November 2024 CPI and Retirement Planning: Protecting Your Savings is a critical topic for anyone nearing retirement or already enjoying their golden years. Inflation is a silent thief, eroding the value of our hard-earned savings over time. Understanding how the Consumer Price Index (CPI) impacts our retirement plans is crucial to safeguarding our financial future.

Obtain recommendations related to November 2024 CPI and Long-Term Interest Rates: What to Expect that can assist you today.

This article delves into the potential impact of the November 2024 CPI on retirement planning, exploring strategies to mitigate inflation’s effects and ensure our savings last throughout our retirement years.

Obtain direct knowledge about the efficiency of Deflation: Causes and Effects in November 2024 (if applicable) through case studies.

The November 2024 CPI, a key indicator of inflation, will be closely watched by retirees and those approaching retirement. While predicting the future is impossible, analyzing potential scenarios and implementing proactive strategies can help us navigate the uncertainties of a volatile economy.

You also will receive the benefits of visiting The CPI Basket of Goods and Services in November 2024: What’s Included? today.

This article examines various factors that could influence the CPI in November 2024, including economic growth, energy prices, and supply chain disruptions. We’ll also explore strategies for protecting our retirement savings, from adjusting investment portfolios to exploring alternative investments.

Finish your research with information from Inflation Expectations and Interest Rates in November 2024.

Understanding the CPI and its Impact on Retirement Planning

The Consumer Price Index (CPI) is a vital economic indicator that tracks the average change in prices paid by urban consumers for a basket of consumer goods and services. It serves as a key gauge of inflation, which is the rate at which the prices of goods and services rise over time.

Inflation can significantly impact retirement planning, as it erodes the purchasing power of savings and investments.

Enhance your insight with the methods and methods of CPI and the Global Interest Rate Environment in November 2024.

How Inflation Affects Retirement Savings

Inflation directly impacts retirement savings by reducing the real value of your accumulated funds. When prices rise, your savings can buy fewer goods and services. For example, if you have $1 million in retirement savings and inflation averages 3% per year, your purchasing power will decline by about 22% over 20 years.

This means your savings will be worth less in terms of what you can buy with them.

Find out further about the benefits of Reconciling Differences Between CPI and PCE in November 2024 that can provide significant benefits.

Examples of CPI Impact on Retirement Funds

Consider a scenario where a retiree needs $50,000 per year to maintain their lifestyle. If inflation averages 3% annually, they will need $80,484 per year after 20 years to maintain the same purchasing power. This highlights the importance of factoring in inflation when planning for retirement.

If you fail to account for inflation, you risk outliving your retirement savings.

Check what professionals state about CPI and the November 2024 Election and its benefits for the industry.

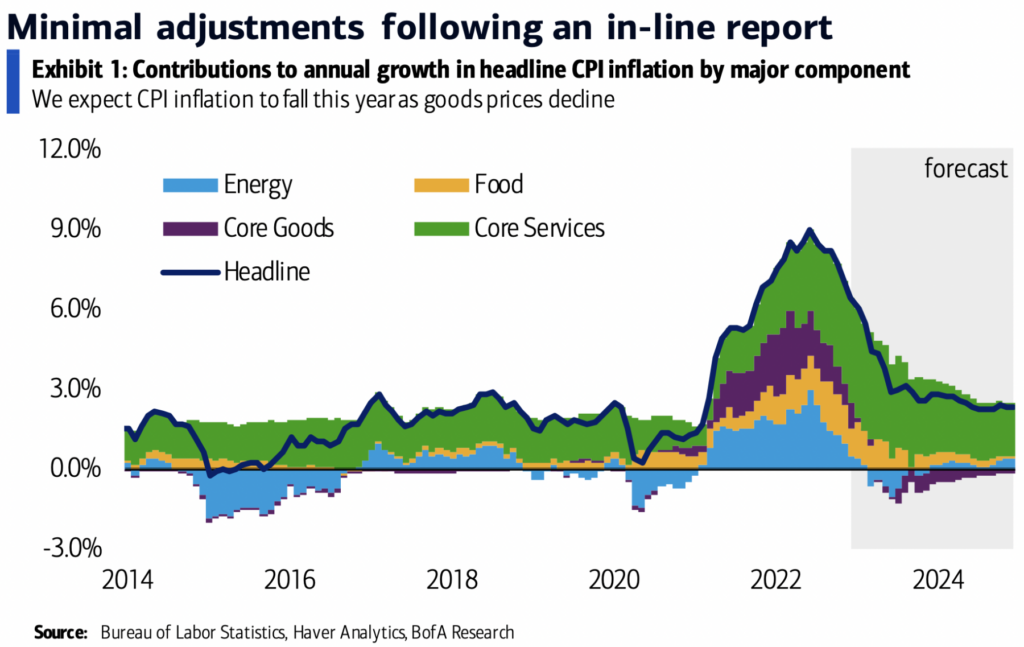

Analyzing November 2024 CPI Projections

Predicting the CPI for November 2024 involves considering various factors, including economic growth, energy prices, supply chain disruptions, and government policies. While it’s impossible to pinpoint an exact figure, we can explore potential scenarios based on current economic trends.

Potential Factors Influencing November 2024 CPI

- Global Economic Conditions:Global economic growth, particularly in major trading partners, can influence inflation in the United States.

- Energy Prices:Fluctuations in oil and gas prices significantly impact transportation and energy costs, affecting overall inflation.

- Supply Chain Issues:Ongoing supply chain disruptions can lead to higher prices for goods and services, contributing to inflation.

- Government Policies:Monetary and fiscal policies implemented by the government can influence inflation. For example, interest rate hikes can curb inflation, while stimulus packages can boost economic activity and potentially increase inflation.

Potential Scenarios for November 2024 CPI

- High Inflation:A scenario with continued high inflation could be driven by persistent supply chain issues, strong consumer demand, and rising energy prices. In this case, the November 2024 CPI could be significantly higher than the previous year, putting pressure on retirement savings.

Remember to click CPI and PCE: Frequently Asked Questions about November 2024 Data to understand more comprehensive aspects of the CPI and PCE: Frequently Asked Questions about November 2024 Data topic.

- Low Inflation:A scenario with low inflation could be driven by factors such as slower economic growth, easing supply chain bottlenecks, and a decline in energy prices. In this case, the November 2024 CPI could be lower than the previous year, providing some relief for retirees.

- Moderate Inflation:A scenario with moderate inflation could be a more likely outcome, with inflation remaining at a manageable level. This scenario would involve a balance between economic growth, energy prices, and supply chain issues. The November 2024 CPI could be slightly higher than the previous year, but not significantly impacting retirement planning.

Obtain access to CPI and Healthcare Costs: A Long-Term View Leading to November 2024 to private resources that are additional.

Strategies for Protecting Retirement Savings in a High Inflation Environment

In a high inflation environment, protecting retirement savings becomes crucial. Several strategies can help safeguard your funds and maintain their purchasing power.

Strategies for Safeguarding Retirement Funds

| Strategy | Description | Benefits | Risks |

|---|---|---|---|

| Adjusting Investment Portfolio | Shifting your investment portfolio towards assets that tend to perform well during periods of high inflation, such as inflation-linked bonds, commodities, and real estate. | Potentially outpace inflation and preserve the real value of your savings. | Higher volatility and potential for losses in the short term. |

| Increasing Contributions | Boosting your retirement contributions to offset the impact of inflation on your savings. | Accelerates the growth of your retirement nest egg and helps you reach your financial goals. | May require adjustments to your current budget and lifestyle. |

| Exploring Alternative Investments | Diversifying your portfolio with alternative investments, such as precious metals, collectibles, or private equity. | Potentially hedge against inflation and offer diversification benefits. | May involve higher risk and lower liquidity compared to traditional investments. |

| Seeking Professional Advice | Consulting a financial advisor to develop a personalized retirement plan that considers your individual circumstances and risk tolerance. | Provides expert guidance on investment strategies, asset allocation, and inflation-proofing your retirement savings. | Involves additional costs for financial advice. |

Inflation-Proofing Your Retirement Income

Retirement income, including Social Security, pensions, and savings, is susceptible to the effects of inflation. Implementing strategies to protect each source of income is essential for maintaining your living standards in retirement.

Protecting Different Sources of Retirement Income, November 2024 CPI and Retirement Planning: Protecting Your Savings

| Income Source | Inflation Impact | Protection Strategies | Pros | Cons |

|---|---|---|---|---|

| Social Security | Annual cost-of-living adjustments (COLAs) are designed to offset inflation, but they may not fully keep pace with rising prices. | Consider delaying claiming Social Security benefits to receive higher monthly payments. | Higher monthly payments, potentially offsetting inflation. | May delay access to benefits and reduce the total amount received. |

| Pensions | Some pensions offer inflation protection, while others do not. | Negotiate for inflation adjustments or consider investing pension funds in inflation-resistant assets. | Preserves the purchasing power of pension income. | May not be available for all pensions or require negotiation. |

| Savings | Savings are susceptible to inflation’s eroding effect. | Invest in inflation-linked assets, such as TIPS (Treasury Inflation-Protected Securities) or REITs (Real Estate Investment Trusts). | Potential for higher returns and preservation of purchasing power. | May involve higher risk and volatility compared to traditional savings. |

Long-Term Considerations for Retirement Planning in a Volatile Economy

In a volatile economic environment, long-term retirement planning requires a diversified approach to mitigate inflation risks. A well-structured retirement portfolio, combined with regular adjustments, can help protect your savings and ensure a comfortable retirement.

Importance of a Diversified Retirement Portfolio

A diversified retirement portfolio, consisting of various asset classes, reduces the impact of inflation on your savings. By spreading your investments across different asset classes, you minimize the risk of significant losses due to market fluctuations or inflation.

Obtain access to CPI vs. Other Inflation Measures: A November 2024 Comparison to private resources that are additional.

Asset Allocation and Portfolio Rebalancing

Asset allocation refers to the distribution of your investments across different asset classes, such as stocks, bonds, real estate, and commodities. Regularly rebalancing your portfolio ensures that your asset allocation remains aligned with your risk tolerance and investment goals. This helps to protect your savings from inflation and market volatility.

Seeking Professional Financial Advice

Consulting a financial advisor can provide valuable insights and personalized strategies for your retirement planning. A financial advisor can help you develop a comprehensive plan that considers your individual circumstances, risk tolerance, and investment goals, including strategies to mitigate inflation risks.

Ultimate Conclusion

Retirement planning in an inflationary environment requires a proactive and strategic approach. By understanding the potential impact of the November 2024 CPI and implementing the strategies Artikeld in this article, we can take control of our financial future and ensure our retirement savings last.

Remember, seeking professional financial advice tailored to your individual circumstances is essential for navigating the complexities of retirement planning. By taking these steps, we can confidently face the challenges of inflation and enjoy a comfortable and secure retirement.

Helpful Answers: November 2024 CPI And Retirement Planning: Protecting Your Savings

How often is the CPI released?

The CPI is released monthly by the Bureau of Labor Statistics (BLS).

What are some common inflation-proof investments?

Some common inflation-proof investments include Treasury Inflation-Protected Securities (TIPS), real estate, and commodities like gold.

Can I adjust my Social Security benefits for inflation?

Yes, Social Security benefits are adjusted annually for inflation based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).