Calculating Annuity Payments 2024: A Comprehensive Guide delves into the intricacies of annuities, providing a detailed understanding of their structure, calculation methods, and real-world applications. Whether you’re planning for retirement, managing debt, or simply seeking financial clarity, this guide equips you with the knowledge to navigate the world of annuities confidently.

Annuity payments can be structured in various ways, including single payments. Annuity Is Single Payment 2024 can help you understand the differences.

Annuities are financial instruments that provide a series of regular payments over a specified period, often used for retirement income, loan repayment, or other financial goals. Understanding the fundamentals of annuity calculations is crucial for making informed financial decisions.

Understanding Annuities

An annuity is a financial product that provides a series of regular payments over a specified period of time. Annuities are commonly used for retirement planning, but they can also be used for other purposes, such as saving for a child’s education or providing income for a specific period of time.

An annuity estimator can help you estimate potential payouts based on your individual circumstances. Annuity Estimator 2024 provides a useful tool for planning.

Annuity Components

An annuity has three main components:

- Principal:The initial amount of money invested in the annuity.

- Interest rate:The rate of return earned on the annuity investment. This rate is typically fixed for the life of the annuity.

- Payment period:The frequency of the annuity payments, such as monthly, quarterly, or annually.

Types of Annuities

There are two main types of annuities:

- Ordinary annuity:Payments are made at the end of each payment period. For example, an ordinary annuity with monthly payments would make the payments on the last day of each month.

- Annuity due:Payments are made at the beginning of each payment period. For example, an annuity due with monthly payments would make the payments on the first day of each month.

Present Value and Future Value

The present value of an annuity is the current value of the future payments, discounted back to the present using the interest rate. The future value of an annuity is the total amount of money that will be accumulated at the end of the payment period, including the principal and interest earned.

John Hancock is a well-known provider of annuities. Annuity John Hancock 2024 can help you learn about their offerings.

Annuity Payment Calculation Formulas

Annuity payments can be calculated using either the present value or the future value of the annuity. The formulas for calculating annuity payments are as follows:

Annuity Payment Formula Using Present Value

PMT = PV- (r / (1 – (1 + r)^-n))

Annuity plans can offer income for life, but it’s important to understand the specifics. Is Annuity For Life 2024 provides insights into these plans.

Where:

- PMT= Annuity payment

- PV= Present value of the annuity

- r= Interest rate per payment period

- n= Total number of payment periods

Annuity Payment Formula Using Future Value

PMT = FV- (r / ((1 + r)^n – 1))

Choosing between an annuity and a drawdown option requires careful consideration. Annuity Or Drawdown 2024 provides insights into the pros and cons of each.

Where:

- PMT= Annuity payment

- FV= Future value of the annuity

- r= Interest rate per payment period

- n= Total number of payment periods

Factors Influencing Annuity Payments

Several factors can influence the amount of annuity payments. These factors include the interest rate, the payment period, and the number of payment periods.

The taxability of single life annuities can vary depending on the type of annuity. Is A Single Life Annuity Taxable 2024 explores the tax implications.

Impact of Interest Rates

Higher interest rates generally result in higher annuity payments. This is because the principal amount is earning a higher rate of return, which translates into larger payments to the annuitant. Conversely, lower interest rates will result in lower annuity payments.

Payment Period

The frequency of payments also affects the amount of each payment. For example, an annuity with monthly payments will have smaller individual payments than an annuity with annual payments, assuming all other factors are equal. This is because the interest is compounded more frequently with monthly payments, leading to a lower overall payment amount.

Number of Payment Periods

The total number of payment periods also affects the amount of each payment. A longer payment period generally results in smaller individual payments. This is because the principal amount is spread out over a longer period, resulting in lower interest earned and lower payments.

Annuity Payment Calculation Examples

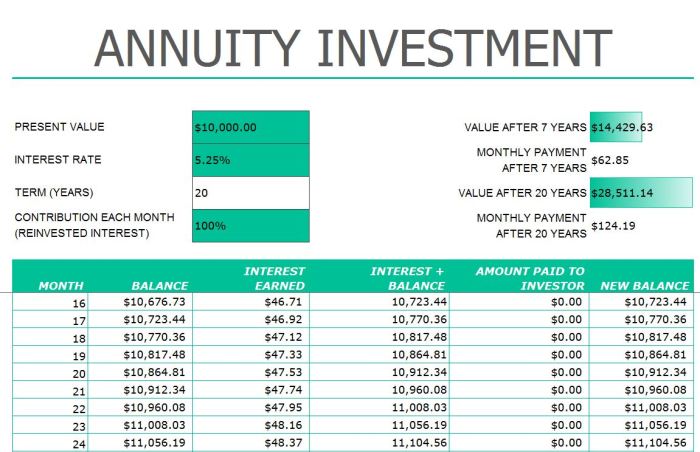

The following table shows different annuity payment scenarios with varying interest rates, payment periods, and principal amounts.

| Scenario | Principal | Interest Rate | Payment Period | Number of Payments | Annuity Payment |

|---|---|---|---|---|---|

| 1 | $100,000 | 5% | Monthly | 120 | $966.28 |

| 2 | $100,000 | 6% | Monthly | 120 | $1,028.61 |

| 3 | $100,000 | 5% | Quarterly | 40 | $3,042.36 |

| 4 | $200,000 | 5% | Monthly | 120 | $1,932.56 |

Scenario 1:This scenario shows an annuity with a principal of $100,000, an interest rate of 5%, monthly payments, and a total of 120 payments. The annuity payment is $966.28 per month.

Reversionary annuities are designed to provide income to a beneficiary after the original annuitant’s death. Annuity Is Reversionary 2024 can help you understand these types of annuities.

Scenario 2:This scenario is the same as Scenario 1, except the interest rate is 6%. As expected, the annuity payment is higher at $1,028.61 per month.

Annuity numbers are always changing, so it’s important to stay up-to-date with the latest information. Check out Annuity Number 2024 for current figures and insights.

Scenario 3:This scenario shows an annuity with a principal of $100,000, an interest rate of 5%, quarterly payments, and a total of 40 payments. The annuity payment is $3,042.36 per quarter.

Khan Academy offers a great introduction to annuities. Annuity Khan Academy 2024 provides a helpful resource for learning about annuities.

Scenario 4:This scenario shows an annuity with a principal of $200,000, an interest rate of 5%, monthly payments, and a total of 120 payments. The annuity payment is $1,932.56 per month. This is double the payment of Scenario 1 because the principal is double.

Thinking about an annuity with a $200,000 payout? Annuity 200k 2024 can help you explore your options and understand the potential benefits.

These examples demonstrate how different factors can affect annuity payments. As you can see, the total amount paid over the life of the annuity can vary significantly depending on the interest rate, payment period, and principal amount.

Annuity Gator is a great resource for learning about annuities. Annuity Gator 2024 provides valuable information and insights.

Real-World Applications of Annuity Payments

Annuity payments have various real-world applications, particularly in financial planning and investment strategies.

Annuity payments are often characterized as a series of equal periodic payments. An Annuity Is A Series Of Equal Periodic Payments 2024 explains this fundamental concept.

Retirement Planning, Calculating Annuity Payments 2024

Annuities are a popular tool for retirement planning. They provide a steady stream of income during retirement, helping individuals maintain their lifestyle and meet their financial needs. Annuities can be structured to provide a fixed income stream or a variable income stream, depending on the individual’s risk tolerance and investment goals.

Loan Amortization Schedules

Annuity payments are also used in loan amortization schedules. When you take out a loan, such as a mortgage or a car loan, the lender typically requires you to make regular payments that include both principal and interest. These payments are structured as an annuity, ensuring that the loan is paid off in full over the agreed-upon term.

Understanding the tax implications of annuities in India is crucial for financial planning. Learn more about Is Annuity Taxable In India 2024 to make informed decisions.

Other Financial Situations

Annuities can be used in other financial situations, such as:

- Saving for a child’s education:Annuities can be used to accumulate funds for a child’s education expenses, providing a guaranteed income stream for college tuition and other costs.

- Providing income for a specific period:Annuities can be used to provide income for a specific period, such as during a disability or after a job loss.

- Estate planning:Annuities can be used in estate planning to provide income to beneficiaries after the death of the annuitant.

Resources and Tools for Annuity Calculation: Calculating Annuity Payments 2024

There are various resources and tools available to help you calculate annuity payments.

Online Calculators

Many online calculators can help you calculate annuity payments based on your specific needs and circumstances. These calculators are often free to use and provide quick and easy results. Some popular online annuity calculators include:

- Bankrate.com

- Investopedia.com

- NerdWallet.com

Financial Software

Financial software programs can also be used to calculate annuity payments and other financial planning needs. These programs often offer more advanced features and customization options than online calculators. Some popular financial software programs include:

- Quicken

- Mint

- Personal Capital

Reputable Financial Websites and Resources

Several reputable financial websites and resources provide information on annuities and other financial products. These websites can be helpful for understanding the different types of annuities available, their benefits and drawbacks, and how to choose the right annuity for your needs.

An annuity loan calculator can help you understand the potential costs and benefits of an annuity loan. Check out Annuity Loan Calculator 2024 for a helpful tool.

Some reputable financial websites include:

- The Financial Industry Regulatory Authority (FINRA)

- The Securities and Exchange Commission (SEC)

- The National Endowment for Financial Education (NEFE)

Tips for Selecting the Right Annuity Product

When selecting an annuity product, it’s essential to consider your individual needs, risk tolerance, and financial goals. Some tips for selecting the right annuity product include:

- Understand the different types of annuities available.There are many different types of annuities, each with its own benefits and drawbacks. It’s essential to understand the different types of annuities and choose one that meets your specific needs.

- Compare rates and fees.Annuity rates and fees can vary significantly from one provider to another. It’s essential to compare rates and fees before choosing an annuity product.

- Consider your investment goals.What are your investment goals? Do you want a fixed income stream or a variable income stream? Consider your investment goals when choosing an annuity product.

- Seek professional advice.If you’re unsure about which annuity product is right for you, consider seeking professional advice from a financial advisor.

Wrap-Up

By grasping the principles of annuity calculations, you gain valuable insights into the long-term financial implications of your choices. Whether you’re considering an annuity for retirement income, loan amortization, or other purposes, understanding the factors that influence annuity payments empowers you to make informed decisions and optimize your financial well-being.

FAQ Insights

What is the difference between an ordinary annuity and an annuity due?

An ordinary annuity makes payments at the end of each period, while an annuity due makes payments at the beginning of each period. This difference affects the timing of interest accrual and the overall value of the annuity.

How do interest rates affect annuity payments?

Annuity options in Westmont, Illinois can provide peace of mind for your future. Explore Annuity Health Westmont Il 2024 to discover your options.

Higher interest rates generally result in larger annuity payments. This is because the interest earned on the principal grows faster, leading to higher payments over time.

What are some online calculators and financial software for calculating annuity payments?

Several online calculators and financial software programs are available, including those offered by financial institutions, websites like Bankrate.com, and financial planning software like Quicken and Mint.