Annuity Calculator Canada 2024 offers a powerful tool for Canadians seeking to secure their financial future. Whether you’re nearing retirement or just starting to plan, understanding how annuities work is crucial. These financial instruments provide a steady stream of income throughout your golden years, ensuring financial stability and peace of mind.

The tax treatment of annuities can be complex, with certain situations leading to tax-exempt withdrawals. Is Annuity Exempt From Tax 2024 explores the conditions under which annuity withdrawals may be exempt from taxes.

This comprehensive guide delves into the intricacies of annuities in Canada, covering everything from their definition and types to the essential features of an annuity calculator. We’ll explore how factors like interest rates, age, and inflation impact your annuity payouts, and demonstrate how to use a calculator to estimate your future income and make informed retirement planning decisions.

Introduction to Annuities in Canada

Annuities are financial products that provide a stream of regular payments, typically for a fixed period or for the rest of your life. In Canada, annuities are often used as a source of retirement income. They offer a way to convert a lump sum of money into a guaranteed stream of payments, providing financial security during retirement.

Types of Annuities

There are various types of annuities available in Canada, each with its own features and benefits. Some common types include:

- Fixed Annuities:These annuities offer guaranteed payments that remain constant throughout the term. The amount of the payment is determined at the time of purchase and is not affected by market fluctuations.

- Variable Annuities:These annuities offer payments that fluctuate based on the performance of the underlying investment portfolio. They provide the potential for higher returns but also come with greater risk.

- Indexed Annuities:These annuities offer payments that are linked to the performance of a specific index, such as the S&P/TSX Composite Index. They provide some protection against inflation while still offering the potential for growth.

- Immediate Annuities:These annuities begin paying out immediately after purchase. They are suitable for individuals who need a steady income stream right away.

- Deferred Annuities:These annuities begin paying out at a future date, typically after a specific period of time or at a certain age. They are suitable for individuals who want to save for retirement and delay receiving payments until later.

Benefits of Annuities, Annuity Calculator Canada 2024

Annuities offer several benefits for individuals seeking retirement income, including:

- Guaranteed Income:Fixed annuities provide guaranteed payments, offering peace of mind about future income.

- Inflation Protection:Some annuities, such as indexed annuities, offer protection against inflation, ensuring that your payments keep pace with rising prices.

- Longevity Protection:Annuities can provide income for life, ensuring that you have a steady stream of payments even if you live longer than expected.

- Tax Advantages:Annuities may offer tax advantages, depending on the type of annuity and the specific terms of the contract.

Drawbacks of Annuities

While annuities offer several benefits, it’s essential to consider potential drawbacks before making a decision:

- Limited Flexibility:Once you purchase an annuity, you may have limited flexibility to access your funds or change the payment terms.

- Potential for Lower Returns:Fixed annuities typically offer lower returns than other investment options, such as stocks or mutual funds.

- Fees and Charges:Annuities often come with fees and charges, which can impact your overall returns.

- Risk of Market Volatility:Variable annuities are subject to market volatility, which can impact the value of your investment and the amount of your payments.

Understanding Annuity Calculator Features

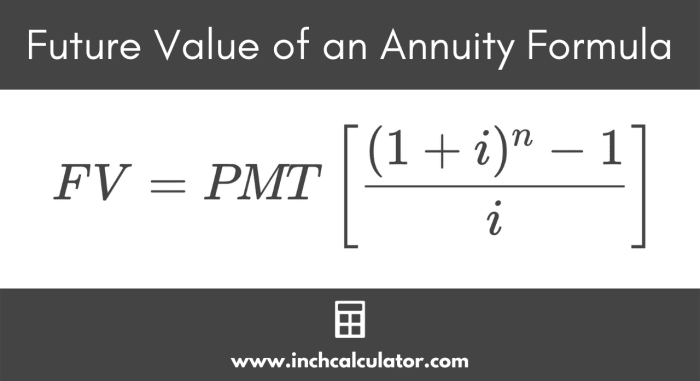

An annuity calculator is a valuable tool for individuals planning for retirement. It allows you to estimate future income based on various factors, including the amount of your initial investment, the interest rate, and your age and life expectancy. By inputting these variables, the calculator can project your potential annuity payments.

The annuity factor plays a crucial role in annuity calculations. Calculating An Annuity Factor 2024 provides insights into the process of calculating this factor and its significance in determining annuity payments.

Essential Features of an Annuity Calculator

An annuity calculator typically includes the following essential features:

- Initial Investment:This feature allows you to input the amount of money you plan to invest in the annuity.

- Interest Rate:This feature allows you to input the expected interest rate on your annuity. The interest rate can be fixed or variable, depending on the type of annuity.

- Payment Frequency:This feature allows you to choose how often you want to receive payments, such as monthly, quarterly, or annually.

- Payment Period:This feature allows you to specify the duration of your annuity payments, such as a fixed term or for life.

- Age and Life Expectancy:This feature allows you to input your current age and your estimated life expectancy. This information is used to calculate the total amount of payments you will receive.

- Inflation Rate:This feature allows you to input the expected inflation rate. This information is used to adjust the value of your payments over time.

Purpose of Each Feature

Each feature plays a crucial role in calculating your potential annuity payments. The initial investment determines the amount of money you have to invest. The interest rate affects the growth of your investment and the amount of your payments. The payment frequency and period determine how often you receive payments and for how long.

While it’s not a common practice, some people might consider using an annuity as a way to manage lottery winnings. Annuity Lottery 2024 explores the potential benefits and drawbacks of this approach.

Your age and life expectancy are essential for calculating the total amount of payments you will receive. The inflation rate adjusts the value of your payments over time to account for rising prices.

Choosing the right annuity can be challenging, as different types offer varying benefits. Annuity Which Is Best 2024 helps you navigate the complexities of annuity selection, providing guidance on choosing the best option for your needs.

Importance of Accurate Information

It is crucial to input accurate information into the annuity calculator to ensure that the results are reliable. If you enter inaccurate data, the calculator may provide inaccurate projections of your future income. To obtain the most accurate results, carefully consider your financial situation and use realistic estimates for each input variable.

Factors Influencing Annuity Calculations

Several factors influence annuity calculations, determining the amount of your payments and the overall value of your investment. Understanding these factors is essential for making informed decisions about annuities.

Understanding the implications of a $400,000 annuity can be crucial for financial planning. Annuity 400k 2024 provides insights into the features and potential returns associated with such an annuity.

Interest Rates

Interest rates play a significant role in annuity calculations. Higher interest rates generally lead to higher annuity payments. This is because your investment grows faster at higher interest rates, resulting in a larger amount of money to be distributed as payments.

Understanding the difference between annuities and perpetuities is crucial when making financial decisions. This article, Annuity Vs Perpetuity 2024 , delves into the key distinctions between these financial instruments, helping you make informed choices.

For example, if you invest $100,000 in a fixed annuity with a 3% interest rate, you will receive higher payments than if you invest the same amount at a 2% interest rate. However, it is important to note that interest rates can fluctuate over time, impacting the value of your annuity.

When dealing with annuity loans, understanding the formula used to calculate payments is essential. Annuity Loan Formula 2024 provides a detailed explanation of the formula and its application in calculating loan payments.

Age and Life Expectancy

Your age and life expectancy are also crucial factors in annuity calculations. Younger individuals with longer life expectancies typically receive lower annuity payments than older individuals with shorter life expectancies. This is because the insurance company has to pay out payments for a longer period for younger individuals, increasing the overall cost of the annuity.

If you’re looking for information about annuity services in Sarasota, you might find this article helpful: Annuity King Sarasota 2024. It provides insights into local annuity providers and their services.

For example, a 65-year-old individual with a life expectancy of 20 years may receive higher annuity payments than a 55-year-old individual with a life expectancy of 30 years, even if they invest the same amount of money.

Inflation

Inflation is another important factor to consider when planning for retirement. Inflation erodes the purchasing power of money over time, meaning that your payments will be worth less in the future than they are today. To account for inflation, annuity calculators often include an inflation adjustment factor.

This factor adjusts the value of your payments to reflect the expected rate of inflation.

For example, if the inflation rate is 2%, your annuity payments will need to increase by 2% each year to maintain their purchasing power. This means that your initial investment will need to be larger to account for the impact of inflation.

Fixed annuities offer a guaranteed rate of return, providing stability and predictability. 4 Fixed Annuity 2024 explores the key features and benefits of fixed annuities, helping you understand their role in retirement planning.

Using an Annuity Calculator for Financial Planning: Annuity Calculator Canada 2024

Annuity calculators can be valuable tools for financial planning, especially when considering retirement income. They can help you estimate future income, compare different annuity options, and make informed decisions about your financial future.

Tax implications are an important factor to consider when withdrawing from an annuity. Annuity Withdrawal Tax Calculator 2024 provides a tool to help you estimate the tax liability associated with annuity withdrawals.

Estimating Future Income

An annuity calculator can help you estimate your potential future income from an annuity. By inputting your initial investment, interest rate, payment frequency, payment period, age, and life expectancy, the calculator can project your estimated annual payments and the total amount of money you will receive over the life of the annuity.

Annuity products are often considered life insurance products, but their specific features can vary. Read more about the details in An Annuity Is A Life Insurance Product That 2024 to gain a better understanding of how annuities function within the context of life insurance.

Retirement Planning

Annuity calculators can be particularly useful for retirement planning. They can help you determine how much money you need to invest in an annuity to achieve your desired level of retirement income. You can also use the calculator to compare different annuity options and choose the one that best suits your needs and financial goals.

Comparing Annuity Options

An annuity calculator can help you compare different annuity options. By inputting the same information into the calculator for different annuities, you can see how the payments and overall value of each annuity differ. This can help you make an informed decision about which annuity is best for you.

For those who prefer to utilize Excel for financial calculations, this article, Calculating An Annuity In Excel 2024 , provides a step-by-step guide on how to calculate annuity payments using Microsoft Excel.

Finding and Using Annuity Calculators in Canada

Several reputable online annuity calculators are available in Canada. These calculators can help you estimate your potential annuity payments and compare different annuity options.

Deciding between an annuity and an IRA can be a complex decision. Annuity Or Ira 2024 offers a comprehensive comparison of these retirement savings options, helping you choose the best fit for your financial goals.

Reputable Online Annuity Calculators

Here are some reputable online annuity calculators available in Canada:

- The Canadian Annuity Calculator:This calculator provides a comprehensive overview of annuity options in Canada, allowing you to compare different types of annuities and estimate your potential payments.

- The Annuity.ca Calculator:This calculator offers a user-friendly interface and provides detailed information about annuity features and benefits. It allows you to input various factors, including your age, life expectancy, and desired payment amount.

- The MoneySense Annuity Calculator:This calculator is a popular choice for individuals seeking to compare different annuity options. It offers a range of features and allows you to customize your calculations based on your individual needs.

Features and Functionalities

| Calculator | Features | Functionalities |

|---|---|---|

| The Canadian Annuity Calculator | Fixed, variable, and indexed annuities | Estimate payments, compare options, calculate present value |

| The Annuity.ca Calculator | Immediate and deferred annuities | Customize payment frequency, adjust for inflation, generate reports |

| The MoneySense Annuity Calculator | Wide range of annuity options | Analyze investment growth, project future income, compare different scenarios |

Choosing the Best Annuity Calculator

When choosing an annuity calculator, consider the following factors:

- Type of Annuities:Ensure that the calculator supports the type of annuity you are interested in.

- Features and Functionalities:Choose a calculator that offers the features and functionalities you need to make informed decisions.

- User-friendliness:Select a calculator that is easy to use and understand.

- Reputation and Accuracy:Choose a calculator from a reputable source and ensure that the calculations are accurate and reliable.

Additional Considerations for Annuity Planning

In addition to using an annuity calculator, it is essential to consider other factors before purchasing an annuity.

Consulting with a Financial Advisor

It is highly recommended to consult with a qualified financial advisor before purchasing an annuity. A financial advisor can help you understand the complexities of annuities, assess your individual financial situation, and recommend the most suitable annuity for your needs.

To accurately determine annuity payments, you need to understand the calculation process. Calculating A Annuity 2024 provides a step-by-step guide to calculating annuity payments, ensuring you can accurately assess your financial future.

They can also provide personalized advice on how to incorporate annuities into your overall financial plan.

Tax Implications

Annuities can have tax implications in Canada. The tax treatment of annuities depends on the type of annuity and the specific terms of the contract. It is important to understand the tax implications of annuities before purchasing one. You can consult with a financial advisor or a tax professional to discuss the tax implications of annuities in your specific situation.

If you’re interested in learning about different types of annuities, you might want to check out this article on 5 Annuity 2024. It provides a comprehensive overview of the various annuity options available in 2024, including fixed, variable, and indexed annuities.

Checklist of Factors to Consider

Before purchasing an annuity, consider the following factors:

- Your financial goals:What are you hoping to achieve with an annuity? Are you looking for guaranteed income, inflation protection, or longevity protection?

- Your risk tolerance:How comfortable are you with risk? Fixed annuities are less risky than variable annuities.

- Your time horizon:How long do you need the annuity payments to last?

- Fees and charges:Compare the fees and charges associated with different annuity options.

- Tax implications:Understand the tax implications of the annuity you are considering.

- Flexibility:Consider the flexibility of the annuity contract. Can you access your funds or change the payment terms?

Epilogue

Armed with the knowledge gained from this guide, you can confidently navigate the world of annuities in Canada. By utilizing an annuity calculator and seeking professional advice, you can tailor your retirement plan to meet your individual needs and goals.

Remember, a well-planned annuity strategy can provide financial security and peace of mind for years to come.

FAQs

How often do annuity payments occur?

Annuity payments are typically made monthly, but can also be made quarterly, semi-annually, or annually, depending on the terms of your annuity contract.

Can I withdraw my annuity payments early?

The ability to withdraw annuity payments early depends on the specific terms of your annuity contract. Some annuities may allow for partial withdrawals, while others may have penalties for early withdrawals.

What happens to my annuity payments if I die?

If you die before receiving all of your annuity payments, your beneficiary will receive the remaining payments, according to the terms of your annuity contract.