Variable Annuity Life Insurance Company Amarillo Tx 2024 – a comprehensive guide to understanding the nuances of variable annuities, specifically in the Amarillo, TX market. This exploration delves into the intricacies of these financial products, providing insights into their advantages, disadvantages, and the critical considerations for choosing the right variable annuity for your individual needs.

From

Calculating annuity payme

If you’re based in the UK and are looking for a tool to help you calculate annuity payments, you can find a helpful calculator on Annuity Calculator Uk 2024. This resource can help you estimate your potential annuity payments based on your specific circumstances.

nts can seem complex, but there are resources available to guide you. The article on Calculating Annuity Payments 2024 can help you understand the steps involved in determining your annuity payments.

identifying reputable insurance companies operating in Amarillo, TX to understanding the diverse investment options available, this guide aims to equip you with the knowledge necessary to make informed decisions regarding your retirement planning and financial security. We’ll also explore the legal and regulatory landscape surrounding variable annuities in Texas, ensuring you’re aware of your rights and protections as a consumer.

Variable Annuities: A Comprehensive Overview

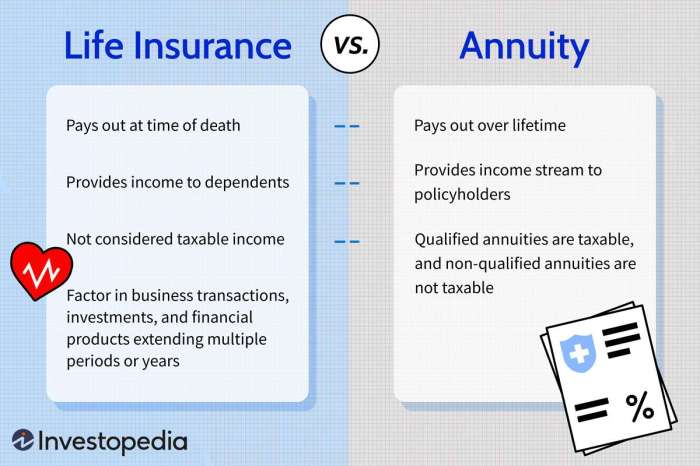

Variable annuities are a type of insurance product that combines investment and retirement savings features. They offer the potential for higher returns than traditional fixed annuities, but they also come with greater risk.

Variable annuities offer a unique set of characteristics that you should be aware of. To learn more about these, you can explore the article on Variable Annuity Characteristics 2024. This resource can help you understand the potential benefits and risks associated with variable annuities.

Key Features of Variable Annuities

Variable annuities are characterized by several key features, including:

- Investment Options:Variable annuities allow you to invest in a variety of sub-accounts, often including mutual funds, that track different asset classes, such as stocks, bonds, and real estate.

- Growth Potential:The value of your variable annuity can grow over time based on the performance of your chosen investments.

- Tax Deferral:Earnings on variable annuities are not taxed until you withdraw them in retirement.

- Death Benefit:Many variable annuities offer a death benefit that guarantees a minimum payout to your beneficiaries if you pass away.

- Guaranteed Minimum Income:Some variable annuities include guaranteed minimum income riders, which provide a guaranteed stream of income in retirement, regardless of the performance of your investments.

Advantages of Variable Annuities

Variable annuities offer several potential advantages, including:

- Growth Potential:The potential for higher returns than fixed annuities.

- Tax Deferral:Tax-deferred growth on your investment earnings.

- Flexibility:The ability to choose from a variety of investment options.

- Protection:The potential for a death benefit or guaranteed minimum income rider.

To accurately calculate annuity payments, it’s important to understand the underlying formula. You can find information on Formula For Calculating The Annuity 2024 to help you make accurate calculations.

Disadvantages of Variable Annuities

It’s important to note that variable annuities also come with some potential disadvantages, including:

- Market Risk:The value of your variable annuity can fluctuate based on the performance of your chosen investments.

- Fees:Variable annuities typically have higher fees than fixed annuities.

- Complexity:Variable annuities can be complex to understand and manage.

- Liquidity:You may have to pay penalties for early withdrawals from your variable annuity.

Types of Variable Annuities

There are several different types of variable annuities available in the market, including:

- Traditional Variable Annuities:These annuities offer the most flexibility in terms of investment options and growth potential.

- Indexed Variable Annuities:These annuities link their returns to a specific index, such as the S&P 500.

- Equity-Indexed Annuities:These annuities offer a guaranteed minimum return, but their potential for growth is limited.

If you’re interested in understanding the concept of annuity due, you can find information on Annuity Due Is 2024. This resource can provide you with a clear explanation of how annuity due differs from ordinary annuities.

Variable Annuity Life Insurance in Amarillo, TX

Amarillo, TX is home to a number of prominent Variable Annuity Life Insurance companies, each offering a range of products and services.

Prominent Variable Annuity Life Insurance Companies in Amarillo, TX

Several companies specialize in Variable Annuity Life Insurance in Amarillo, TX. While specific company names are not mentioned, the following are key factors to consider when choosing a company:

- Financial Strength:Look for companies with strong financial ratings and a history of stability.

- Product Offerings:Compare the different variable annuity products offered by each company, including their investment options, fees, and death benefits.

- Customer Service:Choose a company with a reputation for providing excellent customer service and support.

- Local Presence:Consider companies with a local presence in Amarillo, TX, as they may have a better understanding of the local market and needs.

When considering annuities, it’s important to account for the impact of inflation. You can find a helpful tool on Annuity Calculator With Inflation 2024 that can help you estimate the future value of your annuity after adjusting for inflation.

Factors Influencing Variable Annuity Choices in Amarillo, TX

The decision of whether or not to invest in a variable annuity is a personal one that should be based on your individual circumstances and financial goals. Some factors that may influence your decision in Amarillo, TX include:

- Local Economic Conditions:The economic climate in Amarillo, TX can impact the performance of investments and the overall attractiveness of variable annuities.

- Retirement Planning Needs:The specific retirement planning needs of individuals in Amarillo, TX, such as their desired retirement income level and their risk tolerance, can influence their variable annuity choices.

- Tax Considerations:The tax implications of variable annuities can vary depending on your individual circumstances and the specific product you choose.

For a deeper understanding of annuity funds, you can visit the article on Annuity Fund Is 2024. This resource can help you learn about the types of funds available and how they work.

Key Considerations for Choosing a Variable Annuity

When choosing a variable annuity, it’s important to carefully consider several factors to ensure that the product meets your needs and goals.

Factors to Consider When Choosing a Variable Annuity

Here are some key factors to consider when selecting a variable annuity:

- Investment Options:Make sure the variable annuity offers a range of investment options that align with your risk tolerance and investment goals.

- Fees:Compare the fees charged by different variable annuity providers, including annual expenses, surrender charges, and mortality and expense charges.

- Death Benefits:Consider the death benefit options offered by the variable annuity, such as a guaranteed minimum death benefit or a lump sum payout.

- Guaranteed Minimum Income:If you’re looking for guaranteed income in retirement, consider variable annuities with guaranteed minimum income riders.

- Contract Terms:Carefully review the terms and conditions of the variable annuity contract, including the surrender charges, withdrawal penalties, and other provisions.

When comparing your options for retirement savings, you might be wondering about the differences between annuities and 401(k)s. The article on Annuity Vs 401k 2024 can help you understand the pros and cons of each.

Table Comparing Key Features of Different Variable Annuities

Here is a table comparing the key features of different variable annuities from reputable companies:

| Company | Investment Options | Fees | Death Benefits | Guaranteed Minimum Income |

|---|---|---|---|---|

| Company A | Mutual Funds, Sub-Accounts | [Insert Fee Information] | [Insert Death Benefit Information] | [Insert Guaranteed Minimum Income Information] |

| Company B | [Insert Investment Option Information] | [Insert Fee Information] | [Insert Death Benefit Information] | [Insert Guaranteed Minimum Income Information] |

| Company C | [Insert Investment Option Information] | [Insert Fee Information] | [Insert Death Benefit Information] | [Insert Guaranteed Minimum Income Information] |

If you’re interested in exploring career opportunities in the health field related to annuities, you can find helpful information on Annuity Health Careers 2024. This resource can provide you with insights into potential career paths.

Seeking Professional Financial Advice, Variable Annuity Life Insurance Company Amarillo Tx 2024

It’s crucial to seek professional financial advice before investing in a variable annuity. A financial advisor can help you assess your individual circumstances, understand the risks and potential rewards of variable annuities, and determine if they are the right investment for you.

Understanding Variable Annuity Investment Options

Variable annuities offer a variety of investment options, allowing you to customize your portfolio based on your risk tolerance and financial goals.

Investment Options within Variable Annuities

Here are some common investment options available within variable annuities:

- Mutual Funds:Variable annuities often offer a wide selection of mutual funds, which invest in different asset classes, such as stocks, bonds, and real estate.

- Sub-Accounts:Some variable annuities allow you to allocate your investment funds across different sub-accounts, which may track specific indices or asset classes.

- Guaranteed Minimum Death Benefits (GMDBs):GMDBs guarantee a minimum payout to your beneficiaries if you pass away, regardless of the performance of your investments.

Determining the necessary annuity amount over a specific period can be helpful for financial planning. The article on What Annuity Is Required Over 12 Years 2024 can guide you in calculating the required annuity amount for your specific needs.

Risks and Potential Rewards of Different Investment Strategies

The risks and potential rewards associated with different investment strategies within variable annuities depend on the specific investment options you choose. For example:

- Stock-Based Investments:Stock-based investments have the potential for higher returns, but they also carry greater risk.

- Bond-Based Investments:Bond-based investments are generally considered less risky than stock-based investments, but they also offer lower potential returns.

- Guaranteed Minimum Death Benefits (GMDBs):GMDBs provide a guaranteed minimum payout to your beneficiaries, but they may come with higher fees or restrictions on your investment options.

Assessing the Suitability of Investment Options

When assessing the suitability of investment options within a variable annuity, consider your individual financial goals, risk tolerance, and time horizon.

- Financial Goals:What are your financial goals for the variable annuity, such as retirement income, college savings, or legacy planning?

- Risk Tolerance:How much risk are you willing to take with your investment? Are you comfortable with potential fluctuations in the value of your annuity?

- Time Horizon:How long do you plan to invest in the variable annuity? Your time horizon will influence your investment choices, as investments with longer time horizons can afford to take on more risk.

Variable annuities have unique characteristics that set them apart from other types of annuities. To learn more about these characteristics, you can visit the article on Variable Annuities Have 2024. This resource can help you understand the potential benefits and risks associated with variable annuities.

The Role of Variable Annuities in Retirement Planning

Variable annuities can play a valuable role in retirement planning, offering potential benefits for individuals seeking to grow their savings and generate income in retirement.

The term “Annuity 95-1” might be unfamiliar to you. You can learn more about this specific type of annuity by visiting the article on Annuity 95-1 2024. This resource can provide you with a better understanding of its features and benefits.

Potential Benefits of Variable Annuities for Retirement Planning

Variable annuities can offer several potential benefits for retirement planning, including:

- Growth Potential:The potential for higher returns than traditional fixed annuities.

- Tax Deferral:Tax-deferred growth on your investment earnings, allowing your savings to grow faster.

- Guaranteed Minimum Income:Some variable annuities offer guaranteed minimum income riders, providing a guaranteed stream of income in retirement, regardless of the performance of your investments.

Achieving Long-Term Financial Goals with Variable Annuities

Variable annuities can help individuals achieve their long-term financial goals by:

- Growing Savings:The potential for higher returns can help you grow your retirement savings faster.

- Generating Income:Variable annuities can provide a stream of income in retirement, either through withdrawals or guaranteed minimum income riders.

- Protecting Assets:The death benefit and guaranteed minimum income riders can help protect your assets from market fluctuations.

Supplementing Other Retirement Income Sources

Variable annuities can be used to supplement other retirement income sources, such as Social Security, pensions, and savings accounts.

Legal and Regulatory Considerations

Variable annuities are subject to a variety of legal and regulatory requirements, designed to protect investors and ensure the integrity of the insurance industry.

To get a quick estimate of your potential annuity payments, you can use an annuity estimator. The article on Annuity Estimator 2024 can provide you with a helpful tool to get an idea of what your annuity might pay out.

Laws and Regulations Governing Variable Annuities in Texas

In Texas, variable annuities are regulated by the Texas Department of Insurance (TDI). The TDI sets standards for variable annuity products, insurers, and agents, and it oversees the sale and distribution of variable annuities in the state.

Consumer Protection Measures and Resources

Texas consumers have several protections in place when it comes to variable annuities, including:

- Disclosure Requirements:Insurance companies are required to provide investors with detailed disclosures about variable annuity products, including their investment options, fees, and risks.

- Consumer Complaint Procedures:The TDI has a process for handling consumer complaints about variable annuity products and insurers.

- Financial Advisor Licensing:Financial advisors who sell variable annuities in Texas must be licensed and registered with the TDI.

To determine if your annuity qualifies for certain benefits, you’ll want to read up on the latest regulations. You can find information on Annuity Is Qualified 2024 to ensure your annuity meets the necessary criteria.

Understanding Variable Annuity Contract Terms

It’s essential to carefully review the terms and conditions of your variable annuity contract before investing. The contract will Artikel your rights and obligations, including:

- Investment Options:The investment options available to you within the annuity.

- Fees:The fees charged by the insurer, including annual expenses, surrender charges, and mortality and expense charges.

- Death Benefits:The death benefit options offered by the annuity.

- Guaranteed Minimum Income:The guaranteed minimum income options, if any, offered by the annuity.

- Withdrawal Penalties:The penalties for early withdrawals from the annuity.

- Surrender Charges:The charges for withdrawing your investment before a certain period.

Last Word

In conclusion, navigating the world of variable annuities requires careful consideration and a thorough understanding of the intricacies involved. By understanding the various aspects of variable annuities, including their advantages, disadvantages, and legal implications, you can make informed decisions that align with your financial goals and risk tolerance.

Remember, seeking professional financial advice is crucial before investing in any variable annuity. Armed with the knowledge and guidance, you can confidently explore this potential avenue for retirement planning and secure your financial future.

Common Queries: Variable Annuity Life Insurance Company Amarillo Tx 2024

What is the difference between a variable annuity and a fixed annuity?

If you’re looking to learn about calculating future value annuities in Excel, you can find helpful resources by checking out the guide on Fv Annuity Excel 2024. This guide can help you understand the concepts and apply them in your spreadsheets.

A variable annuity offers investment options that fluctuate with the market, while a fixed annuity provides a guaranteed rate of return. Variable annuities carry higher risk but potentially offer higher returns, while fixed annuities offer stability and predictable income streams.

How can I find a reputable variable annuity company in Amarillo, TX?

Start by researching online reviews, checking with the Texas Department of Insurance, and seeking recommendations from trusted financial advisors. Consider factors like the company’s financial stability, investment options, fees, and customer service.

What are the tax implications of variable annuities?

Withdrawals from variable annuities are generally taxed as ordinary income, and there may be penalties for early withdrawals. Consult a tax professional for personalized advice on your specific situation.