Annuity Calculator Uk Money Saving Expert 2024 – Annuity Calculator UK: Money Saving Expert 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Annuities, a popular retirement income option in the UK, can provide a steady stream of income for life.

For those who prefer using the HP12c calculator, Calculate Annuity Hp12c 2024 provides a comprehensive guide on calculating annuities using this specific calculator. This resource covers all the steps and functions you need to know, making annuity calculations on the HP12c a breeze.

However, navigating the complex world of annuities can be daunting. This guide aims to empower you with the knowledge and tools you need to make informed decisions about your retirement income.

Understanding the formula behind annuity bonds is crucial for making informed investment decisions. Formula Annuity Bond 2024 provides a clear explanation of the formula and its components, allowing you to grasp the underlying mechanics of these bonds. This knowledge can empower you to make better investment choices.

We’ll delve into the different types of annuities available, explore how annuity calculators work, and examine Money Saving Expert’s insightful recommendations. Furthermore, we’ll discuss the current state of the annuity market in the UK, including the latest trends and predictions for the future.

Considering investing with Annuity Gator? You might be wondering if it’s a legitimate company. Is Annuity Gator Legit 2024 provides valuable insights into the company’s reputation and credibility, helping you make an informed decision about whether or not to trust them with your investments.

By the end of this journey, you’ll have a comprehensive understanding of annuities and be well-equipped to make choices that align with your retirement goals.

To fully understand annuities, it’s essential to grasp their definition. Annuity Is Defined As 2024 offers a clear and concise definition of annuities, explaining what they are and how they work.

Understanding Annuities in the UK

Annuities are a popular way for people in the UK to secure a regular income in retirement. They work by converting a lump sum of money into a guaranteed stream of payments for life. This can provide peace of mind knowing that you have a reliable source of income, even if you live longer than expected.

Determining the interest rate on an annuity can be crucial for comparing different investment options. Calculating Annuity Interest Rate 2024 offers a detailed explanation of how to calculate the interest rate, enabling you to assess the returns you can expect from an annuity.

Types of Annuities

There are several different types of annuities available in the UK, each with its own features and benefits. Here are some of the most common:

- Level Annuity:This is the most basic type of annuity, where you receive a fixed amount of income every year for life. This is a simple and predictable option, but it may not offer much flexibility.

- Increasing Annuity:With an increasing annuity, your annual income increases over time, typically linked to inflation. This can help to protect your purchasing power in retirement.

- Guaranteed Period Annuity:This type of annuity provides a guaranteed minimum payment period, even if you die before the end of the period. This can be useful if you want to ensure your beneficiaries receive some income.

- Joint Life Annuity:A joint life annuity provides income for two people, usually a couple. The payments continue until the last surviving person dies.

- With-Profits Annuity:With-profits annuities offer the potential for higher returns, as they are linked to the performance of a fund. However, they also carry more risk.

Annuity Providers in the UK

There are many annuity providers in the UK, including:

- Aviva

- Legal & General

- Scottish Widows

- Standard Life

- Sun Life

It’s important to compare quotes from several providers to find the best deal.

Perpetual annuities, also known as perpetuities, provide income indefinitely. Annuity Is Perpetual 2024 delves into the concept of perpetual annuities, explaining their characteristics and how they differ from regular annuities.

Using an Annuity Calculator

An annuity calculator is a valuable tool for understanding how much income you could receive from an annuity. These calculators take into account factors such as your age, health, and the amount of money you have to invest.

Choosing between an annuity and a pension can be a tough decision. Annuity Vs Pension 2024 helps you understand the key differences between these two retirement income options, allowing you to make an informed choice based on your individual circumstances and goals.

How Annuity Calculators Work, Annuity Calculator Uk Money Saving Expert 2024

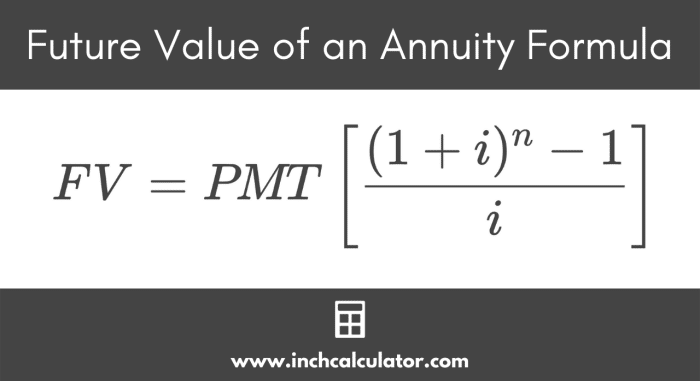

Annuity calculators use complex formulas to estimate your potential annuity income based on the inputs you provide. They consider the interest rates, mortality rates, and other factors that affect annuity payouts.

Deferred annuities offer the flexibility of delaying payments. If you’re interested in learning how to calculate these annuities, How To Calculate A Deferred Annuity 2024 provides a comprehensive guide, covering the formulas and steps involved in these calculations.

Using an Annuity Calculator: A Step-by-Step Guide

- Enter your age and gender:These factors influence your life expectancy and, therefore, the duration of your annuity payments.

- Input the amount of money you want to invest:This is the lump sum that will be converted into an annuity income stream.

- Choose the type of annuity you’re interested in:This could be a level annuity, increasing annuity, or other type of annuity.

- Select any additional options:Some calculators allow you to add options such as a guaranteed period or joint life coverage.

- Review the results:The calculator will show you an estimated annual income, monthly payments, and other details about the annuity.

Factors that Influence Annuity Calculations

- Interest rates:Higher interest rates generally lead to higher annuity payouts.

- Mortality rates:Annuity providers use mortality tables to estimate how long you are likely to live. Higher life expectancy leads to lower annuity payouts.

- Your health:If you have good health, you may be able to secure a higher annuity rate.

- Annuity type:Different types of annuities have different payout structures and may result in different income levels.

Money Saving Expert’s Insights

Money Saving Expert, a popular consumer website in the UK, offers valuable advice on a range of financial topics, including annuities. They provide insights on choosing the right annuity and maximizing your returns.

Calculating future values of annuities can be essential for planning your retirement. Calculating Annuity Future Values 2024 provides a step-by-step guide on how to calculate these values, helping you estimate the potential growth of your annuity over time.

Money Saving Expert’s Recommendations on Annuities

Money Saving Expert recommends that you:

- Shop around and compare quotes:Different providers offer different rates, so it’s important to compare quotes from several providers.

- Consider your needs and circumstances:Think about your income needs, health, and life expectancy when choosing an annuity.

- Seek professional advice:An independent financial advisor can help you understand your options and choose the right annuity for you.

Money Saving Expert’s Tips for Maximizing Annuity Returns

Money Saving Expert suggests the following tips to maximize your annuity returns:

- Choose an increasing annuity:This can help to protect your purchasing power against inflation.

- Consider a guaranteed period annuity:This can provide a safety net for your beneficiaries.

- Negotiate the terms of your annuity:Some providers may be willing to negotiate the rate or terms of your annuity.

Annuities in 2024

The annuity market in the UK is constantly evolving. Interest rates and other factors can affect annuity rates and the overall attractiveness of annuities as a retirement income option.

Are annuity payments subject to taxes? The answer is yes, and you can find detailed information on Annuity Is Taxable 2024. This resource explores the tax implications of annuities, helping you understand how taxes affect your retirement income.

Current State of the Annuity Market

In 2024, annuity rates are generally low, but they are expected to remain stable in the short term. This is due to the low interest rate environment and the increasing life expectancy of the UK population.

If you’re looking to calculate annuity payments on your HP10bii, you’re in the right place! You can find a detailed guide on Calculate Annuity On Hp10bii 2024 , covering all the steps and formulas you need. This guide will help you understand how to use the calculator effectively for annuity calculations.

Trends and Changes in Annuity Rates

There are several trends that are impacting annuity rates, including:

- Low interest rates:Low interest rates make it more expensive for annuity providers to offer high payouts.

- Increasing life expectancy:As people live longer, annuity providers have to pay out for a longer period of time, which can lead to lower rates.

- Competition:The annuity market is competitive, with many providers vying for customers. This can lead to fluctuations in rates as providers try to attract customers with attractive offers.

Predictions for the Future of Annuities

It’s difficult to predict the future of annuities with certainty. However, some experts believe that annuity rates may rise in the future if interest rates increase. Additionally, the development of new annuity products could make annuities more attractive to consumers.

Key Considerations for Choosing an Annuity

Choosing the right annuity is an important decision, as it can have a significant impact on your retirement income. Here are some key factors to consider:

Factors to Consider When Choosing an Annuity

- Your income needs:How much income do you need to live comfortably in retirement?

- Your health:Your health can affect your life expectancy and, therefore, the duration of your annuity payments.

- Your risk tolerance:Are you comfortable with the risk of a variable annuity, or do you prefer the stability of a fixed annuity?

- Your financial goals:What are your long-term financial goals? Do you want to leave an inheritance to your beneficiaries?

Importance of Seeking Professional Advice

It’s important to seek professional advice from an independent financial advisor before choosing an annuity. An advisor can help you understand your options, assess your needs, and make an informed decision.

Checklist for Evaluating Annuity Options

Here’s a checklist to help you evaluate annuity options:

- Compare quotes from several providers.

- Understand the terms and conditions of the annuity.

- Consider the risks and benefits of each type of annuity.

- Make sure the annuity meets your needs and financial goals.

- Seek professional advice from a qualified financial advisor.

Alternatives to Annuities: Annuity Calculator Uk Money Saving Expert 2024

Annuities are not the only retirement income option available. There are other ways to generate income in retirement, each with its own advantages and disadvantages.

Choosing between an annuity and a drawdown option can be a significant decision for retirees. Annuity Or Drawdown 2024 provides a comparison of these two retirement income strategies, helping you determine which option aligns best with your financial goals and risk tolerance.

Comparison of Annuities with Other Retirement Income Options

| Option | Advantages | Disadvantages |

|---|---|---|

| Annuities | Guaranteed income for life, predictable payments, can provide peace of mind | Low returns in a low interest rate environment, limited flexibility, may not keep up with inflation |

| Pensions | Guaranteed income, tax-efficient, may offer benefits beyond retirement income | May be subject to restrictions, may be difficult to access funds early, may be less flexible than other options |

| Investments | Potential for higher returns, flexibility, can be tailored to your individual needs | Higher risk, no guarantee of income, requires active management |

| Property | Potential for rental income, capital appreciation, can provide a place to live | High upfront costs, illiquidity, can be difficult to manage |

Advantages and Disadvantages of Alternative Retirement Income Products

Here are some examples of alternative retirement income products and their advantages and disadvantages:

- Defined contribution pensions:These pensions allow you to build up a pot of money that you can access in retirement. They offer flexibility, but they don’t provide a guaranteed income.

- State pension:The state pension is a basic income provided by the government to people who have paid National Insurance contributions. It’s a guaranteed income, but it’s relatively low.

- Equity release:Equity release allows you to borrow money against the value of your home. This can provide a lump sum of money or a regular income, but it can reduce the value of your estate.

Closure

Choosing the right annuity is a significant decision that should not be taken lightly. By carefully considering your individual circumstances, exploring the available options, and seeking professional advice, you can maximize your retirement income and secure your financial future.

This guide serves as a starting point for your journey, providing you with the knowledge and tools to make informed choices. Remember, your retirement income is a crucial aspect of your financial well-being, so take the time to understand your options and make decisions that align with your long-term goals.

FAQ Corner

What is the difference between a fixed and a variable annuity?

A fixed annuity provides a guaranteed rate of return, while a variable annuity’s returns fluctuate based on the performance of the underlying investments.

Curious about the meaning of “annuity” in Tamil? You can find a comprehensive explanation on Annuity Meaning In Tamil 2024. This resource provides a clear and concise definition of annuity in Tamil, making it easier for you to understand this financial concept in your preferred language.

Is it necessary to use an annuity calculator?

While not mandatory, an annuity calculator can help you estimate your potential income stream and compare different annuity options.

Whether you’re looking to calculate annuity payments, understand the different methods used, or explore the formulas involved, you’ll find comprehensive information on Annuity Method 2024. This resource covers a range of topics related to annuities, making it a valuable tool for anyone seeking to learn more about this financial instrument.

What are the risks associated with annuities?

Annuities can be subject to market risk, interest rate risk, and inflation risk, depending on the type of annuity chosen.