5 Percent Annuity 2024: Navigating the financial landscape of retirement can be daunting, but a well-crafted plan can provide peace of mind. One popular strategy involves withdrawing 5% of your savings annually, a method known as the “5 Percent Annuity.” This approach offers a balance between income and preserving your nest egg, but understanding its nuances is crucial for making informed decisions.

This article explores the 5 Percent Annuity, examining its potential benefits and drawbacks, the factors influencing its success, and strategies for maximizing its effectiveness. We delve into the impact of inflation, investment returns, and longevity risk, providing insights into how these elements affect your retirement income.

Annuities can be a complex financial product, and there are various types available. For example, an Annuity 3 2024 is a specific type of annuity with its own set of features and benefits.

Additionally, we discuss alternative income sources and present a step-by-step guide for creating a personalized retirement plan.

The UK’s HMRC offers various tax-related resources, including annuity calculators. An Annuity Calculator Hmrc 2024 can help you estimate the tax implications of your annuity choices.

Understanding the 5 Percent Annuity

The 5 percent annuity is a retirement planning strategy that involves withdrawing 5 percent of your retirement savings each year. This approach is often favored by financial advisors and retirees alike due to its simplicity and potential for sustainable income.

Annuities often involve compound interest, which can significantly impact your returns over time. An Is Annuity Compound Interest 2024 guide can explain how compound interest works in the context of annuities.

Benefits and Drawbacks of a 5 Percent Annuity

A 5 percent withdrawal rate offers several advantages. It allows for a relatively comfortable retirement lifestyle while potentially preserving your principal for future generations. However, relying solely on a 5 percent annuity comes with its own set of challenges.

Groww is a popular financial platform that offers various investment tools. You can use an Annuity Calculator Groww 2024 to explore annuity options and calculate potential returns.

- Benefits:

- Sustainable Income:A 5 percent withdrawal rate is often considered sustainable, allowing for a consistent stream of income throughout retirement.

- Principal Preservation:This approach helps preserve your retirement savings for future generations or unexpected expenses.

- Simplicity:The 5 percent rule is easy to understand and apply, making retirement planning more straightforward.

- Drawbacks:

- Inflation Risk:Inflation can erode the purchasing power of your withdrawals over time, making your retirement income less effective.

- Market Volatility:Investment returns can fluctuate, potentially affecting the longevity of your annuity.

- Longevity Risk:If you live longer than expected, your retirement savings might deplete before you do.

Examples of a 5 Percent Annuity

Let’s consider a few scenarios to illustrate how a 5 percent annuity might work in practice.

The 72t rule is a specific tax provision that applies to certain types of annuities. An Annuity 72t 2024 guide can explain the requirements and potential benefits of this rule.

| Starting Investment | Annual Withdrawal | Time Horizon | Estimated Duration |

|---|---|---|---|

| $1,000,000 | $50,000 | 30 years | Approximately 30 years |

| $500,000 | $25,000 | 20 years | Approximately 20 years |

| $250,000 | $12,500 | 10 years | Approximately 10 years |

These examples demonstrate how a 5 percent annuity can provide a steady income stream for various time horizons, depending on your starting investment amount.

If you’re considering a $2 million annuity, you might wonder how much income it could generate. An How Much Will A 2 Million Annuity Pay 2024 tool can help you estimate potential payouts.

Factors Influencing Annuity Calculations: 5 Percent Annuity 2024

Several factors can impact the sustainability and longevity of a 5 percent annuity, requiring careful consideration during retirement planning.

An annuity due is a type of annuity where payments are made at the beginning of each period. An Calculating An Annuity Due 2024 guide can help you understand how to calculate these payments.

Inflation’s Impact, 5 Percent Annuity 2024

Inflation erodes the purchasing power of money over time. If your investment returns don’t keep pace with inflation, the value of your 5 percent withdrawals will diminish, reducing your effective retirement income.

Investment Returns

The longevity of your 5 percent annuity heavily depends on your investment returns. Higher returns allow for greater withdrawals while maintaining your principal. Conversely, low returns could shorten the lifespan of your retirement savings.

Visual Basic is a programming language that can be used to create various applications, including annuity calculators. An Annuity Calculator Visual Basic 2024 guide can help you learn how to develop your own custom calculator.

Longevity Risk and Healthcare Costs

Longevity risk refers to the possibility of living longer than expected, potentially outliving your retirement savings. Additionally, rising healthcare costs can significantly impact your retirement budget, requiring adjustments to your withdrawal strategy.

The government offers various resources for retirement planning, including annuity calculators. You can use an Annuity Calculator Gov 2024 to explore government-backed annuity options.

Strategies for Maximizing Annuity Income

Optimizing your investment portfolio can significantly enhance the sustainability and longevity of your 5 percent annuity. Here are some strategies to consider:

Investment Portfolio Optimization

A well-diversified investment portfolio is crucial for maximizing annuity income. Consider allocating your investments across different asset classes, such as stocks, bonds, and real estate, to mitigate risk and potentially enhance returns.

Financial calculators are essential tools for managing your finances, including annuities. An Financial Calculator Annuity 2024 can help you analyze different annuity options and make informed decisions.

- Stocks:Stocks offer the potential for higher returns but also carry greater volatility.

- Bonds:Bonds provide more stability and lower risk compared to stocks, offering a steady income stream.

- Real Estate:Real estate can provide income through rent and appreciation, but it requires active management.

Diversification and Risk Management

Diversifying your investments across various asset classes and sectors helps reduce risk and potentially increase returns. Risk management involves taking steps to protect your investments from potential losses, such as through insurance or hedging strategies.

If you’re looking to plan for your retirement, understanding annuities can be helpful. An Annuity Calculator Quarterly 2024 can help you estimate potential payouts based on your contributions and chosen investment options.

Alternative Retirement Income Sources

Beyond a 5 percent annuity, several other income sources can supplement your retirement income, creating a more robust financial plan.

Schwab, a well-known financial institution, offers various financial products and services, including annuity calculators. You can use an Annuity Calculator Schwab 2024 to assess annuity options and potential payouts.

Social Security, Pensions, and Part-Time Work

- Social Security:A significant source of retirement income for many Americans, providing a monthly benefit based on your earnings history.

- Pensions:Traditional pensions offer a guaranteed income stream throughout retirement, often based on your years of service and salary.

- Part-Time Work:Maintaining a part-time job during retirement can provide additional income and keep you mentally and physically active.

Combining Income Sources

Combining a 5 percent annuity with other income sources can create a comprehensive retirement plan, providing a more secure and comfortable retirement. Consider developing a budget that incorporates all your income streams to ensure a balanced and sustainable approach to retirement finances.

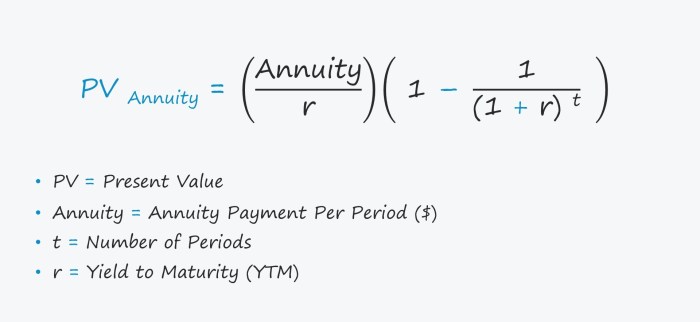

Understanding the math behind annuities is crucial for making informed decisions. The R Annuity Formula 2024 provides a framework for calculating annuity payments.

Planning for Retirement with a 5 Percent Annuity

Creating a personalized retirement plan that incorporates a 5 percent annuity requires careful planning and consideration of your individual circumstances.

When choosing an annuity, it’s essential to consider your specific needs and financial situation. An Annuity Which Is Best 2024 guide can help you navigate the different types and features available.

Sample Retirement Budget

Here’s a sample retirement budget based on a 5 percent annuity withdrawal rate, assuming a starting investment of $1,000,000:

| Expense Category | Estimated Annual Cost |

|---|---|

| Housing | $30,000 |

| Food | $15,000 |

| Healthcare | $10,000 |

| Transportation | $5,000 |

| Entertainment | $5,000 |

| Travel | $5,000 |

| Other Expenses | $10,000 |

| Total Annual Expenses | $80,000 |

This budget provides a starting point for planning your retirement expenses. You can adjust the categories and amounts to reflect your individual needs and lifestyle preferences.

Creating a Personalized Retirement Plan

- Determine Your Retirement Goals:Define your desired retirement lifestyle, including housing, travel, hobbies, and financial goals.

- Estimate Your Retirement Expenses:Create a detailed budget that accounts for all your anticipated expenses, including housing, food, healthcare, transportation, and entertainment.

- Calculate Your Required Retirement Savings:Use financial planning tools or consult with a financial advisor to determine the amount of savings you’ll need to support your desired retirement lifestyle.

- Develop an Investment Strategy:Create a diversified investment portfolio that aligns with your risk tolerance and time horizon.

- Regularly Review and Adjust Your Plan:As your circumstances change, regularly review and adjust your retirement plan to ensure it remains aligned with your goals and financial situation.

Epilogue

Retirement planning is a journey that requires careful consideration and adaptability. While the 5 Percent Annuity offers a valuable framework, it’s essential to approach it with a holistic perspective. By understanding the factors that influence its success, exploring alternative income sources, and regularly reviewing your plan, you can build a retirement strategy that supports your financial well-being and enables you to enjoy your golden years with confidence.

Helpful Answers

What are the risks associated with a 5 Percent Annuity?

The main risks include market volatility, inflation eroding your purchasing power, and outliving your savings. It’s crucial to consider these factors and adjust your strategy accordingly.

Is a 5 Percent Annuity suitable for everyone?

Not necessarily. It depends on your individual circumstances, such as your age, savings, risk tolerance, and desired lifestyle.

How can I determine if a 5 Percent Annuity is right for me?

Consult with a financial advisor to create a personalized retirement plan that considers your specific needs and goals.

What are some alternatives to a 5 Percent Annuity?

Choosing between an annuity and a 401(k) depends on your individual financial goals and risk tolerance. An Annuity Vs 401k 2024 comparison can help you make an informed decision.

Consider options like a Roth IRA, a 401(k) plan, or a combination of different income sources to create a diversified retirement portfolio.