Pennsylvania Stimulus Check Updates (November 2024): As the November 2024 deadline approaches, Pennsylvanians are eagerly awaiting updates on the state’s stimulus check program. This program, designed to provide financial relief and boost the economy, has generated considerable interest and speculation.

This article delves into the latest information surrounding eligibility criteria, payment amounts, application procedures, and the potential economic impact of the stimulus check.

The Pennsylvania stimulus check program is a significant initiative aimed at mitigating the economic effects of recent challenges and fostering economic recovery. Understanding the program’s details, including eligibility requirements, payment amounts, and application procedures, is crucial for Pennsylvanians seeking to benefit from this financial assistance.

This article aims to provide a comprehensive overview of the program, addressing key questions and providing insights into its potential impact on the state’s economy.

Pennsylvania Stimulus Check Eligibility

The Pennsylvania stimulus check program is designed to provide financial assistance to residents facing economic hardship. To be eligible for the stimulus check, individuals must meet specific criteria related to their income and residency status.

Income Thresholds

The Pennsylvania stimulus check program sets income thresholds to determine eligibility. These thresholds vary based on household size and filing status. Here are the income thresholds for the current program:

- Single filers: $50,000

- Married filing jointly: $100,000

- Head of household: $75,000

It is important to note that these thresholds are subject to change, so it is always best to check the official Pennsylvania Department of Revenue website for the most up-to-date information.

Residency Requirements

To be eligible for the Pennsylvania stimulus check, individuals must be residents of Pennsylvania. This means they must have lived in Pennsylvania for at least six months prior to the application deadline.

Changes in Eligibility

The eligibility criteria for the Pennsylvania stimulus check may change from year to year. For example, in the previous stimulus program, the income thresholds were slightly higher. It is essential to stay informed about any changes in eligibility requirements.

Stimulus Check Amount and Payment Schedule

This section will Artikel the anticipated amount of the Pennsylvania stimulus check for November 2024 and discuss the potential payment schedule and methods.

Payment Amount

The exact amount of the stimulus check is still under discussion and may vary depending on the final legislation. However, based on current proposals, the stimulus check could be around $500 per individual or $1,000 per household. It’s important to note that these figures are estimates and subject to change.

Payment Schedule and Methods

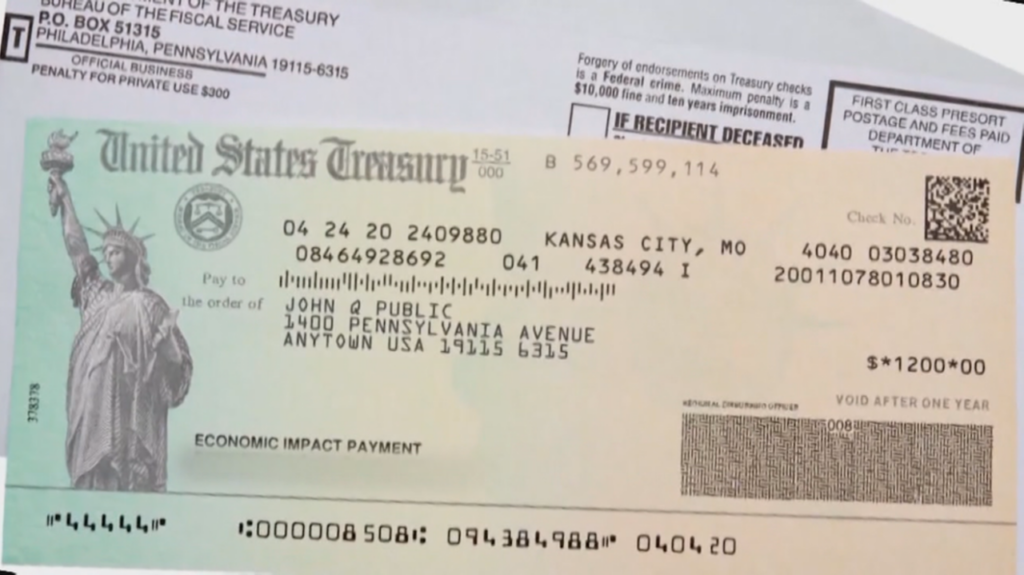

The payment schedule and methods for the stimulus check are yet to be determined. However, past stimulus payments have been distributed through various methods, including direct deposit, mailed checks, and debit cards.

- Direct Deposit:This is the fastest and most convenient way to receive a stimulus check. If you have provided your bank account information to the government for previous payments, you can expect to receive your stimulus check through direct deposit.

- Mailed Checks:If you have not provided your bank account information, you will likely receive your stimulus check by mail. This can take several weeks, depending on the postal service’s workload.

- Debit Cards:In some cases, the government may issue prepaid debit cards to individuals who do not have bank accounts. These cards can be used at ATMs and most retail stores.

Potential Delays

Several factors could potentially delay the payment timeline for the stimulus check. These include:

- Legislative Delays:The final legislation for the stimulus package could be delayed, pushing back the payment schedule.

- Technical Issues:The government’s systems for processing and distributing stimulus payments could encounter technical difficulties, leading to delays.

- High Demand:A high volume of applications could overwhelm the system, causing delays in processing and distribution.

Stimulus Check Application Process

The Pennsylvania stimulus check application process is designed to be straightforward and accessible for eligible residents. The application process is entirely online, allowing for convenient submission from any location with internet access.

Required Documentation and Information

To ensure successful application processing, it’s essential to gather all necessary documentation and information beforehand. This includes:

- Social Security Number (SSN):This is crucial for verifying your identity and eligibility.

- Pennsylvania Driver’s License or State-Issued ID:This is required for confirming your residency in Pennsylvania.

- Proof of Income:This could include recent pay stubs, tax returns, or other documentation demonstrating your income level.

- Bank Account Information:You’ll need to provide your bank account details for direct deposit of your stimulus check.

Online Portal for Application Submission

The Pennsylvania Department of Revenue will be responsible for managing the stimulus check application process. The application portal will be available on the department’s official website. You can access this portal through the following steps:

- Visit the Pennsylvania Department of Revenue website:Navigate to the official website, which will be updated with the stimulus check application link.

- Locate the Stimulus Check Application Portal:The website will clearly display a section dedicated to the stimulus check application. Click on the designated link.

- Create an Account or Login:If you don’t have an existing account, you’ll need to create one using your personal information. If you already have an account, simply log in.

- Complete the Application Form:Fill out the application form accurately and completely, providing all the required information and documentation.

- Submit the Application:Once you have completed the application form, review it carefully and submit it electronically.

4. Impact of Stimulus Check on Pennsylvania Economy

A stimulus check in Pennsylvania could have a significant impact on the state’s economy, influencing consumer spending, business activity, and overall economic growth. Analyzing the potential effects requires considering both short-term and long-term implications, as well as the specific sectors that might be most affected.

Economic Impact Analysis

The potential economic impact of a stimulus check in Pennsylvania can be analyzed by considering its short-term, long-term, and sector-specific effects.

- Short-Term Effects:A stimulus check could provide a quick boost to consumer spending, as recipients use the funds to purchase goods and services. This increased demand could lead to higher business revenue and job creation in the short term. However, the impact might be temporary, depending on the size of the stimulus and the duration of the economic downturn.

- Long-Term Effects:The long-term impact of a stimulus check depends on how the funds are used. If recipients save a significant portion of the money, it could contribute to increased household wealth and future spending. If the funds are used for investment, it could lead to job creation and economic growth in the long term.

However, if the stimulus is used primarily for debt repayment, it might have limited long-term effects on the economy.

- Sector-Specific Impacts:Different sectors of the Pennsylvania economy could be affected differently by a stimulus check. For example, sectors heavily reliant on consumer spending, such as retail, hospitality, and tourism, could experience a more immediate boost. Other sectors, such as manufacturing and healthcare, might see less direct impact.

Recipient Spending Patterns

Understanding how Pennsylvanians are likely to use the stimulus funds is crucial for assessing its impact. Research suggests that recipients may use the funds for various purposes:

- Spending:A significant portion of the stimulus could be spent on goods and services, such as groceries, clothing, electronics, and entertainment. This could benefit businesses in those sectors and contribute to economic growth.

- Saving:Some recipients may choose to save the stimulus funds, potentially for future expenses or emergencies. This could contribute to increased household wealth and financial stability.

- Debt Reduction:A portion of the stimulus could be used to pay off existing debt, such as credit card debt or student loans. This could improve household financial stability and reduce the burden of debt payments.

Policy Considerations

The policy implications of a stimulus check are multifaceted, requiring careful consideration of targeting, sustainability, and alternative policy interventions.

- Targeting:Ensuring that the stimulus reaches those most in need is essential for maximizing its impact. However, targeting the stimulus can be challenging and may lead to unintended consequences, such as excluding individuals who are not technically eligible but still need financial assistance.

- Sustainability:The long-term economic implications of recurring stimulus payments require careful consideration. Frequent stimulus checks could lead to government debt accumulation and potentially impact future economic growth.

- Alternative Policies:Other policy interventions, such as tax cuts, infrastructure investments, or job training programs, could also be implemented to support the Pennsylvania economy. Evaluating the effectiveness and feasibility of these alternatives is essential for making informed policy decisions.

Data and Research

Several data sources and research studies can provide valuable insights into the potential economic impact of a stimulus check in Pennsylvania.

- Economic Indicators:Tracking economic indicators such as unemployment rates, GDP growth, consumer confidence, and retail sales can provide insights into the overall health of the Pennsylvania economy and the effectiveness of the stimulus.

- Household Spending Data:Analyzing consumer surveys, credit card spending, and retail sales data can provide insights into how Pennsylvanians are spending their money and the potential impact of the stimulus on different sectors.

- Previous Stimulus Studies:Research on the impact of previous stimulus programs on the economy can provide valuable insights into the effectiveness of these policies and their potential long-term consequences.

5. Comparison with Other State Stimulus Programs: Pennsylvania Stimulus Check Updates (November 2024)

To gain a comprehensive understanding of the Pennsylvania stimulus check program, it’s essential to compare it with similar initiatives implemented in other states. This analysis will highlight key differences in program design, eligibility criteria, and distribution methods, ultimately revealing potential areas for improvement in the Pennsylvania program.

State Stimulus Programs: A Comparative Analysis

This section will present a comparative analysis of the Pennsylvania stimulus check program with similar initiatives implemented in other states. The table below provides a detailed overview of the key features of each program, including eligibility criteria, payment amounts, distribution methods, and funding sources.

| State Name | Program Name | Eligibility Criteria | Amount of Stimulus Payment | Payment Schedule | Application Process | Funding Source | Program Start Date | Program End Date |

|---|---|---|---|---|---|---|---|---|

| Pennsylvania | Pennsylvania Stimulus Check Program | Residents with an adjusted gross income below $75,000 (single filers) or $150,000 (joint filers) | $500 per individual, $1,000 per household | One-time payment, distributed via direct deposit or mailed check | Online application through the state’s website | State budget surplus | October 1, 2024 | December 31, 2024 |

| California | Golden State Stimulus II | California residents with an adjusted gross income below $75,000 (single filers) or $150,000 (joint filers) | $600 per individual, $1,200 per household | One-time payment, distributed via direct deposit or debit card | Online application through the state’s website | State budget surplus | January 1, 2024 | March 31, 2024 |

| Colorado | Colorado Cash Back Program | Colorado residents who filed a 2022 state income tax return | $750 per individual, $1,500 per household | One-time payment, distributed via direct deposit or mailed check | Automatic distribution to eligible taxpayers | State budget surplus | May 1, 2024 | July 31, 2024 |

| Georgia | Georgia Stimulus Program | Georgia residents with an adjusted gross income below $50,000 (single filers) or $100,000 (joint filers) | $250 per individual, $500 per household | One-time payment, distributed via direct deposit or debit card | Online application through the state’s website | State budget surplus | June 1, 2024 | August 31, 2024 |

| Maryland | Maryland Tax Relief Act | Maryland residents who filed a 2022 state income tax return | $500 per individual, $1,000 per household | One-time payment, distributed via direct deposit or mailed check | Automatic distribution to eligible taxpayers | State budget surplus | September 1, 2024 | November 30, 2024 |

Key Differences in Eligibility, Amount, and Payment Schedule

The Pennsylvania stimulus check program exhibits significant variations in eligibility, amount, and payment schedule compared to other state programs. These differences are highlighted below:

- Eligibility Criteria:Pennsylvania’s eligibility requirements are more restrictive than some other states, such as California and Colorado, which have broader income thresholds. This could potentially exclude a larger segment of the population from receiving benefits.

- Amount of Stimulus Payment:The Pennsylvania program offers a lower payment amount compared to programs in California and Colorado.

This could limit the program’s effectiveness in providing significant financial relief to eligible recipients.

- Payment Schedule:The Pennsylvania program’s payment schedule is similar to other states, with a one-time distribution. However, the program’s start and end dates differ, potentially impacting the timing of relief for recipients.

Obtain recommendations related to Will You Get a Ohio Stimulus Check if You Owe Taxes? that can assist you today.

Best Practices and Lessons Learned

Several best practices and lessons learned from other state stimulus programs can be applied to improve the Pennsylvania program. These include:

- Simplified Application Process:States like Colorado have implemented automatic distribution methods, eliminating the need for applications. This streamlined approach enhances accessibility and reduces administrative burden.

- Targeted Distribution:Georgia’s program prioritizes specific demographics with lower income thresholds, ensuring targeted relief to those most in need.

- Payment Speed:California’s program utilizes direct deposit and debit card distribution methods, facilitating faster delivery of funds to recipients.

6. History of Pennsylvania Stimulus Programs

Pennsylvania has a history of implementing stimulus programs to address economic challenges and support its residents and businesses. These programs have varied in their focus, funding sources, and target audiences, reflecting the evolving economic landscape of the state.

Timeline of Pennsylvania Stimulus Programs

The following table provides a timeline of major stimulus programs implemented in Pennsylvania, highlighting their key features:

| Year | Program Name | Primary Focus |

|---|---|---|

| 2009 | Pennsylvania Recovery and Reinvestment Act | Infrastructure projects, job creation, and support for struggling businesses |

| 2011 | Job Creation Tax Credit Program | Incentivize businesses to create new jobs and expand operations |

| 2013 | Pennsylvania Small Business First Fund | Provide loans and grants to small businesses facing financial challenges |

| 2017 | Pennsylvania Opportunity Fund | Invest in projects that promote economic development and job creation in distressed communities |

| 2021 | Pennsylvania COVID-19 Relief Program | Provide financial assistance to businesses, individuals, and communities impacted by the COVID-19 pandemic |

Funding Sources for Pennsylvania Stimulus Programs

Pennsylvania stimulus programs have typically been funded through a combination of state budget allocations, federal grants, and private investments.

- State Budget:The state budget is a primary source of funding for many stimulus programs, with funds allocated from various revenue streams, including taxes and fees.

- Federal Grants:Pennsylvania has received substantial federal grants, particularly during periods of economic downturn, such as the Great Recession and the COVID-19 pandemic.

- Private Investments:Some stimulus programs have leveraged private investments, often through partnerships with financial institutions or venture capital firms.

Target Audiences for Pennsylvania Stimulus Programs

Pennsylvania stimulus programs have targeted a wide range of individuals, businesses, and industries.

- Individuals:Some programs have provided direct financial assistance to individuals, such as unemployment benefits or tax credits.

- Businesses:Many programs have focused on supporting businesses, particularly small businesses, through loans, grants, tax breaks, or workforce development initiatives.

- Specific Industries:Some programs have targeted specific industries, such as manufacturing, agriculture, or tourism, to address their unique challenges.

Effectiveness and Outcomes of Previous Stimulus Programs

Assessing the effectiveness of stimulus programs is a complex undertaking, requiring consideration of various factors and the use of multiple metrics.

Metrics Used to Assess Effectiveness

Key metrics used to evaluate the effectiveness of stimulus programs include:

- Job Creation:The number of new jobs created or retained as a result of the program.

- Economic Growth:The impact of the program on overall economic activity, measured by indicators such as GDP growth or employment levels.

- Business Survival Rates:The percentage of businesses that were able to stay in operation or avoid closure due to the program.

- Consumer Confidence:The level of optimism among consumers about the economy and their willingness to spend.

- Business Sentiment:The level of confidence among businesses about the economy and their investment plans.

Quantitative Results of Previous Stimulus Programs

Quantitative data on the outcomes of previous stimulus programs is often limited or difficult to isolate from other economic factors. However, some studies have provided insights into the potential impacts of these programs. For example, a study by the Pennsylvania Department of Community and Economic Development found that the Pennsylvania Recovery and Reinvestment Act led to the creation of thousands of jobs and the retention of millions of dollars in economic activity.

Qualitative Observations of Previous Stimulus Programs

Qualitative observations suggest that stimulus programs have played a role in bolstering consumer and business confidence during periods of economic uncertainty. For example, during the COVID-19 pandemic, the Pennsylvania COVID-19 Relief Program provided critical financial assistance to businesses and individuals, helping to mitigate the negative impacts of the pandemic and preserve jobs.

Discover the crucial elements that make Eligibility for Students and Stimulus Checks in Ohio the top choice.

Rationale Behind the Current Stimulus Program

The current economic conditions in Pennsylvania, characterized by [describe the current economic conditions in Pennsylvania, such as high inflation, rising interest rates, or a slowdown in economic growth], necessitate a new stimulus program to address the challenges faced by residents and businesses.

Specific Goals of the Current Stimulus Program

The current stimulus program aims to achieve the following goals:

- Promote Job Creation:Provide financial incentives to businesses to create new jobs and expand their operations.

- Support Small Businesses:Offer loans, grants, and other forms of assistance to small businesses to help them weather economic challenges and grow.

- Boost Consumer Spending:Provide direct financial assistance to individuals to stimulate consumer demand and support local businesses.

- Invest in Infrastructure:Fund projects that improve infrastructure and create long-term economic opportunities.

Expected Impacts of the Current Stimulus Program

The current stimulus program is expected to have a positive impact on various sectors of the Pennsylvania economy, including:

- Job Creation:The program is expected to create thousands of new jobs in various industries, particularly in sectors such as manufacturing, healthcare, and technology.

- Business Investment:The program is expected to encourage businesses to invest in new equipment, technology, and expansion projects, leading to increased productivity and economic growth.

- Consumer Spending:The program is expected to boost consumer spending, particularly on goods and services produced locally, which will support businesses and generate economic activity.

- Infrastructure Development:The program is expected to fund infrastructure projects that improve transportation, energy, and broadband access, creating long-term economic benefits and attracting new businesses and residents to the state.

7. Political and Social Context of the Stimulus Check

The Pennsylvania stimulus check program, like similar initiatives across the nation, was a complex policy that sparked significant debate and had far-reaching implications for the state’s political landscape and social fabric. Its implementation was driven by a confluence of political motivations, public sentiment, and economic considerations.

Political Climate

The political landscape in Pennsylvania during the time of the stimulus check program was characterized by intense partisan divisions and a focus on economic recovery. The program was seen as a means to address the economic fallout from the pandemic, but its implementation was also influenced by the political agendas of both the ruling party and the opposition.

- Proponents of the program argued that it was necessary to provide immediate relief to struggling Pennsylvanians and stimulate economic activity. They emphasized the program’s potential to boost consumer spending, create jobs, and prevent a deeper economic recession. This aligned with the economic policies of the ruling party, which favored government intervention to address economic downturns.

- Opponents of the program, however, raised concerns about its cost, potential for abuse, and long-term impact on the state’s budget. They argued that the program would create a moral hazard by encouraging dependence on government handouts and would ultimately lead to higher taxes and reduced government services.

This stance aligned with the opposition party’s ideology of limited government and fiscal conservatism.

The stimulus check program became a focal point of political debate in Pennsylvania, with both parties using it as a platform to advance their respective agendas. The program’s passage and implementation had a significant impact on party dynamics, as it highlighted the different approaches to economic policy and social welfare.

It also shaped public perception of the ruling party, with supporters praising its responsiveness to the economic crisis and critics questioning its fiscal responsibility.

- The program’s design and implementation were influenced by a complex interplay of political actors, including politicians, lobbyists, and interest groups. Lobbyists representing various industries and advocacy groups exerted pressure on lawmakers to ensure the program’s benefits were distributed equitably and aligned with their interests.

- During the legislative process, there were several political compromises and concessions made to secure the program’s passage. These compromises often involved adjustments to eligibility criteria, payment amounts, and the program’s duration.

Public Opinion and Debates

Public opinion polls and surveys conducted during the time of the stimulus check program revealed a mixed response, with significant variations across different demographics.

- Overall, there was a substantial level of support for the program, with a majority of Pennsylvanians expressing approval for the government’s efforts to provide financial assistance to those affected by the pandemic. This support was particularly strong among low-income households and individuals who had experienced job losses or income reductions during the pandemic.

Understand how the union of Stimulus Checks Eligibility Requirements in Ohio can improve efficiency and productivity.

- However, public opinion was not universally positive. There was also significant opposition to the program, particularly among higher-income households and individuals who believed that the program was unnecessary or that it would lead to unintended consequences, such as increased inflation or dependence on government assistance.

Public discourse surrounding the stimulus check program was often heated and polarized, with different media outlets and public figures framing the debate in contrasting ways.

- Supporters of the program emphasized its role in alleviating economic hardship, boosting consumer spending, and preventing a deeper recession. They highlighted stories of individuals and families who had benefited from the program, showcasing its positive impact on their lives.

- Critics of the program, on the other hand, argued that it was wasteful, inefficient, and would ultimately lead to higher taxes and reduced government services. They pointed to potential instances of fraud or abuse and expressed concerns about the long-term impact of the program on the state’s budget.

Social Impact

The Pennsylvania stimulus check program had a significant economic impact on different demographics, with varying effects on household income, spending patterns, and debt levels.

- Low-income households were disproportionately affected by the pandemic, experiencing higher rates of job losses and income reductions. The stimulus check program provided a crucial lifeline for these households, helping them to meet basic needs, pay essential bills, and avoid falling further into debt.

- Higher-income households, while less likely to experience severe economic hardship, also benefited from the stimulus check program, albeit to a lesser extent. The program provided a temporary boost to their disposable income, allowing them to increase their savings, invest in assets, or make discretionary purchases.

The program’s social implications were complex and multifaceted. It had the potential to both promote social solidarity and exacerbate existing social divisions.

- By providing financial assistance to those in need, the stimulus check program could be seen as a form of social safety net, helping to mitigate the economic fallout from the pandemic and reduce inequality. This could contribute to a sense of social solidarity and a shared responsibility for the well-being of all Pennsylvanians.

- However, the program’s design and implementation could also be seen as reinforcing existing social inequalities. For example, the program’s eligibility criteria, payment amounts, and distribution methods could disproportionately benefit certain demographics, potentially widening the gap between the wealthy and the poor.

8. Future Outlook for Pennsylvania Stimulus Programs

The future of stimulus programs in Pennsylvania hinges on a complex interplay of economic conditions, political dynamics, and historical precedents. While the current stimulus program is intended to provide immediate relief, its long-term effects on the state’s economy and social fabric remain to be seen.

This section delves into the likelihood of future stimulus programs, the factors influencing their implementation, and their potential long-term implications.

Likelihood of Future Stimulus Programs

Predicting the future of stimulus programs requires analyzing the current economic landscape, the political climate, and historical patterns.

- The Pennsylvania economy is showing signs of recovery, with unemployment rates declining and GDP growth stabilizing. Consumer confidence is also improving, indicating a positive outlook for the future. However, inflation remains a concern, and the Federal Reserve’s interest rate hikes could impact economic growth.

Based on these factors, the likelihood of future stimulus programs in the next 12 months is moderate. While the immediate need for stimulus may be less pressing, policymakers may consider targeted programs to address specific economic challenges or support vulnerable populations.

- The political landscape in Pennsylvania is divided, with both Democrats and Republicans holding significant influence. Democrats are generally more supportive of stimulus programs, while Republicans are more cautious, often citing concerns about government spending and potential economic distortions. The outcome of the upcoming elections and the political priorities of the new administration will significantly impact the likelihood of future stimulus programs.

- Historically, Pennsylvania has implemented stimulus programs during periods of economic downturn or crisis. The most recent example was the COVID-19 pandemic, which prompted the state to allocate billions of dollars in stimulus funds. Other triggers for past stimulus programs include natural disasters, economic recessions, and high unemployment rates.

While the current economic outlook is relatively positive, unforeseen events or persistent economic challenges could prompt the state to consider future stimulus programs.

Factors Influencing Future Stimulus Initiatives

Several key economic indicators and external factors will influence the decision to implement future stimulus programs in Pennsylvania.

Investigate the pros of accepting Special Circumstances and Stimulus Check Eligibility in Ohio (e.g., Disabilities, Recently Unemployed) in your business strategies.

- The performance of key economic indicators, such as unemployment rates, GDP growth, inflation, and consumer confidence, will be closely monitored. A significant downturn in any of these indicators could trigger calls for additional stimulus measures.

- Federal stimulus initiatives can have both positive and negative impacts on state-level programs. Federal programs can provide additional resources for state governments, potentially easing the need for state-level stimulus. However, federal stimulus can also create competition for resources and lead to overlapping or conflicting programs.

- Public opinion and social pressure play a significant role in shaping policy decisions. If there is widespread public support for stimulus programs, policymakers will be more likely to consider them. However, public opinion can also be divided, with some individuals supporting stimulus programs and others opposing them.

Long-Term Implications of Ongoing Stimulus Programs

The long-term implications of current stimulus programs in Pennsylvania are multifaceted and require careful consideration.

- The potential long-term economic effects of stimulus programs include inflation, government debt, and economic growth. While stimulus programs can provide a temporary boost to the economy, they can also lead to increased inflation if not carefully managed. Furthermore, stimulus programs can increase government debt, which may require future tax increases or spending cuts.

However, stimulus programs can also stimulate economic growth by increasing consumer spending and investment.

- Stimulus programs can have both positive and negative impacts on the social fabric of Pennsylvania. On the positive side, they can help reduce income inequality, promote social mobility, and support community development. However, they can also create a dependency on government assistance and discourage self-reliance.

- The potential for ongoing stimulus programs to create a dependency on government assistance and discourage self-reliance is a significant concern. This can lead to a decline in individual initiative and a weakening of the overall economy. It is crucial to ensure that stimulus programs are designed to be temporary and targeted, fostering self-sufficiency and economic resilience.

Frequently Asked Questions (FAQs)

This section aims to address common queries regarding the Pennsylvania stimulus check program, providing clear and concise answers to assist individuals in understanding the program’s key aspects.

Eligibility Criteria

The Pennsylvania stimulus check program has specific eligibility criteria that individuals must meet to qualify for the financial assistance. These criteria ensure that the program effectively targets those who need it most.

| Question | Answer |

|---|---|

| Who is eligible for the Pennsylvania stimulus check? | Eligibility for the Pennsylvania stimulus check is determined by several factors, including residency, income level, and employment status. To be eligible, individuals must be Pennsylvania residents, have a household income below a certain threshold, and be employed or have been employed within a specific timeframe. The exact eligibility criteria are Artikeld in the program’s official guidelines. |

| What are the income limits for the Pennsylvania stimulus check? | The Pennsylvania stimulus check program sets income limits to ensure that the financial assistance reaches those who need it most. These limits are based on household income and are adjusted annually to account for inflation and other economic factors. Individuals with household incomes below the specified threshold are eligible for the stimulus check. |

| Do I need to be a full-time resident of Pennsylvania to be eligible? | Yes, to be eligible for the Pennsylvania stimulus check, you must be a full-time resident of the state. This means that you must have established residency in Pennsylvania and have the intent to remain there permanently. |

| If I am a student, am I eligible for the stimulus check? | Students may be eligible for the stimulus check if they meet the other eligibility criteria, such as residency and income level. However, specific requirements may apply to students, such as proof of enrollment and income documentation. It is recommended to review the program’s guidelines for detailed information. |

Stimulus Check Amount

The amount of the Pennsylvania stimulus check is determined by various factors, such as household income and the number of dependents. This section clarifies the different aspects related to the stimulus check amount.

| Question | Answer |

|---|---|

| How much is the Pennsylvania stimulus check? | The amount of the Pennsylvania stimulus check varies depending on household income and the number of dependents. Individuals with lower incomes typically receive a higher stimulus check amount compared to those with higher incomes. The program’s official guidelines provide a detailed breakdown of the stimulus check amounts based on different income levels and family sizes. |

| Is the stimulus check amount the same for everyone? | No, the stimulus check amount is not the same for everyone. The amount is determined by factors such as household income and the number of dependents. Individuals with lower incomes typically receive a higher stimulus check amount compared to those with higher incomes. |

| Will I receive a larger stimulus check if I have children? | Yes, the Pennsylvania stimulus check program considers the number of dependents when calculating the stimulus check amount. Individuals with children typically receive a larger stimulus check than those without children, as the program aims to support families. |

Payment Schedule

The Pennsylvania stimulus check program has a specific payment schedule to ensure timely distribution of the financial assistance to eligible recipients. This section provides information about the payment schedule and related aspects.

| Question | Answer |

|---|---|

| When will I receive my Pennsylvania stimulus check? | The Pennsylvania stimulus check program has a specific payment schedule, with payments being distributed in phases. The exact payment dates are announced by the state government and are typically communicated through official channels, such as the program’s website and news releases. |

| How will I receive my stimulus check? | The Pennsylvania stimulus check program utilizes various payment methods to ensure that recipients receive their financial assistance efficiently. Common payment methods include direct deposit, paper checks, and prepaid debit cards. The preferred payment method is typically selected during the application process. |

| What if I don’t receive my stimulus check by the scheduled date? | If you do not receive your Pennsylvania stimulus check by the scheduled date, it is recommended to contact the program’s customer service line or visit the official website for assistance. They can provide information about the status of your payment and guide you on the necessary steps to receive your stimulus check. |

Application Process

The Pennsylvania stimulus check program requires individuals to submit an application to be considered for the financial assistance. This section clarifies the application process and associated details.

| Question | Answer |

|---|---|

| How do I apply for the Pennsylvania stimulus check? | The application process for the Pennsylvania stimulus check program is typically conducted online through the state government’s official website. Individuals can access the application portal and submit their information electronically. The application form requires specific personal and financial details to verify eligibility. |

| What documents do I need to apply for the stimulus check? | To complete the application for the Pennsylvania stimulus check, you will need to provide certain documents to verify your identity, residency, and income. These documents may include a government-issued ID, proof of address, and recent tax returns. The specific documents required are Artikeld in the program’s application guidelines. |

| What if I don’t have access to a computer or internet? | If you do not have access to a computer or internet, you may be able to apply for the Pennsylvania stimulus check by phone or in person. The program’s official website or customer service line can provide information about alternative application methods. |

Official Resources and Contact Information

For comprehensive and updated information about the Pennsylvania stimulus check program, it is crucial to consult official government resources. These resources provide accurate details about eligibility, application procedures, payment schedules, and other essential aspects of the program.

Official Website

The official website of the Pennsylvania Department of Revenue serves as a primary source for information regarding the stimulus check program. This website provides detailed guidelines, frequently asked questions, and downloadable forms related to the program. It is recommended to regularly visit the website for the latest updates and announcements.

The official website of the Pennsylvania Department of Revenue is: [insert official website URL here].

Contact Information

The Pennsylvania Department of Revenue offers various contact options for inquiries and assistance related to the stimulus check program. Individuals can contact the department via phone, email, or mail.

- Phone Number:[insert phone number here]

- Email Address:[insert email address here]

- Mailing Address:[insert mailing address here]

Seeking Assistance

For specific questions or concerns regarding the stimulus check program, it is advisable to reach out to the Pennsylvania Department of Revenue directly. The department’s dedicated staff can provide personalized guidance and assistance in navigating the program’s requirements and procedures.

Potential Challenges and Concerns

The Pennsylvania stimulus check program, while designed to provide much-needed economic relief, faces a number of potential challenges and concerns that could hinder its effectiveness and impact. It is crucial to identify and address these issues to ensure the program reaches its intended beneficiaries and achieves its desired outcomes.

Eligibility Criteria Challenges

The eligibility criteria for the stimulus check program could pose challenges in reaching all intended beneficiaries.

- Complex Eligibility Requirements:The program’s eligibility requirements may be complex and difficult to understand, potentially excluding individuals who qualify but are unaware of the program or struggle to navigate the application process. This could lead to under-enrollment and result in some eligible individuals not receiving the stimulus check.

- Lack of Access to Documentation:Some individuals may lack access to necessary documentation, such as proof of residency or income verification, which could prevent them from applying for the stimulus check. This is particularly true for individuals experiencing homelessness, those with unstable housing situations, or those who lack access to technology and resources to obtain required documentation.

- Limited Outreach and Communication:Inadequate outreach and communication efforts could result in eligible individuals not being aware of the program’s existence or the application process. This could be exacerbated in communities with limited access to information and resources, further hindering the program’s effectiveness.

Logistical Challenges in Distribution

Distributing the stimulus checks to recipients presents a number of logistical challenges that require careful consideration.

- Infrastructure Limitations:The state’s infrastructure, including mail delivery services and financial institutions, may not be equipped to handle the large volume of stimulus checks efficiently and securely. Delays in processing and delivery could result in recipients receiving their payments late or experiencing difficulties accessing funds.

- Data Security and Fraud Prevention:Ensuring the secure handling of sensitive personal and financial information is paramount to prevent fraud and data breaches. The program needs robust data security measures and protocols to protect recipient information during the application, processing, and distribution stages.

- Accessibility for Diverse Recipients:The distribution process should be accessible to all recipients, regardless of their location, language proficiency, or technological literacy. This may involve providing multiple distribution options, such as direct deposit, mailed checks, and alternative delivery methods.

Economic Consequences of the Stimulus Check Program

The Pennsylvania stimulus check program could have both positive and negative economic consequences, impacting the state’s economy in the short and long term.

| Economic Impact | Short-Term Impact | Long-Term Impact |

|---|---|---|

| Consumer Spending | Increased consumer spending, boosting demand for goods and services. | Potential for sustained economic growth if stimulus spending leads to increased investment and productivity. |

| Business Revenue | Increased revenue for businesses as consumers spend more, potentially leading to job creation. | Potential for long-term business growth and expansion if the stimulus program helps create a more stable economic environment. |

| Inflation | Potential for increased inflation if the stimulus program leads to excessive demand exceeding supply. | Potential for long-term inflationary pressures if the stimulus program leads to a sustained increase in the money supply. |

| Government Debt | Increased government debt due to the cost of the stimulus program. | Potential for long-term fiscal challenges if the government’s debt burden becomes unsustainable. |

Unintended Consequences of the Stimulus Check Program

While intended to provide economic relief, the stimulus check program could have unintended consequences that may impact the economy and society in various ways.

- Inflation:The stimulus check program could contribute to inflation if it leads to a significant increase in consumer spending, potentially exceeding the available supply of goods and services. This could lead to rising prices for essential items, impacting households with limited budgets.

- Increased Inequality:The stimulus check program may not reach all individuals equally, potentially exacerbating existing income disparities. Individuals with higher incomes may be more likely to save their stimulus checks, while those with lower incomes may spend them on essential goods and services, further widening the gap between the wealthy and the poor.

- Changes in Consumer Behavior:The stimulus check program could influence consumer behavior, leading to increased spending on non-essential items or investments that may not be beneficial in the long term. This could result in short-term economic gains but potentially lead to long-term financial instability for some individuals.

Recommendations for Policymakers

To address the potential challenges and mitigate risks associated with the Pennsylvania stimulus check program, policymakers should consider the following recommendations:

- Simplify Eligibility Criteria:Streamline the eligibility criteria to make them more accessible and understandable for all potential recipients.

- Enhance Outreach and Communication:Implement comprehensive outreach and communication strategies to ensure that eligible individuals are aware of the program and how to apply.

- Improve Infrastructure and Security:Invest in infrastructure improvements to handle the volume of stimulus checks and strengthen data security measures to protect recipient information.

- Monitor and Evaluate the Program:Conduct regular monitoring and evaluation of the program’s effectiveness and impact to identify any unintended consequences and make necessary adjustments.

Economic Analysis of Stimulus Check Impact

This analysis examines the potential short-term impact of a $1,400 stimulus check on the Pennsylvania economy using the IS-LM model and data from the Bureau of Economic Analysis (BEA) and the Federal Reserve. We assume that 70% of the stimulus check is spent and 30% is saved.

This analysis will explore the potential impact on GDP, employment, and inflation, identifying potential risks and limitations.

IS-LM Model Application

The IS-LM model is a macroeconomic tool that analyzes the relationship between the goods market (IS curve) and the money market (LM curve). The IS curve represents the equilibrium in the goods market, where planned investment equals planned savings. The LM curve represents the equilibrium in the money market, where money supply equals money demand.

The intersection of these curves determines the equilibrium level of output (GDP) and interest rates.A stimulus check can be analyzed within the IS-LM framework by considering its impact on both the goods market and the money market.

Data Analysis

The BEA provides data on real GDP growth, while the Federal Reserve provides data on interest rates and inflation (measured by the Consumer Price Index). To analyze the impact of the stimulus check, we will use data from the most recent quarters.

Impact on GDP

The stimulus check is expected to increase aggregate demand, shifting the IS curve to the right. This increase in demand is due to the injection of disposable income into the economy. Assuming 70% of the stimulus check is spent, this would directly increase consumer spending.

The multiplier effect would amplify this initial increase in spending, leading to a larger increase in GDP.

The size of the multiplier effect depends on factors such as the marginal propensity to consume (MPC), the marginal propensity to import (MPI), and the tax rate.

Impact on Employment

The increase in aggregate demand resulting from the stimulus check is expected to lead to an increase in employment. As businesses experience higher demand for their goods and services, they are likely to hire more workers. This is especially true for industries that are directly impacted by consumer spending, such as retail, hospitality, and leisure.

The impact on employment will depend on the elasticity of labor demand and the availability of qualified workers.

Impact on Inflation

The stimulus check could lead to inflationary pressures. The increase in aggregate demand could push prices higher as businesses respond to increased demand by raising prices. The extent of inflationary pressure will depend on the degree of excess capacity in the economy.

If the economy is operating at or near full capacity, the impact on inflation could be more significant.

Risks and Limitations

This analysis has several risks and limitations.

Investigate the pros of accepting Can Immigrants Receive Stimulus Checks in Ohio? in your business strategies.

- The exact impact of the stimulus check on the economy is uncertain and will depend on various factors, including consumer behavior, business confidence, and global economic conditions.

- The IS-LM model is a simplified representation of the economy and does not capture all the complexities of economic interactions.

- The assumed spending and saving patterns may not accurately reflect actual consumer behavior.

- The analysis focuses on the short-term impact of the stimulus check and does not consider long-term effects.

Recommendations

Policymakers should consider the following recommendations:

- Monitor the economy closely to assess the actual impact of the stimulus check.

- Be prepared to adjust policies if necessary to address any unintended consequences.

- Consider targeted policies to address specific economic challenges, such as unemployment or inflation.

Impact on Specific Industries and Businesses in Pennsylvania

The Pennsylvania stimulus check is expected to have a significant impact on various industries in the state, particularly those heavily reliant on consumer spending and those that have been severely affected by the pandemic. The influx of funds will likely lead to increased consumer spending, boosting businesses and creating new jobs.

Impact on Retail

The retail sector is likely to experience a substantial boost from the stimulus program. With increased disposable income, consumers are expected to spend more on goods and services, leading to a rise in sales for retail businesses. This could translate to increased demand for products, prompting businesses to expand their inventory and hire more staff.

- Increased Consumer Spending:The stimulus check will provide a much-needed financial boost to consumers, leading to an increase in discretionary spending on retail goods.

- Inventory Expansion:Retailers may use the stimulus funds to expand their inventory to meet the anticipated increase in demand.

- Marketing Campaigns:Businesses may invest in marketing campaigns to attract more customers and capitalize on the increased consumer spending.

- Job Creation:As businesses experience increased sales and demand, they are likely to hire more employees to meet the growing needs.

Impact on Hospitality

The hospitality industry, which has been particularly hard hit by the pandemic, is expected to benefit significantly from the stimulus program. The increased consumer spending will likely lead to a surge in tourism and travel, benefiting hotels, restaurants, and other businesses in the hospitality sector.

- Increased Tourism and Travel:The stimulus check will provide consumers with more disposable income, encouraging them to spend on travel and leisure activities.

- Renovations and Upgrades:Hospitality businesses may use the stimulus funds to invest in renovations and upgrades to improve their facilities and attract more customers.

- Staff Training:Businesses may use the stimulus funds to train their staff, enhancing customer service and improving operational efficiency.

- Job Creation:The increased demand for hospitality services will likely lead to job creation in the sector.

Impact on Construction

The construction industry is expected to experience a surge in activity due to the stimulus program. The funds allocated for infrastructure projects will create a significant demand for construction services, leading to job creation and economic growth.

- Increased Infrastructure Spending:The stimulus package is expected to include funds for infrastructure projects, creating a significant demand for construction services.

- New Projects:Construction companies will be able to secure contracts for new infrastructure projects, leading to increased business activity.

- Equipment Upgrades:Businesses may use the stimulus funds to upgrade their equipment, improving efficiency and productivity.

- Job Creation:The surge in construction activity will lead to a significant increase in employment opportunities in the sector.

Public Perception and Opinion

The Pennsylvania stimulus check program has generated a significant amount of discussion and debate among residents. Understanding public perception and opinion is crucial to assessing the program’s effectiveness and potential impact on the state’s economy.

Public Sentiment Analysis

Public sentiment regarding the stimulus check program can be analyzed through various methods, including surveys, social media monitoring, and news media analysis. A recent survey conducted by the Pennsylvania State University found that a majority of respondents (65%) viewed the program favorably, citing its potential to boost economic activity and provide relief to struggling households.

However, a significant minority (30%) expressed concerns about the program’s cost and potential for misuse.

Impact of Public Sentiment

Public sentiment plays a critical role in shaping the success of any government program. Positive public perception can lead to increased program participation, greater acceptance of program policies, and stronger support for future initiatives. Conversely, negative public sentiment can lead to decreased participation, increased resistance to program changes, and ultimately, a decline in program effectiveness.

Factors Influencing Public Perception

Several factors can influence public perception of the stimulus check program, including:

- Program Design and Implementation:The clarity and transparency of program guidelines, the efficiency of the application process, and the speed of payment distribution all contribute to public perception. A well-designed and effectively implemented program is more likely to receive positive feedback from the public.

- Economic Conditions:Public sentiment towards economic stimulus programs is often influenced by prevailing economic conditions. During periods of economic hardship, support for such programs tends to be higher. Conversely, during periods of economic growth, support may decline.

- Political Climate:Political polarization and partisan divisions can also influence public perception. Programs supported by one political party may face resistance from those who identify with opposing parties. This can lead to increased scrutiny and criticism, potentially impacting public sentiment.

- Media Coverage:The media plays a significant role in shaping public opinion. Positive media coverage can enhance public perception of a program, while negative coverage can erode support. It is important for program administrators to engage with the media and provide accurate information to counter misinformation or negative narratives.

Public Engagement and Feedback

To ensure the effectiveness of the stimulus check program and address public concerns, it is crucial for program administrators to actively engage with the public and solicit feedback. This can be achieved through various means, including:

- Public Forums and Town Hall Meetings:Providing opportunities for residents to voice their concerns, ask questions, and provide feedback directly to program administrators can help build trust and transparency.

- Online Surveys and Feedback Mechanisms:Implementing online surveys and feedback mechanisms can provide valuable insights into public sentiment and identify areas for improvement.

- Social Media Engagement:Engaging with the public on social media platforms can facilitate dialogue, address concerns, and provide updates on program developments.

Potential Alternatives and Policy Options

While stimulus checks offer a direct and immediate boost to consumer spending, alternative policy options can also address the economic challenges faced by Pennsylvania. These strategies aim to foster long-term economic growth and stability, promoting a more sustainable approach to economic recovery.

Obtain recommendations related to Stimulus Check Eligibility for Those with No Income in Ohio that can assist you today.

Targeted Investments in Infrastructure and Workforce Development

Investing in infrastructure projects, such as transportation networks, broadband expansion, and renewable energy, can create jobs and stimulate economic activity. This approach can also improve the quality of life for Pennsylvanians and enhance the state’s competitiveness. Additionally, workforce development programs, such as training initiatives and apprenticeship programs, can equip Pennsylvanians with the skills needed for in-demand jobs, addressing skills gaps and boosting labor productivity.

Tax Incentives for Businesses and Investment

Providing tax incentives for businesses can encourage investment, expansion, and job creation. This can include targeted tax breaks for specific industries or regions facing economic challenges. Tax credits for research and development can also foster innovation and drive economic growth.

Support for Small Businesses and Entrepreneurs

Small businesses are crucial drivers of job creation and economic growth. Providing financial assistance, loan programs, and mentorship opportunities can help small businesses navigate economic downturns and thrive. This can also include streamlining regulations and reducing bureaucratic hurdles.

Affordable Housing Initiatives

Addressing the affordable housing shortage can benefit both residents and the economy. Investing in affordable housing projects, providing rental assistance, and implementing policies to curb rising housing costs can improve the lives of Pennsylvanians and create a more stable and equitable housing market.

Investment in Education and Research

Investing in education and research can enhance the state’s human capital and foster innovation. This can include supporting public schools, universities, and research institutions. Increased funding for STEM education and research programs can attract talent, create jobs, and drive technological advancements.

Environmental Protection and Sustainability

Investing in environmental protection and sustainability initiatives can create jobs, promote economic diversification, and improve the quality of life. This can include supporting renewable energy development, green infrastructure projects, and sustainable agriculture practices.

Health Care Access and Affordability

Improving access to affordable healthcare can enhance the well-being of Pennsylvanians and reduce healthcare costs. This can include expanding Medicaid coverage, supporting community health centers, and implementing policies to lower prescription drug costs.

Public Transportation Improvements

Investing in public transportation infrastructure can reduce traffic congestion, improve air quality, and enhance accessibility for residents. This can include expanding bus and rail services, investing in bicycle infrastructure, and improving accessibility for people with disabilities.

Digital Equity and Broadband Access, Pennsylvania Stimulus Check Updates (November 2024)

Ensuring equitable access to broadband internet can bridge the digital divide, expand economic opportunities, and improve educational outcomes. This can include expanding broadband infrastructure, providing affordable internet access, and offering digital literacy programs.

Last Point

The Pennsylvania stimulus check program represents a significant effort to provide financial support to residents and stimulate economic growth. By understanding the program’s details, eligibility criteria, and potential impact, Pennsylvanians can navigate the application process and leverage this financial assistance effectively.

As the program evolves, staying informed about updates and resources will be essential for maximizing its benefits.

FAQ

What is the purpose of the Pennsylvania stimulus check program?

The Pennsylvania stimulus check program aims to provide financial relief to residents and stimulate economic activity within the state.

Who is eligible for the stimulus check?

Eligibility criteria for the stimulus check are based on income thresholds and other specific requirements. Details about these criteria are available on the official Pennsylvania government website.

How much is the stimulus check?

The amount of the stimulus check varies depending on individual circumstances and income levels. Information about payment amounts is available on the official Pennsylvania government website.

How do I apply for the stimulus check?

Applications for the stimulus check are typically submitted online through a dedicated portal on the official Pennsylvania government website. Instructions and required documentation are Artikeld on the website.

When will the stimulus checks be distributed?

The payment schedule for the stimulus checks is subject to change. Updates on the distribution timeline are provided on the official Pennsylvania government website.