Is Annuity The Same As Pension 2024? This question often arises as individuals approach retirement, seeking clarity on the various options available to secure their financial future. While both annuities and pensions play crucial roles in retirement planning, they differ in their structures, benefits, and potential risks.

Understanding these distinctions is essential for making informed decisions that align with individual financial goals and risk tolerance.

Annuity payments are often structured as a series of regular payments over a set period. Explore the details of Annuity Is A Series Of 2024 to understand how this payment structure works.

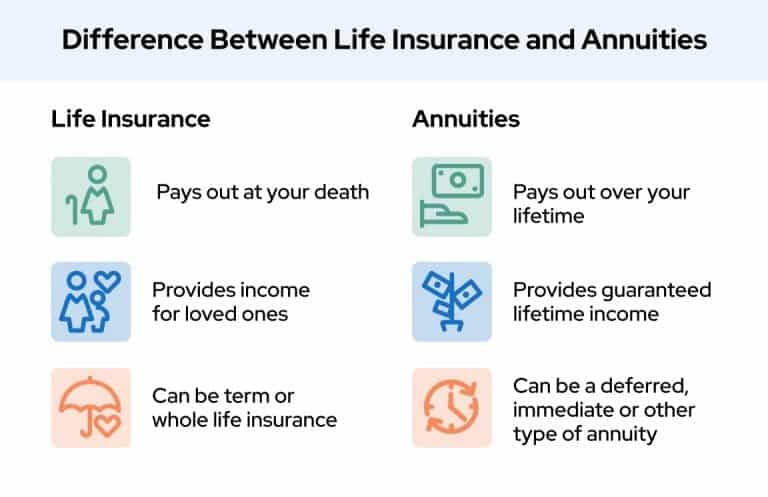

Annuity and pension plans are designed to provide a steady stream of income during retirement, but their similarities end there. Annuities are financial products purchased with a lump sum or series of payments, which then generate a stream of income for a set period or for life.

The taxability of annuity income can be a crucial factor in your financial planning. Find out if Is Annuity Income Taxable 2024 to understand how taxes might impact your annuity payments.

Pensions, on the other hand, are typically employer-sponsored retirement plans where employees contribute a portion of their salary, often matched by the employer. Upon retirement, the pension plan provides a fixed or variable income stream based on the employee’s contributions and years of service.

If you’re looking for information on annuities in Hindi, you can find resources that explain the concept and its implications. Learn about Annuity Ka Hindi Meaning 2024 to better understand this financial tool.

Understanding Annuities and Pensions

Annuities and pensions are both financial products designed to provide income during retirement. While they share similarities in their purpose, they differ in their structure, funding, and tax implications. Understanding these distinctions is crucial for individuals planning for their golden years.

Annuity joint ownership can be a good option for couples who want to ensure their financial security. Learn more about the ins and outs of Annuity Joint Ownership 2024 and how it can benefit you and your partner.

Annuity Definition and Features

An annuity is a financial product that provides a stream of regular payments, typically for a specified period or for life. It is purchased with a lump sum or a series of payments, and the payments start at a later date, usually during retirement.

Certain types of annuities qualify for tax advantages. Learn about Annuity Is Qualified 2024 to see if your annuity qualifies for tax benefits.

Key features of annuities include:

- Guaranteed Payments:Annuities offer guaranteed income for a predetermined period or lifetime, providing financial security in retirement.

- Longevity Protection:Annuities can help mitigate the risk of outliving your savings by providing a steady income stream for as long as you live.

- Investment Options:Some annuities offer investment options, allowing you to grow your principal before receiving payments.

- Tax Advantages:Depending on the type of annuity, there may be tax advantages associated with the accumulation and distribution phases.

Pension Definition and Characteristics

A pension is a retirement plan that provides regular payments to employees after they retire. Pensions are typically funded by employer contributions and are often based on a defined benefit formula, which calculates the pension benefit based on factors like salary and years of service.

Key characteristics of pensions include:

- Defined Benefit:The pension benefit is predetermined and guaranteed by the employer, providing a predictable income stream in retirement.

- Employer-Funded:Employers bear the primary responsibility for funding pensions, relieving employees of the burden of saving for retirement.

- Risk Sharing:Pensions share the investment risk between the employer and employees, as the employer is responsible for managing the pension fund.

- Tax-Deferred Growth:Pension contributions and earnings grow tax-deferred, reducing your tax burden during your working years.

Traditional Pensions vs. Defined Contribution Plans

Traditional pensions are becoming less common, with many employers transitioning to defined contribution plans, such as 401(k)s. Here’s a comparison:

| Feature | Traditional Pension | Defined Contribution Plan |

|---|---|---|

| Benefit Structure | Defined benefit based on a formula | Defined contribution based on employee contributions and investment performance |

| Funding | Employer-funded | Employee-funded, with potential employer matching contributions |

| Risk | Risk shared between employer and employees | Risk borne by employees |

| Income Security | Guaranteed income stream in retirement | Income stream dependent on investment performance and contributions |

Payment Structures and Funding Sources

Annuities and pensions differ in their payment structures and funding sources. Annuities are typically funded by individuals, while pensions are funded by employers. Annuity payments are based on the principal amount invested and the interest earned, while pension payments are based on a defined benefit formula.

Annuity can be a valuable tool for retirement planning. Learn about the benefits of Annuity Is Good 2024 and how it can help you secure your future.

Similarities and Differences

While annuities and pensions serve similar purposes, they have distinct features and considerations.

Commonalities

Both annuities and pensions are designed to provide a stream of income during retirement. They can help individuals achieve financial security and maintain their standard of living in their later years. Both options can provide longevity protection, ensuring that you have income for as long as you live.

The tax implications of annuities can be complex, especially when it comes to life insurance. Find out if Is Annuity For Life Insurance Taxable 2024 to make sure you understand the potential tax liabilities.

Key Distinctions

Despite their similarities, annuities and pensions differ in several crucial aspects:

- Tax Implications:Annuities are typically taxed as ordinary income upon withdrawal, while pensions may offer tax-deferred growth and tax-free distributions in retirement.

- Investment Options:Annuities often offer a variety of investment options, allowing you to tailor your investment strategy to your risk tolerance. Pensions typically have limited investment options, as the employer manages the pension fund.

- Risk Profiles:Annuities carry some investment risk, particularly with variable annuities. Pensions typically have lower investment risk as the employer manages the fund and guarantees a defined benefit.

Comparison Table

| Feature | Annuity | Pension |

|---|---|---|

| Guaranteed Income | Yes, for a specified period or lifetime | Yes, based on a defined benefit formula |

| Longevity Protection | Yes, provides income for as long as you live | Yes, provides income for as long as you live |

| Investment Flexibility | High, with various investment options | Low, limited investment options |

| Funding Source | Individual | Employer |

| Risk Profile | Moderate to high, depending on investment options | Low, risk shared between employer and employees |

Annuity Types and Their Relevance

Annuities come in various forms, each with its own advantages and disadvantages.

Annuity health plans can vary depending on your location. If you’re in Westmont, Illinois, explore the options available for Annuity Health Westmont Il 2024 to find the right plan for your needs.

Types of Annuities

- Fixed Annuities:Offer a guaranteed rate of return, providing a predictable income stream. They are less risky than variable annuities but may have lower returns.

- Variable Annuities:Allow you to invest your premium in a variety of sub-accounts, offering the potential for higher returns but also higher risk. They are linked to the performance of the underlying investments.

- Indexed Annuities:Offer returns linked to the performance of a specific market index, such as the S&P 500. They provide some downside protection while offering potential for growth.

Advantages and Disadvantages

The choice of annuity type depends on your individual financial goals and risk tolerance. Fixed annuities are suitable for those seeking guaranteed income and low risk, while variable annuities may appeal to those with a higher risk appetite and the potential for greater returns.

Indexed annuities offer a balance between growth and protection.

Complementing Pension Income, Is Annuity The Same As Pension 2024

Annuities can complement pension income streams by providing additional income or longevity protection. For example, a fixed annuity can provide a guaranteed income stream to supplement a pension, while a variable annuity can offer the potential for growth to help keep pace with inflation.

One of the key benefits of annuities is the guarantee of income payments. Explore the concept of Is Annuity Income Guaranteed 2024 to understand the level of security offered.

Factors to Consider in 2024

Current economic conditions and market volatility influence the choices you make regarding annuities and pensions.

Many people wonder if they can still work while receiving an annuity. The answer is yes! Learn more about Can You Receive Annuity And Still Work 2024 and how to manage both income streams.

Economic Conditions and Interest Rates

Rising interest rates can impact the returns on fixed annuities, while a volatile market may affect the performance of variable annuities. It’s essential to stay informed about economic trends and their potential impact on your retirement planning.

If you’re in Hong Kong and considering an annuity, it’s essential to understand the specific regulations and options available. Explore the landscape of Annuity Hk 2024 to make the right decisions for your financial needs.

Inflation and Longevity

Inflation can erode the purchasing power of your retirement savings. Longevity is another factor to consider, as you may need to plan for a longer retirement than previous generations. Choosing annuities and pensions that provide longevity protection and potential for growth is crucial.

Legislative Changes and Regulatory Updates

Keep abreast of any legislative changes or regulatory updates that may affect annuities and pensions. These changes could impact tax implications, investment options, or other aspects of these retirement products.

Expert Insights and Recommendations

Consulting with a qualified financial advisor is essential for personalized retirement planning strategies. They can provide insights on the best practices for choosing between annuities and pensions, as well as the appropriate allocation of your retirement savings.

Choosing Between Annuities and Pensions

Financial professionals recommend considering your individual financial situation, risk tolerance, and retirement goals when choosing between annuities and pensions. Factors such as your age, health, and income needs play a role in this decision.

Taxation of annuity income can be a complex topic. Get informed about Annuity Is Taxable 2024 to understand the tax implications of your annuity payments.

Allocation of Retirement Savings

A balanced approach to retirement planning involves diversifying your retirement savings across different asset classes, including annuities, pensions, and other investments. Your financial advisor can help you determine the appropriate allocation based on your specific circumstances.

The type of fund used for an annuity can impact its performance and growth potential. Learn about the different Annuity Fund Is 2024 options to find the one that best suits your investment goals.

Importance of Financial Advice

Seeking advice from a qualified financial advisor is crucial for making informed decisions about your retirement planning. They can provide personalized guidance, help you understand the intricacies of annuities and pensions, and develop a comprehensive retirement plan that aligns with your goals and financial situation.

Ultimate Conclusion

Navigating the complex world of retirement planning requires careful consideration of all available options. Whether choosing an annuity, a pension, or a combination of both, it’s crucial to understand the nuances of each approach and seek professional advice tailored to individual circumstances.

By thoughtfully evaluating these financial tools, individuals can confidently create a retirement plan that provides security and peace of mind for the years to come.

Answers to Common Questions: Is Annuity The Same As Pension 2024

What are the tax implications of annuities and pensions?

The interest rate on an annuity can vary depending on the type of annuity and the market conditions. Stay up-to-date on the latest Annuity Rate Is 2024 to make informed investment choices.

The tax implications of annuities and pensions vary depending on the specific plan and individual circumstances. It’s important to consult with a tax professional for personalized advice.

Understanding the future value of an annuity is crucial for making informed financial decisions. Explore the concept of Annuity Is Future Value 2024 to see how your investment can grow over time.

How can I choose the right annuity type for my needs?

The best annuity type depends on your risk tolerance, financial goals, and time horizon. Consulting with a financial advisor can help you determine the most suitable option.

Are there any downsides to annuities or pensions?

Both annuities and pensions have potential downsides. Annuities may have high fees or surrender charges, while pensions may be subject to changes in employer contributions or funding.

Can I have both an annuity and a pension?

Yes, you can have both an annuity and a pension. In fact, combining these financial tools can provide a diversified and robust retirement income stream.