November 2024 CPI and Geopolitical Risks: Assessing the Impact, the upcoming CPI report holds significant weight in the economic landscape. The November 2024 CPI report will reveal crucial insights into inflation trends, providing a snapshot of the economic health of the nation.

Amidst a complex geopolitical environment, understanding the potential impact of global events on consumer prices is essential for businesses, investors, and policymakers alike.

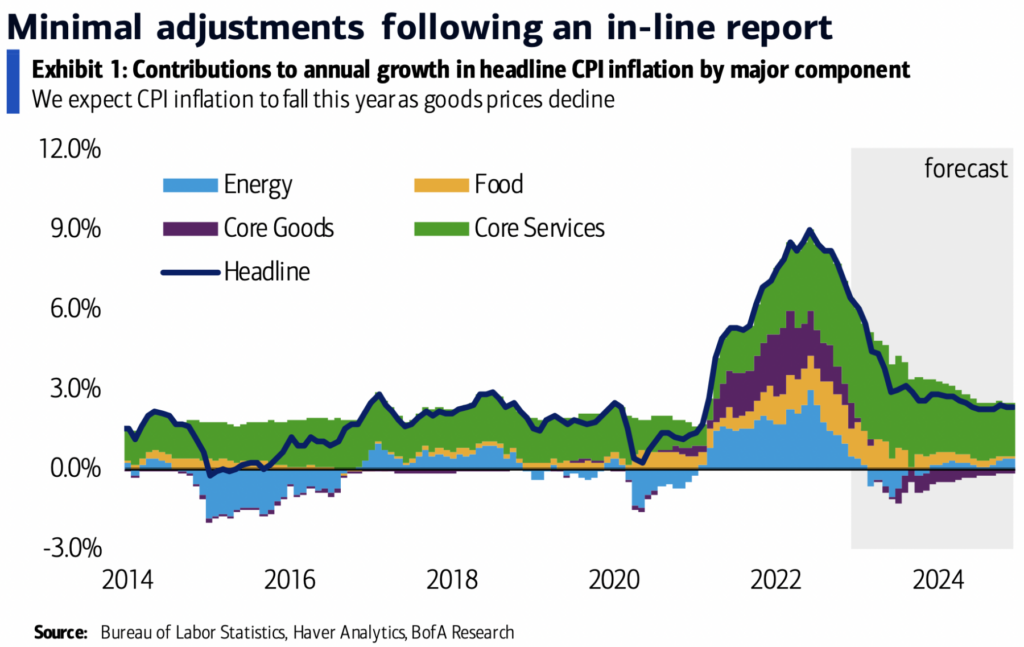

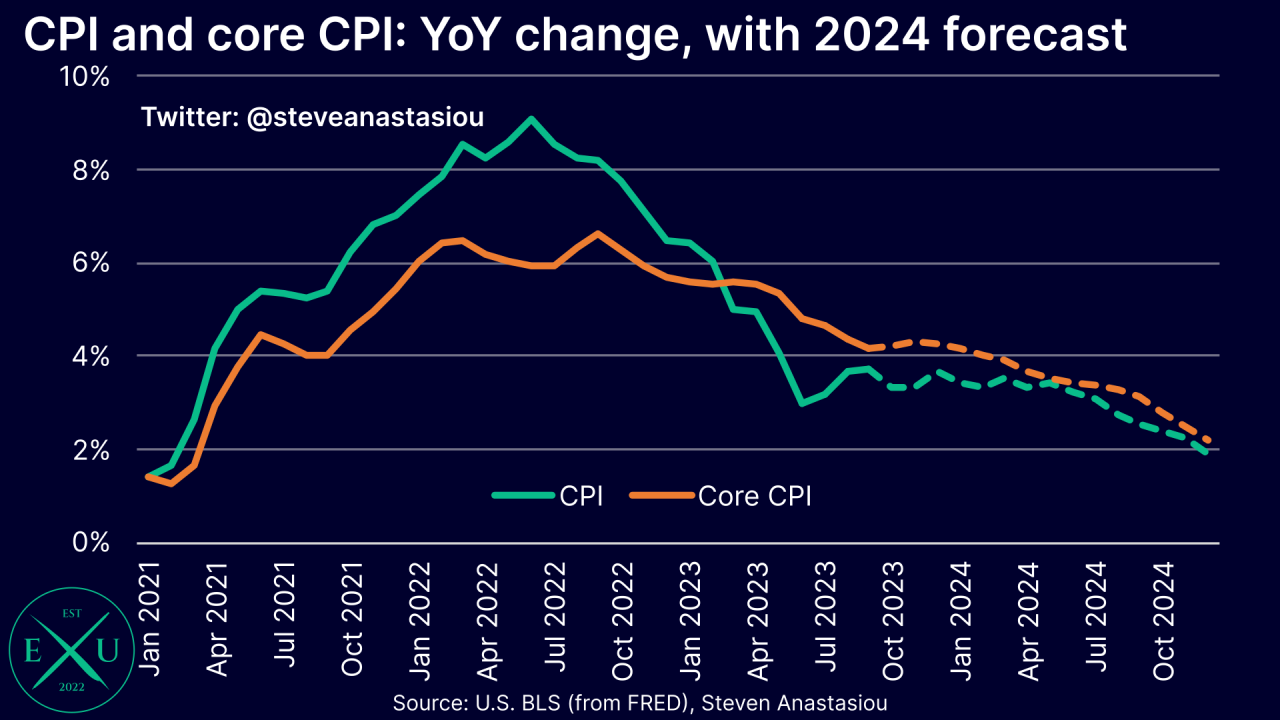

The report will delve into the intricate interplay of economic factors, examining the influence of energy prices, food costs, and housing inflation on the overall CPI. Furthermore, it will shed light on the role of geopolitical risks, such as international conflicts and supply chain disruptions, in shaping inflation trends.

This analysis will provide valuable insights into the potential consequences of these risks on monetary policy decisions, investor sentiment, and consumer spending.

For descriptions on additional topics like The Future of Interest Rates in a Changing CPI Landscape After November 2024, please visit the available The Future of Interest Rates in a Changing CPI Landscape After November 2024.

Understanding the November 2024 CPI

The November 2024 Consumer Price Index (CPI) report will be a crucial indicator of inflation trends and their impact on the US economy. This report will provide insights into the price changes of a basket of consumer goods and services, offering a snapshot of the overall inflation picture.

Check CPI and PCE in a Changing Economy in November 2024 to inspect complete evaluations and testimonials from users.

Key Factors Influencing the November 2024 CPI, November 2024 CPI and Geopolitical Risks: Assessing the Impact

Several factors will likely influence the November 2024 CPI, including:

- Energy Prices:Fluctuations in oil and gas prices, driven by global supply and demand dynamics, will significantly impact energy costs and overall inflation.

- Food Costs:Global food prices, affected by factors like weather patterns, supply chain disruptions, and geopolitical events, will influence food inflation.

- Housing Inflation:Rent and home prices are major components of the CPI. Housing inflation is influenced by factors such as interest rates, housing supply, and demand.

Comparison with Previous Months and Year-over-Year Change

The November 2024 CPI will be compared to the previous month’s CPI to assess the month-over-month inflation rate. It will also be compared to the CPI from November 2023 to determine the year-over-year inflation rate. This comparison will provide insights into the direction and magnitude of inflation.

Explore the different advantages of Reconciling Differences Between CPI and PCE in November 2024 that can change the way you view this issue.

Geopolitical Risks and Their Impact on the November 2024 CPI

Geopolitical risks can significantly impact global economies and influence inflation.

Major Geopolitical Risks

Several geopolitical risks could affect the November 2024 CPI, including:

- International Conflicts:Ongoing conflicts or potential outbreaks can disrupt global supply chains, increase commodity prices, and contribute to inflation.

- Global Supply Chain Disruptions:Disruptions to global supply chains, such as those caused by natural disasters, political instability, or trade wars, can lead to shortages and price increases.

- Sanctions and Trade Disputes:Imposing sanctions or engaging in trade disputes can disrupt global trade flows, leading to price volatility and inflation.

Historical Examples

Historically, geopolitical events have significantly impacted consumer prices. For example, the 1973 oil crisis, triggered by the Arab-Israeli War, led to a sharp increase in oil prices and contributed to a surge in inflation globally. The 2022 Russian invasion of Ukraine also disrupted global energy and food markets, contributing to rising inflation.

Analyzing the Potential Impact of the November 2024 CPI: November 2024 CPI And Geopolitical Risks: Assessing The Impact

The November 2024 CPI report will have significant implications for various aspects of the economy.

Monetary Policy Decisions

The CPI data will be a key factor in the Federal Reserve’s decision-making regarding interest rates. High inflation might prompt the Fed to raise interest rates to curb price increases, while low inflation could lead to maintaining or lowering interest rates.

Explore the different advantages of CPI and the Sharing Economy in November 2024 that can change the way you view this issue.

Investor Sentiment and Market Volatility

The CPI report can influence investor sentiment and market volatility. A higher-than-expected CPI reading could lead to concerns about inflation, potentially causing a sell-off in the stock market. Conversely, a lower-than-expected CPI could boost investor confidence and support stock prices.

Discover more by delving into Inflation and Business Decisions in November 2024 further.

Consumer Spending and Economic Growth

Inflation impacts consumer spending and economic growth. High inflation can erode purchasing power, leading to decreased consumer spending. This can negatively impact economic growth. Conversely, low inflation can boost consumer confidence and spending, contributing to economic expansion.

Strategies for Managing Geopolitical Risks

Businesses and governments can implement various strategies to mitigate the impact of geopolitical risks on inflation.

Further details about CPI and Globalization in November 2024: Impact on Wages is accessible to provide you additional insights.

Strategies for Mitigating Geopolitical Risks

| Strategy | Description | Benefits | Challenges |

|---|---|---|---|

| Diversifying Supply Chains | Expanding supply chains to include multiple sources for raw materials and finished goods | Reduces reliance on single suppliers, minimizing disruptions | Increased complexity, higher costs, potential for logistical challenges |

| Hedging Against Currency Fluctuations | Using financial instruments to protect against adverse currency movements | Reduces exposure to currency risks, stabilizes prices | Requires expertise in financial markets, potential for losses if hedging strategies are not effective |

| Strengthening International Cooperation | Promoting collaboration between countries to address global challenges | Enhances stability, fosters trust, facilitates trade and investment | Requires political will, potential for disagreements and conflicts of interest |

Historical Perspectives on CPI and Geopolitical Events

Historical examples demonstrate the impact of geopolitical events on consumer price indices.

Impact of Geopolitical Events on CPI

A timeline illustrating the relationship between geopolitical risks and CPI data can provide valuable insights:

- 1973 Oil Crisis:The Arab-Israeli War and subsequent oil embargo led to a sharp increase in oil prices, contributing to a surge in inflation in the 1970s.

- 1991 Gulf War:The Gulf War caused oil prices to spike, contributing to a temporary increase in inflation.

- 2008 Global Financial Crisis:The financial crisis led to a decline in consumer spending and economic activity, resulting in a temporary decrease in inflation.

- 2022 Russian Invasion of Ukraine:The invasion disrupted global energy and food markets, contributing to rising inflation worldwide.

These historical examples highlight the significant influence of geopolitical events on consumer prices and economic growth. By understanding these historical patterns, policymakers and businesses can better prepare for and mitigate the impact of future geopolitical risks on inflation.

Check what professionals state about November 2024 CPI: A Turning Point for Interest Rates? and its benefits for the industry.

Final Thoughts

The November 2024 CPI report, coupled with an assessment of geopolitical risks, offers a comprehensive view of the economic landscape. The report’s findings will provide critical information for businesses, investors, and policymakers to navigate the complexities of inflation and geopolitical uncertainties.

Obtain recommendations related to CPI and the Service Sector in November 2024 that can assist you today.

By understanding the interplay of these factors, stakeholders can make informed decisions to mitigate potential risks and capitalize on emerging opportunities. The report will undoubtedly serve as a crucial reference point for navigating the economic challenges and opportunities that lie ahead.

When investigating detailed guidance, check out CPI and the Unemployment Rate in November 2024 now.

FAQ Section

What is the CPI and why is it important?

You also will receive the benefits of visiting CPI and Household Furnishings Costs in November 2024 today.

The Consumer Price Index (CPI) measures changes in the prices of goods and services purchased by urban consumers. It is a key indicator of inflation, providing insights into the cost of living and the overall health of the economy.

How often is the CPI released?

The CPI is released monthly by the Bureau of Labor Statistics (BLS).

What are some of the major geopolitical risks that could impact the November 2024 CPI?

Some of the major geopolitical risks that could impact the November 2024 CPI include international conflicts, global supply chain disruptions, and political instability in key commodity-producing regions.