CPI and Auto Loan Interest Rates in November 2024: Impact on Consumers and the Automotive Industry, a critical juncture in the economic landscape, where the interplay of inflation, monetary policy, and consumer behavior shapes the future of car purchases and the broader automotive sector.

This analysis delves into the expected CPI rate for November 2024, exploring its potential impact on auto loan interest rates, and ultimately, the affordability and desirability of purchasing a vehicle. We’ll examine the intricate relationship between these economic forces and their ramifications for both consumers and the automotive industry.

The November 2024 landscape presents a unique blend of challenges and opportunities. As the Federal Reserve navigates its monetary policy strategy, the interplay of inflation and interest rates will significantly influence the cost of borrowing, particularly for auto loans.

Understanding the potential trajectory of these key economic indicators is crucial for consumers seeking to make informed decisions about car purchases, while automotive manufacturers and dealerships must adapt their strategies to navigate these evolving conditions.

Consumer Price Index (CPI) in November 2024

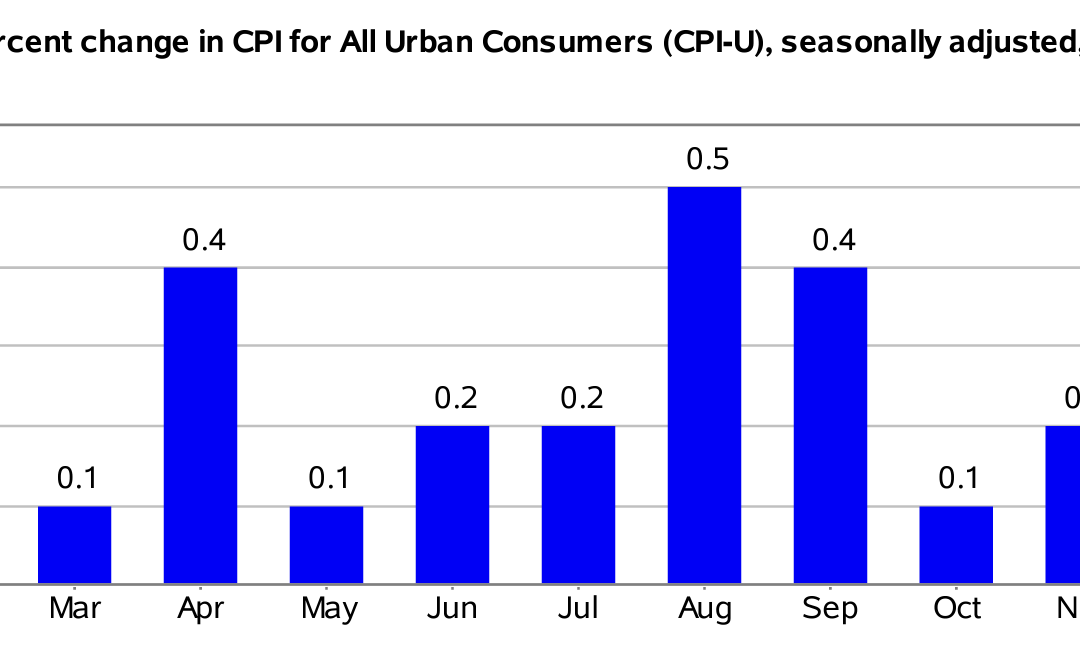

The Consumer Price Index (CPI) is a crucial economic indicator that measures the average change in prices paid by urban consumers for a basket of consumer goods and services. Understanding the expected CPI rate for November 2024 is essential for assessing the overall health of the economy and its impact on various sectors, including the automotive industry.

Expected CPI Rate for November 2024

Predicting the CPI rate for November 2024 requires considering current economic trends and historical data. While it is impossible to predict with certainty, several factors can influence the CPI, leading to potential fluctuations.

You also can understand valuable knowledge by exploring The Impact of Consumer Behavior on CPI and PCE in November 2024.

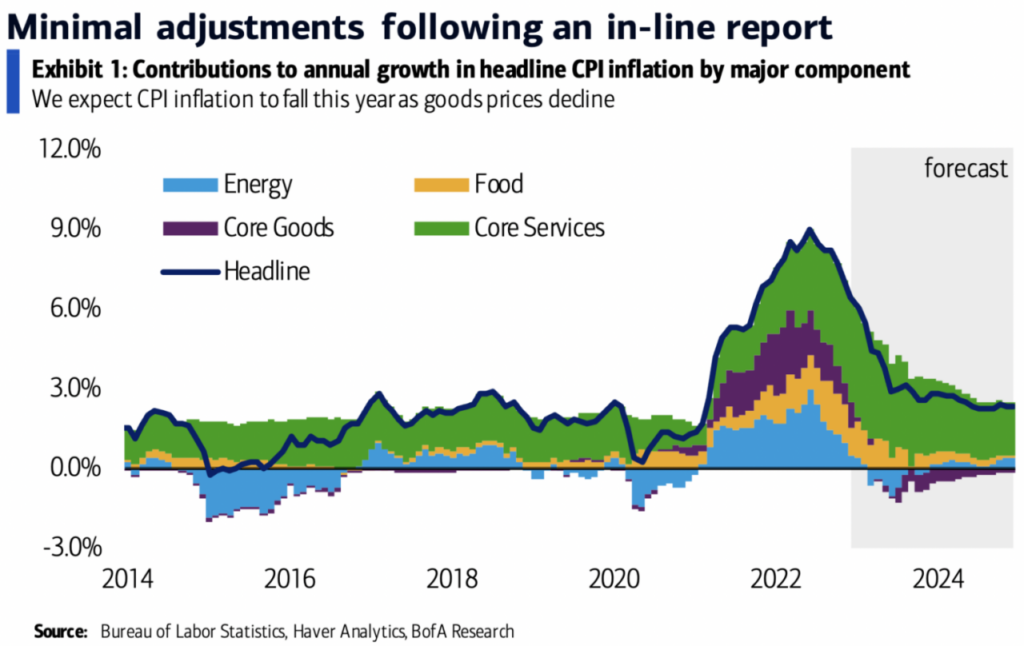

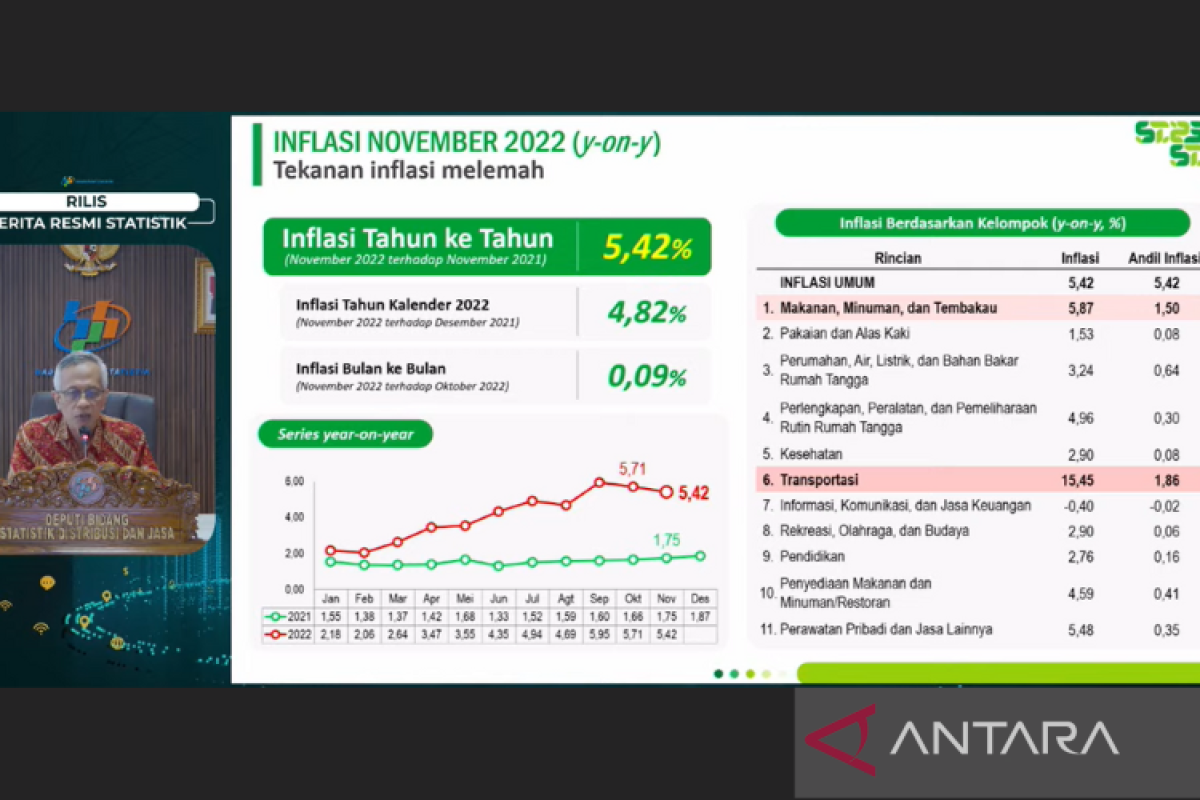

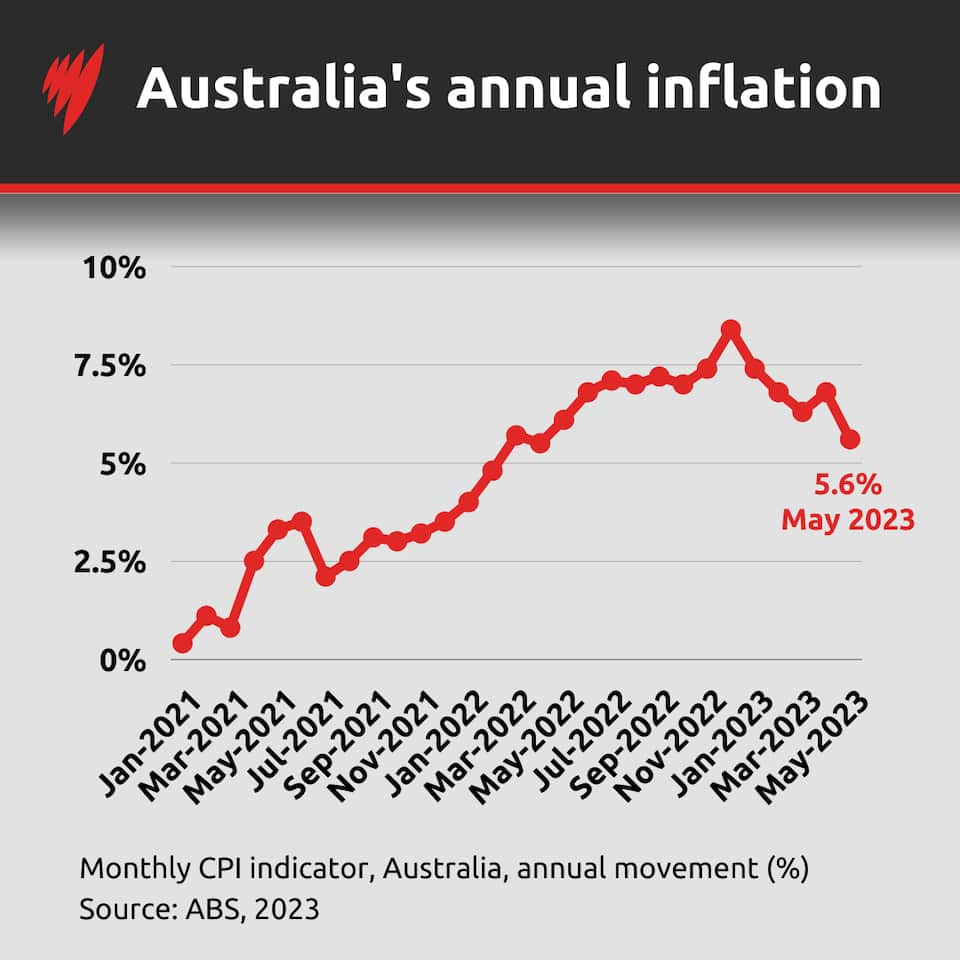

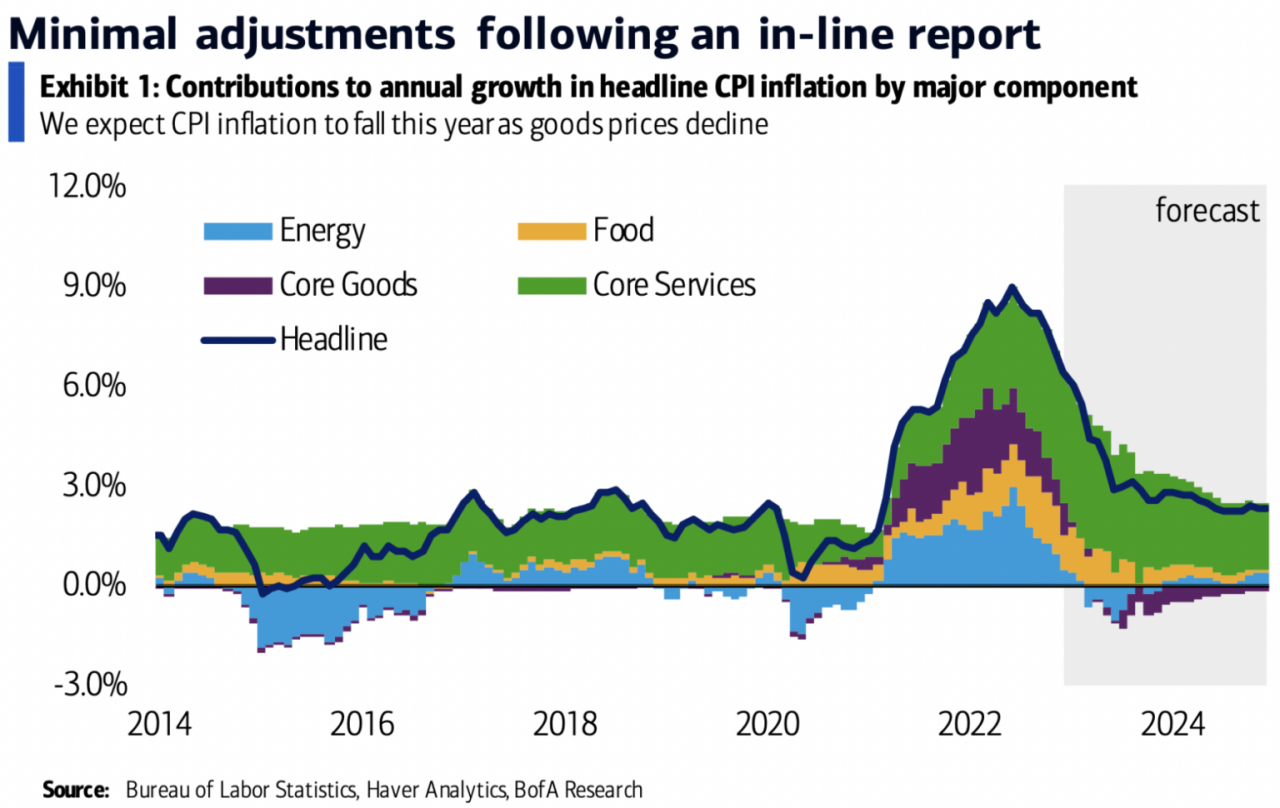

- Inflation:Inflation remains a significant factor impacting the CPI. While the Federal Reserve has been working to tame inflation through interest rate hikes, the effectiveness of these measures will play a crucial role in determining the CPI trajectory.

- Energy Prices:Energy prices are a significant component of the CPI. Fluctuations in oil prices, natural gas prices, and electricity costs can significantly impact the overall CPI rate.

- Consumer Spending:Consumer spending patterns are closely tied to the CPI. As consumer confidence and disposable income fluctuate, so too can spending habits, which can influence price levels.

Impact of CPI Fluctuations on the Economy

Changes in the CPI can have a ripple effect throughout the economy. A higher CPI indicates rising inflation, which can erode purchasing power and lead to higher interest rates. Conversely, a lower CPI suggests lower inflation, which can stimulate economic growth and lower borrowing costs.

Do not overlook explore the latest data about CPI and the Service Sector in November 2024.

- Impact on Wages:A higher CPI often leads to calls for higher wages to compensate for rising prices. This can create a cycle of inflation, as businesses pass on increased labor costs to consumers.

- Impact on Investment:A high CPI can make investors hesitant to invest, as they anticipate lower returns due to inflation. This can slow economic growth.

- Impact on Monetary Policy:The Federal Reserve closely monitors the CPI to inform its monetary policy decisions. A higher CPI might prompt the Fed to raise interest rates further to control inflation.

Auto Loan Interest Rates in November 2024: CPI And Auto Loan Interest Rates In November 2024

Auto loan interest rates are influenced by various factors, including the Federal Reserve’s monetary policy, market conditions, and the prevailing CPI. Understanding the expected auto loan interest rates in November 2024 is crucial for consumers planning to purchase a new or used car.

Investigate the pros of accepting The Role of Monetary Policy in Controlling Inflation in November 2024 in your business strategies.

Expected Auto Loan Interest Rates for November 2024

The Federal Reserve’s monetary policy plays a significant role in shaping auto loan interest rates. As the Fed raises interest rates to combat inflation, borrowing costs tend to rise, impacting auto loan rates. The expected auto loan interest rates for November 2024 will depend on the Fed’s future policy decisions and the overall market conditions.

Discover the crucial elements that make Inflationary Periods in History and Their Impact on November 2024 the top choice.

Relationship Between CPI and Auto Loan Interest Rates

The CPI and auto loan interest rates are interconnected. A higher CPI often leads to higher auto loan interest rates as lenders seek to protect themselves from inflation’s impact on the value of their loans. Conversely, a lower CPI might result in lower auto loan interest rates as lenders become more competitive.

Auto Loan Interest Rates for Different Types of Loans

Auto loan interest rates can vary depending on the type of loan, such as new car loans or used car loans. Generally, new car loans tend to have lower interest rates than used car loans due to the lower risk associated with newer vehicles.

You also can understand valuable knowledge by exploring CPI and PCE: Data Sources and Availability for November 2024.

- New Car Loans:Interest rates for new car loans typically reflect the prevailing market conditions and the borrower’s creditworthiness. They can be influenced by factors like the make and model of the car, the loan term, and the borrower’s credit score.

- Used Car Loans:Used car loans usually carry higher interest rates than new car loans due to the increased risk associated with older vehicles. The interest rate for a used car loan can vary depending on the age and condition of the car, the loan term, and the borrower’s credit score.

Impact of CPI and Auto Loan Interest Rates on Consumers

The CPI and auto loan interest rates have a significant impact on consumer spending and affordability, particularly for those considering purchasing a new or used car. A higher CPI and higher auto loan interest rates can make car financing more expensive, potentially impacting affordability and consumer demand.

Do not overlook explore the latest data about Causes of Inflation in November 2024: A Deep Dive.

Impact on Consumer Spending and Affordability

When the CPI rises, the cost of living increases, reducing consumers’ disposable income. Simultaneously, higher auto loan interest rates make car financing more expensive, further straining budgets. This can lead to a decrease in consumer demand for vehicles, especially among price-sensitive buyers.

Cost of Financing a New Car Under Different Interest Rate Scenarios

| Interest Rate | Loan Amount | Loan Term (Years) | Monthly Payment | Total Interest Paid |

|---|---|---|---|---|

| 5% | $30,000 | 5 | $566.14 | $3,968.40 |

| 7% | $30,000 | 5 | $599.55 | $5,973.00 |

| 9% | $30,000 | 5 | $635.03 | $8,101.80 |

Advice for Consumers Considering Purchasing a Car in November 2024, CPI and Auto Loan Interest Rates in November 2024

Consumers considering purchasing a car in November 2024 should carefully evaluate their financial situation and the expected interest rates. It’s essential to shop around for the best financing options, compare rates from different lenders, and consider the impact of higher interest rates on their monthly payments and overall loan cost.

Find out further about the benefits of The Impact of Inflation on Economic Growth in November 2024 that can provide significant benefits.

- Assess Your Financial Situation:Before shopping for a car, carefully assess your budget and income. Consider your current debt obligations, monthly expenses, and savings.

- Shop Around for Financing Options:Get pre-approved for an auto loan from multiple lenders to compare interest rates and terms. This will give you a better understanding of the available options and help you negotiate a better deal.

- Consider the Impact of Higher Interest Rates:Factor in the potential impact of higher interest rates on your monthly payments and overall loan cost. Consider the long-term financial implications before committing to a loan.

- Negotiate the Price and Interest Rate:Don’t be afraid to negotiate the price of the car and the interest rate with the dealer and lender. Be prepared to walk away if you don’t feel comfortable with the terms.

Potential Implications for the Automotive Industry

The CPI and auto loan interest rates can have a significant impact on the automotive industry, affecting car sales, manufacturing, and pricing. Understanding these implications is crucial for auto manufacturers and dealerships to navigate these economic conditions effectively.

Impact on Car Sales, Manufacturing, and Pricing

A higher CPI and higher auto loan interest rates can lead to a decline in car sales as consumers become more price-sensitive and face higher financing costs. This can impact auto manufacturers’ production plans and lead to adjustments in pricing strategies.

Impact on Profitability of Auto Manufacturers and Dealerships

Lower car sales and potentially lower prices can impact the profitability of auto manufacturers and dealerships. They might need to adjust their business models to cope with reduced demand and potentially lower margins.

Do not overlook explore the latest data about CPI and PCE: Implications for Policymakers in November 2024.

Strategies for the Automotive Industry to Navigate Economic Conditions

The automotive industry can implement various strategies to navigate the economic conditions created by CPI and auto loan interest rates. These strategies might include:

- Focus on Fuel-Efficient Vehicles:With rising energy prices, consumers are increasingly looking for fuel-efficient vehicles. Auto manufacturers can focus on developing and promoting these models to cater to this demand.

- Offer Flexible Financing Options:To attract buyers in a challenging economic environment, auto manufacturers and dealerships can offer flexible financing options, such as longer loan terms and lower down payments.

- Invest in Technology and Innovation:Auto manufacturers can invest in developing new technologies and features that appeal to consumers, such as advanced driver-assistance systems and electric vehicles. This can help them stay competitive and attract buyers.

- Manage Inventory Levels:Auto manufacturers and dealerships need to carefully manage their inventory levels to avoid overstocking in a potential slowdown in demand. They can adjust production plans based on market trends and consumer demand.

Final Review

In conclusion, the confluence of CPI and auto loan interest rates in November 2024 presents a dynamic environment for both consumers and the automotive industry. As the economic landscape continues to evolve, informed decision-making and strategic adjustments will be paramount.

By carefully considering the potential impact of these economic forces, consumers can make sound financial choices regarding car purchases, while the automotive industry can navigate these challenges and capitalize on emerging opportunities. The November 2024 landscape underscores the importance of understanding the intricate relationship between economic indicators and their real-world implications, paving the way for a more informed and adaptable future.

For descriptions on additional topics like The Future of Inflation After November 2024, please visit the available The Future of Inflation After November 2024.

Detailed FAQs

What is the expected CPI rate for November 2024?

The expected CPI rate for November 2024 is currently uncertain and subject to ongoing economic developments. Analysts will consider factors such as inflation, energy prices, and consumer spending to project a potential rate.

Discover more by delving into Accuracy and Reliability of the November 2024 CPI Data further.

How do auto loan interest rates typically fluctuate with changes in CPI?

Generally, when CPI increases, the Federal Reserve may raise interest rates to combat inflation. This can lead to higher auto loan interest rates as lenders adjust their rates to reflect the prevailing economic conditions.

What are some tips for consumers considering a car purchase in November 2024?

Consumers should carefully evaluate their financial situation, research current interest rates, and explore different financing options. Comparing loan terms and exploring potential incentives can help them make informed decisions.