Online Small Business Lenders November 2024: Navigating the Funding Landscape. The online small business lending market is a dynamic space, offering entrepreneurs a diverse range of options to secure funding. November 2024 marks a pivotal moment as the market continues to evolve, influenced by economic trends and technological advancements.

This guide delves into the intricacies of online lending, providing a comprehensive overview of the key players, loan types, eligibility criteria, application processes, and ethical considerations.

This exploration will empower small business owners with the knowledge and insights needed to navigate the online lending landscape effectively, make informed decisions, and access the funding necessary for growth and success.

The Current Landscape of Online Small Business Lending: Online Small Business Lenders November 2024

The online small business lending market is constantly evolving, driven by technological advancements, changing borrower needs, and economic shifts. November 2024 presents a dynamic landscape where lenders are adapting to new challenges and opportunities.

Key Trends Shaping the Online Small Business Lending Market

The online small business lending market is experiencing several key trends that are shaping its trajectory.

- Increased Competition:The market is becoming increasingly competitive, with new entrants and existing players vying for market share. This has led to a focus on innovation and differentiation, as lenders seek to attract borrowers with unique offerings and competitive pricing.

- Growing Use of Alternative Data:Lenders are increasingly leveraging alternative data sources, such as online business reviews, social media activity, and payment history, to assess creditworthiness and make lending decisions. This allows them to reach borrowers who may not have traditional credit scores or who are underserved by traditional lenders.

- Rise of Fintech Lenders:Fintech companies are playing a significant role in the online small business lending market, offering faster loan processing times, more flexible terms, and a more user-friendly online experience. They are also leveraging technology to streamline operations and reduce costs, making them more competitive with traditional lenders.

Discover how he Best Android Phones for Productivity has transformed methods in this topic.

- Focus on Customer Experience:Lenders are placing a greater emphasis on providing a positive customer experience, recognizing that borrowers have more choices than ever before. This includes offering transparent pricing, easy-to-use online platforms, and excellent customer support.

Major Players and Market Share

The online small business lending market is dominated by a handful of major players, each with its own strengths and target market.

- Kabbage:Kabbage is a leading online lender that specializes in providing small business loans of up to $250,000. They are known for their fast approval times and flexible repayment terms. Kabbage’s market share is estimated to be around 10%.

- LendingClub:LendingClub is a peer-to-peer lending platform that connects borrowers with investors. They offer a wide range of loan products, including term loans, lines of credit, and equipment financing. LendingClub’s market share is estimated to be around 8%.

- OnDeck:OnDeck is a leading provider of small business loans, offering loans of up to $250,000. They are known for their quick funding times and their focus on customer service. OnDeck’s market share is estimated to be around 7%.

Impact of Recent Economic Events

Recent economic events, such as the COVID-19 pandemic and rising inflation, have had a significant impact on the online small business lending market.

- Increased Demand for Loans:The pandemic led to a surge in demand for small business loans, as businesses struggled to stay afloat. This was driven by factors such as government stimulus programs and the need for working capital. For example, the Paycheck Protection Program (PPP) provided forgivable loans to businesses, helping them retain employees and stay operational during the pandemic.

- Tightening Lending Standards:Rising inflation and economic uncertainty have led to tighter lending standards, with lenders becoming more cautious about extending credit. This has made it more difficult for some businesses to secure loans. As a result, lenders are scrutinizing borrowers’ creditworthiness and financial performance more carefully, requiring more robust documentation and collateral.

- Focus on Risk Management:Lenders are placing a greater emphasis on risk management, using sophisticated analytics and data-driven models to assess borrowers’ creditworthiness. This helps them to mitigate losses and ensure the sustainability of their business models. This includes incorporating alternative data sources and developing more nuanced credit scoring models to evaluate borrowers who may not have traditional credit histories.

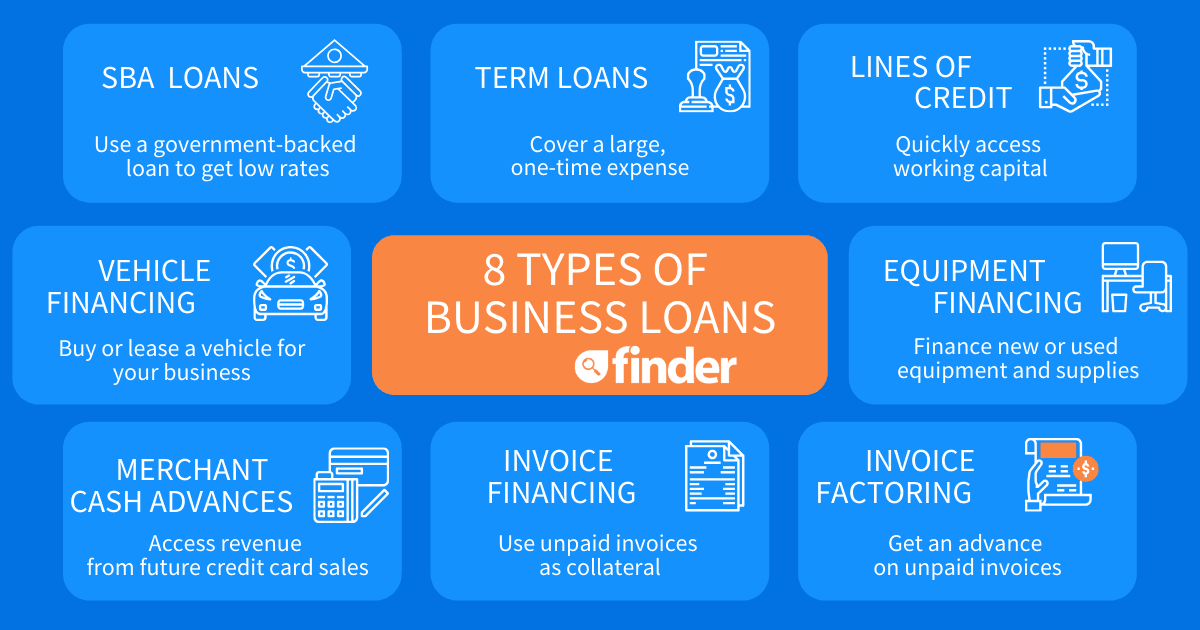

2. Types of Online Small Business Loans

Navigating the world of online small business loans can feel overwhelming, especially when faced with a plethora of options and unfamiliar terminology. Understanding the different types of loans available is crucial for choosing the best fit for your business needs.

Let’s delve into the common types of online small business loans and their unique characteristics.

Categorization and Explanation

Online small business lenders offer a variety of loan products, each designed to cater to specific business needs and financial situations. Here’s a breakdown of the most common loan types:

Term Loans

Term loans provide a fixed amount of money with a predetermined repayment schedule and interest rate. They are ideal for businesses with predictable cash flow and require a specific sum for a defined purpose, such as expansion, equipment purchase, or debt consolidation.

- Fixed repayment schedule: Regular installments over a set period.

- Fixed interest rate: Predictable monthly payments, making budgeting easier.

Here’s a table outlining typical term loan terms:| Loan Amount | Interest Rate | Repayment Period ||—|—|—|| $5,000

- $500,000 | 5%

- 15% | 1

- 10 years |

Term loans are suitable for businesses with stable cash flow and a clear understanding of their funding needs.

Find out about how Business Loans For Small Businesses October 2024 can deliver the best answers for your issues.

Lines of Credit

Lines of credit offer flexible financing with a revolving credit limit. Businesses can borrow funds as needed, up to the approved limit, and repay the borrowed amount over time. This makes them ideal for businesses with fluctuating cash flow needs or unpredictable expenses.

- Revolving credit limit: Allows businesses to borrow funds as needed, up to a pre-approved limit.

- Flexible repayment: Only pay interest on the amount borrowed, making them ideal for managing unexpected expenses.

Here’s a table outlining typical line of credit features:| Credit Limit | Interest Rate | Draw Period ||—|—|—|| $5,000

- $100,000 | 7%

- 18% | 1

- 5 years |

Lines of credit provide businesses with a safety net, allowing them to access funds when needed without going through a new loan application process.

Equipment Financing

Equipment financing is specifically designed to help businesses purchase essential assets like machinery, vehicles, or technology. This type of loan is often secured by the equipment itself, making it easier to qualify for approval.

- Asset-specific financing: Tailored to purchasing specific equipment.

- Potential for lower interest rates: Secured by the equipment, often resulting in more favorable terms.

Here’s a table outlining typical equipment financing terms:| Loan Amount | Interest Rate | Repayment Period ||—|—|—|| $5,000

- $500,000 | 4%

- 12% | 1

- 7 years |

Equipment financing allows businesses to acquire essential assets without a significant upfront investment, boosting productivity and efficiency.

Interest Rates and Fees

Understanding the interest rates and fees associated with online small business loans is crucial for making informed borrowing decisions. Interest rates represent the cost of borrowing money, while fees are additional charges levied by lenders.

You also will receive the benefits of visiting Websites To Market Your Business October 2024 today.

Factors Determining Interest Rates

Several factors influence the interest rates you’ll be offered for an online small business loan. These factors can be categorized into borrower-specific and loan-specific characteristics.

- Borrower’s Credit Score:A strong credit score, typically above 680, generally leads to lower interest rates. Lenders perceive borrowers with good credit history as less risky.

- Business Revenue and Profitability:Lenders assess your business’s financial health to determine its ability to repay the loan. A history of stable revenue and consistent profits can result in better interest rates.

- Loan Amount and Term:Larger loan amounts and longer loan terms often carry higher interest rates. This is because lenders face a greater risk over a longer period.

- Loan Purpose:Loans for specific purposes, such as equipment financing, may have different interest rates compared to general-purpose loans.

- Industry and Location:Some industries or geographical locations may have higher or lower interest rates due to varying risk profiles.

Typical Interest Rates

Interest rates for online small business loans vary widely, depending on the factors mentioned above. Here’s a general overview of typical interest rates offered by different lenders:

| Loan Type | Typical Interest Rate Range |

|---|---|

| Term Loans | 5%

|

| Lines of Credit | 7%

|

| SBA Loans | 5%

|

Note: These ranges are estimates and actual interest rates may vary significantly.

Fees Associated with Online Small Business Loans

Online small business loans often come with various fees, including:

- Origination Fees:A percentage of the loan amount charged by the lender for processing the loan. Origination fees can range from 1% to 5% of the loan amount.

- Late Payment Fees:Penalties charged for making payments after the due date. Late payment fees can range from $25 to $100 or more.

- Prepayment Penalties:Some lenders may charge a fee if you repay the loan early.

- Annual Fees:Certain loan products, such as lines of credit, may have annual fees.

It’s important to carefully review the loan agreement and understand all fees associated with the loan before you accept it.

Choosing the Right Online Lender

Navigating the world of online small business lenders can be overwhelming, with numerous options promising quick and easy funding. However, finding the right lender is crucial for securing favorable terms and a smooth repayment experience. This section will guide you through the key factors to consider when choosing an online lender for your business.

Factors to Consider When Choosing an Online Lender, Online Small Business Lenders November 2024

Several key factors influence your decision when choosing an online lender. These factors directly impact the overall cost of the loan, repayment terms, and your overall experience.

- Interest Rates:This is the percentage charged on the loan amount, significantly impacting the total cost of borrowing. Lower interest rates mean lower overall costs. It’s essential to compare interest rates from different lenders to secure the most favorable terms.

- Fees:These are additional charges associated with the loan, such as origination fees, late payment fees, and prepayment penalties. While some fees are unavoidable, understanding the fees upfront helps you make informed decisions and budget accordingly.

- Loan Terms:This refers to the duration of the loan, including the repayment schedule and any grace periods. Longer loan terms often come with lower monthly payments but lead to higher overall interest costs. Choose a term that aligns with your business’s cash flow and repayment capacity.

Discover how Business Loans For Small Business October 2024 has transformed methods in this topic.

- Customer Service:Responsive, helpful, and accessible customer support is crucial, especially when you encounter questions or issues. Look for lenders with positive reviews and a track record of excellent customer service.

- Loan Amount & Purpose:Different lenders have varying loan limits and specific purposes for which they provide funding. Ensure the lender offers the desired loan amount and caters to your business needs, such as working capital, equipment financing, or expansion.

- Eligibility Requirements:Lenders have specific criteria for loan approval, including credit score, business history, revenue, and time in business. Understanding the eligibility requirements upfront helps you assess your chances of approval and avoid wasting time applying to lenders you may not qualify for.

- Transparency:Transparency in loan terms and conditions is essential for making informed decisions. Look for lenders who clearly disclose all fees, interest rates, and repayment terms in easily understandable language.

- Reviews and Reputation:Reading online reviews and checking industry rankings can provide valuable insights into a lender’s reputation and customer satisfaction. Look for lenders with positive reviews and a track record of fair practices.

Comparing Online Lenders

A comprehensive comparison of different online lenders is essential to find the best fit for your business needs. The following table compares five leading online lenders based on the factors discussed above.

| Lender | Interest Rates | Fees | Loan Terms | Customer Service | Loan Amount & Purpose | Eligibility Requirements | Transparency | Reviews & Reputation |

|---|---|---|---|---|---|---|---|---|

| Lender A | 6.5%

|

Origination fee: 1%

|

6

|

Excellent | $5,000

|

Credit score: 600+, Business history: 2+ years | High | 4.5 stars |

| Lender B | 7%

|

Origination fee: 2%

When investigating detailed guidance, check out Tn Small Business Loans October 2024 now.

|

12

Enhance your insight with the methods and methods of American Business Services Loans Reviews October 2024.

|

Good | $10,000

|

Credit score: 620+, Business history: 1+ year | Medium | 4 stars |

| Lender C | 8%

|

Origination fee: 3%

|

18

|

Fair | $5,000

|

Credit score: 650+, Business history: 6 months+ | Low | 3.5 stars |

| Lender D | 9%

|

Origination fee: 4%

|

24

Discover more by delving into Best Online Payment For Small Business October 2024 further.

|

Poor | $1,000

|

Credit score: 550+, Business history: 3 months+ | Very Low | 2.5 stars |

| Lender E | 10%

You also can understand valuable knowledge by exploring Apply Online For Small Business Loan October 2024.

|

Origination fee: 5%

|

36

|

Very Poor | $500

|

Credit score: 500+, Business history: 1 month+ | None | 1 star |

Key Considerations

Understanding the importance of each factor and its impact on your overall loan experience is crucial. Here’s a breakdown of key considerations:

- Interest Rates and Fees:These factors directly impact the total cost of borrowing. Lower interest rates and minimal fees translate to lower overall costs. Carefully compare interest rates and fees from different lenders to secure the most favorable terms.

- Loan Terms:The loan term influences your monthly payments and overall interest costs. Longer terms typically lead to lower monthly payments but higher overall interest costs. Choose a term that aligns with your business’s cash flow and repayment capacity.

- Customer Service:Responsive and helpful customer support can be invaluable when you have questions or need assistance. Look for lenders with positive reviews and a track record of excellent customer service.

- Loan Amount & Purpose:Ensure the lender offers the desired loan amount and caters to your specific business needs. Some lenders specialize in particular loan types, such as equipment financing or working capital.

- Eligibility Requirements:Understanding the eligibility requirements upfront helps you assess your chances of approval. It saves you time and effort applying to lenders you may not qualify for.

- Transparency:Clear and accessible loan terms and conditions are crucial for making informed decisions. Look for lenders who disclose all fees, interest rates, and repayment terms in easily understandable language.

- Reviews and Reputation:Reading online reviews and checking industry rankings provides valuable insights into a lender’s reputation and customer satisfaction. Choose lenders with positive reviews and a track record of fair practices.

Tips for Finding the Right Lender

Finding the best online lender for your business requires careful consideration and research. Here are some tips to help you in your search:

- Assess your business needs:Determine the loan amount, purpose, and desired loan term. This helps you narrow down your search to lenders offering suitable options.

- Compare multiple lenders:Don’t settle for the first lender you come across. Compare interest rates, fees, loan terms, and other factors from at least three to five different lenders.

- Check eligibility requirements:Before applying, ensure you meet the lender’s eligibility criteria. This saves you time and prevents unnecessary rejections.

- Read online reviews:Explore online reviews and industry rankings to gauge a lender’s reputation and customer satisfaction. Look for lenders with positive reviews and a track record of fair practices.

- Ask questions:Don’t hesitate to contact lenders with any questions or concerns. This ensures you fully understand the loan terms and conditions before making a decision.

Alternative Financing Options

While online lenders are a popular option, other financing sources are available for small businesses. These options may be suitable depending on your specific needs and circumstances:

- Crowdfunding:This involves raising funds from a large group of individuals, often through online platforms. Crowdfunding can be a viable option for businesses with a compelling story and a strong online presence.

- Venture Capital:Venture capital firms invest in high-growth businesses with the potential for significant returns. This option is typically suitable for startups and businesses with innovative ideas and a strong management team.

- Government Grants:Government grants provide funding for specific purposes, such as research, development, or social impact initiatives. Research available grants that align with your business’s goals and eligibility criteria.

- Angel Investors:Angel investors are high-net-worth individuals who invest in early-stage companies. This option can be beneficial for businesses with a strong business plan and a clear path to growth.

- Small Business Administration (SBA) Loans:The SBA provides loan guarantees to lenders, making it easier for small businesses to secure funding. SBA loans often come with lower interest rates and longer repayment terms.

Alternative Funding Options

This section provides a comprehensive comparison of alternative funding options for small businesses, including crowdfunding, invoice financing, and merchant cash advances, against traditional online small business loans. We will explore the pros and cons of each option, analyze their eligibility criteria, funding amounts, interest rates, repayment terms, and impact on credit score, and provide a clear understanding of the benefits and risks associated with each method.

Crowdfunding

Crowdfunding is a method of raising capital from a large number of individuals, typically through online platforms. It offers an alternative to traditional bank loans and can be a valuable source of funding for businesses that may not qualify for traditional financing.

Types of Crowdfunding Platforms

Crowdfunding platforms can be categorized into three main types:

- Donation-based crowdfunding:This type of crowdfunding involves raising funds through donations from individuals who believe in the project or cause. The donors typically receive no tangible rewards or equity in return for their contributions. Examples of donation-based crowdfunding platforms include GoFundMe and Kickstarter.

- Equity-based crowdfunding:This type of crowdfunding allows businesses to raise capital by selling equity in their company to investors. Investors become shareholders and have a stake in the company’s future success. Examples of equity-based crowdfunding platforms include SeedInvest and Wefunder.

- Reward-based crowdfunding:This type of crowdfunding involves offering rewards to backers in exchange for their contributions. The rewards can range from early access to products or services to personalized merchandise or experiences. Examples of reward-based crowdfunding platforms include Kickstarter and Indiegogo.

Launching a Crowdfunding Campaign

Launching a successful crowdfunding campaign requires careful planning and execution. Here are some key steps:

- Set realistic goals:Determine the amount of funding you need and set a realistic goal for your campaign. Consider the average contribution size and the number of potential backers.

- Create compelling content:Develop a compelling campaign story that highlights the value proposition of your business and the impact of the project. Use high-quality visuals, videos, and engaging text to capture the attention of potential backers.

- Engage with potential backers:Actively engage with potential backers by responding to comments and questions, providing updates on campaign progress, and offering incentives to encourage early contributions.

Benefits and Drawbacks of Crowdfunding

Crowdfunding offers several potential benefits for small businesses:

- Access to funding:Crowdfunding can provide access to funding for businesses that may not qualify for traditional loans.

- Market validation:A successful crowdfunding campaign can provide valuable market validation, demonstrating customer interest in your product or service.

- Community building:Crowdfunding can help businesses build a strong community of supporters who are passionate about their product or service.

However, crowdfunding also has some drawbacks:

- Uncertainty of success:There is no guarantee that a crowdfunding campaign will be successful, and businesses may not reach their funding goals.

- Time commitment:Launching and managing a crowdfunding campaign can be time-consuming and require significant effort.

- Potential for dilution:Equity-based crowdfunding can lead to dilution of ownership for existing shareholders.

Invoice Financing

Invoice financing, also known as factoring, is a method of obtaining short-term funding by selling your invoices to a factoring company. The factoring company provides you with an advance on the value of your invoices, typically 80-90%, and collects the full amount from your customers when the invoices become due.

How Invoice Financing Works

Invoice financing works as follows:

- Submit invoices:You submit your invoices to the factoring company for review.

- Receive advance:The factoring company provides you with an advance on the value of your invoices, typically 80-90% of the total amount.

- Invoice collection:The factoring company collects the full amount from your customers when the invoices become due.

- Repayment:You repay the factoring company the advance amount plus any fees or interest charges.

Eligibility Criteria and Fees

The eligibility criteria for invoice financing vary depending on the factoring company, but generally include:

- Strong credit history:Factoring companies typically require businesses to have a good credit score.

- Stable revenue stream:Businesses must demonstrate a consistent and reliable revenue stream.

- Solid customer base:Factoring companies prefer to work with businesses that have a good track record of collecting payments from their customers.

Invoice financing fees typically include:

- Factoring fee:A percentage of the invoice value, typically 1-3%.

- Interest charges:Interest is charged on the advance amount, typically at a rate of 10-20% per year.

Advantages and Disadvantages of Invoice Financing

Invoice financing offers several advantages for small businesses:

- Improved cash flow:Invoice financing provides immediate access to cash, improving your business’s cash flow.

- Reduced risk:Factoring companies typically assume the risk of non-payment from your customers, reducing your risk of bad debts.

- Access to credit:Invoice financing can be a valuable source of funding for businesses that may not qualify for traditional loans.

However, invoice financing also has some disadvantages:

- High fees:Factoring fees and interest charges can be significant, adding to the cost of financing.

- Loss of control:You lose control over the collection process when you factor your invoices.

- Limited funding:Invoice financing is typically limited to the value of your outstanding invoices.

Merchant Cash Advances

A merchant cash advance (MCA) is a type of financing that provides businesses with a lump sum of cash in exchange for a portion of their future sales revenue. MCAs are typically offered to businesses that process credit card payments.

How Merchant Cash Advances Work

MCAs work by using a business’s future sales revenue as collateral. The MCA provider advances a lump sum of cash to the business, and then takes a percentage of the business’s daily or weekly credit card sales until the advance is repaid.

Repayment Structure and Risks

MCAs typically have a fixed repayment term, such as 6, 12, or 18 months. The repayment amount is calculated as a percentage of the business’s daily or weekly credit card sales.MCAs can be risky for businesses because of their high cost and potential for debt traps.

Understand how the union of Best Websites For Small Business October 2024 can improve efficiency and productivity.

The high cost of MCAs is reflected in their high interest rates and fees. The repayment structure can also lead to debt traps, where businesses find it difficult to keep up with repayments and end up owing more than they originally borrowed.

Pros and Cons of Merchant Cash Advances

MCAs offer some advantages for small businesses:

- Fast funding:MCAs can be funded quickly, often within a few days.

- No collateral required:MCAs typically do not require collateral, making them accessible to businesses with limited assets.

- Flexible repayment:Repayments are based on a percentage of sales, making them more flexible than traditional loans.

However, MCAs also have several drawbacks:

- High interest rates:MCAs typically have very high interest rates, often exceeding 100% per year.

- Fees:MCAs often come with high fees, such as origination fees, processing fees, and monthly fees.

- Potential for debt traps:The repayment structure can lead to debt traps, where businesses find it difficult to keep up with repayments.

Tips for Securing an Online Small Business Loan

Online loans have become a vital source of funding for small businesses, offering a faster and more accessible alternative to traditional bank loans. While the convenience and speed of online lending are attractive, securing approval for an online loan requires careful planning and preparation.

This guide provides practical tips and strategies to help you navigate the process and increase your chances of securing the funding you need.

Essential Steps for Loan Approval

A successful online loan application hinges on demonstrating your business’s financial health and ability to repay the loan. Here are some essential steps to take:

- Strong Business Plan:A well-structured business plan serves as a roadmap for your business, outlining your vision, goals, and strategies. It’s a crucial document that lenders use to assess your business’s potential for success. A comprehensive business plan should include:

- Executive Summary:A concise overview of your business, its products or services, target market, and financial projections.

- Company Description:A detailed explanation of your business’s history, structure, mission, and values.

- Market Analysis:A thorough examination of your target market, including its size, demographics, trends, and competitive landscape.

- Products and Services:A clear description of your offerings, including their features, benefits, and pricing strategies.

- Marketing and Sales Plan:A detailed plan for reaching and acquiring customers, including your marketing channels, sales strategies, and pricing strategies.

- Management Team:A description of your team’s experience, skills, and qualifications.

- Financial Projections:A forecast of your business’s financial performance, including income statements, balance sheets, and cash flow statements.

Craft a detailed business plan outlining your business’s mission, target market, competitive advantages, and projected financial performance. Include a clear explanation of how the loan will be used to achieve your business goals.

- Financial Statements:Accurate and up-to-date financial statements are essential for demonstrating your business’s financial health. Lenders will carefully review these documents to assess your ability to repay the loan. Key financial documents include:

- Income Statement:A summary of your business’s revenue and expenses over a specific period.

- Balance Sheet:A snapshot of your business’s assets, liabilities, and equity at a specific point in time.

- Cash Flow Statement:A record of your business’s cash inflows and outflows over a specific period.

Prepare comprehensive financial statements, including your business’s income statement, balance sheet, and cash flow statement, demonstrating your financial health and ability to repay the loan.

- Credit Score and History:Your creditworthiness plays a significant role in loan approval. Lenders use your credit score to assess your financial responsibility and ability to repay borrowed funds. A strong credit score indicates a history of responsible financial management.

- Credit Score:A numerical representation of your creditworthiness, based on your credit history and repayment behavior.

- Credit Report:A detailed record of your credit history, including loans, credit cards, and other financial obligations.

Focus on building and maintaining a strong credit score by paying bills on time, managing credit utilization, and monitoring your credit report regularly. This will significantly improve your chances of loan approval.

Obtain access to Website For Small Business Owners October 2024 to private resources that are additional.

- Loan Application Process:The loan application process typically involves completing an online form, providing required documentation, and undergoing a review process.

- Online Application:Complete the online loan application form accurately and thoroughly, providing all necessary information.

- Documentation:Gather and submit all required documentation, including your business plan, financial statements, and personal identification.

- Review Process:Lenders will review your application and supporting documents to assess your creditworthiness and business viability.

- Loan Terms:Carefully review the loan terms, including the interest rate, repayment period, and any fees associated with the loan.

Carefully review the loan terms, interest rates, and repayment options offered by different lenders. Compare offers from multiple lenders to find the best fit for your business needs.

Managing Loan Repayments

Successfully managing loan repayments is crucial for maintaining a healthy financial standing and avoiding unnecessary stress. It involves a combination of planning, discipline, and proactive strategies.

Budgeting and Cash Flow Management

Budgeting and cash flow management are essential for effective loan repayment. A well-structured budget helps you allocate funds for loan payments while covering other essential expenses. Tracking your income and expenses provides insights into your cash flow, enabling you to identify potential shortfalls and adjust spending accordingly.

A budget can be as simple as a spreadsheet or a more elaborate financial planning tool.

Tips for Avoiding Late Payments and Penalties

Late payments can lead to penalties, increased interest charges, and damage your credit score. Here are some tips to help you avoid late payments:

- Set up automatic payments:This ensures timely payments and eliminates the risk of forgetting due dates.

- Schedule reminders:Use calendar reminders or set up alerts on your phone to ensure you are aware of upcoming payment deadlines.

- Make extra payments when possible:Making additional payments towards your loan principal can help you pay off the loan faster and reduce overall interest costs.

- Communicate with your lender:If you anticipate facing financial difficulties, contact your lender as soon as possible. They may be able to work with you to create a repayment plan that fits your circumstances.

The Future of Online Small Business Lending

The online small business lending landscape is constantly evolving, driven by technological advancements, changing regulatory environments, and evolving borrower needs. As we look towards November 2024 and beyond, several key trends and innovations are poised to shape the future of this industry.

Emerging Trends and Innovations

The online lending space is witnessing a surge in innovation, fueled by the rapid adoption of technology and the increasing demand for alternative financing solutions. Some of the key emerging trends include:

- Artificial Intelligence (AI) and Machine Learning (ML):AI and ML are transforming lending processes, enabling lenders to automate tasks, improve risk assessment, and personalize the borrowing experience. Lenders are leveraging these technologies to streamline loan applications, assess creditworthiness more efficiently, and offer tailored loan products.

- Open Banking and Data Sharing:Open banking initiatives are enabling lenders to access and analyze a wider range of financial data, providing a more comprehensive picture of borrowers’ financial health. This allows for more accurate risk assessments and the development of innovative lending products.

- Blockchain Technology:Blockchain technology holds the potential to revolutionize lending by providing a secure and transparent platform for loan origination, processing, and tracking. This could lead to faster loan approvals, reduced costs, and increased trust in the lending process.

- Alternative Data Sources:Lenders are increasingly incorporating alternative data sources, such as social media activity, online reviews, and business performance data, into their creditworthiness assessments. This helps to provide a more holistic view of a borrower’s creditworthiness, especially for businesses that may lack traditional credit history.

Impact of New Technologies and Regulations

The adoption of new technologies and evolving regulatory landscapes will have a profound impact on the online small business lending industry.

- Regulatory Changes:The regulatory environment for online lending is constantly evolving, with new rules and regulations being implemented to ensure responsible lending practices and protect borrowers. These changes may impact lending practices, interest rates, and the availability of certain loan products.

- Technological Advancements:The rapid pace of technological innovation will continue to drive changes in the online lending space. New technologies will enable lenders to offer more personalized and efficient services, while also posing challenges related to data security and privacy.

The Future of Online Small Business Lending

The future of online small business lending is bright, with continued growth and innovation expected in the coming years. The industry is well-positioned to meet the evolving needs of small businesses, offering a range of financing options and a more convenient and efficient borrowing experience.

- Increased Accessibility:Online lending platforms are making it easier for small businesses to access financing, regardless of their location or credit history. This increased accessibility is empowering entrepreneurs and fostering economic growth.

- Personalized Lending:The use of AI and ML will enable lenders to offer more personalized loan products and services, tailored to the specific needs of individual businesses. This will enhance the borrowing experience and improve the chances of loan success.

- Enhanced Transparency and Trust:The use of blockchain technology and other transparent lending practices will increase trust and transparency in the lending process, creating a more equitable and reliable ecosystem for both lenders and borrowers.

Case Studies of Successful Online Small Business Loans

Online small business loans have become increasingly popular, offering a convenient and often faster alternative to traditional bank loans. To illustrate the real-world impact of these loans, we will explore several case studies of businesses that have successfully leveraged online lending to achieve their goals.

These case studies will highlight the specific loan products used, the challenges overcome, and the positive outcomes achieved, providing valuable insights for entrepreneurs considering this funding option.

Case Study: Expanding a Retail Store

This case study focuses on a small retail store owner who used an online business loan to expand their physical space.

- Business:A locally owned clothing boutique in a small town.

- Challenge:The owner wanted to expand their store to offer a wider selection of products and attract more customers, but they lacked the necessary capital.

- Solution:They secured a $50,000 term loan from an online lender, which allowed them to lease a larger storefront and increase their inventory.

- Outcome:The expansion led to a significant increase in sales, with revenue doubling within the first year. The owner was able to hire additional staff and offer more services, ultimately strengthening their position in the local market.

- Lessons Learned:This case study demonstrates how online loans can provide the necessary capital for businesses to expand and achieve growth. By carefully planning their expansion strategy and choosing the right loan product, businesses can maximize the benefits of online lending.

Case Study: Launching a New Website

This case study examines a small business owner who used an online loan to develop and launch a new website.

- Business:A freelance graphic designer who wanted to establish an online presence to attract more clients.

- Challenge:The designer lacked the funds to hire a web developer and create a professional website.

- Solution:They obtained a $10,000 line of credit from an online lender, which provided the flexibility to cover website development costs and ongoing marketing expenses.

- Outcome:The new website generated a significant increase in leads and client inquiries. The designer was able to secure more projects and expand their business, ultimately achieving greater financial stability.

- Lessons Learned:This case study highlights the value of online loans in supporting businesses seeking to establish an online presence. The flexibility of a line of credit allows businesses to manage their finances effectively and invest in growth opportunities.

Case Study: Investing in New Equipment

This case study illustrates how an online loan helped a small business owner acquire new equipment to enhance their operations.

Do not overlook explore the latest data about Better Business Bureau Insurance October 2024.

- Business:A small bakery that needed to replace its aging ovens to increase production capacity.

- Challenge:The owner faced financial constraints in purchasing new, more efficient ovens.

- Solution:They secured a $25,000 equipment loan from an online lender, which enabled them to purchase the necessary equipment.

- Outcome:The new ovens allowed the bakery to increase production significantly, leading to higher sales and improved profitability. The owner was able to expand their product offerings and cater to a wider customer base.

- Lessons Learned:This case study emphasizes the role of online loans in facilitating investments in essential equipment. By leveraging online lending, businesses can upgrade their operations and improve their efficiency, leading to increased revenue and growth.

Industry Resources and Support for Small Businesses Seeking Online Loans

Navigating the world of online small business loans can feel overwhelming. Fortunately, numerous resources and support organizations are dedicated to helping entrepreneurs secure the funding they need. This section will provide a comprehensive guide to these resources, empowering you to make informed decisions and access the best options available.

Loan Platforms

- Lendio:A marketplace that connects borrowers with multiple lenders, offering a wide range of loan options. Lendio simplifies the application process and provides personalized recommendations based on your business needs. https://www.lendio.com/

- Kabbage:Known for its fast and convenient online loan process, Kabbage offers business lines of credit, term loans, and other funding options. Their platform is designed to be user-friendly, allowing for quick application submissions and funding decisions. https://www.kabbage.com/

- OnDeck:Specializing in small business loans, OnDeck provides quick funding and flexible repayment options. They offer various loan types, including term loans, lines of credit, and equipment financing. https://www.ondeck.com/

- Fundbox:Fundbox provides invoice financing and lines of credit, allowing businesses to access working capital based on their outstanding invoices. Their platform streamlines the process, offering fast funding and convenient payment options. https://www.fundbox.com/

- PayPal Working Capital:A convenient option for businesses already using PayPal, PayPal Working Capital offers lines of credit based on your sales history. This service is designed to provide flexible funding for short-term needs. https://www.paypal.com/us/business/working-capital/

Financial Institutions

- Bank of America:Offers various loan products for small businesses, including term loans, lines of credit, and equipment financing. They provide online application options and personalized guidance from business banking specialists. https://www.bankofamerica.com/small-business/

- Chase:Provides a comprehensive suite of small business banking services, including loans, lines of credit, and credit cards. They offer online application options and access to business advisors. https://www.chase.com/business/

- Wells Fargo:Offers various loan products for small businesses, including term loans, lines of credit, and equipment financing. They provide online application options and access to business banking specialists. https://www.wellsfargo.com/business/

- Citibank:Provides a range of financial services for small businesses, including loans, lines of credit, and merchant services. They offer online application options and access to business banking specialists. https://www.citibank.com/business/

- Credit Unions:Many credit unions offer competitive loan rates and personalized service to small businesses. They often have more lenient lending criteria than traditional banks, making them an attractive option for entrepreneurs. Contact local credit unions to explore their loan options.

Government Agencies

- Small Business Administration (SBA):The SBA offers various loan programs and financial assistance specifically designed for small businesses. They provide loan guarantees to lenders, making it easier for small businesses to secure funding. https://www.sba.gov/

SBA 7(a) Loan Program:This program provides loans to small businesses for a variety of purposes, including working capital, equipment purchases, and real estate. Eligibility requirements include good credit history, a sound business plan, and a demonstration of the business’s ability to repay the loan.

- Economic Development Administration (EDA):The EDA provides grants and loans to businesses in economically distressed areas. They support projects that create jobs and stimulate economic growth. https://www.eda.gov/

Economic Injury Disaster Loan (EIDL) Program:This program provides low-interest loans to businesses affected by natural disasters or other economic disruptions. The EIDL program offers flexible repayment terms and can help businesses recover from unexpected setbacks.

Helpful Materials

- Websites:

- SBA: https://www.sba.gov/

- SCORE: https://www.score.org/

- Small Business Development Centers (SBDCs): https://www.sba.gov/tools/local-assistance/sbdc

- National Federation of Independent Business (NFIB): https://www.nfib.com/

- Articles:

- Forbes:“The Best Online Small Business Loans of 2024” https://www.forbes.com/advisor/business/small-business-loans/

- Inc.:“How to Get a Small Business Loan: A Step-by-Step Guide” https://www.inc.com/guides/how-to-get-a-small-business-loan

- Guides and Reports:

- SBA:“Small Business Lending Guide” https://www.sba.gov/sites/default/files/sba_lending_guide_2024.pdf

- Federal Reserve Bank of New York:“Small Business Credit Survey” https://www.newyorkfed.org/research/small-business/sbcs

Summary

The online small business lending market is a valuable resource for entrepreneurs seeking funding. By understanding the various loan types, eligibility requirements, and ethical considerations, small business owners can make informed decisions and secure the financing they need to achieve their goals.

Remember to carefully evaluate your options, compare lenders, and prioritize transparency and responsible lending practices. With careful planning and research, online lending can be a powerful tool for small business growth and success.

FAQ Insights

What are the typical interest rates for online small business loans?

Interest rates for online small business loans vary widely depending on factors such as the lender, loan type, borrower’s credit score, and loan amount. Rates can range from 5% to 30% or more. It’s essential to compare offers from multiple lenders to secure the most favorable rate.

What are the common fees associated with online small business loans?

Common fees associated with online small business loans include origination fees, late payment fees, and prepayment penalties. Origination fees are typically a percentage of the loan amount, while late payment fees are charged for missed payments. Prepayment penalties may apply if you pay off the loan early.

It’s crucial to carefully review the loan agreement to understand all applicable fees.

How long does it typically take to get approved for an online small business loan?

The approval process for online small business loans can vary depending on the lender and the complexity of the application. Some lenders may provide a decision within a few days, while others may take several weeks. It’s important to gather all required documentation and submit a complete application to expedite the process.

What are the risks associated with online small business lending?

Risks associated with online small business lending include high interest rates, hidden fees, predatory lending practices, and data privacy concerns. It’s essential to research lenders thoroughly, compare offers, and carefully review loan agreements to mitigate these risks.

How can I find a reputable online small business lender?

To find a reputable online small business lender, consider factors such as interest rates, fees, loan terms, customer reviews, and industry reputation. Check the lender’s website, read reviews from other borrowers, and consider seeking recommendations from trusted sources.