Calculating Retirement Annuity Payments 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Retirement annuities are a crucial element of financial planning, providing a steady stream of income during your golden years.

To gain a more personalized understanding of your annuity options, use an Annuity Calculator Based On Life Expectancy 2024 Annuity Calculator Based On Life Expectancy 2024. This tool factors in your projected lifespan for more accurate estimates.

This guide delves into the intricacies of retirement annuities, covering everything from understanding their purpose to calculating potential payments and making informed decisions for a secure future.

If you have a lump sum of £100,000, you might wonder How Much Annuity For 100 000 2024 How Much Annuity For 100 000 2024 you can generate. An annuity calculator can help you determine the potential income stream.

We’ll explore the various types of retirement annuities available, including fixed, variable, and indexed options, each with its own unique characteristics and risk-reward profile. We’ll also examine the key factors that influence annuity payments, such as age, contribution amount, investment performance, and the impact of inflation and interest rates.

If you’re planning to designate a beneficiary for your annuity, consider the implications of making a Annuity Beneficiary Is A Trust 2024 Annuity Beneficiary Is A Trust 2024. Trusts can offer tax and estate planning advantages.

By understanding these factors, you can make informed decisions about your retirement savings and ensure you receive the income you need to enjoy your later years.

Understanding Retirement Annuities: Calculating Retirement Annuity Payments 2024

Retirement annuities are financial products designed to provide a steady stream of income during your retirement years. They work by accumulating your contributions over time and then paying you a regular income starting at your chosen retirement age. Annuities offer a guaranteed stream of income, making them a popular choice for individuals seeking financial security in their golden years.

Types of Retirement Annuities

Retirement annuities come in various forms, each with its own characteristics and risk profiles. The most common types include:

- Fixed Annuities:These annuities offer a fixed rate of return, guaranteeing a predictable income stream. The downside is that fixed annuities typically have lower returns than variable annuities.

- Variable Annuities:These annuities offer a variable rate of return, depending on the performance of the underlying investments. Variable annuities have the potential for higher returns but also carry a higher risk of losing money.

- Indexed Annuities:These annuities offer a rate of return linked to a specific index, such as the S&P 500. Indexed annuities provide some protection from inflation while offering potential for growth.

Benefits of Retirement Annuities

Retirement annuities offer several benefits, making them an attractive option for retirement planning:

- Guaranteed Income:Annuities provide a guaranteed income stream, ensuring a steady source of funds during retirement.

- Protection from Inflation:Some annuities, such as indexed annuities, offer protection from inflation, ensuring your income keeps pace with rising prices.

- Tax Advantages:Depending on the type of annuity, there may be tax advantages associated with contributions and withdrawals.

- Long-Term Growth Potential:Variable annuities have the potential for long-term growth, potentially outpacing inflation.

Example of How Retirement Annuities Work

Imagine you contribute $1000 per month to a fixed annuity for 30 years, earning a 5% annual return. At retirement, you would receive a monthly income of $1,000, guaranteed for life. This income stream would provide you with financial security during your retirement years, regardless of market fluctuations.

As with any financial product, there are potential Annuity Issues 2024 Annuity Issues 2024 that you should be aware of. Thorough research and consultation with a financial advisor are recommended.

Factors Influencing Retirement Annuity Payments

Several factors determine the amount of retirement annuity payments you receive. Understanding these factors is crucial for planning your retirement income effectively.

To get a general idea of your potential annuity income, use an Annuity Estimator 2024 Annuity Estimator 2024. This tool can provide a preliminary estimate based on your chosen parameters.

Key Factors, Calculating Retirement Annuity Payments 2024

- Age at Retirement:The earlier you retire, the lower your annuity payments will be, as you have fewer years to accumulate contributions.

- Contribution Amount:The more you contribute to your annuity, the higher your payments will be. Regularly contributing to your annuity is crucial for maximizing your retirement income.

- Investment Performance:For variable and indexed annuities, the performance of the underlying investments directly impacts your annuity payments. Higher returns generally lead to higher payments.

Impact of Inflation and Interest Rates

Inflation and interest rates play a significant role in annuity payments. Inflation erodes the purchasing power of your income over time. Therefore, annuities offering inflation protection are essential for maintaining your living standards in retirement. Interest rates influence the return on your annuity investments, impacting the amount of income you receive.

Role of Actuarial Calculations

Actuaries use complex calculations to determine annuity payments. They consider factors such as your age, life expectancy, and interest rates to calculate a sustainable income stream that ensures you don’t outlive your savings. Actuarial calculations ensure that your annuity payments are sufficient to meet your financial needs throughout your retirement years.

Understanding the Annuity Loan Formula 2024 Annuity Loan Formula 2024 can help you calculate your loan payments and understand the total cost of borrowing.

Calculating Retirement Annuity Payments

Calculating retirement annuity payments involves considering several factors and using various methods. While complex calculations are typically handled by financial professionals, you can estimate your future annuity payments using online calculators or by consulting with a financial advisor.

Understanding the Annuity Exclusion Ratio 2024 Annuity Exclusion Ratio 2024 is crucial for anyone considering an annuity, as it helps determine the tax implications of your income stream.

Methods for Estimating Annuity Payments

- Online Calculators:Numerous online calculators allow you to estimate your annuity payments based on your contribution amount, retirement age, and expected rate of return.

- Financial Advisors:A financial advisor can provide personalized calculations and guidance based on your individual circumstances, risk tolerance, and financial goals.

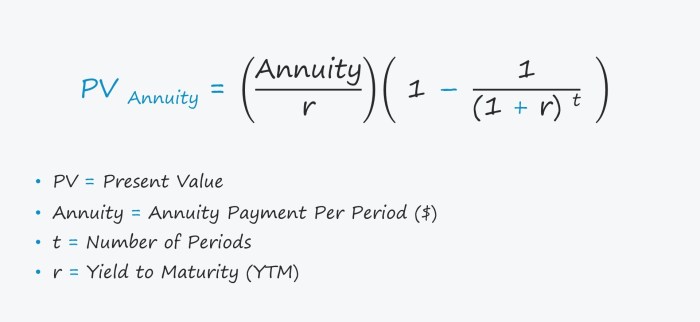

Formulas and Calculations

The calculation of annuity payments involves complex formulas that consider several factors, including:

Present Value (PV) = Payment Amount (PMT) x [1

For those seeking a significant income stream, an Annuity 400k 2024 Annuity 400k 2024 could be a viable option. It’s important to consider your individual needs and financial situation.

(1 + Interest Rate (i)) ^ (-Number of Periods (n))] / Interest Rate (i)

This formula calculates the present value of a stream of future payments, taking into account the time value of money and the interest rate earned on the annuity. The higher the interest rate and the longer the investment period, the higher the present value of the annuity.

Example Calculation

Assume you want to retire at age 65 and receive $5,000 per month in annuity payments for 20 years. The interest rate is 5% per year. Using the formula above, we can calculate the present value of this annuity as follows:

PV = $5,000 x [1

An annuity is often described as the An Annuity Is Sometimes Called The Flip Side Of 2024 An Annuity Is Sometimes Called The Flip Side Of 2024 a lump sum investment, providing a steady stream of income instead of a single payout.

(1 + 0.05) ^ (-20 x 12)] / 0.05

PV = $5,000 x [1

In essence, an Annuity Is What 2024 Annuity Is What 2024 a financial product that converts a lump sum into a series of regular payments, providing a steady income stream.

(1.05) ^ (-240)] / 0.05

PV = $5,000 x [1

0.367879] / 0.05

Thinking about securing a substantial income stream? Explore the potential of an Annuity 500k 2024 Annuity 500k 2024 , which could provide you with a steady flow of payments for years to come.

PV = $5,000 x 0.632121 / 0.05

PV = $63,212.10

If you’re looking for a shorter-term income solution, consider an Annuity 5 Year Payout 2024 Annuity 5 Year Payout 2024. This type of annuity provides payments over a fixed period of time.

Therefore, the present value of this annuity is $63,212.10. This means you would need to contribute this amount today to receive $5,000 per month for 20 years, assuming a 5% annual return.

To get a personalized estimate of your potential annuity payments, use an Annuity Calculator Uk 2024 Annuity Calculator Uk 2024. These online tools provide insights based on your specific circumstances and financial goals.

Choosing the Right Retirement Annuity

Selecting the right retirement annuity is crucial for ensuring your financial security in retirement. There are various annuity options available, each with its own features and benefits. The best annuity for you depends on your risk tolerance, investment goals, and financial situation.

If you’ve won the lottery, you might be considering an annuity payout. An Annuity Calculator Lottery 2024 Annuity Calculator Lottery 2024 can help you understand the potential value of your winnings over time.

Factors to Consider

- Risk Tolerance:Consider your comfort level with investment risk. Fixed annuities offer low risk but may have lower returns, while variable annuities have higher potential returns but also carry higher risk.

- Investment Goals:Determine your investment goals, such as income generation, growth potential, or inflation protection. Choose an annuity that aligns with your goals.

- Financial Situation:Evaluate your current financial situation, including your savings, income, and expenses. Select an annuity that fits your budget and financial needs.

- Fees:Compare fees associated with different annuities, as they can significantly impact your returns. Choose an annuity with low fees and transparent pricing.

- Tax Implications:Understand the tax implications of different annuities, as they can vary based on the type of annuity and your tax bracket.

- Withdrawal Options:Consider your withdrawal options, such as the frequency, minimum withdrawal amount, and any penalties for early withdrawals.

Tips for Selecting an Annuity

- Do your research:Compare different annuity options from reputable providers.

- Consult a financial advisor:Seek professional advice from a qualified financial advisor who can help you understand your options and make informed decisions.

- Read the fine print:Carefully review the annuity contract to understand the terms and conditions, including fees, withdrawal options, and guarantees.

Managing Retirement Annuity Payments

Managing your retirement annuity payments effectively is crucial for maximizing your income and ensuring your financial well-being during retirement. Here are some tips and strategies for managing your annuity payments wisely.

Maximizing Annuity Income

- Consider a structured settlement:A structured settlement can provide a lump-sum payment upfront, which can be invested to generate additional income.

- Explore investment options:Invest your annuity payments to potentially grow your income. Consult a financial advisor for personalized investment recommendations.

- Take advantage of tax benefits:Utilize tax-advantaged accounts, such as IRAs or 401(k)s, to maximize your retirement income.

Minimizing Taxes

- Choose a tax-advantaged annuity:Consider annuities that offer tax advantages, such as tax-deferred growth or tax-free withdrawals.

- Consult a tax advisor:Seek professional advice from a tax advisor to optimize your tax planning and minimize your tax liability.

- Consider Roth conversions:If eligible, convert traditional IRAs or 401(k)s to Roth accounts to avoid paying taxes on withdrawals in retirement.

Protecting Annuity Payments from Inflation and Market Volatility

- Choose inflation-protected annuities:Consider indexed annuities or other annuities that offer protection from inflation.

- Diversify your investments:Spread your investments across different asset classes to reduce risk and potentially protect your income from market fluctuations.

- Regularly review your portfolio:Monitor your investments and adjust your portfolio as needed to maintain your desired level of risk and return.

Last Point

As you navigate the world of retirement annuities, remember that careful planning and understanding are paramount. This guide has provided a comprehensive overview of the key aspects of retirement annuities, equipping you with the knowledge to make informed decisions about your financial future.

By considering your individual needs, risk tolerance, and financial goals, you can select the most suitable retirement annuity option and create a secure and fulfilling retirement.

Query Resolution

What is the difference between a fixed and a variable annuity?

Excel is a powerful tool for financial planning, and you can use it to calculate the Pv Annuity Excel 2024 Pv Annuity Excel 2024 to understand the present value of your future annuity payments.

A fixed annuity provides a guaranteed rate of return, while a variable annuity’s returns are tied to the performance of underlying investments.

How can I calculate my potential retirement annuity payments?

You can use online calculators, consult with a financial advisor, or use formulas to estimate your future annuity payments.

What are the tax implications of retirement annuities?

Tax implications vary depending on the type of annuity and your individual circumstances. It’s essential to consult with a tax advisor to understand the tax implications of your specific annuity.