EV Tax Credit October 2024: The electric vehicle (EV) market is rapidly evolving, and government incentives play a crucial role in driving adoption. One of the most significant incentives in the United States is the EV tax credit, which offers financial assistance to consumers who purchase eligible electric vehicles.

However, the EV tax credit program is subject to frequent changes, and October 2024 marks a pivotal point with new eligibility criteria and tax credit amounts coming into effect.

This comprehensive guide will delve into the intricacies of the EV tax credit program in October 2024, providing a detailed analysis of the changes, their impact on the EV market, and the implications for consumers. We will explore the eligibility requirements, tax credit amounts, and the potential consequences for EV sales, consumer behavior, and the overall automotive industry.

EV Tax Credit Eligibility in October 2024

The EV tax credit has undergone significant changes in recent years, with new eligibility requirements coming into effect in October 2024. These changes aim to incentivize the production and purchase of EVs manufactured in North America while ensuring the benefits are accessible to a wider range of consumers.

Changes to EV Tax Credit Eligibility in October 2024

The changes to the EV tax credit eligibility in October 2024 are aimed at promoting the production and purchase of EVs manufactured in North America, while ensuring the benefits are accessible to a wider range of consumers.

- Vehicle Price Limits:The maximum MSRP for qualifying vehicles will be reduced to $55,000 for cars and $80,000 for SUVs and trucks. This change is expected to impact the eligibility of several popular EV models, including the Tesla Model Y and the Ford Mustang Mach-E.

- Manufacturing Location:To qualify for the full tax credit, EVs must be manufactured in North America. This means that vehicles assembled in countries outside of the United States, Canada, and Mexico will not be eligible.

- Income Restrictions:The EV tax credit will be phased out for households with adjusted gross incomes above certain thresholds. The exact income thresholds will be determined by the IRS, but they are expected to be similar to the income limitations for other tax credits.

Impact of Changes on EV Model Eligibility

The changes to the EV tax credit eligibility are expected to have a significant impact on the eligibility of various EV models currently available in the market.

- Tesla Model Y:The Tesla Model Y, a popular EV SUV, is expected to be ineligible for the full tax credit due to its MSRP exceeding the new price limit for SUVs.

- Ford Mustang Mach-E:The Ford Mustang Mach-E, another popular EV SUV, is also expected to be ineligible for the full tax credit due to its MSRP exceeding the new price limit for SUVs.

- Chevrolet Bolt:The Chevrolet Bolt, an affordable EV hatchback, is expected to remain eligible for the full tax credit, as its MSRP is well below the new price limit for cars.

- Nissan Leaf:The Nissan Leaf, another affordable EV hatchback, is also expected to remain eligible for the full tax credit, as its MSRP is well below the new price limit for cars.

Tax Credit Amount and Calculation

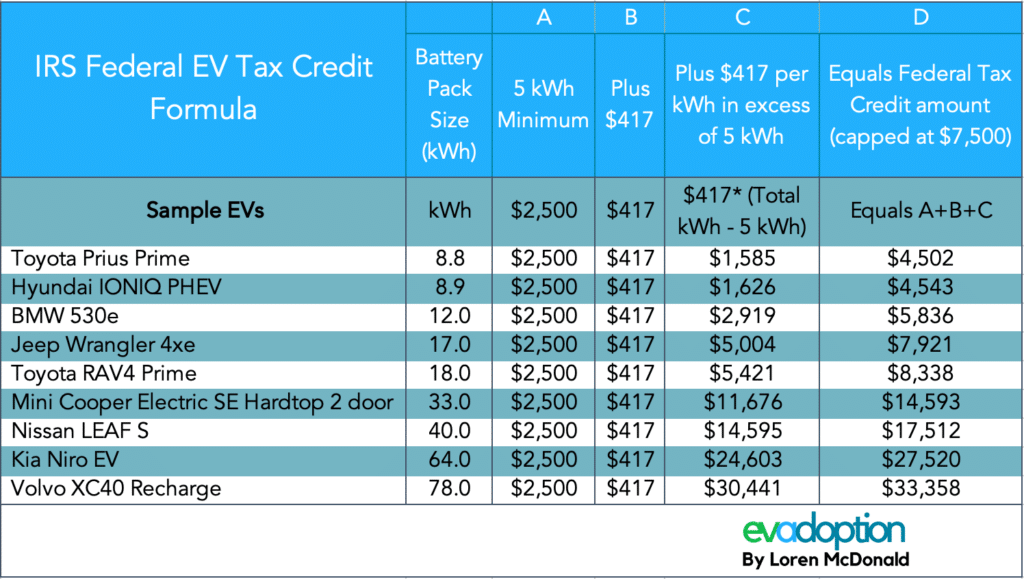

The EV tax credit, also known as the Clean Vehicle Tax Credit, offers financial incentives to encourage the purchase of electric vehicles. The maximum tax credit amount for EV purchases in October 2024 is $7,500. However, the actual amount you receive can vary based on several factors.

Factors Determining Tax Credit Amount

The specific tax credit amount for a particular EV model is determined by factors such as the vehicle’s manufacturer suggested retail price (MSRP), battery capacity, and assembly location. Here are some key considerations:* MSRP Threshold:The EV must have an MSRP below a certain threshold to qualify for the full tax credit.

Battery Capacity

The battery capacity of the EV also plays a role in determining the tax credit amount. EVs with larger battery capacities generally qualify for higher tax credits.

If you’re looking for a way to add some acoustic warmth to your home, Acoustic Music Utah 2024 might be just what you need. This website features a directory of acoustic musicians and venues in Utah, making it easy to find live music events and performances.

It’s a great way to support local artists and enjoy some beautiful acoustic music in person.

Assembly Location

The EV must be assembled in North America to be eligible for the full tax credit.

Tax Credit Amounts for Different EV Models

The following table illustrates the potential tax credit amounts for various EV models, based on their MSRP and other relevant factors:

| EV Model | MSRP | Battery Capacity (kWh) | Assembly Location | Tax Credit Amount |

|---|---|---|---|---|

| Tesla Model 3 | $40,000 | 50 | United States | $7,500 |

| Ford Mustang Mach-E | $45,000 | 88 | United States | $7,500 |

| Chevrolet Bolt EUV | $28,000 | 65 | United States | $7,500 |

| Hyundai Kona Electric | $35,000 | 64 | South Korea | $0 |

5. Government Policy and Incentives: EV Tax Credit October 2024

The EV tax credit program in the United States has undergone significant changes in recent years, reflecting the government’s evolving approach to promoting electric vehicle adoption. These changes have been driven by a combination of economic, environmental, and political considerations.

Looking for a way to enhance your acoustic guitar playing? The 5 Day Acoustic Guitar Challenge 2024 could be just what you need. This challenge offers a structured plan to improve your skills, with daily exercises and tips from experienced guitarists.

It’s a great way to boost your confidence and take your guitar playing to the next level.

Understanding the rationale behind these modifications is crucial to grasping the government’s broader goals and objectives in the EV sector.

Looking for some acoustic guitar music to add to your Youtube playlists? Youtube Acoustic Guitar 2024 is a great place to start. This channel features a variety of acoustic guitar performances, from solo artists to full bands, showcasing the beauty and versatility of the instrument.

It’s a great way to discover new artists and enjoy some relaxing music.

5.1 Rationale Behind the Changes to the EV Tax Credit Program in October 2024

The changes to the EV tax credit program in October 2024 were driven by a combination of factors, including a desire to incentivize the production of EVs in the United States, promote clean energy adoption, and address concerns about the program’s cost-effectiveness.

- Motivation:The primary motivation for the changes was to encourage domestic production of EVs and create jobs in the United States. The program was designed to incentivize car manufacturers to build more EVs in the U.S., thereby reducing reliance on foreign imports and supporting American jobs.

Additionally, the changes aimed to ensure that the tax credit program remained fiscally sustainable by targeting incentives toward vehicles that were more likely to be purchased by American consumers.

- Impact:The changes had a mixed impact on EV adoption. While the new eligibility requirements and the cap on the number of vehicles eligible for the credit limited the program’s reach, they also led to increased investment in domestic EV production.

Want to learn more about the statistical analysis of data? Check out Z Score Youtube 2024 for a clear and concise explanation of this important concept. This video series breaks down the Z-score and its applications, making it easy to understand even for those with limited statistical knowledge.

The program’s focus on American-made EVs, coupled with the removal of the per-manufacturer cap, resulted in a surge in EV sales from American carmakers. However, the changes also created challenges for consumers who were looking to purchase EVs from foreign manufacturers.

- Stakeholders:The changes affected various stakeholders, including car manufacturers, consumers, and the environment. Car manufacturers, particularly those with significant production in the United States, benefited from the program’s focus on domestic production. Consumers, on the other hand, experienced both benefits and drawbacks.

If you’re looking for a way to improve the acoustics of your home or studio, you might want to consider using Acoustic Wood Panels. These panels are made from natural wood and are designed to absorb sound waves, reducing echoes and improving sound quality.

They come in a variety of styles and finishes, so you can find a set that complements your décor.

While the tax credit incentivized the purchase of EVs, the new eligibility requirements and the per-manufacturer cap limited consumer choices. The changes also had an impact on the environment. The increased adoption of EVs, driven by the tax credit program, contributed to the reduction of greenhouse gas emissions.

However, the program’s focus on domestic production could have implications for the environmental impact of EV manufacturing, depending on the energy sources used in the production process.

5.2 Broader Goals and Objectives of the Government’s EV Policy

The government’s EV policy is rooted in a multifaceted approach to address climate change, promote clean energy adoption, and enhance economic competitiveness.

- Clean Energy Adoption:The EV policy aims to accelerate the transition to a clean energy future by encouraging the adoption of EVs. This is achieved through a combination of incentives, such as tax credits and rebates, as well as investments in charging infrastructure and research and development.

The policy aims to create a more sustainable transportation system that reduces dependence on fossil fuels and promotes clean energy sources.

- Carbon Emission Reduction:The EV policy seeks to achieve significant reductions in carbon emissions by promoting the adoption of EVs. The government has set ambitious targets for reducing carbon emissions from the transportation sector, and the EV policy is a key component of achieving these targets.

The policy aims to incentivize the transition to EVs, thereby reducing greenhouse gas emissions from the transportation sector and contributing to the broader goal of combating climate change.

- Economic Development:The EV policy aims to stimulate economic growth and create new jobs in the United States. The government believes that investing in the EV sector will create opportunities for American workers and businesses, while also strengthening the country’s position in the global clean energy economy.

Want to discover the latest and greatest in acoustic guitar music on Youtube? Acoustic Guitar On Youtube 2024 is the place to be. This channel features a curated selection of the best acoustic guitar performances from around the world, showcasing a diverse range of styles and talent.

It’s a great way to stay up-to-date on the latest trends in acoustic guitar music.

The policy aims to attract investment in domestic EV manufacturing, battery production, and charging infrastructure, creating new jobs and boosting economic activity.

- Technological Innovation:The EV policy encourages technological innovation in the EV sector. The government recognizes the importance of investing in research and development to advance EV technology and improve battery performance, range, and affordability. The policy aims to foster innovation by providing funding for research projects, supporting startups, and creating incentives for the development of new EV technologies.

If you’re looking for some acoustic guitar music to download, you’ll want to check out Acoustic Guitar Music Download 2024. This website features a vast library of acoustic guitar tracks, from solo pieces to full band arrangements. You can browse by genre, artist, or mood to find the perfect music for any occasion.

5.3 Comparison of EV Tax Credit Policies in the United States with Other Countries

The United States is not alone in its efforts to promote EV adoption. Many countries around the world have implemented various policies to incentivize the purchase of EVs. These policies vary in their target audience, incentive structure, effectiveness, and evolution over time.

- Target Audience:Some policies target specific types of EVs, such as those with a certain range or battery capacity, while others target specific consumer groups, such as low-income households or those who live in urban areas.

- Incentive Structure:The financial incentives offered for EV purchases vary widely across countries. Some countries offer tax credits, while others provide subsidies or rebates. The amount of the incentive may also vary depending on the type of EV, the purchase price, and other factors.

- Policy Effectiveness:The effectiveness of EV tax credit policies in promoting EV adoption varies across countries. Factors that influence the effectiveness of these policies include the level of the incentive, the availability of charging infrastructure, and the overall cost of EVs.

- Policy Evolution:EV tax credit policies have evolved over time in different countries. As the EV market has matured, governments have adjusted their policies to address changing market conditions and to ensure the continued growth of the EV sector.

5.4 Comparative Analysis of EV Tax Credit Policies in the United States, China, and the European Union

The United States, China, and the European Union are among the leading players in the global EV market, each with its own approach to promoting EV adoption.

| Country | Policy Goal | Policy Instruments | Policy Effectiveness | Lessons Learned |

|---|---|---|---|---|

| United States | Promote clean energy adoption, reduce carbon emissions, and stimulate economic growth | Tax credits, rebates, investments in charging infrastructure, research and development funding | The U.S. EV tax credit program has been effective in promoting EV adoption, particularly in recent years. However, the program has also faced challenges, such as the limited availability of EVs eligible for the credit and the per-manufacturer cap. | The U.S. experience highlights the importance of providing clear and consistent incentives for EV adoption. It also underscores the need to address the challenges of affordability, charging infrastructure, and consumer awareness. |

| China | Promote domestic EV production, reduce air pollution, and enhance technological competitiveness | Subsidies, tax breaks, preferential access to government procurement, investments in charging infrastructure, and support for research and development | China’s EV policy has been highly effective in promoting EV adoption, resulting in the world’s largest EV market. The government’s aggressive support for domestic EV production has led to a significant increase in EV sales and a rapid decline in EV prices. | China’s experience demonstrates the importance of government support for the EV sector. The government’s commitment to developing a domestic EV industry has been crucial to the country’s success in the EV market. |

| European Union | Reduce greenhouse gas emissions, promote energy security, and enhance competitiveness in the global automotive industry | Tax incentives, subsidies, investments in charging infrastructure, fuel efficiency standards, and regulations promoting EV production | The EU’s EV policy has been successful in promoting EV adoption, with a significant increase in EV sales in recent years. However, the policy has faced challenges, such as the high cost of EVs and the limited availability of charging infrastructure in some countries. | The EU’s experience highlights the importance of a comprehensive approach to promoting EV adoption, including policies that address the cost of EVs, charging infrastructure, and consumer awareness. |

5.5 Impact of Government Policy on EV Adoption in the United States

Government policy has played a significant role in shaping the EV market in the United States. The EV tax credit program, along with other incentives and investments, has been instrumental in driving EV adoption.

- Data Analysis:Data analysis shows a strong correlation between the implementation of EV tax credit programs and the growth of the EV market in the United States. Studies have found that the EV tax credit program has been a major factor in increasing EV sales and reducing the cost of EVs for consumers.

Looking for some high-quality sound effects to enhance your Youtube videos? Top Youtube Sound Effects 2024 has you covered. This website features a wide variety of sound effects, from nature sounds to Foley effects, all royalty-free and ready to use in your videos.

It’s a great resource for adding a professional touch to your Youtube content.

- Case Studies:Case studies of individual car manufacturers and consumers have shown the impact of the EV tax credit program on EV adoption. For example, some car manufacturers have reported a significant increase in EV sales following the implementation of the tax credit program.

Consumers have also reported that the tax credit has made EVs more affordable and attractive.

- Expert Opinions:Experts in the EV industry have consistently pointed to the importance of government policy in promoting EV adoption. They argue that the EV tax credit program, along with other incentives and investments, has been essential to the growth of the EV market in the United States.

5.6 Evaluation of the Effectiveness of the EV Tax Credit Program in the United States, EV Tax Credit October 2024

The effectiveness of the EV tax credit program in the United States can be evaluated based on its cost-effectiveness, equity, environmental impact, and long-term sustainability.

If you’re a fan of acoustic music from the 70s, you’ll want to check out Acoustic Music 70s 2024. This playlist features some of the best acoustic tracks from the decade, including folk, singer-songwriter, and even some early rock.

It’s a great way to relive the golden age of acoustic music and discover some forgotten gems.

- Cost-effectiveness:The EV tax credit program has been relatively cost-effective in promoting EV adoption. Studies have shown that the program has generated a significant return on investment, with the cost of the tax credit being outweighed by the benefits of reduced greenhouse gas emissions and increased economic activity.

For a unique take on acoustic music, check out Acoustic Music Eg Without Electric Effects 2024. This playlist features a selection of acoustic tracks that showcase the raw power and beauty of acoustic instruments without the use of electric effects.

It’s a great way to appreciate the natural sound of acoustic music and discover new artists.

- Equity:The EV tax credit program has been criticized for its lack of equity. The program benefits higher-income households more than lower-income households, as they are more likely to be able to afford the purchase of an EV. The program’s focus on luxury vehicles has also been criticized for disproportionately benefiting wealthier consumers.

For a deep dive into the world of acoustic music, visit The Acoustic Music Archive 2024. This online resource is a treasure trove of information, with articles, interviews, and recordings from a wide range of acoustic artists. It’s a must-visit for anyone who wants to learn more about the history and evolution of acoustic music.

- Environmental impact:The EV tax credit program has had a positive environmental impact, contributing to the reduction of greenhouse gas emissions from the transportation sector. The program has encouraged the adoption of EVs, which are more efficient and produce fewer emissions than gasoline-powered vehicles.

- Long-term sustainability:The long-term sustainability of the EV tax credit program is a matter of debate. Some argue that the program is unsustainable in the long term, as the cost of the program is likely to increase as EV adoption grows. Others argue that the program is essential to achieving the government’s climate goals and that the benefits of the program outweigh the costs.

For a weekly dose of acoustic music, check out Acoustic Tuesday Youtube 2024. This channel features a diverse range of acoustic artists, from folk singers to indie bands, all showcasing their raw talent and musicality. It’s a great way to discover new artists and enjoy some beautiful music.

5.7 Role of Government Policy in Shaping the Future of the EV Market

Government policy will continue to play a crucial role in shaping the future of the EV market. As the EV market matures, governments will need to address a number of policy challenges and opportunities to ensure the continued growth of the EV sector.

- Policy Priorities:Key policy priorities for the future include promoting the development of affordable EVs, expanding charging infrastructure, and addressing consumer concerns about range anxiety and battery life.

- Policy Challenges:Key policy challenges facing the EV market include the need to ensure that the EV tax credit program remains sustainable, the need to address the equity concerns associated with the program, and the need to promote the development of new EV technologies.

If you’re looking for acoustic music from the 2000s, you’ll want to check out Acoustic Music 2000s 2024. This playlist features some of the best acoustic tracks from the decade, including folk, singer-songwriter, and even some pop hits. It’s a great way to relive the acoustic music of the 2000s and discover some forgotten gems.

- Policy Recommendations:Policy recommendations to ensure the continued growth of the EV market include extending the EV tax credit program, expanding the program’s eligibility requirements, and providing incentives for the development of new EV technologies.

EV Industry Response and Strategies

The changes to the EV tax credit have sparked a range of responses from major EV manufacturers, prompting adjustments to their strategies and investment plans. These changes have brought about a need for adaptation and innovation within the EV industry.

Impact on Investment and Development Plans

The shift in eligibility criteria has prompted some EV manufacturers to reassess their investment and development plans. The changes have potentially created uncertainty for companies that were heavily reliant on the tax credit for their sales projections.

- For example, some manufacturers have announced plans to prioritize production of vehicles that meet the new requirements. This could involve adjusting production lines or investing in new technologies to ensure compliance.

- Others have expressed concerns about the potential impact on their ability to expand into new markets or introduce new models. The revised eligibility criteria could lead to higher costs and a need to adjust pricing strategies.

Adapting to the Evolving Policy Landscape

The EV industry is actively adapting to the evolving policy landscape. This includes:

- Engaging in lobbying efforts to influence future policy decisions.

- Developing innovative technologies and manufacturing processes to meet the new requirements.

- Focusing on market segments where the tax credit remains a significant incentive.

Strategies for Continued Growth

Despite the challenges, the EV industry remains optimistic about its long-term growth prospects. Key strategies include:

- Investing in research and development to improve battery technology, reduce costs, and enhance vehicle performance.

- Expanding into new markets with strong government support for EV adoption.

- Developing new business models, such as subscription services or vehicle sharing, to increase affordability and accessibility.

7. Future Outlook for EV Tax Credits

The EV tax credit program has been a significant driver of EV adoption in the US. However, its future is uncertain, influenced by several factors including political priorities, budgetary constraints, market trends, and technological advancements. This section delves into the potential trajectory of the EV tax credit program, analyzing its potential impact on the automotive industry, the environment, and the economy.

Speculative Policy Changes

The future of the EV tax credit program is subject to various policy changes. The program’s continuation, modification, or potential phase-out hinges on several factors, including:

- Shifting Political Priorities:Political priorities can significantly impact the EV tax credit program. If the political landscape shifts towards greater emphasis on clean energy and climate change mitigation, the program might be extended or expanded. Conversely, a change in political priorities could lead to budget cuts or program termination.

- Budgetary Constraints:Budgetary constraints are another critical factor influencing the program’s future. If the government faces budget limitations, the EV tax credit program might be subject to cuts or modifications. This could involve reducing the tax credit amount, imposing income limits, or limiting eligibility to specific vehicle types.

If you’re a fan of acoustic rock ballads, you’ll want to check out Youtube Acoustic Rock Ballads 2024. This playlist features some of the best acoustic rock ballads from the past few years, including both popular hits and hidden gems.

It’s the perfect soundtrack for a relaxing evening or a thoughtful moment.

- Public Opinion:Public opinion plays a crucial role in shaping policy decisions. If public perception of the EV tax credit program shifts negatively, due to concerns about its cost or effectiveness, it could lead to program adjustments or even its elimination.

Market Trends and Technological Advancements

Market trends and technological advancements also play a significant role in shaping the future of the EV tax credit program.

- Increased EV Adoption:As EV adoption increases, the need for continued tax incentives might diminish. If EVs become more affordable and readily available, consumer demand could drive adoption without the need for government subsidies. This could lead to a gradual phase-out of the program.

- Battery Technology Advancements:Improvements in battery technology, such as increased range and reduced cost, could influence the program’s design. For example, if battery technology advances significantly, the program might focus on incentivizing EVs with specific battery performance or charging capabilities.

- Competition from Other Countries:The US approach to EV tax credits is influenced by policies and incentives in other countries. If other countries implement more generous EV incentives, the US might need to adjust its program to remain competitive in attracting EV manufacturing and investment.

Long-Term Implications

The EV tax credit program has significant long-term implications for the automotive industry, the environment, and the economy.

- The Automotive Industry:The program has significantly influenced the development and production of EVs in the US. It has encouraged automakers to invest in EV research and development, leading to increased production and model diversity. Continued support for the program could further accelerate the transition to EVs, creating new manufacturing jobs and opportunities for innovation.

- The Environment:The program has contributed to a reduction in greenhouse gas emissions by encouraging the adoption of EVs. Continued support for the program could lead to a significant reduction in transportation-related emissions, helping to achieve environmental sustainability goals. However, the program’s long-term impact on the environment depends on factors such as the source of electricity used to charge EVs and the environmental impact of battery production and disposal.

- The Economy:The EV tax credit program has had both positive and negative economic impacts. On the positive side, it has stimulated demand for EVs, supporting jobs in the automotive industry and related sectors. It has also created new opportunities for businesses involved in EV charging infrastructure, battery production, and other related industries.

However, the program’s long-term economic impact depends on factors such as the cost of implementing the program and its impact on consumer spending.

Comparison with other countries

The US EV tax credit program is not unique. Many countries around the world have implemented similar programs to promote EV adoption.

- Program Design and Eligibility Criteria:The design and eligibility criteria of EV tax credit programs vary across countries. Some countries offer tax credits based on the purchase price of the vehicle, while others provide incentives based on battery size or range. Eligibility criteria can also vary, with some programs targeting specific vehicle types or income levels.

- Program Effectiveness:The effectiveness of EV tax credit programs in promoting EV adoption and achieving environmental outcomes varies across countries. Some programs have been more successful than others, depending on factors such as the program’s design, the availability of charging infrastructure, and consumer preferences.

- Policy Lessons Learned:Experiences from other countries can provide valuable insights into designing and implementing effective EV incentives. For example, some countries have found that combining tax credits with other policies, such as charging infrastructure development and vehicle purchase subsidies, can be more effective in driving EV adoption.

Final Thoughts

The EV tax credit program in October 2024 presents a complex landscape with numerous factors influencing its effectiveness. From consumer demand to manufacturer strategies, the changes will undoubtedly shape the future of the EV market. As we navigate this evolving landscape, understanding the intricacies of the program and its potential impact is crucial for consumers, policymakers, and industry stakeholders alike.

By staying informed and adapting to the changing incentives, we can foster a more sustainable and prosperous future for the electric vehicle industry.

Question & Answer Hub

What are the main changes to the EV tax credit program in October 2024?

The EV tax credit program in October 2024 will see significant changes to eligibility requirements, including vehicle price limits, manufacturing location, and income restrictions. These changes are designed to target the tax credit towards specific types of EVs and consumers.

Will the EV tax credit be available for all electric vehicles in October 2024?

No, the EV tax credit will only be available for electric vehicles that meet the new eligibility criteria, which include a price cap, manufacturing location requirements, and income restrictions.

How can I determine if my electric vehicle qualifies for the tax credit?

You can determine if your electric vehicle qualifies for the tax credit by checking the updated eligibility requirements on the IRS website or consulting with a tax professional.

What is the maximum tax credit amount available for EV purchases in October 2024?

The maximum tax credit amount available for EV purchases in October 2024 will vary depending on the vehicle model and other factors. It’s essential to refer to the latest guidelines and regulations for specific details.

What are the potential implications of the EV tax credit changes for the overall automotive industry?

The EV tax credit changes could have significant implications for the overall automotive industry, influencing investment, production, and market dynamics. The impact on different segments of the industry, such as luxury vehicles, affordable EVs, and commercial vehicles, will need to be carefully assessed.