Interest Rate Forecasts for 2025 Based on the November 2024 CPI are a key focus for investors, businesses, and policymakers alike. The upcoming CPI report holds significant weight as it will provide insights into inflation trends and potentially influence the Federal Reserve’s future monetary policy decisions.

Do not overlook the opportunity to discover more about the subject of CPI and PCE in a Changing Economy in November 2024.

Understanding the intricate relationship between CPI data and interest rate adjustments is crucial for navigating the economic landscape in 2025.

The November 2024 CPI report is expected to shed light on the trajectory of inflation, which will directly impact the Federal Reserve’s stance on interest rates. Key indicators within the report, such as core inflation and energy prices, will be closely scrutinized for any signs of persistent price pressures or easing.

This analysis will then be used to inform the Fed’s decision on whether to raise, lower, or maintain interest rates in the coming months.

Understanding the November 2024 CPI Report

The November 2024 CPI report holds immense significance in shaping interest rate forecasts for 2025. This report provides a comprehensive snapshot of inflation trends, offering crucial insights into the Federal Reserve’s (Fed) upcoming monetary policy decisions. The Fed closely monitors CPI data to gauge inflation’s trajectory and make informed decisions about adjusting interest rates.

Obtain access to CPI and PCE: Data Sources and Availability for November 2024 to private resources that are additional.

Key Indicators within the CPI Report

The CPI report encompasses various indicators that directly influence interest rate decisions. These include:

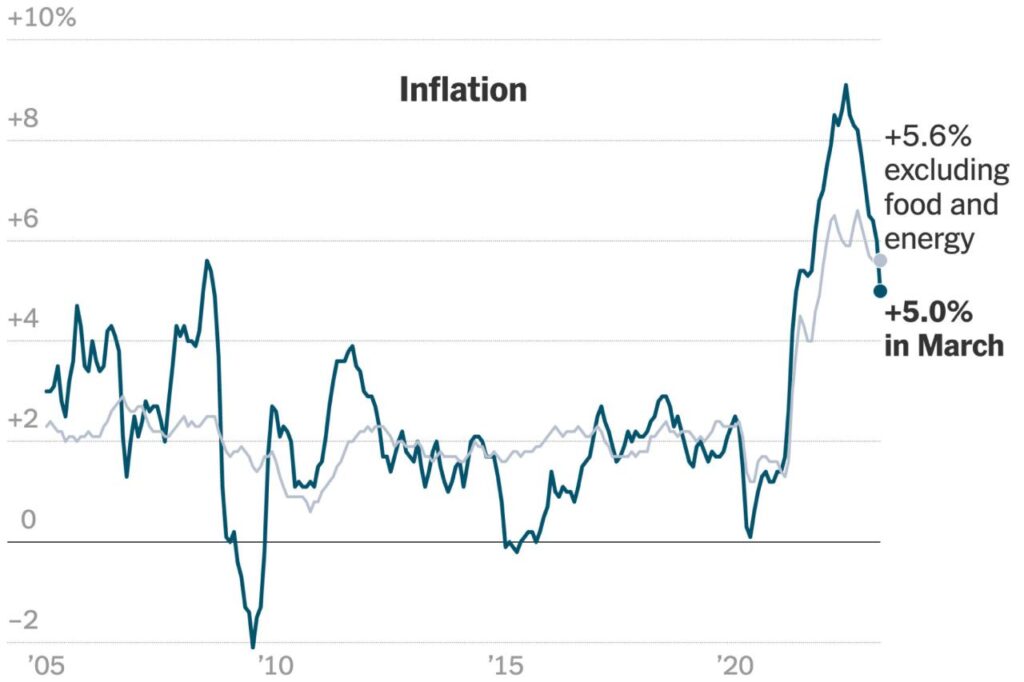

- Core Inflation:Excludes volatile food and energy prices, providing a clearer picture of underlying inflationary pressures.

- Energy Prices:Fluctuations in energy prices can significantly impact overall inflation, prompting the Fed to adjust interest rates accordingly.

- Food Prices:Rising food prices are a key concern, as they affect consumer spending and inflation expectations.

- Shelter Costs:Housing costs constitute a substantial portion of the CPI, making it a critical indicator for assessing inflation.

- Used Car Prices:The used car market’s performance provides valuable insights into consumer demand and inflationary pressures.

Components of the CPI Report and their Influence on Interest Rate Forecasts

The CPI report is divided into various components, each contributing to the overall inflation picture. The report’s components and their potential influence on interest rate forecasts are Artikeld below:

| Component | Potential Influence on Interest Rates |

|---|---|

| Energy | Higher energy prices can lead to higher inflation, potentially prompting the Fed to raise interest rates to cool down the economy. Conversely, lower energy prices might allow the Fed to maintain or even lower interest rates. |

| Food | Similar to energy, rising food prices can contribute to inflation, potentially leading to interest rate hikes. Conversely, declining food prices could support a more accommodative monetary policy stance. |

| Shelter | Shelter costs represent a significant portion of the CPI. Rising shelter costs can exert upward pressure on inflation, potentially necessitating interest rate hikes. Conversely, stable or declining shelter costs might support a more dovish monetary policy approach. |

| Medical Care | Rising healthcare costs can contribute to inflation, potentially leading to interest rate hikes. Conversely, stable or declining medical care costs might support a more accommodative monetary policy stance. |

| Transportation | Fluctuations in transportation costs, including vehicle prices and fuel costs, can impact overall inflation. Rising transportation costs might lead to interest rate hikes, while declining costs could support a more dovish monetary policy approach. |

Federal Reserve’s Response to CPI Data: Interest Rate Forecasts For 2025 Based On The November 2024 CPI

The Fed’s response to CPI data is crucial for understanding the direction of interest rates. The Fed has historically adjusted interest rates based on inflation trends reflected in the CPI report.

Obtain access to CPI and Housing Affordability in November 2024 to private resources that are additional.

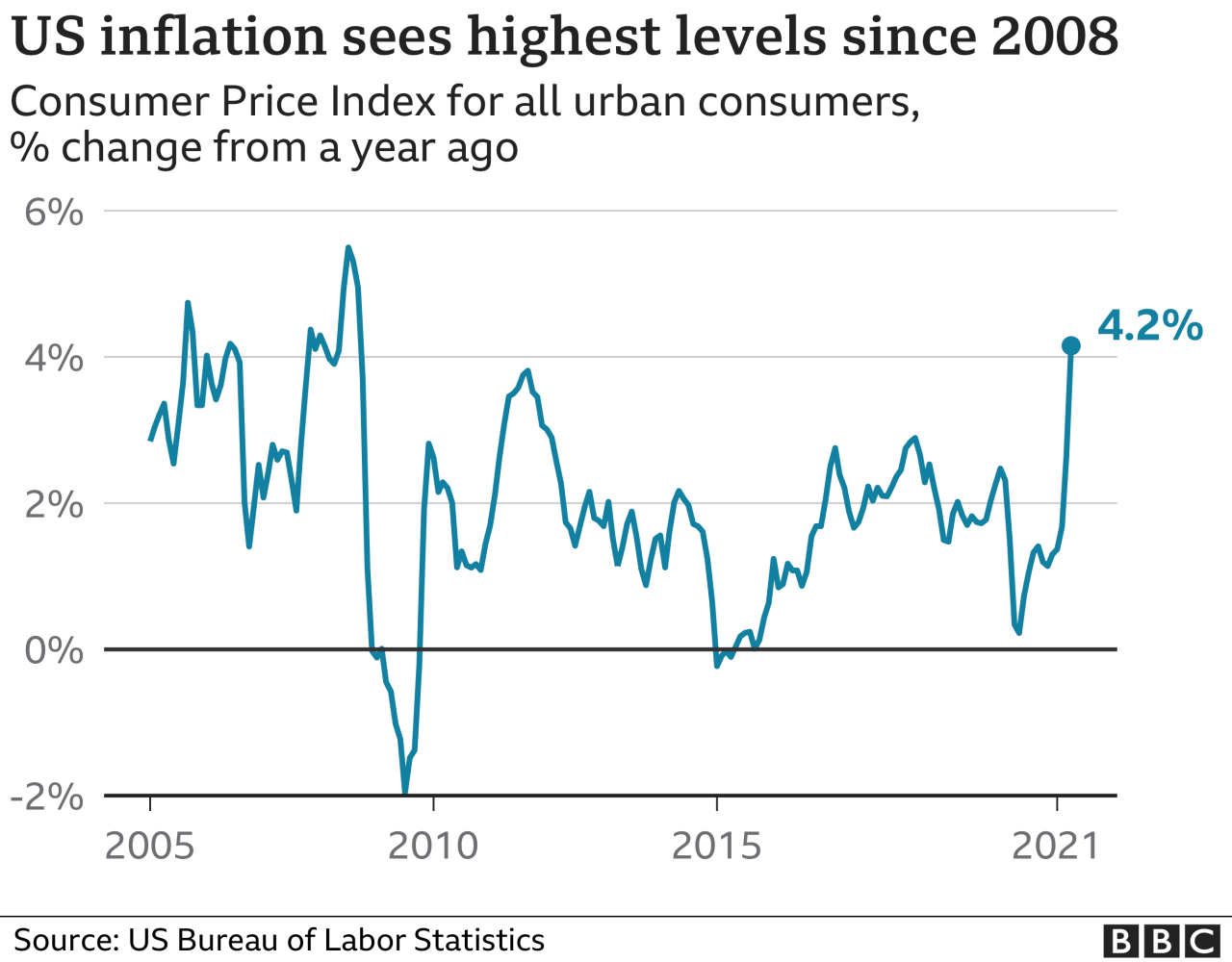

Historical Relationship Between CPI Data and the Fed’s Interest Rate Decisions

Historically, the Fed has raised interest rates when inflation has risen above its target rate of 2%. Conversely, the Fed has lowered interest rates when inflation has fallen below its target rate. The Fed’s actions aim to keep inflation under control and maintain a stable economy.

The Fed’s Likely Response to the November 2024 CPI Report

The Fed’s likely response to the November 2024 CPI report will depend on several factors, including the current inflation rate, the pace of economic growth, and the overall state of the economy. If inflation remains elevated, the Fed might consider further interest rate hikes to cool down the economy and curb inflation.

Enhance your insight with the methods and methods of The Use of Technology in November 2024 CPI Data Collection.

However, if inflation shows signs of cooling down, the Fed might choose to maintain or even lower interest rates.

Potential Scenarios for Interest Rate Adjustments Based on the CPI Data

Based on the CPI data, several potential scenarios for interest rate adjustments could unfold:

- Interest Rate Hikes:If the November 2024 CPI report shows a persistent rise in inflation, the Fed might raise interest rates to curb inflationary pressures and maintain price stability.

- Interest Rate Cuts:If the CPI report indicates a significant decline in inflation, the Fed might consider lowering interest rates to stimulate economic growth.

- Maintaining Current Rates:If the CPI report reflects a stable inflation rate, the Fed might choose to maintain current interest rates to assess the impact of its previous monetary policy decisions.

Economic Factors Influencing Interest Rate Forecasts

While the CPI report provides valuable insights into inflation trends, other economic factors also play a significant role in shaping interest rate forecasts for 2025.

Factors Beyond the CPI Report Shaping Interest Rate Forecasts

Several economic factors beyond the CPI report influence interest rate forecasts. These include:

- Unemployment Rate:A low unemployment rate indicates a strong economy, which might lead to higher inflation and necessitate interest rate hikes. Conversely, a high unemployment rate might prompt the Fed to lower interest rates to stimulate job growth.

- Gross Domestic Product (GDP) Growth:Strong GDP growth can lead to higher inflation, potentially necessitating interest rate hikes. Conversely, weak GDP growth might prompt the Fed to lower interest rates to stimulate economic activity.

- Consumer Confidence:High consumer confidence indicates a healthy economy, which might lead to higher inflation and necessitate interest rate hikes. Conversely, low consumer confidence might prompt the Fed to lower interest rates to boost consumer spending.

- Global Economic Conditions:Global economic conditions, including trade tensions, geopolitical risks, and global interest rate trends, can influence the Fed’s monetary policy decisions.

Impact of Economic Factors on Interest Rate Expectations

The impact of these economic factors on interest rate expectations is multifaceted:

| Economic Factor | Expected Impact on Interest Rates | Current State |

|---|---|---|

| Unemployment Rate | Low unemployment rate might lead to higher inflation and necessitate interest rate hikes. | Current unemployment rate data |

| GDP Growth | Strong GDP growth can lead to higher inflation, potentially necessitating interest rate hikes. | Current GDP growth data |

| Consumer Confidence | High consumer confidence indicates a healthy economy, which might lead to higher inflation and necessitate interest rate hikes. | Current consumer confidence data |

| Global Economic Conditions | Global economic conditions can influence the Fed’s monetary policy decisions, potentially impacting interest rates. | Current global economic conditions data |

Expert Opinions and Market Predictions

Expert opinions and market predictions offer valuable insights into the potential trajectory of interest rates in 2025.

Browse the multiple elements of The CPI and the Environment in November 2024 to gain a more broad understanding.

Summary of Current Expert Opinions and Market Predictions for Interest Rates in 2025, Interest Rate Forecasts for 2025 Based on the November 2024 CPI

Experts and market analysts hold diverse opinions on interest rate forecasts for 2025. Some experts believe that interest rates will continue to rise, while others predict a stabilization or even a decline in interest rates.

Browse the implementation of Which is a Better Measure of Inflation in November 2024: CPI or PCE? in real-world situations to understand its applications.

Rationale Behind Predictions and Implications for Investors and Businesses

The rationale behind these predictions often stems from different interpretations of economic data, inflation trends, and the Fed’s policy stance. For instance, some experts believe that persistent inflation will force the Fed to continue raising interest rates, while others anticipate a moderation in inflation that could lead to a more accommodative monetary policy.

Key Market Indicators and their Relationship to Interest Rate Forecasts

Several key market indicators provide insights into interest rate forecasts:

| Market Indicator | Relationship to Interest Rate Forecasts |

|---|---|

| Bond Yields | Rising bond yields typically indicate expectations of higher interest rates. Conversely, falling bond yields suggest expectations of lower interest rates. |

| Stock Market Performance | Strong stock market performance can indicate economic optimism and potentially higher interest rates. Conversely, weak stock market performance might suggest concerns about economic growth and potentially lower interest rates. |

| Currency Exchange Rates | A strong currency can indicate a healthy economy and potentially higher interest rates. Conversely, a weak currency might suggest economic weakness and potentially lower interest rates. |

Potential Scenarios for Interest Rates in 2025

Based on the November 2024 CPI report and other economic factors, several potential scenarios for interest rates in 2025 can be envisioned.

Examine how The Future of the CPI: What to Expect After November 2024 can boost performance in your area.

Different Potential Scenarios for Interest Rates in 2025

The potential scenarios for interest rates in 2025 depend on various factors, including inflation trends, economic growth, and the Fed’s policy stance. Here are a few potential scenarios:

- Scenario 1: Continued Interest Rate Hikes: If inflation remains persistently high, the Fed might continue raising interest rates to curb inflationary pressures and maintain price stability. This scenario could lead to higher borrowing costs for businesses and consumers, potentially slowing down economic growth.

- Scenario 2: Stabilization of Interest Rates: If inflation begins to moderate, the Fed might choose to stabilize interest rates at their current levels to assess the impact of its previous monetary policy decisions. This scenario could provide a more stable economic environment, but it might not be enough to significantly curb inflation.

Expand your understanding about CPI and the Stock Market: A Historical Link Leading to November 2024 with the sources we offer.

- Scenario 3: Interest Rate Cuts: If inflation falls significantly below the Fed’s target rate, the Fed might lower interest rates to stimulate economic growth. This scenario could boost consumer spending and business investment, but it might also lead to higher inflation in the long run.

Implications of Each Scenario for Different Sectors of the Economy

Each scenario for interest rates carries different implications for various sectors of the economy:

| Scenario | Key Characteristics | Potential Impacts | Likelihood of Occurrence |

|---|---|---|---|

| Continued Interest Rate Hikes | Persistent high inflation, Fed’s continued focus on curbing inflation. | Higher borrowing costs for businesses and consumers, potentially slowing down economic growth. | Likelihood of occurrence based on current economic data and expert opinions |

| Stabilization of Interest Rates | Moderation in inflation, Fed’s assessment of the impact of previous monetary policy decisions. | More stable economic environment, but might not be enough to significantly curb inflation. | Likelihood of occurrence based on current economic data and expert opinions |

| Interest Rate Cuts | Significant decline in inflation, Fed’s focus on stimulating economic growth. | Boost consumer spending and business investment, but might also lead to higher inflation in the long run. | Likelihood of occurrence based on current economic data and expert opinions |

Ultimate Conclusion

The November 2024 CPI report will be a pivotal data point for shaping interest rate forecasts for 2025. The Fed’s response to the report, coupled with other economic indicators, will determine the direction of interest rates and their impact on various sectors of the economy.

Finish your research with information from CPI and the Sharing Economy in November 2024.

By carefully analyzing the report’s implications and considering expert opinions, investors and businesses can make informed decisions to navigate the uncertainties of the coming year.

FAQ Guide

What is the CPI, and why is it so important for interest rate forecasts?

The Consumer Price Index (CPI) measures the average change over time in the prices paid by urban consumers for a basket of consumer goods and services. It is a key indicator of inflation, and the Fed closely monitors CPI data to guide its monetary policy decisions, including setting interest rates.

How do interest rate changes impact the economy?

You also can understand valuable knowledge by exploring Decoding the November 2024 CPI: Key Terms and Concepts.

Interest rate changes can have a significant impact on the economy. Higher interest rates generally make borrowing more expensive, which can slow down economic growth. Conversely, lower interest rates encourage borrowing and spending, which can stimulate economic activity.

What are some of the potential scenarios for interest rates in 2025?

Possible scenarios for interest rates in 2025 include: (1) continued rate hikes if inflation remains elevated, (2) a pause in rate increases if inflation shows signs of moderating, or (3) potential rate cuts if inflation falls significantly.