Stimulus Check Payments for Married Couples vs. Single Filers in Michigan, a topic that has sparked numerous questions and discussions, offers insights into the complexities of government assistance. This guide aims to provide clarity on the eligibility requirements, payment amounts, and tax implications of stimulus checks for both married couples and single filers in Michigan.

Understanding these nuances is crucial for navigating the process of receiving and maximizing the benefits of these payments.

Whether you’re a married couple filing jointly or a single filer, knowing your specific situation is vital. This information will help you determine your eligibility, calculate your potential payment amount, and understand any tax implications.

Get the entire information you require about Getting Help with Your Stimulus Check Application in Your Illinois Community on this page.

Stimulus Check Eligibility in Michigan

The eligibility for stimulus check payments in Michigan, like in other states, is primarily determined by factors like income, marital status, and dependents. Understanding these requirements is crucial for individuals and families to determine if they qualify for these payments.

Income Thresholds for Stimulus Checks

The eligibility for stimulus checks is based on adjusted gross income (AGI) reported on your federal tax return. Here’s a breakdown of the income thresholds for married couples filing jointly and single filers for the most recent stimulus check:

- Married Filing Jointly:AGI must be less than $150,000 to receive the full amount.

- Single Filers:AGI must be less than $75,000 to receive the full amount.

It’s important to note that these thresholds may vary depending on the specific stimulus package and the year it was enacted. It’s always best to refer to the official IRS guidelines for the most up-to-date information.

Dependents and Stimulus Check Eligibility

Having dependents can also impact your stimulus check eligibility. The amount of the payment is often adjusted based on the number of dependents claimed on your tax return.

- Age:There are typically no age restrictions for dependents to qualify for stimulus check benefits.

- Residency Status:Dependents must be U.S. citizens, U.S. nationals, or residents of the U.S. for the majority of the tax year to be eligible.

The specific criteria for dependents may vary, so it’s important to review the official IRS guidelines for the most accurate information.

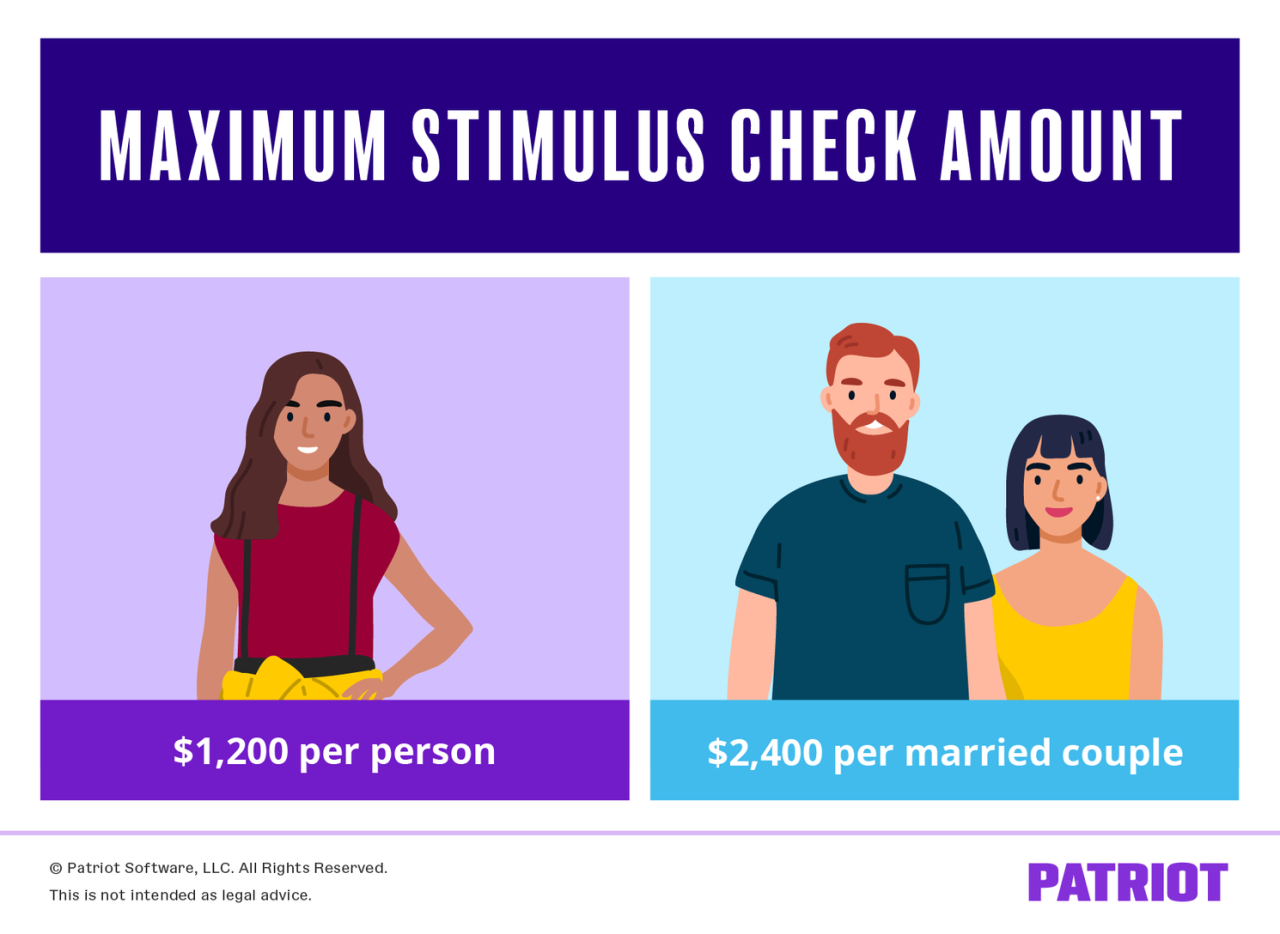

Payment Amounts for Married Couples vs. Single Filers: Stimulus Check Payments For Married Couples Vs. Single Filers In Michigan

The amount of the stimulus check payment received by married couples filing jointly and single filers can differ based on their income levels. Here’s how the payment amount is calculated:

Stimulus Check Payment Calculation

The stimulus check amount is generally a fixed amount, but it can be reduced or eliminated for individuals or couples with higher incomes. The payment amount is phased out gradually as income increases above the specified thresholds.

Examples of Payment Amounts

Here are some examples of potential stimulus check payment amounts based on different income brackets:

| Filing Status | AGI | Payment Amount |

|---|---|---|

| Married Filing Jointly | $100,000 | Full Amount |

| Married Filing Jointly | $160,000 | Reduced Amount |

| Single | $50,000 | Full Amount |

| Single | $80,000 | Reduced Amount |

It’s crucial to remember that these are just examples, and the actual payment amount can vary depending on the specific stimulus package and your individual circumstances.

Filing Status and Stimulus Check Distribution

The filing status you choose on your federal tax return can significantly impact how you receive your stimulus check payment.

You also can investigate more thoroughly about Stimulus Checks Payment Amounts in Michigan to enhance your awareness in the field of Stimulus Checks Payment Amounts in Michigan.

Impact of Filing Status on Stimulus Check Distribution

The IRS uses your filing status to determine the correct amount of the stimulus check and to send the payment to the appropriate address. Here’s a breakdown of how filing status affects the distribution process:

- Married Filing Jointly:The stimulus check is typically sent to the address listed on the joint tax return.

- Single:The stimulus check is sent to the address listed on the single filer’s tax return.

- Head of Household:The stimulus check is sent to the address listed on the head of household filer’s tax return.

Payment Timing and Filing Status

The timing of your stimulus check payment can also be influenced by your filing status. In some cases, the IRS may prioritize payments to certain filing statuses based on factors like income levels and processing capacity.

It’s important to note that the specific payment timing can vary depending on the stimulus package and the year it was enacted. It’s always best to consult the official IRS guidelines for the most accurate information.

Tax Implications of Stimulus Checks

Understanding the tax implications of stimulus check payments is crucial for both married couples and single filers.

Get the entire information you require about Stimulus Check Application Process in Different Languages in Illinois on this page.

Taxability of Stimulus Checks

Stimulus checks are generally not considered taxable income. This means you don’t have to report them as income on your federal tax return.

Reporting Requirements for Stimulus Checks, Stimulus Check Payments for Married Couples vs. Single Filers in Michigan

While stimulus checks are not taxable income, you may still need to report certain information about them on your tax return.

- Recovery Rebate Credit:If you received a stimulus check and your income was below certain thresholds, you may be eligible for the Recovery Rebate Credit on your tax return. This credit can increase your tax refund or reduce your tax liability.

- Reconciling Payments:The IRS may send you a notice if you received a stimulus check but were not eligible based on your income. In this case, you may need to reconcile the payment on your tax return.

It’s always recommended to consult with a tax professional for personalized guidance on the tax implications of stimulus checks.

Resources for Stimulus Check Information

For the most accurate and up-to-date information about stimulus check payments in Michigan, it’s essential to rely on official government resources.

Reliable Sources for Stimulus Check Information

- Internal Revenue Service (IRS): https://www.irs.gov/

- Michigan Department of Treasury: https://www.michigan.gov/treasury

- Michigan Tax Tribunal: https://www.michigan.gov/taxes/0,4632,7-154-35287_35290—,00.html

Support Services for Stimulus Check Questions

If you have questions about stimulus check payments or need assistance with filing your tax return, you can contact the following organizations:

- IRS Taxpayer Advocate Service: https://www.irs.gov/advocate

- Michigan Taxpayer Assistance Program: https://www.michigan.gov/taxes/0,4632,7-154-35287_35290—,00.html

Remember, it’s always best to seek guidance from qualified professionals when dealing with tax matters.

Wrap-Up

Navigating the complexities of stimulus check payments can be challenging, but understanding the rules and regulations is essential for maximizing your potential benefits. This guide has provided a clear overview of the key considerations for married couples and single filers in Michigan, including eligibility criteria, payment amounts, tax implications, and helpful resources.

By staying informed and utilizing the available resources, individuals can ensure they receive the maximum benefit from these government programs.

FAQ Guide

How do I know if I’m eligible for a stimulus check?

You also can investigate more thoroughly about Illinois Stimulus Check Application Process for Non-Filers to enhance your awareness in the field of Illinois Stimulus Check Application Process for Non-Filers.

To be eligible, you must meet certain income thresholds and residency requirements. The IRS website provides a comprehensive eligibility tool that you can use to determine your status.

Discover how Troubleshooting Common Stimulus Check Application Issues in Illinois has transformed methods in this topic.

What if I’m married but filing separately?

If you’re married but filing separately, you’ll be treated as a single filer for stimulus check purposes. This means you’ll receive the payment amount based on your individual income.

Obtain direct knowledge about the efficiency of Common Mistakes Illinoisns Avoid When Applying for a Stimulus Check through case studies.

Can I get a stimulus check if I’m a dependent?

Generally, dependents are not eligible for stimulus checks unless they meet specific criteria, such as being a qualifying child or a qualifying relative.

What if I didn’t receive my stimulus check?

If you believe you’re eligible but didn’t receive your stimulus check, you can claim it as a credit on your federal tax return.