Variable Annuity Disclosure 2024 takes center stage, offering investors a crucial roadmap for navigating the complex world of variable annuities. This guide delves into the essential disclosures required by regulatory bodies, providing a clear understanding of the potential benefits and risks associated with these investment vehicles.

Curious about how a $500,000 annuity might work? This guide on Annuity 500k 2024 provides valuable information.

Understanding the intricacies of variable annuities is essential for investors seeking to make informed decisions. This guide explores key aspects such as investment options, fee structures, risk management strategies, and tax implications, equipping investors with the knowledge they need to make sound financial choices.

Learn how to calculate annuity payments using a TI-84 calculator with this guide on Calculate Annuity On Ti 84 2024.

Introduction to Variable Annuities: Variable Annuity Disclosure 2024

Variable annuities are insurance contracts that offer a combination of investment growth potential and guaranteed income payments. They are designed to help individuals accumulate and preserve wealth for retirement. Variable annuities are complex financial products, and it is essential to understand their features, benefits, and risks before making an investment decision.

Learn about different annuity options, including the 6 Annuity 2024 and its potential benefits.

Core Concept of Variable Annuities

Variable annuities work by investing premiums in a sub-account that holds a variety of mutual funds or other investment options. The value of the sub-account fluctuates based on the performance of the underlying investments. When the annuity holder is ready to receive income, they can choose to withdraw a portion of their accumulated value or annuitize their contract, receiving regular payments for life.

Looking for the Hindi meaning of “annuity”? This resource on Annuity Ka Hindi Meaning 2024 provides the translation.

Key Features of Variable Annuities

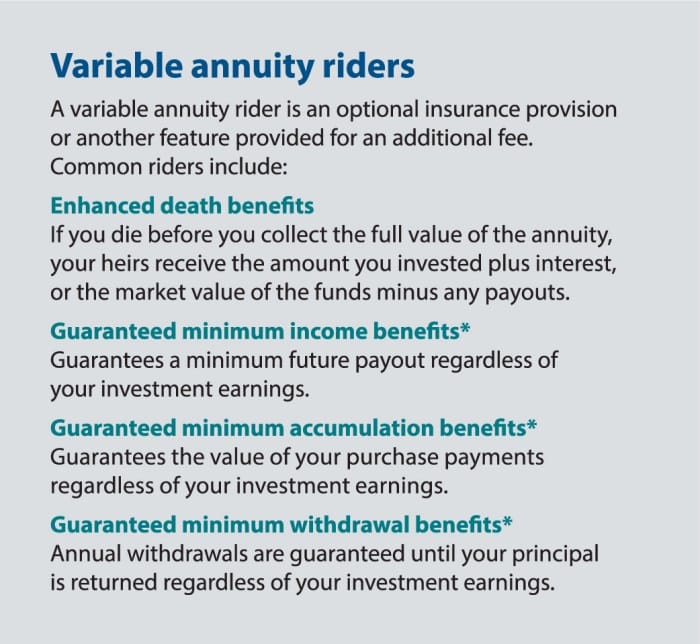

Variable annuities offer a range of features that can be tailored to meet individual needs and investment goals. Some of the key features include:

- Investment Growth Potential:Variable annuities allow investors to participate in the potential growth of the stock market or other investment options.

- Guaranteed Income Payments:Some variable annuities offer guaranteed minimum income benefits (GMIBs) that provide a guaranteed level of income payments, regardless of the performance of the sub-account.

- Tax Deferral:Earnings within the sub-account are generally not taxed until they are withdrawn.

- Death Benefit:Many variable annuities offer a death benefit that guarantees a minimum payout to beneficiaries if the annuity holder dies.

Benefits of Variable Annuities

Variable annuities can offer several potential benefits, including:

- Growth Potential:The potential for investment growth can help individuals accumulate wealth for retirement.

- Income Security:Guaranteed income benefits can provide a steady stream of income in retirement, even if market conditions are unfavorable.

- Tax Deferral:Tax deferral can help individuals reduce their overall tax burden.

- Death Benefit:A death benefit can provide financial protection for beneficiaries.

Risks of Variable Annuities

Variable annuities also carry several risks, including:

- Market Risk:The value of the sub-account can fluctuate based on the performance of the underlying investments, which can lead to losses.

- Fees and Expenses:Variable annuities can have high fees and expenses that can erode investment returns.

- Liquidity Risk:Variable annuities are not as liquid as other investments, and it can be difficult to access funds quickly.

- Complexity:Variable annuities are complex financial products, and it is essential to understand their features and risks before investing.

Disclosure Requirements for Variable Annuities

Regulatory bodies play a crucial role in ensuring that investors have access to clear and accurate information about variable annuities. The Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) are the primary regulators that govern variable annuity disclosures.

Understanding how to calculate your pension annuity is essential. This guide on Calculating Annuity Pension 2024 can help you navigate the process.

Regulatory Bodies and Disclosure Requirements

- SEC:The SEC oversees the disclosure of information in prospectuses and other materials related to variable annuities.

- FINRA:FINRA establishes rules and regulations for the sale of variable annuities and requires brokers and dealers to provide investors with specific disclosures.

Specific Disclosure Requirements for Variable Annuities in 2024

In 2024, variable annuity contracts must include specific disclosures that are designed to provide investors with a comprehensive understanding of the product’s features, risks, and costs. These disclosures include:

- Investment Objectives:A clear statement of the investment objectives of the variable annuity contract.

- Fees and Expenses:A detailed breakdown of all fees and expenses associated with the contract.

- Risk Factors:A comprehensive discussion of the risks associated with investing in variable annuities.

- Performance Data:Historical performance data for the underlying investment options.

- Guarantees and Limitations:A clear explanation of any guarantees or limitations associated with the contract.

- Tax Implications:A discussion of the tax implications of investing in variable annuities.

- Withdrawal Options:A description of the available withdrawal options and any associated penalties.

- Annuitization Options:An explanation of the annuitization options available to investors.

- Contractual Provisions:A summary of the key contractual provisions, including surrender charges and death benefit provisions.

Comparison with Other Financial Products

The disclosure requirements for variable annuities are more extensive than those for other financial products, such as mutual funds or exchange-traded funds (ETFs). This is because variable annuities are more complex products with a greater range of features and risks.

Key Disclosures for Variable Annuity Contracts

Variable annuity contracts are required to include a variety of disclosures that are designed to provide investors with a comprehensive understanding of the product’s features, risks, and costs. These disclosures are essential for making informed investment decisions.

Table of Essential Disclosures

| Disclosure | Importance to Investors | Example of Presentation |

|---|---|---|

| Investment Objectives | Helps investors understand the investment goals of the contract. | “The investment objective of this variable annuity is to provide long-term growth potential for retirement income.” |

| Fees and Expenses | Allows investors to compare the cost of different variable annuity contracts. | A table outlining the various fees and expenses, such as mortality and expense charges, administrative fees, and investment management fees. |

| Risk Factors | Informs investors of the potential risks associated with investing in variable annuities. | A detailed discussion of market risk, liquidity risk, and other relevant risks. |

| Performance Data | Provides investors with historical performance data for the underlying investment options. | A table showing the historical performance of the investment options, including average annual returns and risk measures. |

| Guarantees and Limitations | Explains any guarantees or limitations associated with the contract, such as guaranteed minimum income benefits or surrender charges. | A clear statement of the guarantees and limitations, including the conditions that must be met to receive the guarantees. |

| Tax Implications | Informs investors of the tax implications of investing in variable annuities, such as the tax treatment of withdrawals and death benefits. | A discussion of the tax implications, including examples of how taxes may be calculated. |

| Withdrawal Options | Describes the available withdrawal options and any associated penalties. | A table outlining the different withdrawal options, including the minimum and maximum withdrawal amounts and any applicable surrender charges. |

| Annuitization Options | Explains the annuitization options available to investors, such as the different payout options and the factors that affect the amount of income payments. | A detailed description of the annuitization options, including examples of how income payments may be calculated. |

| Contractual Provisions | Summarizes the key contractual provisions, including surrender charges, death benefit provisions, and other relevant terms. | A summary of the key provisions, written in plain language that is easy for investors to understand. |

Understanding Variable Annuity Fees and Expenses

Variable annuities are subject to a variety of fees and expenses that can impact investor returns. It is essential to understand these fees and expenses before making an investment decision.

Want to get an idea of how much your annuity payments could be? Utilize an Annuity Estimator 2024 to get a personalized estimate.

Types of Fees and Expenses, Variable Annuity Disclosure 2024

| Fee/Expense | Description |

|---|---|

| Mortality and Expense Charges | Fees charged to cover the cost of providing the death benefit and other expenses. |

| Administrative Fees | Fees charged to cover the cost of managing the annuity contract. |

| Investment Management Fees | Fees charged to manage the underlying investment options. |

| Surrender Charges | Fees charged if the annuity contract is surrendered before a certain period. |

| Annuitization Fees | Fees charged when the annuity contract is annuitized. |

Impact on Investor Returns

Fees and expenses can significantly impact investor returns. High fees can erode investment growth, reducing the overall return on investment. It is important to compare the fee structures of different variable annuity contracts to find the most cost-effective option.

Evaluating Fee Structure

When evaluating the fee structure of variable annuity contracts, investors should consider the following factors:

- Total Annual Fee:The total annual fee is the sum of all fees and expenses charged on the contract.

- Fee Structure:Some contracts have a front-loaded fee structure, while others have a back-loaded fee structure. Front-loaded contracts charge higher fees upfront, while back-loaded contracts charge higher fees later in the contract term.

- Investment Options:The fees and expenses associated with the underlying investment options should also be considered.

- Comparison with Other Contracts:It is important to compare the fee structures of different variable annuity contracts to find the most cost-effective option.

The Role of Investment Options in Variable Annuities

Variable annuities offer investors a variety of investment options, allowing them to tailor their portfolio to their risk tolerance and investment goals. The performance of these investment options can significantly impact the value of the annuity contract and the amount of income payments received in retirement.

Need a step-by-step guide on how to calculate annuity payments? Check out this Calculate Annuity Example 2024 for practical insights.

Investment Options Available

Variable annuity contracts typically offer a range of investment options, including:

- Mutual Funds:Mutual funds provide investors with access to a diversified portfolio of stocks, bonds, or other assets.

- Exchange-Traded Funds (ETFs):ETFs are similar to mutual funds but are traded on stock exchanges, offering greater liquidity.

- Annuities:Some variable annuity contracts offer the option to invest in other annuities, such as fixed annuities or indexed annuities.

- Target-Date Funds:Target-date funds are designed to automatically adjust the asset allocation mix as the investor approaches retirement.

Factors to Consider When Selecting Investment Options

When selecting investment options for a variable annuity, investors should consider the following factors:

- Risk Tolerance:Investors with a high risk tolerance may choose to invest in stocks or other higher-risk assets. Investors with a low risk tolerance may prefer to invest in bonds or other lower-risk assets.

- Investment Goals:The investment goals should also be considered. For example, an investor seeking long-term growth may choose to invest in stocks, while an investor seeking income may prefer to invest in bonds.

- Time Horizon:The time horizon is the amount of time the investor plans to hold the investment. Investors with a longer time horizon can afford to take on more risk.

- Fees and Expenses:The fees and expenses associated with the investment options should also be considered.

- Performance History:It is important to review the performance history of the investment options to get an idea of their past performance.

Impact of Investment Performance on Payouts

The performance of the investment options within a variable annuity can significantly impact the value of the annuity contract and the amount of income payments received in retirement. If the investments perform well, the value of the contract will increase, and the investor will receive higher income payments.

Determine your potential annuity payout with this guide on Calculating Annuity Payout 2024 , which provides helpful tools and strategies.

However, if the investments perform poorly, the value of the contract will decrease, and the investor may receive lower income payments.

Risk Management and Variable Annuities

Variable annuities are subject to various risks that investors should carefully consider before investing. Risk management strategies can help mitigate these risks and protect investment capital.

Key Risk Factors

The key risk factors associated with variable annuities include:

- Market Risk:The value of the sub-account can fluctuate based on the performance of the underlying investments, which can lead to losses.

- Interest Rate Risk:Changes in interest rates can impact the value of fixed income investments within the sub-account.

- Inflation Risk:Inflation can erode the purchasing power of income payments, reducing the real value of the annuity contract.

- Liquidity Risk:Variable annuities are not as liquid as other investments, and it can be difficult to access funds quickly.

- Fees and Expenses:High fees and expenses can erode investment returns.

- Guarantees and Limitations:Guarantees and limitations, such as guaranteed minimum income benefits or surrender charges, can impact the overall return on investment.

- Company Risk:The financial stability of the insurance company issuing the annuity contract can also be a risk factor.

Risk Management Strategies

Investors can employ various risk management strategies to mitigate the risks associated with variable annuities. These strategies include:

- Diversification:Diversifying the investment portfolio across different asset classes can help reduce market risk.

- Asset Allocation:Carefully allocating assets across different investment options can help manage risk and meet investment goals.

- Rebalancing:Rebalancing the investment portfolio periodically can help ensure that the asset allocation remains consistent with the investor’s risk tolerance and investment goals.

- Understanding Fees and Expenses:Carefully evaluating the fee structure of variable annuity contracts can help minimize the impact of fees on investment returns.

- Choosing a Reputable Provider:Selecting a reputable insurance company with a strong financial track record can help reduce company risk.

Assessing and Managing Risks

Investors should carefully assess the risks associated with variable annuities before making an investment decision. It is essential to understand the potential risks and the strategies available to manage them. Consulting with a financial advisor can help investors make informed decisions about variable annuities and develop a risk management plan that meets their individual needs.

Explore various methods for calculating annuity payments. This resource on Annuity Method 2024 provides insights into different approaches.

The Impact of Market Volatility on Variable Annuities

Market volatility can significantly impact the value of variable annuity contracts, as the value of the sub-account fluctuates based on the performance of the underlying investments. Investors need to understand how market volatility can affect their investments and develop strategies to mitigate its impact.

For those in New Zealand, finding the right annuity plan can be crucial. Discover information about Annuity Nz 2024 to help you make informed decisions.

Impact on Value

During periods of market volatility, the value of variable annuity contracts can fluctuate significantly. If the market declines, the value of the sub-account will decrease, and the investor may experience losses. Conversely, if the market rises, the value of the sub-account will increase, and the investor may experience gains.

Strategies to Mitigate Impact

Investors can employ various strategies to mitigate the impact of market volatility on their variable annuity investments. These strategies include:

- Diversification:Diversifying the investment portfolio across different asset classes can help reduce the impact of market volatility.

- Asset Allocation:Carefully allocating assets across different investment options can help manage risk and reduce volatility.

- Rebalancing:Rebalancing the investment portfolio periodically can help ensure that the asset allocation remains consistent with the investor’s risk tolerance and investment goals.

- Dollar-Cost Averaging:Investing a fixed amount of money at regular intervals, regardless of market conditions, can help reduce the impact of market volatility.

- Long-Term Perspective:Taking a long-term perspective can help investors ride out short-term market fluctuations.

Historical Performance During Volatility

Historical performance data can provide insights into how variable annuities have performed during periods of market volatility. For example, during the 2008 financial crisis, many variable annuity contracts experienced significant losses. However, those contracts that were well-diversified and had a long-term investment horizon were able to recover from the downturn.

Ending Remarks

As you embark on your journey into the realm of variable annuities, remember that transparency is paramount. By understanding the disclosures required by regulatory bodies and carefully evaluating the terms of your contract, you can navigate the complexities of this investment landscape with confidence.

Understanding the formula behind annuity bonds can be a bit complex. Fortunately, this resource on Formula Annuity Bond 2024 can help simplify things.

This guide has provided a comprehensive overview of Variable Annuity Disclosure 2024, empowering you to make informed decisions that align with your financial goals.

If you’re new to annuities, understanding how they work is key. This guide on Annuity How It Works 2024 can provide valuable insights.

Essential FAQs

What are the key differences between variable annuities and traditional annuities?

Annuity plans can be complex. Get a clear understanding of how they operate with this resource on Annuity Explained 2024.

Variable annuities differ from traditional annuities in that their returns are linked to the performance of underlying investment options. This means that the value of your annuity can fluctuate based on market conditions, unlike traditional annuities which offer a fixed rate of return.

Annuity options are available through the National Pension System (NPS). Explore the details of Annuity Nps 2024 to learn more.

Are variable annuities suitable for all investors?

Variable annuities are not suitable for all investors. They are best suited for individuals with a long-term investment horizon and a higher risk tolerance, as their value can fluctuate significantly. It’s crucial to consult with a financial advisor to determine if variable annuities are right for your individual needs and circumstances.

What are the tax implications of withdrawals from variable annuities?

The tax implications of withdrawals from variable annuities depend on the type of withdrawal. Withdrawals of earnings are generally taxed as ordinary income, while withdrawals of principal are typically tax-free. It’s essential to understand the tax implications of your specific variable annuity contract.

Want to understand how variable annuities work in 2024? Check out this Variable Annuity Example 2024 for a clear explanation.