Annuity 2000 Basic Mortality Table 2024 provides a crucial framework for understanding life expectancy and its implications for financial planning. Developed as a cornerstone of actuarial science, this table offers a comprehensive overview of mortality rates across different age groups and genders, serving as a foundation for calculating annuity premiums and benefits.

The

Understanding the tax implications of immediate annuities is important for retirement planning. You can find more information about the taxability of immediate annuity income here: Is Immediate Annuity Income Taxable 2024.

If you’re looking for the meaning of “annuity” in Tamil, you can find the answer here: Annuity Meaning In Tamil 2024.

table’s historical context is significant, reflecting the evolving trends in longevity and demographic shifts. Its meticulous analysis of mortality rates helps actuaries assess the risk associated with long-term financial products, such as annuities, and ensures the sustainability of these products over time.

Annuity 2000 Basic Mortality Table: Overview

The Annuity 2000 Basic Mortality Table is a widely used actuarial tool that provides mortality rates for the United States population. It serves as a foundation for calculating premiums and benefits for annuities, life insurance, and other financial products. This table, developed by the Society of Actuaries (SOA), has been a cornerstone in the actuarial industry, reflecting the evolving life expectancies and mortality trends of the American population.

Purpose and Application

The primary purpose of the Annuity 2000 Basic Mortality Table is to provide a standardized set of mortality rates for use in actuarial calculations. These rates are essential for determining the probability of death at different ages and genders, which is crucial for pricing and managing financial risks associated with longevity.

The table is widely used by actuaries, insurance companies, and financial institutions for a range of applications, including:

- Calculating annuity premiums and benefits

- Pricing life insurance policies

- Evaluating the financial viability of pension plans

- Modeling longevity risk in financial planning

Understanding how annuities are taxed is crucial for planning your retirement. You can learn more about annuity taxation here: How Annuity Is Taxed 2024.

Historical Context and Significance

The Annuity 2000 Basic Mortality Table was developed in the late 1990s as a replacement for the 1980 Commissioners Standard Ordinary (CSO) Mortality Table. The development of the Annuity 2000 table was driven by several factors, including:

- Improvements in healthcare and medical technology

- Changes in lifestyle and health habits

- Increased life expectancies

The Annuity 2000 table reflects the significant improvements in mortality rates observed in the late 20th century. Its adoption marked a significant shift in actuarial practice, providing a more accurate representation of mortality trends for the new millennium.

Key Features and Characteristics

The Annuity 2000 Basic Mortality Table is characterized by several key features, including:

- Base Year:The table is based on mortality data from the 1990s.

- Age Groups:It covers mortality rates for ages 0 to 120.

- Gender Differentiation:The table includes separate mortality rates for males and females.

- Smoker/Non-Smoker Differentiation:The table includes adjustments for smokers and non-smokers, reflecting the impact of smoking on mortality.

- Actuarial Basis:The table is based on actuarial principles and methodologies, ensuring consistency and reliability.

Mortality Rates and Life Expectancy

The Annuity 2000 Basic Mortality Table provides a comprehensive view of mortality rates across different age groups and genders. This data is crucial for understanding the probability of death at various ages and for calculating life expectancies.

Analysis of Mortality Rates

The mortality rates presented in the Annuity 2000 Basic Mortality Table show a general trend of decreasing mortality rates with age. This trend reflects the improvements in healthcare and living conditions over time. However, the table also highlights significant differences in mortality rates between males and females, with females generally experiencing lower mortality rates at all ages.

Annuity is a popular retirement vehicle, and there are many resources available to help you understand how it works. You can learn more about it by checking out this article: Annuity Is A Voluntary Retirement Vehicle 2024.

This difference is attributed to various factors, including biological differences, lifestyle choices, and healthcare access.

Comparison of Mortality Rates

The Annuity 2000 Basic Mortality Table reveals a clear disparity in mortality rates between different age groups. Mortality rates are significantly higher for younger ages, particularly in the first few years of life. This is due to factors such as infant mortality and childhood diseases.

Some annuities allow for a single payment, while others require regular payments. This article explains more about single-payment annuities: Annuity Is Single Payment 2024.

As individuals age, mortality rates gradually decrease, reflecting the increased resilience and survivability of older age groups.

Factors Influencing Life Expectancy

The data presented in the Annuity 2000 Basic Mortality Table underscores the influence of various factors on life expectancy. These factors include:

- Healthcare:Improvements in healthcare access and medical technology have significantly contributed to increased life expectancies.

- Lifestyle:Factors such as diet, exercise, smoking, and alcohol consumption play a significant role in determining mortality rates and life expectancy.

- Genetics:Genetic predispositions can influence an individual’s susceptibility to certain diseases and their overall lifespan.

- Socioeconomic Factors:Factors such as income, education, and access to healthcare services can impact mortality rates and life expectancy.

There are a number of potential issues that can arise with annuities. You can learn more about these issues by reading this article: Annuity Issues 2024.

Applications in Financial Planning: Annuity 2000 Basic Mortality Table 2024

The Annuity 2000 Basic Mortality Table plays a vital role in financial planning, particularly for retirement and longevity. Its data is used by actuaries to calculate annuity premiums and benefits, ensuring that these products are priced appropriately and can meet the financial needs of individuals throughout their retirement years.

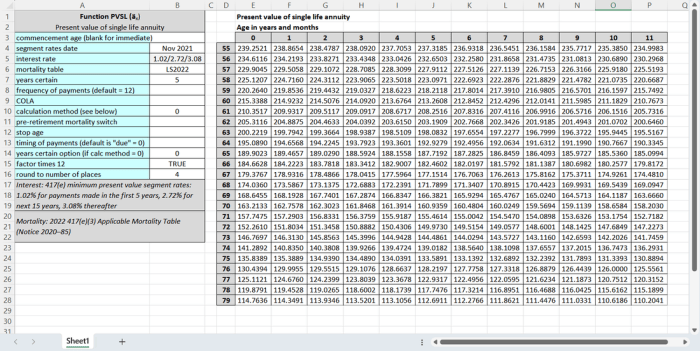

Actuarial Calculations for Annuities

The Annuity 2000 Basic Mortality Table is a cornerstone in actuarial calculations for annuities. Actuaries use the table’s mortality rates to determine the probability of an annuitant living to a certain age, which is crucial for calculating the present value of annuity payments.

The table’s data helps ensure that annuity premiums are sufficient to cover the expected payouts over the annuitant’s lifetime.

When deciding between an annuity and a drawdown, it’s important to weigh the pros and cons of each option. This article can help you make that decision: Is Annuity Better Than Drawdown 2024.

Determining Annuity Premiums and Benefits

The mortality rates presented in the Annuity 2000 Basic Mortality Table directly impact the pricing of annuities. Higher mortality rates generally lead to higher annuity premiums, as insurance companies need to charge more to cover the increased risk of early death.

If you’re interested in a career in the health field, annuities might be a good option for you. You can find more information about annuity health careers here: Annuity Health Careers 2024.

Conversely, lower mortality rates can result in lower premiums. The table’s data also plays a role in determining annuity benefits, as the expected payout period is influenced by the mortality rates.

It’s helpful to use an annuity value calculator to estimate the potential value of your annuity. You can find one here: Annuity Value Calculator 2024.

Impact on Financial Planning

The Annuity 2000 Basic Mortality Table has a significant impact on financial planning for retirement and longevity. The table’s data helps individuals and financial advisors understand the potential lifespan of retirees, allowing for more accurate planning for retirement income needs.

It also helps assess the adequacy of retirement savings and the need for longevity insurance to mitigate the risk of outliving one’s assets.

When researching annuity providers, it’s important to ensure they are legitimate. You can find information about Annuity Gator’s legitimacy in this article: Is Annuity Gator Legit 2024.

Comparison with Other Mortality Tables

The Annuity 2000 Basic Mortality Table is not the only mortality table used in actuarial calculations. Several other widely used tables, such as the 2001 CSO Mortality Table and the 2008 CSO Mortality Table, provide alternative mortality rates. Comparing these tables helps understand the evolution of mortality trends and the impact of different data sources on actuarial calculations.

If you’re looking for a qualified retirement plan, annuities might be a good option. This article can help you understand if an annuity fits your needs: Is An Annuity A Qualified Retirement Plan 2024.

Comparison with Other Mortality Tables

The Annuity 2000 Basic Mortality Table is often compared with other widely used mortality tables, such as the 2001 CSO Mortality Table and the 2008 CSO Mortality Table. These comparisons help understand the evolution of mortality trends and the impact of different data sources on actuarial calculations.

- 2001 CSO Mortality Table:This table, based on data from the early 2000s, reflects the continued improvements in mortality rates observed after the Annuity 2000 table was developed. It generally shows lower mortality rates compared to the Annuity 2000 table, particularly for older age groups.

- 2008 CSO Mortality Table:This table, based on data from the mid-2000s, reflects the continued decline in mortality rates and the impact of factors such as the opioid epidemic and obesity on mortality trends. It generally shows lower mortality rates compared to both the Annuity 2000 table and the 2001 CSO table, particularly for middle-aged adults.

Strengths and Weaknesses

Each mortality table has its strengths and weaknesses depending on the data source and the period it covers. For example, the Annuity 2000 Basic Mortality Table is considered a reliable and well-established table, but it may not fully reflect the latest mortality trends due to its base year of the 1990s.

While some annuities offer tax advantages, it’s important to know if they are fully exempt from taxes. You can learn more about tax exemption for annuities here: Is Annuity Exempt From Tax 2024.

The newer CSO tables may be more accurate in reflecting current mortality trends, but they are also subject to ongoing revisions and updates.

Impact on Actuarial Calculations and Financial Planning, Annuity 2000 Basic Mortality Table 2024

The differences between mortality tables can significantly impact actuarial calculations and financial planning. For example, using a mortality table with higher mortality rates can lead to higher annuity premiums or lower life insurance payouts. Conversely, using a table with lower mortality rates can result in lower premiums or higher payouts.

It is essential for actuaries and financial advisors to carefully select the appropriate mortality table based on the specific needs of the client and the available data.

Future Projections and Trends

Future demographic trends, such as an aging population and the increasing prevalence of chronic diseases, are expected to impact mortality rates and life expectancies. These trends will likely influence the use and relevance of the Annuity 2000 Basic Mortality Table in actuarial calculations and financial planning.

Impact of Future Demographic Trends

Future demographic trends, such as an aging population and the increasing prevalence of chronic diseases, are expected to impact mortality rates and life expectancies. These trends will likely influence the use and relevance of the Annuity 2000 Basic Mortality Table in actuarial calculations and financial planning.

A living annuity provides income during your lifetime, but it’s important to know if it’s taxable. You can find the answer to this question here: Is A Living Annuity Taxable 2024.

- Aging Population:As the population ages, the number of older individuals with higher mortality rates is expected to increase. This could lead to higher mortality rates overall and necessitate adjustments to mortality tables.

- Chronic Diseases:The increasing prevalence of chronic diseases, such as heart disease, cancer, and diabetes, is expected to impact mortality rates, particularly for older age groups.

To fully understand annuities, it’s important to know their definition. You can find a comprehensive definition here: Annuity Is Definition 2024.

- Healthcare Advancements:Continued advancements in healthcare and medical technology have the potential to further reduce mortality rates and increase life expectancies. However, these advancements may also lead to higher healthcare costs and potential changes in the distribution of mortality rates across age groups.

Implications for the Annuity 2000 Basic Mortality Table

The future demographic trends described above could have significant implications for the Annuity 2000 Basic Mortality Table. As mortality rates continue to evolve, the table may need to be updated or replaced with newer tables that better reflect current trends.

This would ensure the accuracy of actuarial calculations and the adequacy of financial planning for retirement and longevity.

Impact on Annuity Pricing and Financial Planning

Future changes in mortality rates could impact annuity pricing and financial planning. If mortality rates continue to decline, annuity premiums may decrease, as insurance companies face a lower risk of early death. However, if mortality rates increase, premiums may need to rise to compensate for the higher risk.

These changes in mortality rates could also affect the adequacy of retirement savings and the need for longevity insurance.

Ending Remarks

The Annuity 2000 Basic Mortality Table 2024 stands as a vital tool for financial professionals, individuals planning for retirement, and policymakers seeking to address the complexities of longevity and its impact on society. Its ongoing evolution and adaptation to emerging trends ensure its relevance in a rapidly changing world, empowering individuals to make informed decisions about their financial future.

If you’re looking for annuity health services in Westmont, Illinois, you can find more information about available options here: Annuity Health Westmont Il 2024.

Quick FAQs

How often is the Annuity 2000 Basic Mortality Table updated?

The Annuity 2000 Basic Mortality Table is typically updated every few years to reflect changes in mortality rates and demographic trends.

Is the Annuity 2000 Basic Mortality Table applicable to all populations?

While the table is widely used, it may not be universally applicable to all populations due to variations in mortality rates across different regions and demographics.

How can I access the Annuity 2000 Basic Mortality Table 2024?

The table is often available through actuarial societies, insurance companies, and financial institutions.