DealBook Summit 2024: The Future of Fintech takes center stage, bringing together industry leaders, innovators, and investors to explore the transformative power of financial technology. This summit promises to be a catalyst for groundbreaking discussions and insightful analyses, shaping the future of financial services and the global economy.

The summit delves into the most influential trends shaping the fintech landscape, including the rise of artificial intelligence, blockchain technology, and embedded finance. Attendees will gain valuable insights into how these trends are disrupting traditional financial institutions and creating new opportunities for growth and innovation.

The Dealbook Summit 2024, a gathering of the financial elite, offered a glimpse into the future of investment. Key takeaways highlighted the importance of understanding emerging markets, a trend that’s reshaping the global economic landscape.

The DealBook Summit 2024: A Catalyst for Fintech Innovation

The DealBook Summit 2024 is poised to be a pivotal event in the world of fintech, serving as a platform for industry leaders, innovators, and investors to converge and shape the future of financial services. The summit’s impact will extend far beyond the event itself, setting the stage for groundbreaking advancements and reshaping the landscape of finance.

Key Themes and Topics

The summit will delve into a wide range of critical themes and topics that are shaping the future of fintech. These include:

- The rise of embedded finance and its implications for businesses and consumers.

- The impact of artificial intelligence and machine learning on financial services.

- The evolving regulatory landscape and its influence on fintech innovation.

- The role of blockchain technology in transforming financial systems.

- The growing importance of financial inclusion and its connection to fintech.

Emerging Trends Shaping the Fintech Landscape

The fintech industry is characterized by rapid innovation and the emergence of transformative trends. These trends are driving significant changes in the way financial services are delivered and consumed.

Emerging markets, with their burgeoning populations and rapid technological advancements, present both opportunities and challenges. Navigating this terrain requires a nuanced understanding of local dynamics and a willingness to embrace risk.

Key Fintech Trends

- Open Banking:The rise of open banking is enabling consumers to share their financial data with third-party applications, leading to a more personalized and customized financial experience.

- Embedded Finance:Embedded finance involves integrating financial services into non-financial platforms, such as e-commerce sites and social media apps, making financial services more accessible and convenient.

- Regtech:Regtech refers to the use of technology to automate and streamline regulatory compliance processes, making it easier for fintech companies to navigate the regulatory landscape.

- Insurtech:Insurtech companies are leveraging technology to disrupt the insurance industry, offering more personalized and affordable insurance products.

The Future of Financial Services: A Fintech Perspective

Fintech is fundamentally changing the way financial services are delivered, creating a more accessible, efficient, and customer-centric landscape. The future of financial services will be shaped by the continued integration of fintech solutions.

A Fintech-Driven Financial Landscape

- Personalized Financial Services:Fintech companies are using data analytics and AI to provide personalized financial products and services tailored to individual needs.

- Frictionless Transactions:Fintech solutions are streamlining payment processes, making transactions faster, more secure, and more convenient.

- Increased Financial Inclusion:Fintech is enabling access to financial services for underserved populations, promoting financial literacy, and driving economic growth.

Key Players and Innovations Driving Fintech Forward: DealBook Summit 2024: The Future Of Fintech

The fintech industry is home to a diverse range of companies and innovators who are driving groundbreaking advancements in financial services.

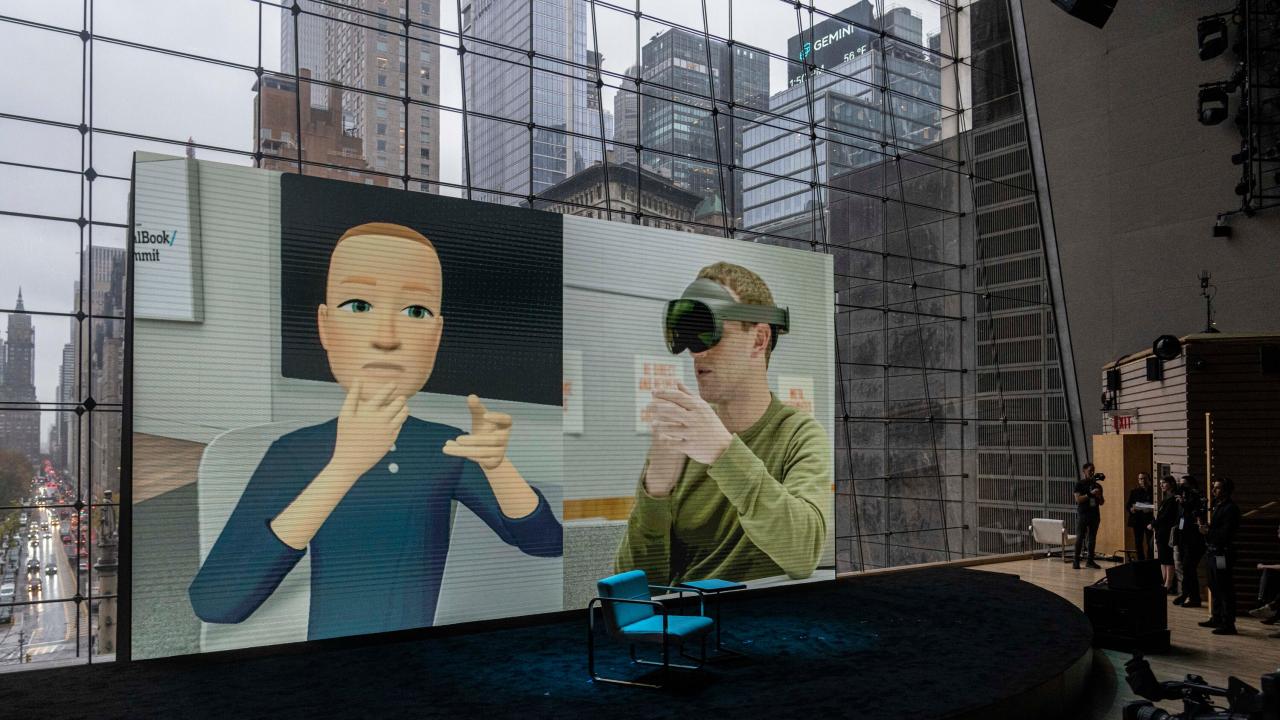

Technology’s impact is undeniable, from the way we communicate to the way we conduct business. This transformative power presents both opportunities and challenges, demanding a careful approach and a willingness to adapt.

Leading Fintech Players, DealBook Summit 2024: The Future of Fintech

| Company | Area of Expertise |

|---|---|

| Stripe | Payment processing |

| Square | Point-of-sale systems, financial services for small businesses |

| Robinhood | Investment platform |

| Brex | Corporate credit cards and financial management |

| Plaid | Financial data aggregation and API platform |

The Regulatory Landscape and Its Impact on Fintech

The regulatory landscape for fintech is evolving rapidly, presenting both challenges and opportunities for innovation. Regulators are working to balance the need for innovation with the protection of consumers and financial stability.

Navigating the Regulatory Landscape

- Compliance Challenges:Fintech companies face the challenge of complying with a complex and evolving regulatory framework.

- Regulatory Sandbox:Regulatory sandboxes provide a controlled environment for fintech companies to test new products and services under the supervision of regulators.

- Collaboration with Regulators:Fintech companies are engaging with regulators to ensure that regulations are conducive to innovation and financial stability.

The Human Element in Fintech: Building Trust and Inclusion

While technology plays a crucial role in fintech, the human element remains essential. Building trust and promoting financial inclusion are critical aspects of a thriving fintech ecosystem.

In a world of constant change, leadership demands more than just competence. Reimagining leadership requires purpose, resilience, and a vision for the future, especially as we navigate the complexities of a rapidly evolving world.

Financial Inclusion and Fintech

- Bridging the Gap:Fintech solutions are helping to bridge the gap in financial services for underserved populations, such as low-income individuals and those in rural areas.

- Promoting Financial Literacy:Fintech companies are playing an active role in promoting financial literacy through educational resources and tools.

- Building Trust:Building trust in the fintech ecosystem is essential for its long-term success. This requires transparency, accountability, and ethical practices.

Looking Ahead: The Future of Fintech Beyond 2024

The future of fintech holds immense potential for innovation and disruption. The industry is expected to continue to grow and evolve at a rapid pace, transforming the global financial landscape.

The Trajectory of Fintech Development

- Increased Adoption of AI and Machine Learning:AI and machine learning will play an even greater role in financial services, enabling more personalized and efficient solutions.

- Growth of Embedded Finance:Embedded finance is expected to become increasingly prevalent, integrating financial services into various platforms and applications.

- Expansion of Open Banking:Open banking will continue to evolve, leading to a more interconnected and data-driven financial ecosystem.

Conclusive Thoughts

DealBook Summit 2024: The Future of Fintech is a testament to the rapid evolution of the fintech industry. As we look ahead, it’s clear that fintech will continue to play a pivotal role in shaping the future of financial services, driving financial inclusion, and empowering individuals and businesses around the world.

The summit serves as a platform to connect, collaborate, and inspire, ensuring a future where financial technology is a force for positive change.

Technology, with its relentless march, continues to redefine industries and reshape societies. The transformative power of AI, Web3, and other emerging technologies presents both opportunities and risks, demanding a careful approach and a willingness to adapt.

Answers to Common Questions

Where will the DealBook Summit 2024 be held?

The location of the DealBook Summit 2024 is not specified in the provided Artikel. Please refer to official event information for the exact location.

Who are the key speakers at the DealBook Summit 2024?

The Artikel doesn’t provide details about specific speakers. For information on speakers, check the official event website or related announcements.

The Dealbook Summit 2024 also delved into the global economic outlook, a landscape marked by uncertainty and volatility. Decoding the complexities requires a keen eye for data, a grasp of geopolitical shifts, and a touch of intuition.

How can I register for the DealBook Summit 2024?

To register for the DealBook Summit 2024, visit the official event website. Look for registration information and instructions.