Variable Annuity 457 2024 presents a unique opportunity for retirement planning, combining the growth potential of variable annuities with the tax advantages of a 457 plan. This guide explores the intricacies of this strategy, offering insights into its workings, potential benefits, and key considerations for 2024.

An annuity is a financial product that provides a stream of income for life. It can be a valuable tool for retirement planning, but it’s important to understand how annuities work before you invest. To learn more about how annuities are calculated in accounting, you can check out this article: Calculating Annuity In Accounting 2024.

Variable annuities are investment vehicles that offer the potential for growth through a variety of sub-accounts, often linked to mutual funds or other investment options. 457 plans, on the other hand, are tax-advantaged retirement savings plans designed for government employees and certain non-profit organizations.

A variable annuity is a type of retirement savings product that offers the potential for growth. However, it also provides a guaranteed minimum income benefit, which ensures that you will receive a certain amount of income each year, regardless of the performance of the underlying investment options.

To learn more about this benefit, you can check out this article: Variable Annuity Guaranteed Minimum Income Benefit 2024.

Combining these two elements can create a powerful retirement savings strategy, potentially maximizing growth and minimizing taxes.

An annuity is a financial product that provides a stream of income for life. The amount of income you receive each month depends on the amount of money you invest and the type of annuity you choose. To learn more about how much an annuity can pay out per month, check out this article on How Much Does A 80 000 Annuity Pay Per Month 2024.

Variable Annuities: An Overview: Variable Annuity 457 2024

Variable annuities are retirement savings vehicles that offer the potential for growth through investments in a variety of sub-accounts, similar to mutual funds. These sub-accounts are typically invested in a range of assets, including stocks, bonds, and money market instruments.

A variable annuity is a type of retirement savings product that offers the potential for growth. It can be a valuable tool for retirement planning, but it’s important to understand how variable annuities work before you invest. To learn more about using variable annuities in a retirement plan, check out this article: Variable Annuity Retirement Plan 2024.

Key Features of Variable Annuities, Variable Annuity 457 2024

- Growth Potential:Variable annuities offer the potential for higher returns compared to fixed annuities, as their value fluctuates with the performance of the underlying investments.

- Investment Flexibility:Investors can choose from a variety of sub-accounts, allowing them to tailor their portfolio based on their risk tolerance and investment goals.

- Tax Deferral:Earnings from variable annuities are not taxed until withdrawn, providing tax advantages for long-term savings.

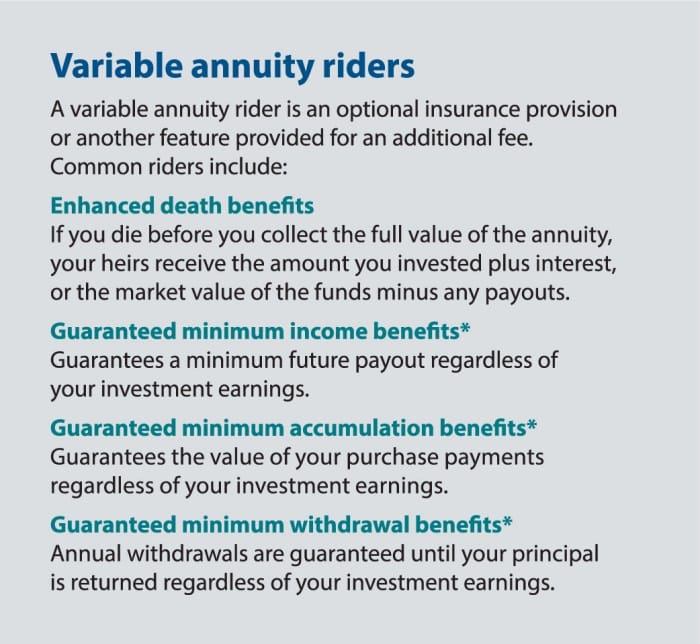

- Death Benefit:Many variable annuities include a death benefit that guarantees a minimum payout to beneficiaries, providing some protection against market losses.

Advantages and Disadvantages

- Advantages:

- Growth potential

- Investment flexibility

- Tax deferral

- Death benefit protection

- Disadvantages:

- Higher fees compared to traditional retirement accounts

- Market risk, as the value of the annuity can fluctuate with the market

- Complexity, requiring careful research and understanding of investment options

How Variable Annuity Investments Work

Variable annuities are structured around sub-accounts, which are similar to mutual funds. Each sub-account represents a specific investment strategy, such as a stock fund, a bond fund, or a balanced fund. Investors allocate their contributions to these sub-accounts based on their investment preferences.

An annuity can be a valuable tool for retirement planning, especially for individuals who are approaching retirement age. It can provide you with a stream of income for life, which can help you meet your financial needs in retirement. To learn more about annuities for 60-year-old men, you can check out this article: Annuity 60 Year Old Man 2024.

The value of each sub-account fluctuates with the performance of the underlying investments.

A variable annuity is a type of retirement savings product that offers the potential for growth. However, it’s important to understand that the value of the annuity can fluctuate based on the performance of the underlying investment options. To learn more about the minimum return on variable annuities, you can check out this article: Variable Annuity Minimum Return 2024.

- Sub-accounts:Each sub-account is managed by a professional investment manager who selects and trades securities based on the specific investment strategy.

- Investment Options:Variable annuities offer a wide range of investment options, including stocks, bonds, money market instruments, and real estate.

- Performance:The value of the annuity is determined by the performance of the sub-accounts in which the investor has allocated their funds.

457 Plans: Understanding the Basics

A 457 plan is a retirement savings plan designed for employees of state and local governments, as well as certain non-profit organizations. It allows pre-tax contributions to grow tax-deferred until retirement.

If you win the Powerball lottery, you can choose to receive your winnings as a lump sum or as an annuity. The annuity option will pay out your winnings in annual installments over a period of 30 years. To learn more about calculating these payments, you can read this article on Calculating Powerball Annuity Payments 2024.

Eligibility Criteria

To be eligible for a 457 plan, you must be an employee of a participating employer. This typically includes state and local government employees, as well as employees of certain non-profit organizations. Eligibility criteria may vary depending on the specific employer’s plan.

Variable annuities are a type of retirement savings product that offers the potential for growth. The value of the annuity is linked to the performance of the underlying investment options. If you’re interested in a career in the financial industry, you may want to consider a job related to variable annuities.

You can find more information about variable annuity jobs in this article: Variable Annuity Jobs 2024.

Types of 457 Plans

There are two main types of 457 plans:

- Governmental 457 Plans:These plans are offered by state and local governments. They are subject to specific regulations and may have different contribution limits and investment options compared to non-governmental plans.

- Non-Governmental 457 Plans:These plans are offered by certain non-profit organizations, such as educational institutions and hospitals. They may have more flexible contribution limits and investment options than governmental plans.

Variable Annuities in 457 Plans

Combining a variable annuity with a 457 plan can provide several potential benefits, including:

Potential Benefits

- Growth Potential:Variable annuities offer the potential for higher returns compared to traditional fixed-income investments within a 457 plan.

- Tax Deferral:Both the 457 plan and the variable annuity provide tax-deferred growth, maximizing potential returns.

- Investment Flexibility:Variable annuities offer a variety of investment options within the 457 plan, allowing for diversification and tailored portfolio management.

Tax Implications

While contributions to a 457 plan are pre-tax, the earnings from a variable annuity within the plan are not taxed until withdrawn in retirement. This can provide significant tax savings over the long term.

The Brighthouse Series L Variable Annuity is a type of retirement savings product that offers the potential for growth. It also provides a guaranteed minimum income benefit, which ensures that you will receive a certain amount of income each year, regardless of the performance of the underlying investment options.

To learn more about this specific annuity, you can check out this article: Brighthouse Series L Variable Annuity 2024.

Growth Potential

Variable annuities can offer the potential for higher growth compared to traditional fixed-income investments within a 457 plan. This can be particularly beneficial for individuals with a longer time horizon and a higher risk tolerance.

An annuity calculator can help you estimate the potential income you could receive from an annuity. Some calculators allow you to input your personal information, while others don’t require any details. You can find an annuity calculator that doesn’t require personal details by clicking this link: Annuity Calculator No Personal Details 2024.

Considerations for 2024

The 457 plan regulations are subject to change, and it is essential to stay updated on any potential updates for 2024. Market trends and innovations in variable annuities can also influence investment decisions.

An annuity can be a valuable tool for retirement planning. It can provide you with a stream of income for life, which can help you meet your financial needs in retirement. For more information on annuities with a starting value of $600,000, check out this article: Annuity 600 000 2024.

Potential Market Trends

- Interest Rate Changes:Fluctuations in interest rates can impact the performance of both fixed-income and equity investments within variable annuities. Monitoring interest rate trends is crucial for adjusting investment strategies.

- Inflation:Rising inflation can erode the purchasing power of retirement savings. Variable annuities may offer potential protection against inflation through investments in inflation-linked assets.

- Economic Uncertainty:Global economic events and geopolitical risks can impact market volatility and investment returns. It is essential to consider these factors when making investment decisions.

New Features and Innovations

- Target-Date Funds:Some variable annuities may offer target-date funds, which automatically adjust the asset allocation mix based on the investor’s retirement date. This can provide a more hands-off approach to investment management.

- Guaranteed Income Riders:Certain variable annuities include guaranteed income riders, which provide a guaranteed income stream in retirement, regardless of market performance. This can offer peace of mind for individuals seeking income security.

- Enhanced Death Benefit Options:Some variable annuities may offer enhanced death benefit options, which provide additional protection for beneficiaries in case of the investor’s death. These options can be particularly beneficial for individuals with dependents.

Key Factors for Decision-Making

When considering a variable annuity within a 457 plan, it is essential to evaluate your risk tolerance, investment goals, and other factors.

A guaranteed variable annuity is a type of retirement savings product that provides a guaranteed minimum return on your investment. It also offers the potential for growth, which is linked to the performance of the underlying investment options. To learn more about this product and its features, check out this article on Guaranteed Variable Annuity 2024.

Investment Options Comparison

| Investment Option | Potential Growth | Risk | Fees | Liquidity |

|---|---|---|---|---|

| Variable Annuity | High | High | High | Low |

| Mutual Funds | Moderate | Moderate | Moderate | High |

| Target-Date Funds | Moderate | Moderate | Low | High |

Decision-Making Checklist

- Risk Tolerance:Are you comfortable with the potential for market fluctuations and losses?

- Investment Goals:What are your retirement income needs and how much time do you have to reach your goals?

- Fees and Expenses:Compare the fees associated with variable annuities to other investment options within your 457 plan.

- Tax Implications:Understand the tax implications of withdrawing funds from a variable annuity in retirement.

- Investment Options:Review the available investment options within the variable annuity and ensure they align with your investment preferences.

Role of Risk Tolerance and Investment Goals

- Risk Tolerance:Individuals with a higher risk tolerance may be more comfortable with the potential for higher returns and greater volatility associated with variable annuities.

- Investment Goals:Variable annuities can be a suitable option for individuals with long-term investment goals and a desire for potential growth.

Illustrative Examples

Let’s consider a hypothetical scenario to demonstrate the potential growth of a variable annuity within a 457 plan.

Scenario:

Assume an individual contributes $10,000 annually to a 457 plan for 20 years. They allocate their contributions to a variable annuity with an average annual return of 8%.

An annuity is a financial product that provides a stream of income for life. It can be a valuable tool for retirement planning, but it’s important to understand how annuities work before you invest. To learn more about annuities, check out this article on Annuity 95-1 2024.

Projected Returns:

| Year | Contribution | Beginning Balance | Growth | Ending Balance |

|---|---|---|---|---|

| 1 | $10,000 | $10,000 | $800 | $10,800 |

| 2 | $10,000 | $10,800 | $864 | $11,664 |

| … | … | … | … | … |

| 20 | $10,000 | $46,609 | $3,729 | $50,338 |

Retirement Planning Objectives:

Variable annuities can be used to address specific retirement planning objectives, such as:

- Income Generation:Variable annuities can provide a stream of income in retirement through periodic withdrawals or annuitization.

- Legacy Planning:Variable annuities can be used to create a legacy for beneficiaries through death benefit provisions.

- Inflation Protection:Variable annuities may offer potential protection against inflation through investments in inflation-linked assets.

Ultimate Conclusion

Navigating the world of retirement savings can be complex, and variable annuities within a 457 plan offer a unique path for those seeking growth potential and tax advantages. Understanding the nuances of this strategy, including the potential risks and rewards, is crucial for making informed decisions.

By carefully considering your individual circumstances, risk tolerance, and financial goals, you can determine if a variable annuity 457 plan is the right fit for your retirement planning journey.

Questions and Answers

What are the potential risks associated with variable annuities?

Variable annuities carry investment risk, meaning the value of your investment can fluctuate. You could lose money, and the returns are not guaranteed. It’s important to carefully consider your risk tolerance before investing.

How do I choose the right sub-accounts within a variable annuity?

An annuity is a financial product that can provide you with a stream of income for life. It can be a valuable tool for retirement planning, but it’s important to understand how annuities work before you invest. To find out more about the relationship between annuities and life insurance, you can read this article on An Annuity Is A Life Insurance Product That 2024.

The best sub-accounts for you will depend on your investment goals and risk tolerance. It’s essential to diversify your investments across different asset classes and consider the long-term growth potential of each sub-account.

Are there any fees associated with variable annuities?

Yes, variable annuities typically come with fees, including administrative fees, investment management fees, and surrender charges. It’s important to carefully review these fees before investing.

What are the tax implications of withdrawing money from a variable annuity within a 457 plan?

Withdrawals from a 457 plan are generally taxed as ordinary income. However, the specific tax implications may vary depending on your individual circumstances. It’s best to consult with a tax advisor to understand the tax implications of your specific situation.

The Metlife Series L Variable Annuity is a type of retirement savings product that offers the potential for growth. It also provides a guaranteed minimum income benefit, which ensures that you will receive a certain amount of income each year, regardless of the performance of the underlying investment options.

To learn more about this specific annuity, you can check out this article: Metlife Series L Variable Annuity 2024.