Apply Online For Small Business Loan October 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The world of small business loans can be daunting, with numerous options and complex requirements.

But fear not, for this guide is your compass, leading you through the intricate maze of loan types, eligibility criteria, and application processes. We’ll delve into the intricacies of securing funding in October 2024, exploring the best avenues for your small business to thrive.

From traditional bank loans to innovative online lending platforms, we’ll illuminate the diverse landscape of available options. We’ll unravel the mysteries of eligibility requirements, empowering you with the knowledge to confidently navigate the application process. With actionable tips and insightful advice, we’ll equip you with the tools to make informed decisions and secure the financing your business needs to reach its full potential.

Finding the Right Lender

Securing a small business loan is a crucial step for many entrepreneurs. However, with numerous lenders offering a wide range of loan products, choosing the right one can be challenging. This section will guide you through the process of finding the ideal lender for your specific business needs.

Researching Loan Sources

Identifying potential lenders is the first step in the loan application process. This involves compiling a comprehensive list of lenders and classifying them based on their loan offerings and target market.

- Banks:Traditional banks are established financial institutions with extensive lending programs for small businesses. They typically offer a variety of loan products, including term loans, lines of credit, and SBA loans. Some well-known banks with strong small business lending programs include Bank of America, Wells Fargo, and JPMorgan Chase.

Expand your understanding about Best Banks For Small Business Checking 2024 with the sources we offer.

- Credit Unions:Credit unions are member-owned financial institutions that prioritize serving their members’ financial needs. They often offer more competitive interest rates and flexible loan terms compared to traditional banks. Examples of prominent credit unions with small business loan offerings include Navy Federal Credit Union, State Employees’ Credit Union, and Alliant Credit Union.

- Online Lenders:Online lenders are digital platforms that specialize in providing small business loans through an online application process. They typically offer faster funding times and more flexible eligibility requirements compared to traditional lenders. Some popular online lenders include LendingClub, Kabbage, and OnDeck.

Check Best Small Business Banks In Maryland 2024 to inspect complete evaluations and testimonials from users.

- Government Programs:The government offers various programs that provide financial assistance to small businesses. These programs often include low-interest loans, grants, and other forms of support. The Small Business Administration (SBA) is a primary source of government-backed loans for small businesses. Other federal and state initiatives may also offer financial assistance to specific industries or regions.

Comparing Lender Services

Once you have compiled a list of potential lenders, it’s crucial to compare their loan offerings to determine which one best suits your business needs. This comparison should include factors such as loan types, amounts, interest rates, fees, repayment terms, eligibility requirements, and application processes.

| Lender Category | Loan Types | Loan Amounts | Interest Rates | Fees | Repayment Terms | Eligibility Requirements | Application Process |

|---|---|---|---|---|---|---|---|

| Banks | Term loans, lines of credit, SBA loans | $5,000

Obtain access to Small Business Loans California 2024 to private resources that are additional.

|

Variable, based on credit score and business performance | Loan origination fees, annual percentage rates (APRs) | 1-25 years | Strong credit history, good business financials, collateral | Typically involves a lengthy application process with documentation requirements |

| Credit Unions | Term loans, lines of credit, SBA loans | $5,000

Obtain access to Make A Business Page 2024 to private resources that are additional.

|

Fixed or variable, often lower than banks | Loan origination fees, annual percentage rates (APRs) | 1-15 years | Membership in the credit union, good credit history, business financials | Typically faster and less complex than banks |

| Online Lenders | Term loans, lines of credit, invoice financing, equipment financing | $1,000

Discover more by delving into Register A Business For Free 2024 further.

|

Variable, based on credit score and business performance | Loan origination fees, annual percentage rates (APRs) | 3-7 years | Good credit history, business financials, online presence | Fast and easy online application process |

| Government Programs | SBA loans, grants, loan guarantees | $5,000

Obtain recommendations related to Best Email Program For Small Business 2024 that can assist you today.

|

Fixed or variable, often lower than commercial lenders | Loan origination fees, annual percentage rates (APRs) | 1-25 years | Meet specific eligibility criteria based on the program | Complex application process with specific documentation requirements |

Designing a Lender Selection Flowchart

To streamline the lender selection process, a flowchart can be helpful. This visual guide Artikels the key steps involved in finding the right lender for your business.

Notice Washington Small Business Credit 2024 for recommendations and other broad suggestions.

- Identify Business Needs and Goals:The first step is to clearly define your business’s financial needs and goals. This includes determining the loan amount required, the purpose of the loan, and the desired repayment terms.

- Research Loan Options:Once you have a clear understanding of your business needs, you can start researching different loan options. This involves gathering information on different lenders, their loan products, interest rates, fees, and eligibility requirements.

- Compare Loan Terms:After researching loan options, it’s crucial to compare the terms offered by different lenders. This includes analyzing interest rates, fees, repayment options, and other factors that may impact the overall cost of the loan.

- Assess Eligibility:Before applying for a loan, it’s important to check if your business meets the lender’s eligibility requirements. This includes factors such as credit score, business financials, and collateral.

- Apply for Loans:Once you have shortlisted a few lenders, you can submit loan applications. The application process may vary depending on the lender, but it typically involves providing information about your business, financial history, and loan request.

- Negotiate Loan Terms:After submitting your loan applications, you may have the opportunity to negotiate the loan terms with the lender. This includes discussing interest rates, fees, and repayment options.

- Finalize Loan Agreement:If you are approved for a loan, you will need to finalize the loan agreement with the lender. This involves reviewing and signing loan documents, and receiving the loan funds.

Writing a Prompt for an AI Assistant, Apply Online For Small Business Loan October 2024

To further assist you in finding the right lender, you can use an AI assistant. Here is a sample prompt that you can use to guide the AI assistant in providing information and guidance:

“I am looking for a small business loan for [loan amount] to [purpose of loan]. My business has been operating for [years] and has a credit score of [credit score]. I am interested in [loan type] and would like to know which lenders offer the best terms and eligibility requirements.”

You also can understand valuable knowledge by exploring Help Me Set Up My Business 2024.

By providing specific details about your business and loan needs, the AI assistant can analyze the information and provide personalized recommendations for suitable lenders.

4. Application Process and Requirements

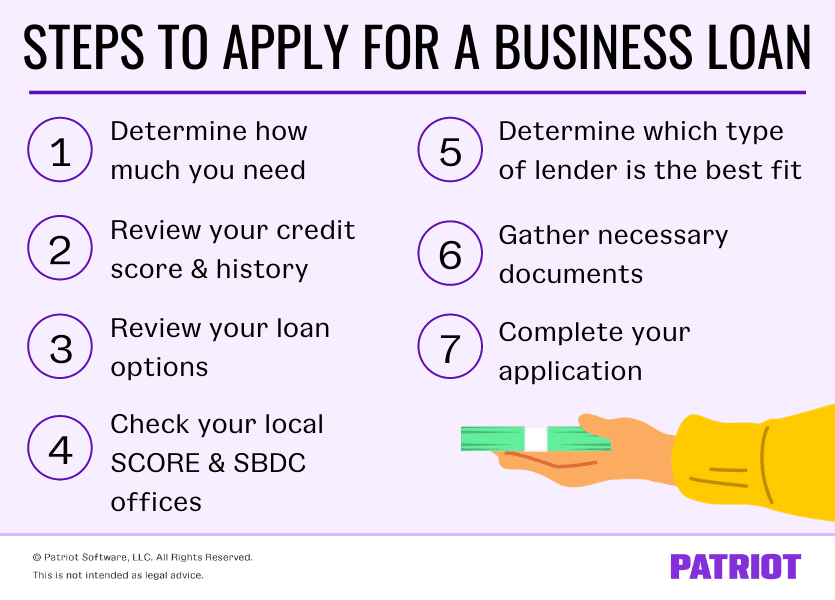

Securing a small business loan can be a crucial step in your entrepreneurial journey. The online application process for small business loans has become increasingly streamlined, making it more accessible for entrepreneurs. Understanding the steps involved and the requirements needed to complete the application successfully is essential.

Discover more by delving into California Small Business Loans 2024 further.

4.1. Online Application Steps (October 2024)

The online application process for a small business loan typically involves several key steps:

- Locate a Lender:The first step is to identify a reputable online lender specializing in small business loans. Consider factors like interest rates, loan terms, and the lender’s reputation.

- Gather Essential Documents:Before you begin the application, ensure you have the following documents ready:

- Business Plan:A comprehensive business plan outlining your business’s goals, strategies, and financial projections is crucial. It demonstrates your understanding of the market, your competitive advantage, and your financial viability.

- Financial Statements:Provide recent balance sheets, income statements, and cash flow statements to give lenders a clear picture of your business’s financial health.

- Tax Returns:Copies of your most recent tax filings will provide lenders with evidence of your business’s revenue and profitability.

- Personal Credit Report:Obtain a copy of your personal credit report from all three major credit bureaus (Equifax, Experian, and TransUnion). Your credit score is a significant factor in loan approval and interest rates.

- Proof of Identity:Provide a valid driver’s license or passport to verify your identity.

- Business License and Permits:Include copies of all necessary licenses and permits for your business to demonstrate compliance with regulations.

- Fill out the Online Application:Once you’ve chosen a lender, access their online application portal and provide the requested information:

- Basic Business Information:Include your business name, address, industry, and legal structure.

- Financial Details:Provide details about your revenue, expenses, debt, and equity.

- Loan Details:Specify the loan amount, purpose, and desired repayment terms.

- Submit the Application:Review all the information you’ve provided carefully before submitting the completed application electronically.

- Verification and Processing:The lender will verify the information you’ve provided and may request additional documents. This process can take several days or weeks.

- Loan Approval or Denial:You’ll receive a notification regarding the loan decision, along with the loan terms if approved.

4.2. Sample Application Form

| Section | Information Required |

|---|---|

| Business Information | Business name, address, industry, legal structure, date of establishment, number of employees, business description. |

| Financial Details | Annual revenue, expenses, profit margins, assets, liabilities, debt-to-equity ratio, credit score. |

| Loan Request | Loan amount, purpose, desired repayment terms, collateral offered (if any). |

| Personal Information | Name, address, phone number, social security number, credit history. |

4.3. Tips for Completing the Application Successfully

Here are some tips to ensure a smooth and successful application process:

- Thoroughness:Ensure all sections of the application are completed accurately and thoroughly.

- Accuracy:Double-check all financial information for accuracy.

- Clarity:Present your business plan and financial information clearly and concisely.

- Professionalism:Use professional language and formatting throughout the application.

- Promptness:Respond to any requests for additional information promptly.

4.4. Tips for Writing

- Navigating the Online Small Business Loan Application Process in 2024:When writing your blog post, ensure you include the steps Artikeld above, tips for completing the application, and common mistakes to avoid.

Future Trends in Small Business Lending

The landscape of small business lending is constantly evolving, driven by technological advancements, shifting economic conditions, and evolving borrower needs. This dynamic environment presents both challenges and opportunities for small business owners seeking financing.

Alternative Financing Options

Alternative financing options have emerged as a viable alternative to traditional bank loans. These options offer greater flexibility and accessibility for small businesses, particularly those that may not meet the stringent requirements of traditional lenders.

Expand your understanding about he Best Android Phones for Productivity with the sources we offer.

- Peer-to-peer (P2P) lending: Platforms like LendingClub and Prosper connect borrowers with individual investors, providing access to capital without the need for bank approval. These platforms often have faster approval times and lower interest rates than traditional loans.

- Crowdfunding: Platforms like Kickstarter and Indiegogo allow businesses to raise funds directly from the public. This approach can be particularly effective for businesses with a strong online presence and a passionate customer base.

- Invoice financing: Businesses can access funding by selling their unpaid invoices to a financing company. This option provides immediate cash flow, but it typically comes with higher interest rates.

- Merchant cash advances: These advances provide businesses with a lump sum of money in exchange for a percentage of their future sales. This option can be attractive for businesses with predictable sales, but it can come with high interest rates.

Fintech Solutions

Fintech companies are revolutionizing the way small businesses access and manage financing. These companies leverage technology to streamline the lending process, reduce costs, and provide greater transparency.

Browse the multiple elements of Insider Pages Business Listing 2024 to gain a more broad understanding.

- Automated underwriting: Fintech platforms use algorithms to assess borrower creditworthiness, reducing the time and effort required for loan approval.

- Digital loan applications: Fintech companies have developed online platforms that allow businesses to apply for loans digitally, simplifying the application process and reducing paperwork.

- Real-time data analysis: Fintech solutions leverage real-time data from business bank accounts and other sources to provide lenders with a more comprehensive picture of borrower financial health.

Online Platforms

Online lending platforms have made it easier for small businesses to find and compare loan options from multiple lenders. These platforms provide a convenient and transparent way to shop for loans, reducing the time and effort required to secure financing.

- Increased competition: The proliferation of online platforms has increased competition among lenders, leading to lower interest rates and more flexible loan terms.

- Greater transparency: Online platforms provide borrowers with access to loan terms and conditions, allowing them to compare options and make informed decisions.

- Faster loan approval: Online platforms often have faster approval times than traditional lenders, allowing businesses to access funds more quickly.

Last Word

As you embark on your journey to secure a small business loan in October 2024, remember that knowledge is power. Thoroughly research your options, compare loan terms, and choose a lender that aligns with your business needs. Embrace the power of planning, budgeting, and seeking professional guidance to ensure a smooth and successful financing experience.

With a well-defined strategy and a proactive approach, you can confidently navigate the world of small business loans and unlock the financial resources necessary to fuel your business’s growth and success.

FAQ: Apply Online For Small Business Loan October 2024

What are the best small business loans for startups?

Startups often benefit from SBA Microloans, which offer lower interest rates and flexible repayment terms, or online business loans that provide quick funding with less stringent requirements.

How can I improve my chances of getting a loan?

Boost your credit score, create a detailed business plan, and maintain strong financial records. Consider seeking professional advice to strengthen your application.

What are the common mistakes to avoid when applying for a loan?

Avoid incomplete applications, inaccurate financial information, and failing to respond promptly to lender requests. Review your application carefully before submission.