Cigna Severance 2024: Frequently Asked Questions provides essential information for employees navigating the severance process. This guide covers crucial aspects of Cigna’s severance package, including eligibility criteria, benefit calculations, health insurance options, outplacement services, and legal considerations. Understanding these details can help you make informed decisions and ensure a smoother transition during this time.

Learn about more about the process of Understanding Non-Disparagement Agreements in Cigna Severance Packages (2024) in the field.

Whether you’re facing an involuntary separation or a planned departure, knowing your rights and options is paramount. This resource aims to clarify the process and empower you with the knowledge you need to confidently navigate the next chapter of your career.

Cigna Severance Overview

Cigna’s severance package is designed to provide financial and practical support to employees who are involuntarily separated from the company. The package aims to help these individuals navigate the transition period and find new employment opportunities.

Examine how Negotiating Your Cigna Severance Package in 2024: Tips and Strategies can boost performance in your area.

Eligibility Criteria

The eligibility criteria for receiving severance benefits vary depending on factors such as length of service, job position, and the circumstances surrounding the separation. Generally, eligible employees may include those who are laid off, terminated without cause, or voluntarily resign under certain circumstances.

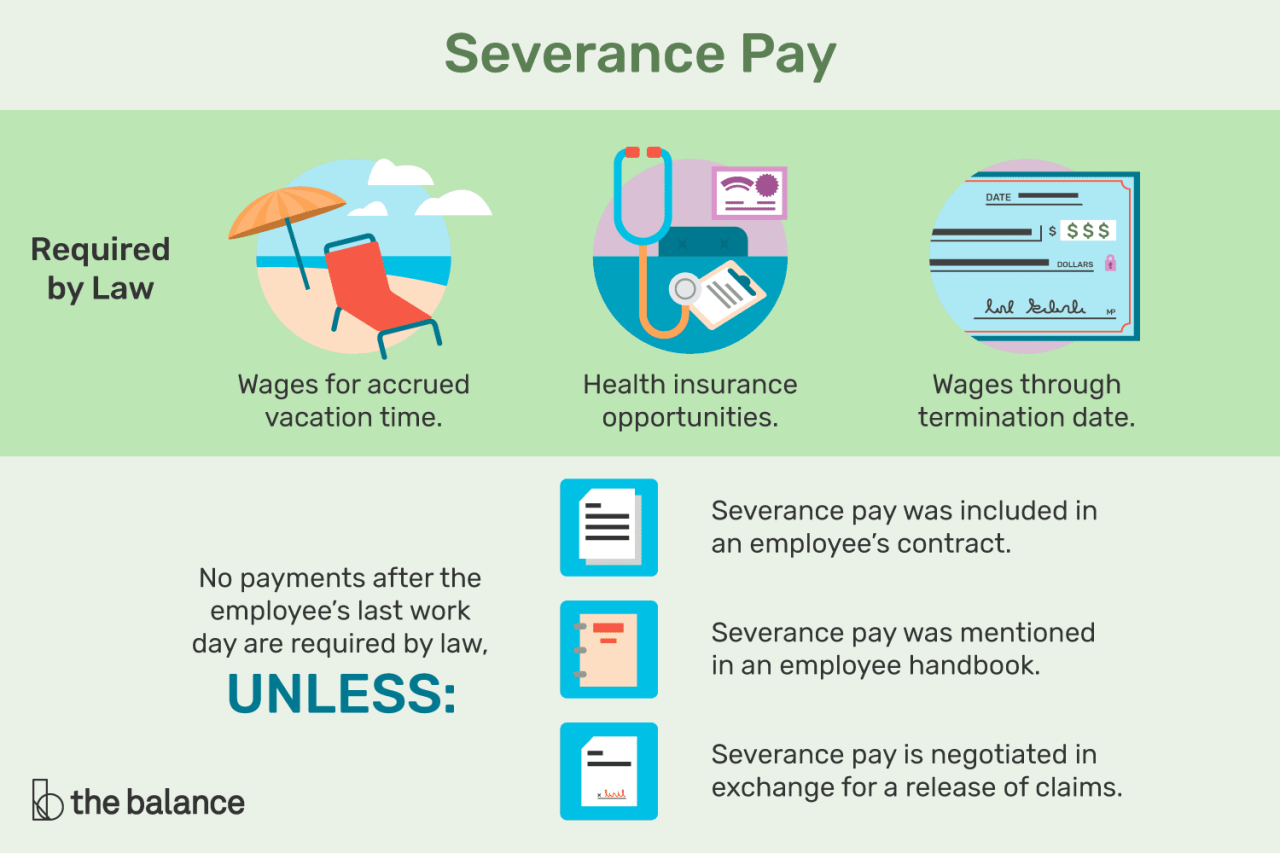

Types of Severance Benefits

- Salary Continuation:This benefit provides a continuation of a portion of the employee’s salary for a specified period, offering financial stability during the job search.

- Health Insurance:Cigna offers options for continuing health insurance coverage after separation, such as COBRA continuation or other health insurance plans.

- Outplacement Services:Cigna provides outplacement services to assist separated employees in their job search, including career counseling, resume writing, and interview preparation.

Severance Calculation and Payment

The severance pay amount is calculated based on a formula that considers factors such as length of service, job position, and company performance. The calculation may also take into account the employee’s salary and benefits package.

Factors Considered

- Length of Service:Generally, employees with longer tenure receive a higher severance pay amount.

- Job Position:Senior-level positions may have different severance pay structures compared to entry-level roles.

- Company Performance:In some cases, the company’s financial performance may influence the severance pay amount.

Payment Schedule and Timeframe

Severance pay is typically paid in a lump sum or in installments, depending on Cigna’s policies. The payment schedule and timeframe for receiving severance benefits will be Artikeld in the severance agreement.

Remember to click Calculating Your Cigna Severance Pay in 2024: Factors That Influence the Amount to understand more comprehensive aspects of the Calculating Your Cigna Severance Pay in 2024: Factors That Influence the Amount topic.

Health Insurance Coverage

Cigna offers several options for continuing health insurance coverage after separation. These options provide employees with the flexibility to maintain health insurance coverage during the transition period.

Browse the implementation of Understanding Confidentiality Agreements in Cigna Severance Packages (2024) in real-world situations to understand its applications.

COBRA Coverage

COBRA (Consolidated Omnibus Budget Reconciliation Act) allows eligible employees to continue their group health insurance coverage for a limited time after separation. The cost of COBRA coverage is generally higher than the cost of coverage while employed, as the employee is responsible for paying the full premium.

Other Health Insurance Options

Cigna may offer other health insurance options, such as individual health insurance plans or short-term health insurance policies. These options may be more affordable than COBRA coverage, but they may have different coverage limitations and requirements.

Outplacement Services

Cigna’s outplacement services are designed to help separated employees transition smoothly into new employment opportunities. These services provide valuable resources and support to help individuals navigate the job search process.

Purpose and Benefits

- Career Counseling:Outplacement services include career counseling sessions to help individuals assess their skills, identify career goals, and develop a job search strategy.

- Resume Writing and Interview Preparation:Outplacement providers offer assistance with resume writing, cover letter development, and interview preparation techniques.

- Job Search Support:Outplacement services provide access to job boards, networking opportunities, and other resources to support the job search process.

Resources and Support, Cigna Severance 2024: Frequently Asked Questions

Cigna’s outplacement program may include access to online resources, workshops, and individual coaching sessions. These resources provide valuable guidance and support to help separated employees navigate the job search process and secure new employment opportunities.

Find out further about the benefits of Cigna Severance Benefits 2024: Healthcare Continuation, Outplacement, and More that can provide significant benefits.

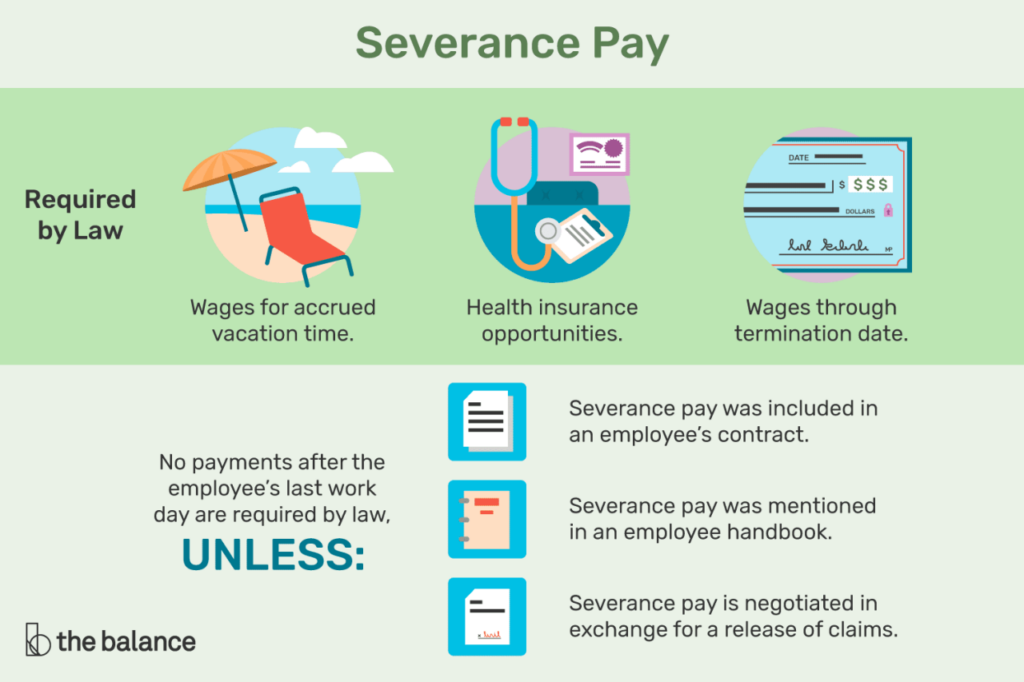

Legal and Tax Considerations

Severance packages are subject to legal and tax implications. It is important to understand these aspects to ensure that you are maximizing your benefits and complying with relevant laws and regulations.

Find out about how Cigna Severance and Stock Options 2024: What Happens to Your Equity can deliver the best answers for your issues.

Legal Implications

Severance packages are governed by employment laws, which vary by state and jurisdiction. It is advisable to consult with an attorney to understand your rights and obligations regarding severance benefits.

Tax Implications

Severance pay is generally taxable income. You may be able to deduct certain expenses related to your job search, such as resume writing and travel costs, from your taxable income. Consult with a tax professional for guidance on the tax implications of your severance benefits.

Seeking Legal or Tax Advice

It is recommended to seek legal or tax advice from qualified professionals to ensure that you are fully informed about the legal and tax implications of your severance package.

Understand how the union of Cigna Severance and Retirement Plan Options (2024) can improve efficiency and productivity.

Additional Information

For detailed information about Cigna’s severance policies, please refer to your employee handbook or contact your HR representative.

Cigna Severance Package Summary

| Feature | Description | Eligibility | Notes |

|---|---|---|---|

| Salary Continuation | Continuation of a portion of salary for a specified period. | Varies based on length of service, job position, and circumstances of separation. | The amount and duration of salary continuation are determined by Cigna’s policies. |

| Health Insurance | Options for continuing health insurance coverage after separation, including COBRA and other plans. | Varies based on eligibility requirements and plan specifics. | COBRA coverage is generally more expensive than employer-sponsored coverage. |

| Outplacement Services | Career counseling, resume writing, interview preparation, and job search support. | Available to eligible employees who are separated from Cigna. | The specific services offered may vary based on Cigna’s outplacement program. |

| Severance Pay | Financial compensation provided to employees upon separation. | Varies based on factors such as length of service, job position, and company performance. | The amount and payment schedule are determined by Cigna’s policies. |

Closing Summary: Cigna Severance 2024: Frequently Asked Questions

Navigating a severance situation can be complex, but with clear understanding and proper planning, you can approach the transition with confidence. By utilizing the resources provided in this guide and seeking further assistance when needed, you can ensure a smooth and successful transition to your next opportunity.

Popular Questions

What is the purpose of Cigna’s severance package in 2024?

For descriptions on additional topics like Severance Pay Taxation in 2024: What Cigna Employees Need to Know, please visit the available Severance Pay Taxation in 2024: What Cigna Employees Need to Know.

Cigna’s severance package is designed to provide financial and support services to employees who are involuntarily separated from the company. It aims to help employees transition smoothly to new opportunities and minimize disruption during this time.

How is severance pay calculated?

Severance pay is typically calculated based on factors such as length of service, job position, and company performance. The specific formula used may vary depending on individual circumstances.

You also will receive the benefits of visiting Decoding Your Cigna Severance Agreement: Key Terms and Clauses (2024) today.

What are the different types of severance benefits offered?

Cigna’s severance package may include various benefits, such as salary continuation, health insurance continuation, outplacement services, and legal and tax advice. The specific benefits offered may vary based on individual circumstances.

How long does it take to receive severance pay?

The payment schedule for severance benefits will be Artikeld in the severance agreement. Typically, payments are made in installments over a set period, but the specific timeframe may vary.

When investigating detailed guidance, check out Seeking Legal Advice for Your Cigna Severance Agreement (2024) now.

What are the tax implications of severance pay?

Severance pay is generally considered taxable income. However, certain deductions may be available depending on the specific circumstances. It is essential to consult with a tax professional for personalized advice.