How Stimulus Check Payments Are Calculated for Part-Time Workers in Pennsylvania is a topic that has sparked significant interest, particularly among those who rely on part-time employment for their income. This guide delves into the intricacies of stimulus check eligibility and calculation for part-time workers in Pennsylvania, providing clarity and insight into a complex process.

Enhance your insight with the methods and methods of Recent Changes to Ohio Stimulus Check Eligibility Requirements.

Understanding the factors that influence stimulus check payments is crucial for part-time workers in Pennsylvania. This includes assessing income levels, dependents, and filing status, all of which play a role in determining the amount of financial assistance received. By navigating the complexities of the calculation process, part-time workers can gain a clearer understanding of their eligibility and potential benefits.

Eligibility Criteria for Stimulus Check Payments in Pennsylvania

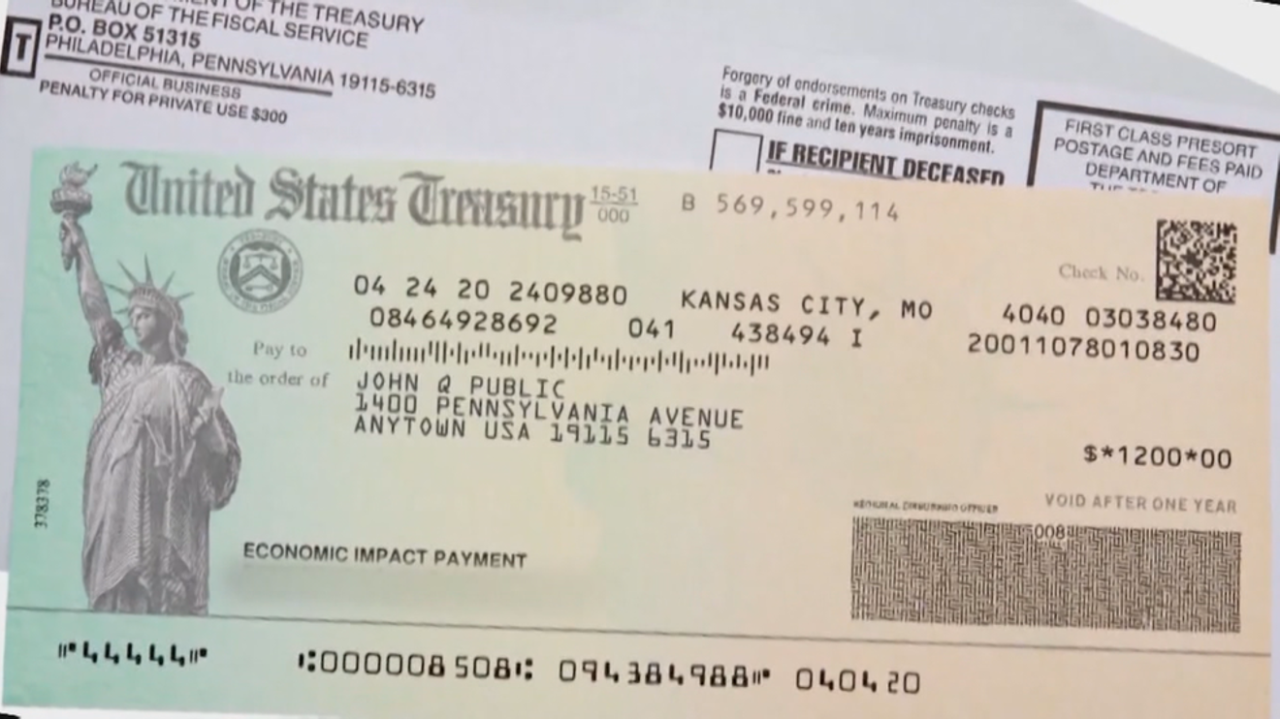

Stimulus check payments, officially known as Economic Impact Payments, were distributed by the federal government to help individuals and families cope with the economic fallout of the COVID-19 pandemic. In Pennsylvania, as in other states, eligibility for these payments was determined by a set of criteria, including income levels, filing status, and dependents.

This article will delve into the specific eligibility requirements for part-time workers in Pennsylvania, providing clarity on who qualified for these payments.

General Eligibility Requirements

To be eligible for stimulus check payments in Pennsylvania, individuals generally had to meet the following criteria:

- Be a U.S. citizen or lawful resident.

- Have a valid Social Security number.

- Not be claimed as a dependent on someone else’s tax return.

- Have an adjusted gross income (AGI) below a certain threshold.

Income Thresholds for Part-Time Workers, How Stimulus Check Payments Are Calculated for Part-Time Workers in Pennsylvania

The income thresholds for stimulus check eligibility varied depending on the individual’s filing status and the number of dependents they claimed. For part-time workers, the key factor in determining eligibility was their adjusted gross income (AGI), which is calculated after certain deductions and credits are applied to their total income.

Find out further about the benefits of Future of the Stimulus Check Program in Ohio that can provide significant benefits.

Here’s a breakdown of the income thresholds for different filing statuses:

Examples of Eligibility

Here are some examples of situations where part-time workers might qualify or not qualify for stimulus check payments based on their income levels and filing status:

- Scenario 1: Single filer with no dependents.A part-time worker with an AGI of $75,000 would not qualify for a stimulus check payment, as the income threshold for single filers without dependents was $75,000.

- Scenario 2: Married filing jointly with one dependent.A part-time worker who is married and filing jointly with one dependent would have an income threshold of $150,000. If their AGI was $145,000, they would be eligible for a stimulus check payment.

- Scenario 3: Head of household with two dependents.A part-time worker who is filing as head of household with two dependents would have an income threshold of $112,500. If their AGI was $110,000, they would be eligible for a stimulus check payment.

Calculating Stimulus Check Payments for Part-Time Workers

The amount of the stimulus check payment was based on the individual’s income level, filing status, and number of dependents. For part-time workers, the calculation involved determining their AGI and then using that figure to determine the applicable payment amount.

Browse the implementation of Addressing Concerns and Rumors About Ohio Stimulus Checks in real-world situations to understand its applications.

Here’s a step-by-step guide on how stimulus check payments were calculated for part-time workers in Pennsylvania:

Step-by-Step Calculation

- Determine Adjusted Gross Income (AGI):This is calculated by subtracting certain deductions and credits from your total income. For part-time workers, this would include income from their part-time job, as well as any other sources of income, such as unemployment benefits, interest, or dividends.

- Identify Filing Status:This refers to how you file your taxes. The most common filing statuses include single, married filing jointly, married filing separately, head of household, and qualifying widow(er).

- Determine Number of Dependents:This includes children, spouses, or other individuals who are claimed as dependents on your tax return.

- Consult Payment Schedule:The IRS provided a table outlining the different payment amounts based on income levels, filing statuses, and dependents. You can find this table on the IRS website or consult a tax professional.

Factors Affecting Calculation

Several factors can affect the calculation of stimulus check payments for part-time workers, including:

- Income Level:The higher your AGI, the lower the amount of your stimulus check payment, or you may not qualify at all.

- Dependents:Individuals with dependents typically received a larger stimulus check payment than those without dependents.

- Filing Status:The amount of the stimulus check payment varied depending on your filing status.

Payment Amount Table

| Filing Status | AGI Threshold | Payment Amount |

|---|---|---|

| Single | $75,000 | $1,200 |

| Married Filing Jointly | $150,000 | $2,400 |

| Head of Household | $112,500 | $1,200 |

Note:This table is for illustrative purposes only and may not reflect the exact payment amounts. For accurate information, consult the IRS website or a tax professional.

Impact of Part-Time Employment on Stimulus Check Calculations

The calculation process for stimulus check payments was the same for both full-time and part-time workers. The key difference was in how income was assessed. For full-time workers, income was typically based on W-2 forms, which document wages and withholdings from employment.

For part-time workers, income could be derived from various sources, such as W-2 forms, 1099 forms (for independent contractors), or other income sources.

Seasonal or Temporary Part-Time Employment

For part-time workers with seasonal or temporary employment, the calculation of stimulus check payments could be more complex. The IRS provided guidance on how to handle income from seasonal or temporary work, which typically involved averaging income over a specific period to determine eligibility.

Expand your understanding about Stimulus Check Program and the Upcoming Election in Ohio with the sources we offer.

In some cases, part-time workers with seasonal or temporary employment might have been ineligible for stimulus check payments if their income did not meet the required thresholds.

Browse the implementation of Stimulus Checks Payment Amounts in Pennsylvania in real-world situations to understand its applications.

Resources and Assistance for Part-Time Workers: How Stimulus Check Payments Are Calculated For Part-Time Workers In Pennsylvania

Part-time workers who have questions about stimulus check eligibility or calculation can find information and assistance from various resources, including:

Government Agencies and Websites

- Internal Revenue Service (IRS):The IRS website (www.irs.gov) provides comprehensive information on stimulus check payments, including eligibility criteria, calculation methods, and frequently asked questions.

- Pennsylvania Department of Revenue:The Pennsylvania Department of Revenue (www.revenue.pa.gov) offers information on state taxes and related matters, although it does not provide specific guidance on stimulus check payments.

Programs and Initiatives

While there are no specific programs or initiatives designed exclusively for part-time workers in Pennsylvania regarding stimulus check payments, there are various resources available to assist individuals with financial challenges, including:

- Pennsylvania Department of Human Services (DHS):DHS provides various programs and services to assist low-income individuals and families, including food assistance, cash assistance, and healthcare benefits.

- United Way of Pennsylvania:The United Way of Pennsylvania offers a wide range of resources and support services to individuals and families in need, including financial assistance, housing assistance, and job training.

Frequently Asked Questions (FAQs)

- Q: If I am a part-time worker and my income is below the threshold, am I automatically eligible for a stimulus check payment?A:No, meeting the income threshold is only one of the eligibility requirements. You must also meet other criteria, such as being a U.S. citizen or lawful resident and having a valid Social Security number.

- Q: If I am a part-time worker and my income fluctuates throughout the year, how is my eligibility determined?A:Your eligibility for stimulus check payments was based on your adjusted gross income (AGI) for the tax year in which the payments were distributed.

- Q: If I am a part-time worker and I received unemployment benefits, does that affect my eligibility for a stimulus check payment?A:Yes, unemployment benefits are considered income and can affect your eligibility for stimulus check payments.

Conclusive Thoughts

Navigating the stimulus check process can be challenging, especially for part-time workers. By understanding the eligibility criteria, calculation methods, and available resources, part-time workers in Pennsylvania can confidently pursue the financial assistance they deserve. Remember to explore the relevant government websites and programs for the most up-to-date information and support.

Essential Questionnaire

What if I’m a seasonal part-time worker?

Explore the different advantages of Stimulus Check Impact on the Ohio Economy that can change the way you view this issue.

Seasonal employment is considered part-time work, and your eligibility for stimulus payments will be based on your total income for the relevant tax year.

How do I find out if I qualify for a stimulus check?

The best way to determine your eligibility is to visit the official IRS website or consult with a tax professional. They can provide personalized guidance based on your specific circumstances.

What if I haven’t received my stimulus check yet?

If you believe you are eligible for a stimulus check and haven’t received it, you can contact the IRS directly or seek assistance from a tax professional. They can help you navigate the process of claiming your payment.