Annuity 250k 2024 presents a compelling opportunity to secure your retirement future. With a significant sum like $250,000, you can explore a range of annuity options, each offering unique features, potential growth, and risk profiles. This guide delves into the world of annuities, providing insights on how to choose the right option for your financial goals and risk tolerance.

Keeping track of your annuity payments and contributions is essential. Your annuity statement provides a detailed overview of your account activity, allowing you to monitor your financial progress.

We’ll cover various annuity types, including fixed, variable, and indexed annuities, and examine their advantages and disadvantages. Understanding the tax implications of annuities and exploring different investment strategies for your $250,000 will be crucial. By considering current market conditions and industry trends, we’ll help you make informed decisions about your annuity investment in 2024.

Many people wonder about the tax treatment of annuities. The good news is that in many cases, annuities are tax deferred , meaning you won’t have to pay taxes on the earnings until you start receiving payments.

Understanding Annuities

An annuity is a financial product that provides a stream of regular payments over a set period of time. It’s essentially a contract between you and an insurance company where you make a lump-sum payment or series of payments, and in return, the insurance company guarantees you a stream of income for a specific period.

Annuities can be a source of income during retirement. Understanding whether your annuity payments are considered annuity income is crucial for tax purposes.

This can be for a fixed duration, like 10 years, or for your entire life, making it a crucial tool for retirement planning.

If you’re planning for your long-term financial security, a joint and survivor annuity can provide peace of mind. This type of annuity ensures that payments continue even if one of the beneficiaries passes away.

Core Components of an Annuity, Annuity 250k 2024

The core components of an annuity are:

- Premium:The initial lump-sum payment or series of payments you make to purchase the annuity.

- Annuity Period:The duration for which you’ll receive regular payments. This can be fixed or for your lifetime.

- Payment Amount:The amount of money you’ll receive in each payment, which can be fixed or variable.

- Interest Rate:The rate of return you’ll earn on your premium, which can be fixed or variable.

Types of Annuities

Annuities come in different types, each with its own features and risks. The most common types include:

- Fixed Annuities:These provide a guaranteed rate of return on your premium and fixed, predictable payments for the duration of the annuity. They offer stability and security but may not keep up with inflation.

- Variable Annuities:These invest your premium in a variety of sub-accounts, like mutual funds. The payments you receive are tied to the performance of these investments, making them potentially higher but also riskier than fixed annuities.

- Indexed Annuities:These offer a guaranteed minimum return linked to a specific market index, like the S&P 500. They can provide some protection from market downturns while still allowing for potential growth.

Advantages and Disadvantages of Annuities for Retirement Planning

Annuities can be a valuable tool for retirement planning, offering advantages like:

- Guaranteed Income Stream:Fixed annuities provide predictable, guaranteed income, helping you plan for your future expenses.

- Tax-Deferred Growth:Annuity earnings grow tax-deferred, meaning you won’t pay taxes on them until you withdraw the money.

- Protection from Market Volatility:Fixed annuities offer protection from market downturns, providing stability and peace of mind.

However, they also come with disadvantages like:

- Limited Liquidity:Accessing your annuity funds before the annuity period can result in penalties.

- Fees and Expenses:Annuities often come with various fees, including surrender charges and administrative fees, which can eat into your returns.

- Potential for Low Returns:Fixed annuities may not keep up with inflation, resulting in lower returns over time.

Annuity Options for $250,000: Annuity 250k 2024

If you have $250,000 to invest in an annuity, you have several options available, each with its own features, benefits, and risks. Here’s a breakdown of some popular annuity options:

Comparing Annuity Options

The following table Artikels the key characteristics of different annuity types, providing a comparative overview of their features, potential growth, and fees:

| Annuity Type | Guaranteed Return | Potential Growth | Fees and Expenses |

|---|---|---|---|

| Fixed Annuity | Yes, fixed rate of return | Limited, based on guaranteed rate | Typically lower than variable annuities |

| Variable Annuity | No, returns tied to market performance | Higher potential growth, but also higher risk | Higher fees and expenses, including management fees |

| Indexed Annuity | Yes, minimum return linked to a market index | Potential growth tied to index performance, but with caps | Fees vary depending on the specific index and provider |

Annuity Investment Strategies

Investing $250,000 in an annuity requires careful consideration of your investment goals, risk tolerance, and time horizon. Here are some strategies to consider:

Diversification and Asset Allocation

Diversification is crucial for any investment portfolio, including annuities. It involves spreading your investment across different asset classes, such as stocks, bonds, and real estate. This helps to mitigate risk by reducing the impact of any single asset’s performance on your overall portfolio.

If you’re thinking about sharing an annuity with someone, understanding the details of annuity joint ownership is crucial. It’s important to consider the potential tax implications and how it affects both parties’ financial futures.

Asset allocation involves determining the percentage of your portfolio that should be invested in each asset class, based on your risk tolerance and time horizon.

If you’re interested in learning more about annuities in Hindi, you can find information about the annuity meaning in Hindi online. This can be helpful for understanding the concept in a language you’re familiar with.

Allocating Funds Within an Annuity

When allocating funds within an annuity, consider the following:

- Risk Tolerance:If you’re risk-averse, you may prefer a fixed annuity with a guaranteed return. If you’re comfortable with higher risk, a variable annuity could be a better choice.

- Time Horizon:If you have a long time horizon, you can afford to take on more risk. If you need income in the near term, a fixed annuity may be a better option.

For example, if you have a long time horizon and a high risk tolerance, you could allocate a larger portion of your $250,000 to a variable annuity with a diversified portfolio of stocks and bonds. If you have a short time horizon and a low risk tolerance, you might allocate a larger portion to a fixed annuity with a guaranteed return.

The term “annuity jackpot” is often used in the context of lotteries. Winning a annuity jackpot means receiving a large sum of money over a period of years, rather than a lump sum.

Tax Implications of Annuities

Understanding the tax implications of annuities is crucial for making informed investment decisions.

Calculating how long your annuity payments will last is essential. Thankfully, there are online tools like the annuity number of periods calculator to help you estimate the duration of your income stream.

Tax Treatment of Annuity Payments and Withdrawals

Annuity payments are generally taxed as ordinary income. However, the specific tax treatment depends on the type of annuity and how the money was withdrawn. For example, withdrawals from a traditional IRA annuity are taxed as ordinary income, while withdrawals from a Roth IRA annuity are tax-free.

The term “annuity” can be used in different contexts. For example, an annuity is term used to describe a type of insurance product that guarantees a specific period of payments.

Tax Advantages and Disadvantages of Different Annuity Types

Different annuity types have different tax implications. For example, fixed annuities generally offer tax-deferred growth, meaning you won’t pay taxes on your earnings until you withdraw the money. Variable annuities also offer tax-deferred growth, but withdrawals may be subject to capital gains taxes.

Deciding whether an annuity is a good investment depends on your individual financial situation and goals. There are pros and cons to consider, so it’s wise to research and compare different options before making a decision about whether an annuity is a good investment for you.

Comparing Tax Treatment of Annuities with Other Retirement Savings Options

Annuities are just one of many retirement savings options available. It’s important to compare the tax treatment of annuities with other options, such as 401(k)s, IRAs, and Roth IRAs, to determine which is best for your individual circumstances.

If you’re receiving an annuity from Life Insurance Corporation (LIC), it’s important to know whether the payments are taxable. The taxability of annuity received from LIC depends on various factors, so it’s best to consult with a financial advisor.

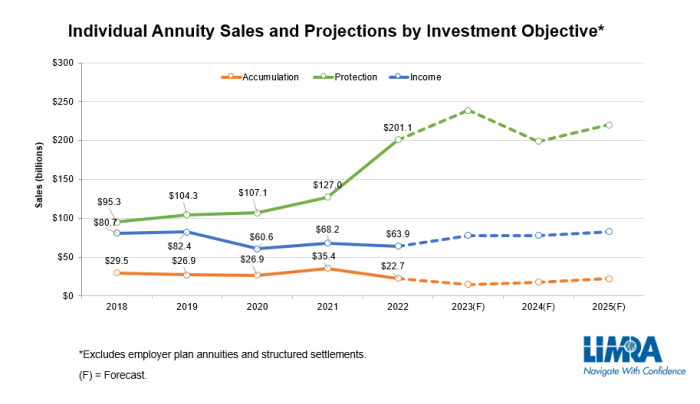

Annuity Considerations for 2024

The annuity market is constantly evolving, influenced by factors like interest rates, inflation, and regulatory changes. Here are some considerations for 2024:

Current Market Conditions and Their Impact on Annuity Investments

Interest rates and inflation are major factors influencing annuity investments. In a low-interest-rate environment, fixed annuities may offer lower returns. High inflation can erode the purchasing power of your annuity payments, making it essential to consider inflation-protected annuities or adjust your investment strategy accordingly.

When considering an annuity, it’s essential to understand how the death benefit is treated for tax purposes. While the details can vary, it’s important to know if the annuity death benefit is taxable to avoid surprises.

Regulatory Changes and Industry Trends Affecting Annuities in 2024

Keep an eye on any regulatory changes or industry trends that could impact annuities in 2024. For example, changes to tax laws or new regulations regarding annuity products could affect your investment decisions.

An annuity is a financial product designed to provide a consistent income stream. In essence, an annuity is a series of equal periodic payments that can be a valuable source of retirement income.

Choosing an Annuity Provider

Choosing the right annuity provider is crucial. Look for a financially stable company with a strong track record and excellent customer service. Consider factors like:

- Financial Stability:Check the company’s financial ratings and ensure they have a strong track record.

- Customer Service:Read reviews and testimonials from other customers to get an idea of the company’s customer service quality.

- Product Offerings:Make sure the company offers the types of annuities you’re interested in and that the products meet your specific needs.

Last Word

Securing your financial future through an annuity requires careful consideration and planning. By understanding the different annuity options available, their potential benefits and risks, and the tax implications involved, you can make an informed decision that aligns with your retirement goals.

Remember, consulting with a financial advisor can provide personalized guidance and help you navigate the complexities of annuity investments.

Common Queries

What is the minimum investment amount for an annuity?

The minimum investment amount for an annuity varies depending on the provider and the specific annuity type. Some annuities may have a minimum investment of $1,000 or $5,000, while others may require a larger initial investment.

Are annuity payments guaranteed?

The guarantee of annuity payments depends on the type of annuity. Fixed annuities typically offer guaranteed payments for life, while variable and indexed annuities do not guarantee a specific return.

How are annuities taxed?

Annuities are taxed as ordinary income when you receive payments. The amount of tax you pay depends on your tax bracket and the type of annuity you have.

When you purchase an annuity, you’re entering into a contract with an insurance company. The annuity contract outlines the terms of your agreement, including payment amounts, duration, and other important details.

An annuity fund is a pool of money that is used to pay out annuity benefits. The fund is managed by the insurance company and is invested in a variety of assets to generate returns.