Calculating Annuity In Accounting 2024 takes center stage as we delve into the world of annuities, a crucial concept in accounting. Annuities, a series of equal payments made over a specific period, are widely used in various financial scenarios, from loan repayments to retirement planning.

Annuity rates can fluctuate, and understanding the current rates is important for planning. You can find information about annuity rates, including those at 4%, on the Annuity 4 Percent 2024 page. Staying informed about annuity rates can help you make the best decisions for your financial future.

Understanding annuity calculations is essential for accountants and financial professionals to make informed decisions and accurately assess financial obligations and future cash flows.

Calculating a growing annuity involves considering factors like interest rates and the growth rate of your investment. You can find helpful information about calculating growing annuities on the How To Calculate A Growing Annuity 2024 page. This information can help you make informed decisions about your financial planning.

This guide will provide a comprehensive overview of annuities, exploring their definition, types, and applications within the accounting realm. We will delve into the formulas and calculations used to determine the present and future values of annuities, showcasing practical examples to illustrate their real-world relevance.

Predicting the future growth of your annuity can be beneficial for financial planning. You can learn about methods for calculating annuity growth on the Calculate Annuity Growth 2024 page. This information can help you estimate the potential future value of your annuity and make informed decisions.

Additionally, we will examine how accounting software simplifies annuity calculations and discuss the benefits of utilizing such tools.

The question of whether an annuity is lifetime is a crucial one to consider, especially as you plan for your retirement. You can find information on the specifics of annuity lifespans in 2024 on the Is Annuity Lifetime 2024 page.

Understanding the terms of your annuity is essential to make informed decisions about your financial future.

Introduction to Annuities in Accounting

An annuity is a series of equal payments made at regular intervals over a specified period of time. Annuities are commonly used in accounting to value financial assets and liabilities, particularly those involving streams of future cash flows. Understanding annuities is crucial for making informed financial decisions, as they play a significant role in various accounting applications.

Defining Annuities and Their Relevance in Accounting

An annuity is a sequence of equal payments made at regular intervals over a predetermined period. These payments can be made at the beginning or end of each period, depending on the type of annuity. Annuities are prevalent in accounting as they help analyze and value financial instruments involving future cash flows.

Types of Annuities

There are three main types of annuities:

- Ordinary Annuity:Payments are made at the end of each period. This is the most common type of annuity.

- Annuity Due:Payments are made at the beginning of each period.

- Perpetuity:Payments continue indefinitely.

Time Value of Money in Annuity Calculations

The concept of the time value of money is fundamental to annuity calculations. It recognizes that money received today is worth more than the same amount received in the future due to its potential earning capacity. This principle is used to discount future cash flows to their present value, allowing for a fair comparison of investments with different payment schedules.

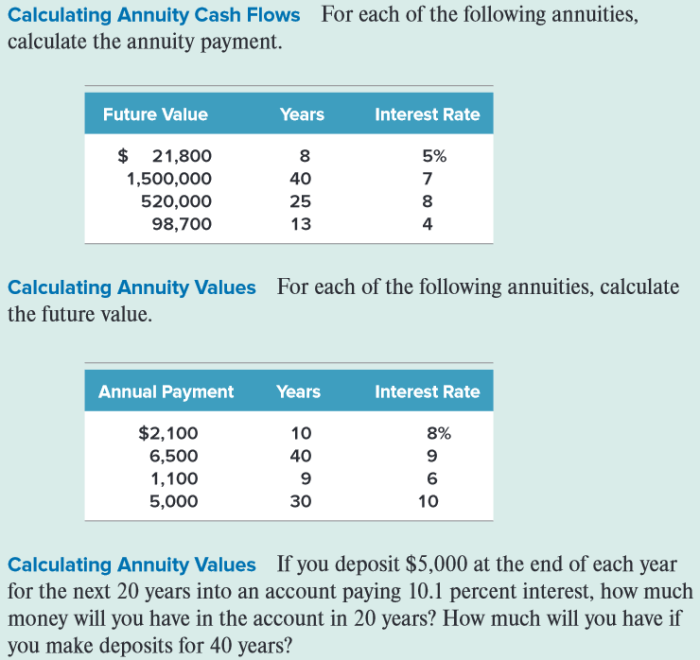

Annuity Formulas and Calculations

Annuity calculations involve determining the present or future value of a stream of payments. These calculations are essential for making informed financial decisions, such as evaluating investment opportunities or planning for retirement.

Keeping track of your annuity statement is crucial for managing your finances. You can find information on annuity statements, including those for 2024, on the Annuity Statement Is 2024 page. Understanding the details of your annuity statement is essential for managing your financial well-being.

Present Value of an Annuity Formula

The present value of an annuity (PVA) represents the current worth of a series of future payments, discounted to reflect the time value of money. The formula for calculating the present value of an ordinary annuity is:

PVA = PMT

- [1

- (1 + r)^-n] / r

where:* PVA = Present Value of Annuity

For those using Excel for financial calculations, understanding how to calculate annuity factors is crucial. You can find helpful information on the Calculating Annuity Factor In Excel 2024 page. This information can help you streamline your financial calculations and make informed decisions.

- PMT = Payment Amount

- r = Interest Rate per Period

- n = Number of Periods

Variables Involved in the Formula

The formula incorporates several key variables:

- Payment Amount (PMT):The fixed amount paid at each interval.

- Interest Rate (r):The rate of return earned on the investment or the cost of borrowing funds.

- Number of Periods (n):The total number of payment intervals.

Example Calculation of the Present Value of an Annuity

Suppose you are considering an investment that promises to pay you $1,000 at the end of each year for the next five years. The annual interest rate is 5%. To calculate the present value of this annuity, we can use the formula above:

PVA = $1,000

For those pursuing a career in finance, the Jaiib exam is a significant step. The Annuity Jaiib 2024 page provides information about the role of annuities in the Jaiib exam, helping you prepare for this important test.

- [1

- (1 + 0.05)^-5] / 0.05 = $4,329.48

Therefore, the present value of this annuity is $4,329.48. This means that receiving $1,000 at the end of each year for five years is equivalent to receiving $4,329.48 today, considering the time value of money.

For those preparing for financial exams, multiple-choice questions (MCQs) on annuities are common. You can find information about annuities in MCQ format on the Annuity Is Mcq 2024 page. Practicing with MCQs can help you solidify your understanding of annuities for exams.

Applications of Annuities in Accounting

Annuities have wide-ranging applications in accounting, particularly in areas involving future cash flows. Understanding how annuities are used in these contexts is crucial for accurate financial reporting and decision-making.

The term “X Share Annuity” might be unfamiliar to some, but it refers to a specific type of annuity. You can find information about X Share Annuities and their relevance in 2024 on the X Share Annuity 2024 page. This information can help you make informed decisions about your financial planning.

Loan Amortization Schedules

Annuity calculations are fundamental to loan amortization schedules. When a loan is taken out, the borrower makes periodic payments that consist of both principal and interest. The amount of interest paid decreases over time as the principal balance reduces. Annuity formulas are used to determine the periodic payment amount and the breakdown of each payment into principal and interest.

Understanding the relationship between annuities and future value is essential for financial planning. The Annuity Is Future Value 2024 page provides insights into this connection, helping you understand how annuities can contribute to your future financial goals.

Retirement Planning and Pension Calculations

Annuities play a vital role in retirement planning and pension calculations. Retirement plans often involve accumulating a sum of money over time and then receiving periodic payments during retirement. Annuity formulas are used to calculate the amount of savings needed to generate a desired retirement income and to determine the value of pension benefits.

, dengan link yang terintegrasi di dalamnya:

If you’re looking to understand how much annuity you might receive for a lump sum of 100,000 in 2024, you can find some helpful information on the How Much Annuity For 100 000 2024 page. This page will provide details on factors that affect the amount of annuity you receive, such as your age and the current interest rates.

Lease Accounting and Property Valuation

Annuities are used in lease accounting to value lease obligations and to determine the present value of future lease payments. In property valuation, annuities can be used to estimate the present value of future rental income streams, which is crucial for determining the fair market value of a property.

Annuity drawdown is a common strategy for managing retirement income. You can find information about annuity drawdown, including its relevance in 2024, on the Is Annuity Drawdown 2024 page. Understanding annuity drawdown can help you make informed decisions about your retirement planning.

Annuity Calculations in Accounting Software

Accounting software has become increasingly sophisticated, offering features that simplify and automate annuity calculations. Utilizing accounting software for annuity calculations offers numerous advantages, including increased accuracy, efficiency, and time savings.

The concept of an annuity can be complex, but a clear definition is essential for understanding its role in financial planning. You can find a comprehensive definition of annuities on the An Annuity Is Best Defined As 2024 page. A solid understanding of annuities is crucial for making informed financial decisions.

Functionality of Accounting Software in Calculating Annuities

Modern accounting software often includes built-in functions for calculating annuities. These functions typically allow users to input the relevant variables, such as payment amount, interest rate, and number of periods, and then automatically calculate the present or future value of the annuity.

An annuity is often seen as a way to supplement retirement income, but its connection to a pension plan can be a bit confusing. You can learn more about the relationship between annuities and pension plans on the Annuity Is Pension Plan 2024 page.

It helps to understand how these financial tools can work together to ensure a secure retirement.

Advantages of Using Software for Annuity Calculations

There are several advantages to using accounting software for annuity calculations:

- Accuracy:Software programs typically have built-in formulas that ensure accurate calculations.

- Efficiency:Automated calculations save time and effort compared to manual calculations.

- Time Savings:Software programs can quickly generate results, reducing the time needed for analysis.

- Flexibility:Many software programs allow users to adjust variables and perform multiple calculations.

Popular Accounting Software Options and their Features Related to Annuity Calculations, Calculating Annuity In Accounting 2024

Several popular accounting software options offer features for annuity calculations. Some of these include:

- QuickBooks:QuickBooks is a popular accounting software that includes tools for calculating annuities.

- Xero:Xero is another cloud-based accounting software that offers features for annuity calculations.

- Sage Intacct:Sage Intacct is a comprehensive accounting software suite that includes advanced functions for annuity calculations.

Real-World Examples of Annuity Calculations

Annuity calculations are frequently used in real-world accounting scenarios. These calculations help make informed financial decisions and provide insights into the value of various financial instruments.

Case Study: Loan Amortization Schedule

Consider a scenario where a company takes out a $100,000 loan with an annual interest rate of 6% and a repayment period of 10 years. The loan agreement requires equal monthly payments. Using annuity formulas, the accounting department can calculate the monthly payment amount and create an amortization schedule that shows the breakdown of each payment into principal and interest.

Practical Implications of Annuity Calculations in Financial Decision-Making

Annuity calculations have practical implications in various financial decision-making processes:

- Investment Analysis:Annuities can be used to evaluate the profitability of different investment opportunities.

- Retirement Planning:Annuity calculations help individuals determine the amount of savings needed to generate a desired retirement income.

- Loan Repayment Strategies:Annuity formulas can be used to analyze different loan repayment options and minimize interest costs.

Table Comparing the Present Value of Different Annuity Scenarios

The following table shows the present value of different annuity scenarios, assuming a payment amount of $1,000 and varying interest rates and payment periods:

| Interest Rate | Number of Periods | Present Value of Annuity |

|---|---|---|

| 5% | 5 | $4,329.48 |

| 5% | 10 | $7,721.73 |

| 10% | 5 | $3,790.79 |

| 10% | 10 | $6,144.57 |

Concluding Remarks

As we conclude our exploration of annuities in accounting, it becomes evident that these financial instruments play a vital role in various financial decisions. By understanding the fundamentals of annuity calculations, accountants and financial professionals can navigate complex scenarios involving loan amortization, retirement planning, and property valuation with greater confidence.

This knowledge empowers them to make informed decisions that optimize financial outcomes and ensure long-term financial stability.

FAQ Explained: Calculating Annuity In Accounting 2024

What are the different types of annuities?

When dealing with annuities, calculating the due amount is a key aspect. The Calculating An Annuity Due 2024 page offers insights into the process, which can be helpful for individuals and financial professionals alike. Understanding the calculation of annuity due can help you make informed decisions about your financial planning.

Annuities can be classified into ordinary annuities, annuity dues, and perpetuities. Ordinary annuities have payments made at the end of each period, while annuity dues involve payments at the beginning of each period. Perpetuities are annuities with an infinite number of payments.

How does the time value of money apply to annuity calculations?

The time value of money recognizes that money received today is worth more than the same amount received in the future due to the potential for earning interest. This concept is crucial in annuity calculations, as it allows for the discounting of future cash flows to their present value.

What are some examples of accounting software that can calculate annuities?

Popular accounting software options that include annuity calculation features include QuickBooks, Xero, and Sage Intacct. These platforms provide tools for calculating present and future values of annuities, simplifying the process for accountants.