Calculating A Annuity 2024 is a crucial step in securing your financial future. Annuities are powerful financial instruments that provide a steady stream of income, making them an attractive option for retirement planning, income generation, and even estate planning. This guide delves into the intricacies of annuity calculations, equipping you with the knowledge and tools to make informed financial decisions.

Choosing between an annuity and an IRA can be a complex decision. This resource helps you understand the key differences between annuities and IRAs in 2024 to make the right choice for your financial goals.

Understanding the different types of annuities, the factors influencing their calculations, and the various applications available will empower you to navigate the complex world of annuities and harness their potential for achieving your financial goals.

Are you curious about the tax implications of annuities? You can find out if annuities are exempt from tax in 2024 and what the specific tax rules are.

Understanding Annuities

An annuity is a financial product that provides a series of regular payments over a set period of time. It’s like a steady stream of income that you can rely on, making it a popular choice for retirement planning and other financial goals.

Need help calculating the potential tax implications of your annuity withdrawals? This annuity withdrawal tax calculator for 2024 can provide you with personalized estimates.

Imagine it like a monthly paycheck, but instead of coming from your employer, it comes from your savings or investment.

Understanding the tax implications of annuities is crucial. You can find information on whether annuities are taxable or not in 2024 to make informed financial decisions.

Types of Annuities

Annuities come in different flavors, each with its own unique features and benefits. Here are some common types:

- Fixed Annuities:These provide guaranteed payments at a fixed interest rate. You know exactly how much you’ll receive each month, making them ideal for those who want predictable income.

- Variable Annuities:The payments for these annuities are linked to the performance of a specific investment portfolio. While they offer the potential for higher returns, they also come with more risk. Think of it as investing in the stock market, but with the added benefit of regular payments.

If you’re new to annuities, you can find general information on annuities in 2024 , including their purpose, types, and potential benefits.

- Immediate Annuities:Payments begin immediately after you purchase this type of annuity. It’s perfect for those who need a steady stream of income right away, like retirees who want to supplement their retirement savings.

Key Features of Annuities

Understanding the key features of an annuity is crucial before making a decision. Here’s what you need to consider:

- Payment Period:This refers to the length of time you’ll receive payments. It could be for a specific number of years, for life, or until a certain event occurs.

- Interest Rate:This determines the rate at which your annuity grows. The higher the interest rate, the more money you’ll earn over time.

- Principal Amount:This is the initial amount of money you invest in the annuity. It forms the foundation of your future payments.

Calculating Annuity Payments: Calculating A Annuity 2024

Calculating annuity payments can seem daunting, but it’s actually a straightforward process using a specific formula. Let’s break it down step-by-step.

Interested in understanding how annuity payouts work over a specific timeframe? This resource provides detailed information on annuity payouts over a 5-year period in 2024 , helping you make informed decisions.

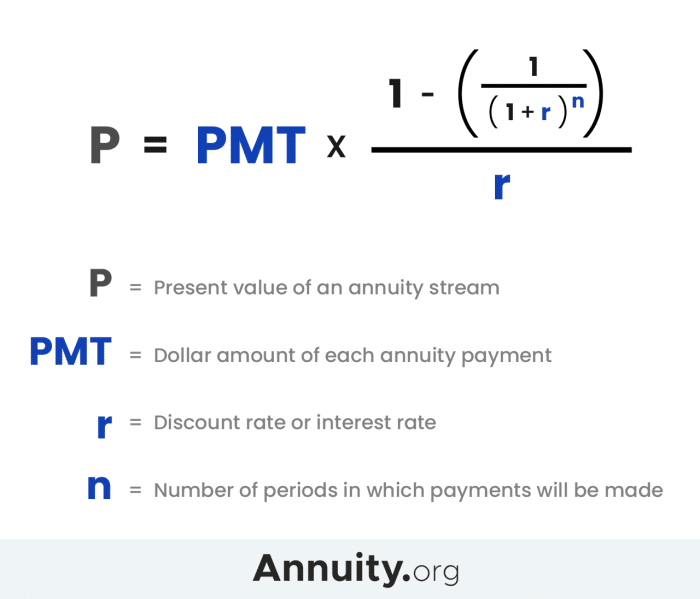

Annuity Payment Formula

Annuity Payment = (Principal Amount- Interest Rate) / (1 – (1 + Interest Rate)^-Number of Payments)

Step-by-Step Guide, Calculating A Annuity 2024

- Determine the principal amount:This is the initial amount you invest in the annuity.

- Identify the interest rate:This is the rate at which your annuity grows.

- Calculate the number of payments:This depends on the payment period, which could be years or months.

- Plug the values into the formula:Use the formula above to calculate the annuity payment.

Example Calculation

Let’s say you invest $100,000 in an annuity with a 5% interest rate and a 20-year payment period. Using the formula, we can calculate the monthly payment:

- Principal Amount:$100,000

- Interest Rate:5% per year (or 0.05/12 per month)

- Number of Payments:20 years

12 months/year = 240 months

- Annuity Payment:($100,000

- (0.05/12)) / (1

- (1 + (0.05/12))^-240) = $659.46 per month

Factors Affecting Annuity Calculations

Several factors can influence the outcome of your annuity calculations. Understanding these factors can help you make informed decisions about your annuity.

Want to understand annuities in Hindi? This resource provides information on what an annuity is in 2024 , explained in a simple and understandable way.

Interest Rates

Interest rates play a significant role in annuity calculations. Higher interest rates lead to larger annuity payments. This is because your money grows faster at a higher interest rate, resulting in more money to be distributed as payments.

If you’re looking for information on a specific annuity type, you can find information on Annuity 95-1 in 2024 , including its features and potential benefits.

Payment Frequency

The frequency of your annuity payments can also impact the calculation. If you receive payments more frequently (e.g., monthly instead of annually), you’ll receive smaller individual payments but a higher total amount over the payment period. This is because the interest is compounded more often.

Still unsure what an annuity is or how it works? This comprehensive guide explains everything you need to know about annuities in 2024 , from the basics to advanced concepts.

Other Factors

Other factors can influence annuity calculations, including:

- Inflation:Inflation erodes the purchasing power of your money over time. While annuities may offer a fixed or variable rate of return, inflation can reduce the real value of your payments.

- Taxes:Annuities are subject to taxes. The interest earned on your annuity and the payments you receive may be taxed, depending on the type of annuity and your tax bracket.

Using Annuity Calculators

Annuity calculators are valuable tools that can simplify the process of calculating annuity payments. They take care of the complex calculations for you, allowing you to quickly estimate your potential payments and explore different scenarios.

Online Annuity Calculators

Several online annuity calculators are available, each with its own unique features and functionality. Here are some popular options:

- Bankrate:This calculator allows you to compare different annuity options and see how your payments would change based on different interest rates and payment periods.

- NerdWallet:This calculator provides a detailed breakdown of your annuity payments, including the principal, interest, and taxes.

- Investopedia:This calculator allows you to calculate the present value of an annuity, which is the amount you need to invest today to receive a specific stream of payments in the future.

Using an Annuity Calculator

Using an annuity calculator is simple. Most calculators require you to input the principal amount, interest rate, payment period, and payment frequency. The calculator will then generate an estimate of your annuity payments.

If you’re looking to plan for your financial future, you might be interested in learning about annuity requirements over a 12-year period in 2024.

Comparing Annuity Calculators

When choosing an annuity calculator, consider the following factors:

- Ease of use:The calculator should be user-friendly and intuitive.

- Features:The calculator should offer the features you need, such as the ability to adjust interest rates, payment periods, and payment frequencies.

- Accuracy:The calculator should provide accurate and reliable results.

Annuity Applications

Annuities are versatile financial products with various applications. They can be used to achieve a wide range of financial goals, from retirement planning to income generation and estate planning.

Want to learn more about fixed annuities? This resource offers information on 4 fixed annuities in 2024 , including their features and potential benefits.

Retirement Planning

Annuities are a popular tool for retirement planning. They provide a steady stream of income during retirement, helping you maintain your lifestyle and cover your expenses. You can use an annuity to supplement your retirement savings, create a guaranteed income stream, or even protect your savings from market volatility.

Income Generation

Annuities can also be used to generate income for other purposes, such as paying off debt or funding a child’s education. By converting a lump sum into an annuity, you can create a regular stream of income that can be used to achieve your financial goals.

Looking for information on specific annuity rates? This resource provides insights into 6 percent annuities in 2024 , including potential benefits and risks.

Estate Planning

Annuities can be incorporated into estate planning strategies to provide for loved ones after you’re gone. You can use an annuity to create a legacy that will provide financial support for your beneficiaries for years to come.

Interested in specific annuity rates? This resource provides insights into 7 percent annuities in 2024 , including potential benefits and risks.

Real-World Examples

Here are some real-world examples of how annuities have been used successfully:

- A retiree used a fixed annuity to create a guaranteed income stream that would cover their essential living expenses.

- A couple used a variable annuity to grow their retirement savings while still receiving regular payments.

- An individual used an immediate annuity to provide financial support for their disabled child.

Closing Notes

Mastering the art of calculating annuities empowers you to take control of your financial future. By understanding the fundamentals, the various factors that influence calculations, and the practical applications of annuities, you can make informed decisions that align with your financial aspirations.

Whether you’re planning for retirement, seeking a reliable income stream, or safeguarding your legacy, annuities offer a valuable tool for achieving financial security.

FAQ Compilation

How do I choose the right type of annuity?

If you’re looking for information on the latest annuity numbers for 2024, you can find it here. This resource will provide you with insights into annuity rates, benefits, and potential risks.

The best type of annuity depends on your individual needs and financial goals. Consider factors such as your risk tolerance, desired income stream, and time horizon when making your decision.

Are annuities subject to taxes?

Facing financial hardship and need to access your annuity funds? You can find information on annuity hardship withdrawal options for 2024 to see if you qualify and what the process entails.

Yes, annuity payments are typically subject to taxes. However, the specific tax implications vary depending on the type of annuity and your individual circumstances. Consult with a financial advisor for personalized guidance.

Can I withdraw my annuity payments early?

Early withdrawals from an annuity may be subject to penalties. It’s crucial to understand the terms and conditions of your specific annuity contract before making any withdrawals.

What are the risks associated with annuities?

Annuities carry certain risks, such as potential losses in the market, interest rate fluctuations, and early withdrawal penalties. Carefully evaluate these risks before investing in an annuity.