Pv Annuity Excel 2024 empowers you to navigate the complexities of financial planning by harnessing the power of Excel’s robust functions. This guide delves into the world of present value annuities, providing a comprehensive understanding of their concept, calculation, and practical applications.

Annuity and IRA are both retirement savings options, but they differ in their features and benefits. The Annuity V Ira 2024 article provides a comparison between these two retirement savings vehicles. This information can help you determine which option best suits your financial goals and needs.

From calculating mortgage payments to planning for retirement, the insights gained here will equip you with the knowledge to make informed financial decisions.

Annuity contracts can be complex, and it’s essential to understand the terms and conditions. The Annuity 9 Letters 2024 article might be helpful in deciphering some of the jargon associated with annuities. This information can help you make informed decisions about your financial future.

We’ll explore the fundamental principles behind PV annuities, including their key components, the different types, and the formula used to calculate them. You’ll discover how to leverage Excel’s specialized functions for accurate and efficient calculations, with step-by-step examples and a practical spreadsheet template to guide you.

An annuity can be a valuable tool for retirement planning, but it’s crucial to understand how it differs from a traditional pension plan. The Annuity Is Pension Plan 2024 article provides insights into the differences between these two retirement income options.

This knowledge can help you make informed decisions about your retirement planning strategy.

The guide also examines the factors that influence PV annuities, including interest rates, payment amounts, and the timing of payments.

When planning for retirement, it’s important to consider various financial options. The Is An Annuity A Qualified Retirement Plan 2024 article explores whether an annuity can be considered a qualified retirement plan. Understanding the different retirement plan options available can help you make informed decisions about your savings and investments.

Introduction to PV Annuities

A present value (PV) annuity is a financial concept that calculates the current worth of a series of future payments. It plays a crucial role in financial planning, helping individuals and businesses make informed decisions about investments, loans, and retirement planning.

Annuity contracts can be complex, and it’s essential to understand the terms and conditions. The Annuity 9 Letters 2024 article might be helpful in deciphering some of the jargon associated with annuities. This information can help you make informed decisions about your financial future.

Understanding PV annuities allows you to assess the value of future cash flows in today’s terms, enabling you to make sound financial choices.

The Annuity Basis Is 2024 article provides information on the basis of an annuity, which is crucial for understanding the tax implications of annuity payments. This information can be helpful in making informed decisions about your annuity investments and managing your tax liability.

Key Components of a PV Annuity Calculation

The calculation of a PV annuity involves several key components:

- Present Value (PV):The current worth of a future stream of payments. It represents the amount of money you would need today to generate the same future cash flows.

- Future Value (FV):The total amount of money that will be received in the future, including all payments and accumulated interest.

- Interest Rate (i):The rate of return earned on the investment or the cost of borrowing money. It represents the discount rate used to calculate the present value.

- Number of Periods (n):The number of payment periods in the annuity. This can be years, months, or any other time interval.

Real-World Example of a PV Annuity

Consider a mortgage loan. When you take out a mortgage, you are essentially borrowing a sum of money (the present value) and agreeing to make regular payments (annuity) over a specified period (number of periods). The interest rate determines the cost of borrowing.

Annuity payments can be subject to taxation, and it’s important to understand the tax implications. The Is Annuity Received From Lic Taxable 2024 article explores the taxability of annuity payments received from Life Insurance Corporation (LIC). This information can help you plan for potential tax liabilities associated with your annuity income.

The PV annuity calculation helps you determine the monthly payments required to repay the loan, taking into account the interest rate and the loan term.

An annuity is a financial product that provides a stream of regular payments, often used for retirement planning. The Annuity Is Payment 2024 article sheds light on how annuities work and how these payments are structured. It’s important to carefully consider your financial goals and needs when deciding if an annuity is right for you.

PV Annuity Formula and Calculation

The formula for calculating the present value of an annuity is as follows:

PV = PMT

The Annuity 65 Male 2024 article might provide insights into annuity options for a 65-year-old male. This information can be helpful in understanding the potential benefits and considerations for annuities at different stages of life.

- [1

- (1 + i)^-n] / i

Where:

- PV = Present Value

- PMT = Payment Amount

- i = Interest Rate per Period

- n = Number of Periods

Types of Annuities

There are different types of annuities, each with its own specific characteristics:

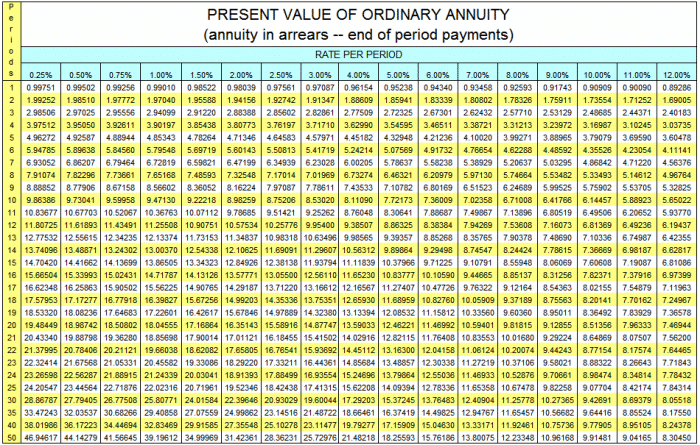

- Ordinary Annuity:Payments are made at the end of each period.

- Annuity Due:Payments are made at the beginning of each period.

- Perpetuity:Payments continue indefinitely.

Step-by-Step Calculation of a PV Annuity Using Excel 2024

To calculate the present value of an annuity using Excel 2024, follow these steps:

- Enter the payment amount (PMT) in a cell.

- Enter the interest rate (i) per period in a cell. Make sure to convert the annual interest rate to the period rate.

- Enter the number of periods (n) in a cell.

- Use the PV() function in Excel to calculate the present value. The syntax for the PV() function is as follows:

- Enter the values for rate, nper, and pmt. The optional arguments fv and type can be left blank if not applicable.

- Press Enter to calculate the present value of the annuity.

=PV(rate, nper, pmt, [fv], [type])

Annuity contracts can be complex, and it’s essential to understand the terms and conditions. The Annuity 9 Letters 2024 article might be helpful in deciphering some of the jargon associated with annuities. This information can help you make informed decisions about your financial future.

Using Excel 2024 for PV Annuity Calculations

Excel 2024 provides several functions specifically designed for PV annuity calculations, making the process efficient and accurate.

If you’re considering an annuity, you might be wondering about the potential penalties for withdrawing funds early. The Annuity 10 Penalty 2024 article provides insights into the potential consequences of early withdrawals. It’s essential to understand the rules and regulations surrounding annuities before making any decisions.

Excel Functions for PV Annuity Calculations

- PV():Calculates the present value of an annuity. It takes the interest rate, number of periods, payment amount, future value (optional), and payment type (optional) as arguments.

- PMT():Calculates the payment amount for an annuity. It takes the interest rate, number of periods, present value, future value (optional), and payment type (optional) as arguments.

- FV():Calculates the future value of an annuity. It takes the interest rate, number of periods, payment amount, present value (optional), and payment type (optional) as arguments.

Examples of Using Excel Functions

Here are some examples of how to use these functions to calculate PV annuities for different scenarios:

- Calculating the present value of a mortgage loan:

- Loan amount (PV): $200,000

- Interest rate (i): 4% per year

- Loan term (n): 30 years

- Formula: =PV(4%, 30, 0, 200000)

- Result: -$8,988.29 (negative value indicates a loan received)

- Calculating the monthly payment for a car loan:

- Loan amount (PV): $30,000

- Interest rate (i): 5% per year

- Loan term (n): 5 years

- Formula: =PMT(5%, 5*12, 30000)

- Result: -$566.14 (negative value indicates a payment made)

Spreadsheet Template for PV Annuity Calculations

A spreadsheet template can be designed to streamline PV annuity calculations with varying inputs. This template would include cells for entering the payment amount, interest rate, number of periods, and other relevant information. The template would then use the appropriate Excel functions to automatically calculate the present value of the annuity.

An annuity is a financial product that is often used for retirement planning. The Annuity Is Which Account 2024 article explores the different types of accounts where annuities can be held. Understanding these account options can help you choose the best fit for your financial situation and goals.

This allows for quick and easy calculations with different scenarios.

An annuity is a financial product that provides a series of regular payments, often used for retirement planning. The An Annuity Is A Series Of 2024 article explains the concept of an annuity and how these payments are structured. Understanding the workings of an annuity can help you determine if it aligns with your financial goals and needs.

Applications of PV Annuities

PV annuities have numerous applications in finance, providing valuable insights for various financial decisions.

Applications of PV Annuities in Finance, Pv Annuity Excel 2024

| Application | PV Annuity Calculation |

|---|---|

| Loan Amortization Schedules | Calculating the monthly payments required to repay a loan over a specified period. |

| Investment Planning | Determining the present value of future investment returns, helping investors make informed decisions. |

| Retirement Planning | Estimating the amount of savings needed to generate a desired retirement income stream. |

| Real Estate Valuation | Assessing the value of rental properties by calculating the present value of future rental income. |

Factors Affecting PV Annuities

Several factors can influence the present value of an annuity, affecting the overall value of future cash flows.

Key Factors Affecting PV Annuities

- Interest Rate:A higher interest rate leads to a lower present value, as the discount rate applied to future cash flows is greater. Conversely, a lower interest rate results in a higher present value.

- Number of Periods:A longer period (more payments) generally results in a higher present value, as the discount rate is applied over a longer time. Conversely, a shorter period results in a lower present value.

- Payment Amount:A larger payment amount leads to a higher present value, as the total future cash flows are greater. Conversely, a smaller payment amount results in a lower present value.

- Timing of Payments:Earlier payments have a higher present value than later payments, as they are discounted over a shorter time period. This is because the value of money diminishes over time.

Practical Considerations for PV Annuities

When working with PV annuities, it’s essential to consider practical factors that can influence the accuracy and reliability of the calculations.

Practical Considerations

- Accurate Data Input:Using accurate data for the payment amount, interest rate, and number of periods is crucial for obtaining a reliable present value. Inaccurate data can lead to significant errors in the calculations.

- Impact of Inflation:Inflation erodes the purchasing power of money over time. When calculating PV annuities, it’s important to consider the impact of inflation on the future value of payments. Adjusting the discount rate to account for inflation can provide a more realistic present value estimate.

- Risk and Uncertainty:PV annuity calculations are based on assumptions about future cash flows and interest rates. However, there is always uncertainty and risk associated with these assumptions. It’s important to acknowledge these uncertainties and consider different scenarios to assess the potential range of outcomes.

Last Point

By mastering the concepts and techniques presented in this guide, you’ll gain the ability to confidently analyze and plan for your financial future. Whether you’re an individual seeking to optimize personal finances or a professional navigating complex financial scenarios, the knowledge and skills gained here will prove invaluable.

User Queries: Pv Annuity Excel 2024

How does inflation affect PV annuities?

Inflation erodes the purchasing power of future payments, resulting in a lower present value. To account for inflation, you can adjust the discount rate used in the PV annuity calculation.

What are some real-world examples of PV annuities besides mortgages and retirement savings?

Other examples include student loans, car loans, and lease payments.

What are the limitations of using Excel for PV annuity calculations?

Excel is a powerful tool, but it’s important to remember that its calculations are based on the inputs provided. Errors in data input can lead to inaccurate results. It’s also essential to understand the underlying assumptions of the formulas used in Excel.

Annuity can be a valuable tool for retirement planning, but it’s crucial to understand its purpose and how it fits into your overall retirement strategy. The Is Annuity Retirement 2024 article discusses whether an annuity can be considered a retirement income source.

This information can help you make informed decisions about incorporating annuities into your retirement planning.

Annuity and life insurance are distinct financial products, though they can sometimes be confused. The Is Annuity The Same As Life Insurance 2024 article clarifies the differences between these two products. Understanding these differences can help you make informed decisions about your financial planning needs.

Annuity payments can be subject to taxation, and it’s important to understand the tax implications. The Is Annuity Income Taxable 2024 article explores the taxability of annuity income. This information can help you plan for potential tax liabilities associated with your annuity income.