CPI and Gold Prices: A Historical Connection Leading to November 2024, this exploration delves into the intricate relationship between the Consumer Price Index (CPI) and the price of gold. Throughout history, gold has served as a reliable hedge against inflation, a concept deeply intertwined with the fluctuations of the CPI.

Find out further about the benefits of The Impact of Consumer Behavior on CPI and PCE in November 2024 that can provide significant benefits.

Looking ahead to November 2024, this analysis seeks to understand the potential impact of economic trends, geopolitical events, and technological advancements on both CPI and gold prices, ultimately revealing their significance for investors and consumers alike.

Further details about Inflation Targeting and the CPI in November 2024 is accessible to provide you additional insights.

The CPI, a key economic indicator measuring the average change in prices paid by urban consumers for a basket of goods and services, plays a crucial role in gauging inflation. Gold, on the other hand, has historically been perceived as a safe haven asset, its value often rising during periods of economic uncertainty and high inflation.

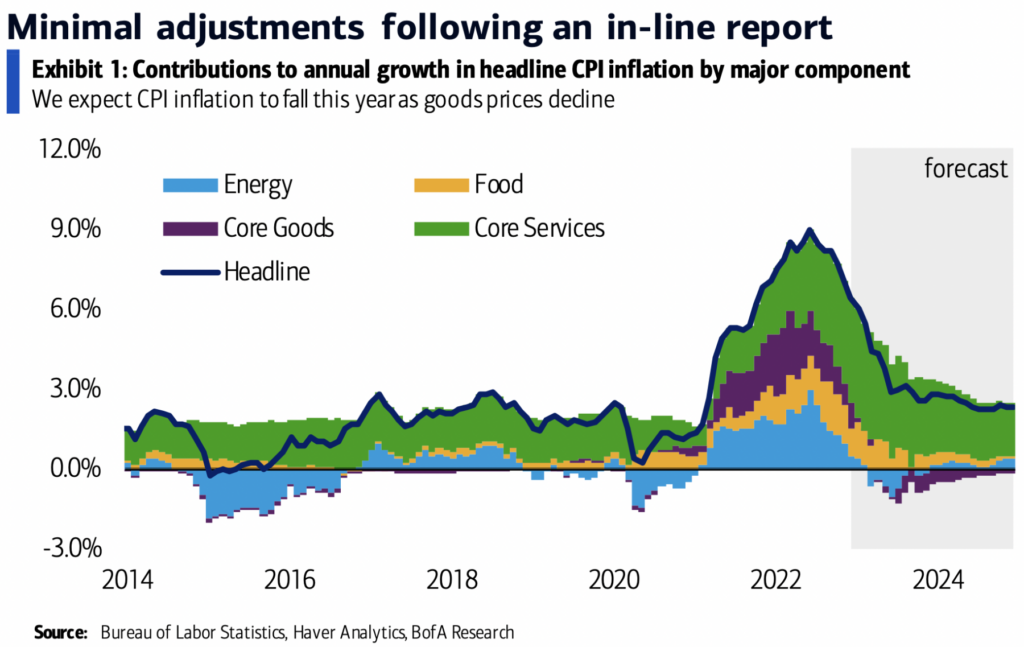

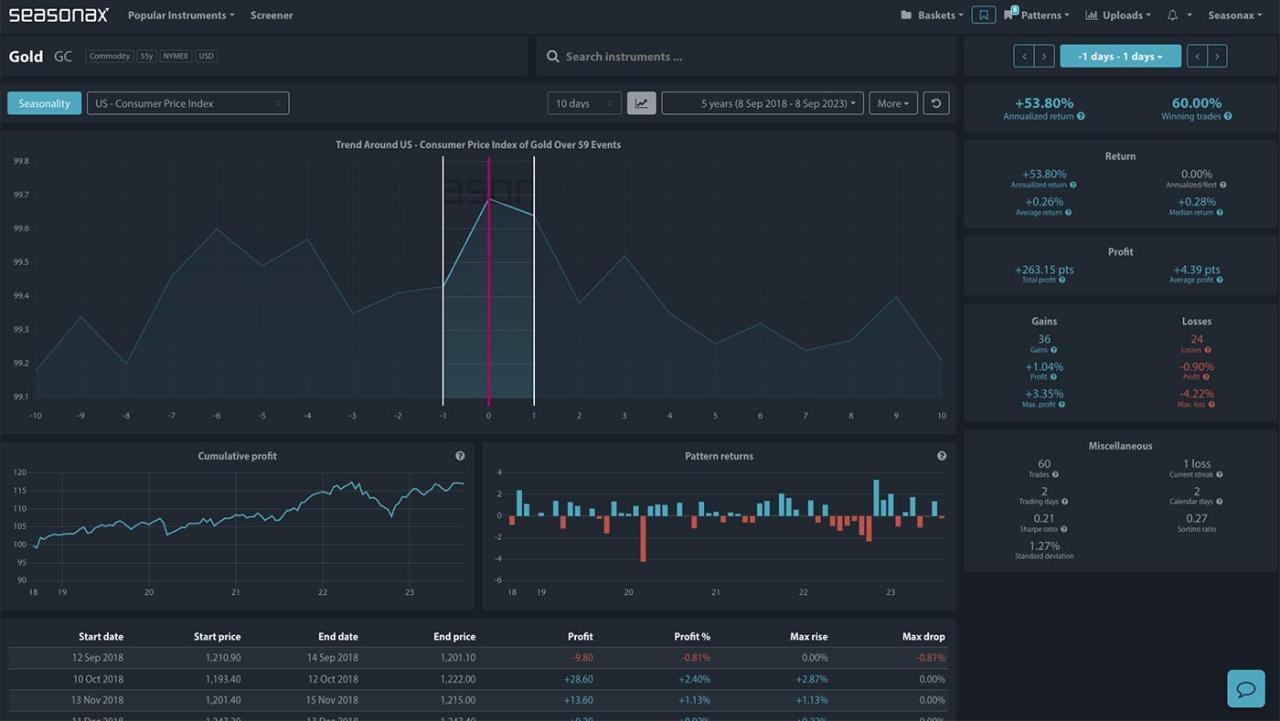

The historical connection between these two elements is undeniable, with periods of high inflation often coinciding with significant increases in gold prices. This analysis will delve into historical data and explore the factors driving this correlation, providing insights into the potential future trajectory of both CPI and gold prices in the context of November 2024.

You also can understand valuable knowledge by exploring The Use of Technology in November 2024 CPI Data Collection.

CPI and Gold Prices: A Historical Connection Leading to November 2024

The Consumer Price Index (CPI) is a vital economic indicator that measures the average change in prices paid by urban consumers for a basket of consumer goods and services. It provides insights into the rate of inflation, which is a key factor influencing economic growth, investment decisions, and consumer spending.

Gold, a precious metal with a long history as a store of value, has often been seen as a hedge against inflation. Its price tends to rise during periods of economic uncertainty and rising inflation, as investors seek to preserve their wealth and protect against the eroding purchasing power of fiat currencies.

You also can understand valuable knowledge by exploring CPI and PCE: A Guide for Researchers Using November 2024 Data.

This article explores the historical relationship between CPI and gold prices, examining the factors that influence their movements and the potential implications for investors and consumers in the context of November 2024. By analyzing historical data, identifying key drivers, and considering current economic trends, we aim to provide a comprehensive understanding of the dynamic relationship between CPI and gold prices and its relevance to future economic scenarios.

Discover more by delving into CPI Through the Decades: Key Trends and Patterns Leading to November 2024 further.

Historical Analysis of CPI and Gold Prices, CPI and Gold Prices: A Historical Connection Leading to November 2024

Throughout history, gold prices have generally exhibited a positive correlation with inflation, as measured by the CPI. During periods of high inflation, gold has often served as a safe haven asset, attracting investors seeking to protect their purchasing power.

- For instance, during the 1970s, when the US experienced a period of high inflation driven by the Vietnam War and the oil crisis, gold prices surged significantly. From 1971 to 1980, the price of gold increased from around $35 per ounce to over $800 per ounce, reflecting its role as a hedge against inflation.

Discover the crucial elements that make The Role of the CPI in Economic Policy in November 2024 the top choice.

- Similarly, during the global financial crisis of 2008-2009, gold prices rose sharply as investors sought safe haven assets amid market volatility and economic uncertainty.

However, the relationship between CPI and gold prices is not always straightforward. There have been instances where gold prices have not risen in line with inflation, or even declined during periods of high inflation. This can be attributed to various factors, such as:

- Changes in investor sentiment:Gold prices can be influenced by market sentiment and investor expectations, which can sometimes override the inflation hedge effect.

- Monetary policy:Central bank policies, such as interest rate changes, can impact the demand for gold and influence its price.

- Technological advancements:Advances in gold mining technologies can affect the supply of gold and influence its price.

Factors Influencing CPI and Gold Prices

Several factors contribute to fluctuations in both CPI and gold prices. Understanding these drivers is crucial for predicting future trends and making informed investment decisions.

- Economic growth:Strong economic growth can lead to higher demand for goods and services, potentially pushing up prices and contributing to inflation. However, economic growth can also increase investor confidence, potentially reducing demand for safe haven assets like gold.

- Supply chain disruptions:Disruptions to global supply chains, such as those caused by pandemics, natural disasters, or geopolitical tensions, can lead to shortages and price increases, contributing to inflation. These disruptions can also create uncertainty and increase demand for gold as a safe haven asset.

Obtain access to Common Misconceptions about the CPI in November 2024 to private resources that are additional.

- Government policies:Fiscal and monetary policies implemented by governments can have a significant impact on both CPI and gold prices. Expansionary fiscal policies, such as increased government spending, can stimulate economic growth but also lead to inflation. Monetary policies, such as interest rate adjustments, can influence the cost of borrowing and affect the demand for gold.

The interplay between CPI, interest rates, and gold prices is complex. When interest rates rise, the opportunity cost of holding gold increases, as investors can earn higher returns on other assets. This can lead to a decline in gold prices.

Conversely, when interest rates fall, the opportunity cost of holding gold decreases, potentially boosting demand and driving up its price.

Economic Outlook for November 2024

Predicting CPI and gold prices in November 2024 requires considering current economic trends and potential future developments. While it is impossible to predict the future with certainty, we can analyze various factors to develop a reasoned forecast.

Several factors could impact CPI and gold prices in November 2024:

- Geopolitical events:Ongoing geopolitical tensions, such as the Russia-Ukraine conflict, could continue to disrupt global supply chains and contribute to inflation. These events could also increase demand for gold as a safe haven asset.

- Technological advancements:Technological advancements, such as automation and artificial intelligence, could potentially reduce production costs and mitigate inflationary pressures. However, these advancements could also create economic disruptions and lead to job losses, potentially increasing demand for gold as a safe haven asset.

- Global economic policies:Monetary and fiscal policies implemented by major economies will play a crucial role in shaping economic growth and inflation. If central banks continue to raise interest rates to combat inflation, it could potentially dampen economic growth and lead to a decline in gold prices.

Obtain a comprehensive document about the application of CPI Calculation in Different Countries: A Comparison with November 2024 Data that is effective.

Conversely, if governments implement expansionary fiscal policies, it could contribute to inflation and increase demand for gold.

Based on these factors, we can envision several potential scenarios for CPI and gold prices in November 2024:

| Scenario | CPI | Gold Price |

|---|---|---|

| Scenario 1: Continued Inflation | Higher than current levels | Higher than current levels |

| Scenario 2: Inflation Moderation | Stable or slightly lower than current levels | Stable or slightly lower than current levels |

| Scenario 3: Deflationary Pressures | Lower than current levels | Lower than current levels |

These scenarios are based on different economic assumptions and are not intended to be definitive predictions. Actual outcomes will depend on the interplay of various factors and may differ significantly from these projections.

Understand how the union of CPI and the November 2024 Election can improve efficiency and productivity.

Summary

As we navigate the complex interplay between CPI and gold prices, understanding their historical connection and the factors influencing their future trajectory is essential for informed decision-making. While the economic landscape is constantly evolving, the analysis presented here offers valuable insights into the potential impact of these two key elements on investors and consumers alike.

Discover more by delving into CPI and Food Security in November 2024 further.

By considering the implications of potential gold price movements, individuals and businesses can better manage their financial risks and capitalize on opportunities in a dynamic and unpredictable market.

Frequently Asked Questions

What is the Consumer Price Index (CPI)?

The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a basket of consumer goods and services. It is a key economic indicator used to gauge inflation.

Why is gold considered a hedge against inflation?

Gold is often seen as a hedge against inflation because its value tends to rise during periods of economic uncertainty and high inflation. This is due to its inherent value and scarcity, making it a safe haven asset that can preserve wealth during times of economic turmoil.

How can investors use the relationship between CPI and gold prices to their advantage?

Investors seeking to protect their portfolios against inflation may consider including gold as part of their investment strategy. Gold’s historical performance during inflationary periods suggests it can act as a hedge, potentially mitigating losses in other asset classes.