variable annuity for your needs.

Investment Options within Variable Annuities

Variable annuities offer investors a variety of investment options, allowing them to tailor their portfolios to their specific needs and risk tolerance. These options include:

Investment Options within Variable Annuities

- Mutual Funds:Variable annuities typically offer a wide selection of mutual funds, providing investors with access to a diverse range of investment strategies and asset classes.

- Exchange-Traded Funds (ETFs):Some variable annuities also offer ETFs, which provide investors with a low-cost and transparent way to invest in a variety of asset classes.

- Sub-Accounts:Variable annuities often allow investors to create their own sub-accounts within the annuity, providing greater control over their investment portfolio.

The performance and risk profiles of different investment options within variable annuities can vary significantly. Investors should carefully consider the investment objectives, risk tolerance, and time horizon when selecting investment options within their variable annuity.

Variable annuities offer potential growth, but it’s important to understand the guarantees they provide. Variable Annuity Contracts Contain Which Of The Following Guarantees 2024 outlines the common guarantees included in variable annuity contracts.

Asset Allocation and Diversification

Asset allocation and diversification are crucial components of any investment strategy, including variable annuities. Asset allocation refers to the process of dividing an investment portfolio among different asset classes, such as stocks, bonds, and real estate. Diversification involves spreading investments across different asset classes and sectors to reduce risk.

Are you considering an annuity as part of your retirement income stream? Is Annuity Stream 2024 examines the role of annuities in retirement income planning, helping you determine if they fit your needs.

By diversifying their investments within a variable annuity, investors can help to reduce the overall risk of their portfolio.

To ensure your annuity is tax-advantaged, it’s crucial to understand the qualifications. Annuity Is Qualified 2024 provides insights into the criteria that determine whether an annuity qualifies for tax-deferred growth.

Fees and Expenses Associated with Variable Annuities

Variable annuities come with a variety of fees and expenses that can impact the overall return on investment. It is essential to understand these fees and expenses before investing in a variable annuity.

Exploring different types of annuities can be overwhelming. 4 Annuity 2024 offers a comprehensive guide to four common annuity types, allowing you to choose the one that best aligns with your financial goals.

Fees and Expenses Associated with Variable Annuities

- Mortality and Expense (M&E) Charges:These charges cover the insurance company’s costs of providing the death benefit and other features of the annuity.

- Administrative Fees:These fees cover the costs of managing the annuity contract and the underlying investments.

- Investment Fees:These fees are charged by the mutual funds or ETFs that are invested within the annuity.

- Surrender Charges:These charges apply if the annuity is withdrawn before a certain period of time.

- Rider Fees:Some variable annuities offer optional riders, such as living benefit riders, that come with additional fees.

The fees and expenses associated with variable annuities can vary significantly depending on the specific product and the insurance company. It is essential to compare the fee structures of different variable annuity products before making a decision.

The duration of an annuity can vary. Annuity Is Indefinite Duration 2024 explores the concept of indefinite duration annuities, which provide payments for an unspecified period.

Tax Implications of Variable Annuities: Different Types Of Variable Annuities 2024

The tax implications of variable annuities can be complex and vary depending on the type of annuity and the investment strategy. It is essential to understand the tax treatment of variable annuities before investing.

If you’re receiving an annuity from LIC, it’s essential to understand its tax implications. Is Annuity Received From Lic Taxable 2024 explains the taxability of annuities received from LIC, providing valuable information for tax planning.

Tax Implications of Variable Annuities

- Tax Deferral:Earnings on variable annuities are not taxed until they are withdrawn. This can be a significant advantage for long-term investors.

- Taxable Withdrawals:When withdrawals are made from a variable annuity, they are taxed as ordinary income.

- Tax Treatment of Death Benefits:Death benefits from variable annuities are generally not subject to income tax.

The tax implications of variable annuities can have a significant impact on investment decisions. It is essential to consult with a tax advisor to understand the tax implications of variable annuities and how they can affect your overall financial plan.

Risk Management and Considerations

Variable annuities are not without risks. It is essential to understand and manage these risks to protect your investment.

Understanding the tax implications of annuities is crucial. Annuity Under Income Tax Act 2024 explains how annuities are treated under income tax laws, providing valuable insights for tax planning.

Key Risks Associated with Variable Annuities

- Market Risk:The value of variable annuities is tied to the performance of the underlying investments, so they carry investment risk.

- Interest Rate Risk:Rising interest rates can negatively impact the value of variable annuities, particularly those with guaranteed minimum withdrawal benefits.

- Inflation Risk:Inflation can erode the purchasing power of investment returns, reducing the real value of variable annuity payments.

- Longevity Risk:Variable annuities with income guarantees may not provide sufficient income to cover living expenses for a long retirement.

Risk Management Techniques

Investors can mitigate the risks associated with variable annuities through a variety of risk management techniques, including:

- Diversification:Diversifying investments across different asset classes and sectors can help to reduce the overall risk of the portfolio.

- Asset Allocation:Allocating assets based on risk tolerance, investment goals, and time horizon can help to manage risk effectively.

- Living Benefit Riders:Some variable annuities offer living benefit riders, which provide guaranteed minimum withdrawal benefits or death benefits.

It is essential to understand and manage the risks associated with variable annuities to protect your investment. Consulting with a financial advisor can help you develop a comprehensive risk management strategy.

Accurately calculating the growth of an annuity is essential for financial planning. Calculate Growing Annuity In Excel 2024 provides a step-by-step guide on using Excel to project the future value of your annuity.

Considerations for Choosing a Variable Annuity

Choosing a variable annuity is a significant financial decision. It is essential to carefully consider all factors before making a choice.

Factors to Consider When Choosing a Variable Annuity

- Fees and Expenses:Compare the fees and expenses of different variable annuity products to find the most cost-effective option.

- Investment Options:Consider the investment options available within the annuity, such as mutual funds, ETFs, and sub-accounts.

- Features and Riders:Evaluate the features and riders offered by the annuity, such as death benefits, living benefit riders, and guaranteed minimum withdrawal benefits.

- Financial Advisor:Consult with a financial advisor to determine the suitability of a variable annuity for your individual needs.

It is essential to thoroughly research and compare different variable annuity products before making a decision. Consulting with a financial advisor can help you make an informed choice that aligns with your financial goals and risk tolerance.

When it comes to taxes, it’s important to know if annuity payments are considered income. Is Annuity Considered Income 2024 provides clarity on the tax treatment of annuity payments, helping you plan accordingly.

Recent Developments and Trends in Variable Annuities

The variable annuity market is constantly evolving, with new products and features emerging regularly. Some of the recent developments and trends in variable annuities include:

Recent Developments and Trends in Variable Annuities

- Increased Focus on Income Guarantees:Investors are increasingly seeking variable annuities with guaranteed minimum withdrawal benefits or other income guarantees.

- Growth of Indexed Annuities:Indexed annuities, which offer potential for growth with downside protection, are becoming increasingly popular.

- Innovation in Living Benefit Riders:Insurance companies are developing new and innovative living benefit riders to meet the evolving needs of investors.

These developments and trends are shaping the future of variable annuities. As investors continue to seek products that provide both growth potential and protection against market volatility, variable annuities are likely to remain a popular investment option.

Last Recap

Navigating the world of variable annuities requires careful consideration and a thorough understanding of the different types available, their associated fees, and the inherent risks. While variable annuities offer potential for growth and income security, it’s essential to choose a product that aligns with your investment goals, risk tolerance, and financial situation.

Consulting with a qualified financial advisor can provide valuable insights and guidance in making informed decisions regarding variable annuities.

Question Bank

What are the tax implications of withdrawing money from a variable annuity?

Withdrawals from a variable annuity before age 59 1/2 are generally subject to a 10% penalty, plus ordinary income tax. After age 59 1/2, withdrawals are taxed as ordinary income.

Are there any guarantees associated with variable annuities?

While variable annuities offer potential for growth, they typically do not guarantee a specific return on investment. However, some variable annuities may include guarantees such as death benefits or minimum death benefits, which protect your principal or provide a minimum payout to your beneficiaries.

What are the risks associated with investing in variable annuities?

If you’re considering an annuity in 2024, it’s important to understand how it’s taxed. How Annuity Is Taxed 2024 explains the different tax implications associated with annuities, including the distinction between qualified and non-qualified annuities.

Variable annuities carry market risk, meaning the value of your investment can fluctuate with market performance. Other risks include investment risk, which refers to the possibility of losing money on your investments, and longevity risk, which is the risk that you outlive your retirement savings.