Annuity Value Calculator 2024 is your comprehensive guide to understanding and utilizing these powerful tools for retirement planning. Annuities are financial products designed to provide a steady stream of income during your golden years, and an annuity value calculator can help you determine the best options for your specific needs and goals.

To calculate the present value of an annuity, you might need a tool to help you. Annuity Npv Calculator 2024 provides a convenient calculator for this purpose.

This guide will delve into the intricacies of annuity value calculators, explaining their functionality, key factors affecting their calculations, and the benefits of using them. We’ll explore how to choose the right calculator, understand the different types of annuities, and make informed decisions for your financial future.

If you’re in India, understanding the tax implications of annuities is crucial. Is Annuity Taxable In India 2024 provides insights into the tax treatment of annuities in India.

What is an Annuity Value Calculator?: Annuity Value Calculator 2024

An annuity value calculator is a handy tool that helps you estimate the present or future value of an annuity. It’s like a financial crystal ball, giving you insights into how much your annuity payments will be worth over time.

When considering an annuity, you might be wondering if it’s a guaranteed source of income. Is Annuity Certain 2024 addresses this question and helps you understand the guarantees associated with different types of annuities.

Defining an Annuity Value Calculator

An annuity value calculator is a financial tool that allows you to determine the present or future value of a stream of payments. It takes into account factors like interest rates, payment frequency, and the duration of the annuity.

Who provides annuities? Annuity Is Given By 2024 explores the various entities that offer annuity products.

Purpose and Functionality

The main purpose of an annuity value calculator is to provide you with a clear understanding of the financial implications of an annuity. It can help you:

- Compare different annuity options and choose the one that best suits your needs.

- Estimate the amount of income you will receive from an annuity.

- Determine the present value of an annuity, which can be helpful for investment decisions.

- Plan for retirement and ensure you have sufficient income to cover your expenses.

Types of Annuities

There are several types of annuities, each with its own unique characteristics and features. Some common types include:

- Fixed Annuities:These provide guaranteed payments for a specific period, with the interest rate fixed for the duration of the annuity.

- Variable Annuities:These offer payments that fluctuate based on the performance of underlying investments. They have the potential for higher returns but also carry greater risk.

- Immediate Annuities:Payments begin immediately after the annuity is purchased.

- Deferred Annuities:Payments are delayed for a specific period, allowing the investment to grow before income starts.

Real-World Scenarios

Annuity value calculators can be valuable in various real-world scenarios:

- Retirement Planning:Calculating the present value of an annuity can help you determine how much you need to save to achieve your retirement goals.

- Investment Decisions:Comparing the present value of different annuity options can guide your investment choices.

- Estate Planning:Annuities can be used to provide a steady stream of income for beneficiaries after your passing.

Key Factors Affecting Annuity Value

The value of an annuity is influenced by several key factors. Understanding these factors is crucial for making informed decisions about your annuity.

If you’re looking to learn more about annuities in the UK, Annuity Quotes Uk 2024 provides valuable information about available options and how to get quotes.

Interest Rates

Interest rates play a significant role in determining annuity payments. Higher interest rates generally result in higher annuity payments, as the principal amount grows faster over time.

Inflation

Inflation erodes the purchasing power of money over time. Annuity calculations often take inflation into account to ensure that payments keep pace with the rising cost of living.

The concept of annuities can be a bit complex, so you might be looking for a simpler explanation. Annuity Meaning In Hindi 2024 offers a clear and concise explanation in Hindi.

Annuity Term (Duration)

The length of the annuity term significantly impacts the total amount of payments received. Longer annuity terms typically result in lower individual payments but a higher overall payout.

Annuity payments are often considered a form of insurance, but it’s important to clarify their nature. Is Annuity Insurance 2024 examines the relationship between annuities and insurance.

Using an Annuity Value Calculator

Using an annuity value calculator is a straightforward process. Here’s a step-by-step guide:

Steps Involved, Annuity Value Calculator 2024

- Choose an Annuity Calculator:There are numerous online and offline calculators available. Consider factors like ease of use, features, and accuracy.

- Input Data:Enter the relevant information, including the annuity amount, interest rate, payment frequency, and duration.

- Calculate:Click the “Calculate” button to generate the present or future value of the annuity.

- Review Results:Analyze the results and compare different annuity options to make informed decisions.

Choosing the Right Calculator

When selecting an annuity calculator, consider the following factors:

- Features:Ensure the calculator offers the features you need, such as the ability to calculate present and future values, adjust for inflation, and compare different annuity types.

- Accuracy:Look for calculators that use reliable formulas and provide accurate results.

- Ease of Use:Choose a calculator with a user-friendly interface and clear instructions.

Popular Annuity Calculators

| Calculator | Features | Pros | Cons |

|---|---|---|---|

| Calculator A | Present value, future value, inflation adjustment, various annuity types | Comprehensive features, user-friendly interface | Limited customization options |

| Calculator B | Present value, future value, interest rate sensitivity analysis | Accurate calculations, detailed results | May require some financial knowledge |

| Calculator C | Simple present value and future value calculations | Easy to use, quick results | Limited features, no inflation adjustment |

Understanding Annuity Value Calculations

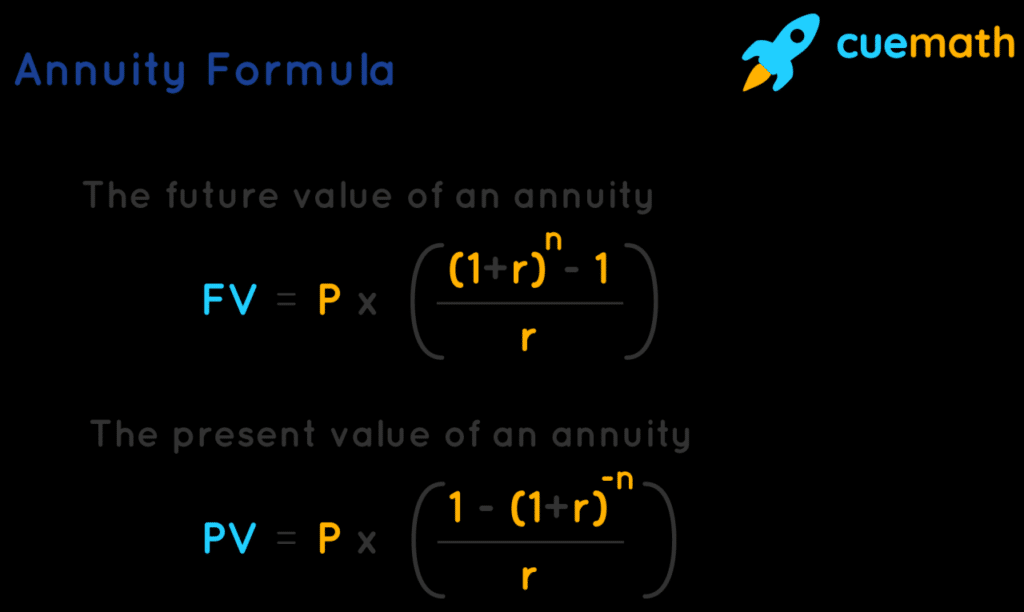

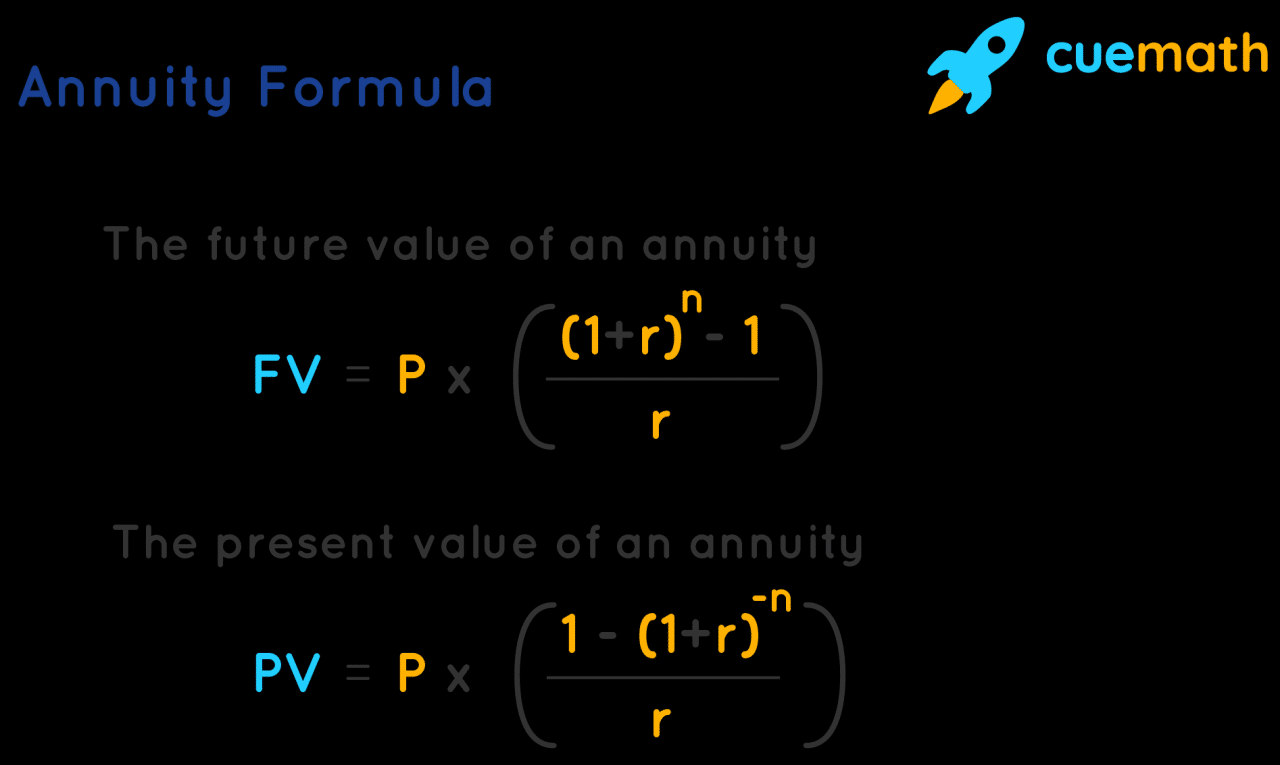

Annuity value calculations involve determining the present or future value of a series of payments. Here’s a brief explanation of the formulas used:

Present Value of an Annuity

Present Value = Payment Amount x [1

Annuity payments can provide a steady stream of income, but how do they differ from pensions? Annuity Vs Pension 2024 breaks down the key differences and helps you understand which option might be best for your situation.

(1 + Interest Rate)^-Number of Payments] / Interest Rate

This formula calculates the present value of an annuity by discounting future payments back to their current worth.

For a more in-depth understanding of annuities, Annuity Khan Academy 2024 provides educational resources and videos.

Future Value of an Annuity

Future Value = Payment Amount x [(1 + Interest Rate)^Number of Payments

1] / Interest Rate

If you’re planning for retirement, understanding annuities can be crucial. You might be wondering, “Is an annuity a good investment?” Is Annuity Good Investment 2024 explores the pros and cons to help you decide.

This formula calculates the future value of an annuity by compounding the payments forward to their value at a future point in time.

The specific date of an annuity payment can be important. Annuity Date Is 2024 provides information about the timing of annuity payments.

Annuity Types

| Annuity Type | Features | Benefits |

|---|---|---|

| Fixed Annuity | Guaranteed payments, fixed interest rate | Predictable income stream, low risk |

| Variable Annuity | Payments based on investment performance, potential for higher returns | Growth potential, flexibility |

| Immediate Annuity | Payments begin immediately | Quick income stream, ideal for immediate needs |

| Deferred Annuity | Payments delayed for a specific period | Time for investment growth, potential for higher future payments |

Benefits of Using an Annuity Value Calculator

Annuity value calculators offer numerous benefits, empowering you to make informed financial decisions.

Annuity payments can be a source of income for an extended period. Annuity Is Indefinite Duration 2024 discusses the potential duration of annuity payments.

Informed Decisions

By providing accurate calculations and insights, annuity calculators help you compare different options and choose the annuity that aligns with your financial goals.

Enhanced Financial Planning

Annuity calculators can be integrated into your overall financial planning process, allowing you to estimate future income streams and adjust your investment strategies accordingly.

Retirement Planning

Annuity calculators are essential tools for retirement planning, helping you determine the amount of income you can expect from an annuity and ensure a comfortable retirement.

For those seeking a deeper understanding, Annuity Explained 2024 provides a comprehensive overview of annuity concepts. It’s a great resource for those looking to learn more about the different types of annuities and how they work.

Risk Assessment

By analyzing the present and future value of annuities, calculators can help you assess the potential risks and rewards associated with different annuity options.

When researching annuities, you might have some specific questions. Annuity Questions 2024 addresses common questions about annuities.

Considerations for Choosing an Annuity

Choosing the right annuity is a crucial decision that requires careful consideration. Here are some factors to keep in mind:

Factors to Consider

- Your Financial Goals:What are you hoping to achieve with an annuity? Are you seeking guaranteed income, growth potential, or a combination of both?

- Risk Tolerance:How comfortable are you with investment risk? Fixed annuities offer lower risk but potentially lower returns, while variable annuities have the potential for higher returns but also carry greater risk.

- Time Horizon:How long do you need the annuity payments to last? This will influence the type of annuity you choose and the payment amount.

- Fees and Charges:Compare the fees associated with different annuities to ensure you’re getting a good value for your investment.

Pros and Cons of Different Annuity Options

| Annuity Type | Pros | Cons |

|---|---|---|

| Fixed Annuity | Guaranteed payments, predictable income, low risk | Lower potential returns, limited growth potential |

| Variable Annuity | Potential for higher returns, investment flexibility | Higher risk, payments can fluctuate |

| Immediate Annuity | Quick income stream, ideal for immediate needs | Lower potential returns, limited growth potential |

| Deferred Annuity | Time for investment growth, potential for higher future payments | Delayed income stream, may not be suitable for immediate needs |

Consulting with a Financial Advisor

It’s always wise to consult with a qualified financial advisor before making any decisions about annuities. They can provide personalized advice based on your individual circumstances and financial goals.

Checklist

- Understand the different types of annuities available.

- Compare the fees and charges associated with different options.

- Assess your risk tolerance and time horizon.

- Consider your financial goals and how an annuity can help you achieve them.

- Consult with a financial advisor for personalized guidance.

Closure

By understanding the fundamentals of annuity value calculators and utilizing their capabilities, you can gain valuable insights into your retirement planning options. Whether you’re just starting to think about retirement or are nearing the end of your working years, an annuity value calculator can be a powerful tool for ensuring a secure and comfortable future.

Questions and Answers

What is the difference between a fixed and variable annuity?

A fixed annuity offers a guaranteed rate of return, while a variable annuity’s return is tied to the performance of underlying investments.

How do I find a reputable annuity value calculator?

Look for calculators from well-known financial institutions, insurance companies, or reputable financial websites. Consider factors like user-friendliness, features, and accuracy.

Can I use an annuity value calculator without consulting a financial advisor?

While calculators can be helpful, it’s always advisable to consult a financial advisor to discuss your specific needs and make informed decisions about your retirement planning.