How Previous Stimulus Payments Affect Eligibility in Michigan is a crucial topic for residents who might be considering applying for additional financial assistance. Understanding the impact of past stimulus payments on current eligibility is essential for ensuring a smooth application process and maximizing potential benefits.

You also can understand valuable knowledge by exploring Latest News & Updates on Michigan Stimulus Checks.

This article delves into the intricacies of Michigan’s stimulus programs, highlighting the factors that influence eligibility and providing valuable insights for navigating the application process.

Michigan has implemented various stimulus programs aimed at supporting its residents during challenging economic times. These programs often have specific eligibility criteria, including income thresholds, residency requirements, and other factors. However, a key aspect that often arises is the impact of previous stimulus payments, both federal and state, on eligibility for subsequent programs.

This article will shed light on how receiving prior stimulus payments might affect current eligibility, exploring the potential impact on income thresholds and other criteria.

Michigan Stimulus Payment Eligibility Overview

Michigan has implemented various stimulus programs to provide financial relief to its residents during times of economic hardship. These programs offer one-time payments to eligible individuals and families, aiming to alleviate financial burdens and boost the state’s economy. Understanding the eligibility criteria for these programs is crucial for residents to determine if they qualify for the assistance.

Eligibility Criteria for Michigan Stimulus Payments

The eligibility criteria for Michigan stimulus payments vary depending on the specific program. However, common factors include:

- Residency Requirement:Generally, applicants must be Michigan residents at the time of application and during the qualifying period.

- Income Thresholds:Most stimulus programs have income limits, meaning individuals or families exceeding certain income levels may not be eligible. These thresholds are often based on household size and adjusted gross income (AGI) reported on federal tax returns.

- Other Factors:Additional factors may influence eligibility, such as filing status (single, married, head of household), dependents, and employment status. Specific program guidelines may include unique criteria, such as being a student, a veteran, or a caregiver.

Summary of Michigan Stimulus Programs

Michigan has implemented several stimulus programs over the years, each with its own purpose, target audience, and key features. Here’s a brief overview:

| Program Name | Purpose | Target Audience | Key Features |

|---|---|---|---|

| Michigan Stimulus Payment (2021) | Provide financial relief to individuals and families impacted by the COVID-19 pandemic. | Michigan residents who filed state income tax returns in 2020 and met certain income thresholds. | One-time payment of $3,600 for individual filers and $7,200 for joint filers. |

| Michigan Economic Recovery Plan (2020) | Support businesses and individuals affected by the pandemic-induced economic downturn. | Businesses and individuals experiencing financial hardship due to COVID-19. | Offered grants, loans, and other financial assistance to businesses and individuals. |

| Michigan Unemployment Benefits (Ongoing) | Provide income support to individuals who have lost their jobs through no fault of their own. | Michigan residents who are unemployed and meet eligibility requirements. | Offers weekly unemployment benefits to eligible individuals. |

Eligibility Requirements for Each Stimulus Program, How Previous Stimulus Payments Affect Eligibility in Michigan

The following table summarizes the eligibility requirements for the Michigan stimulus programs discussed above, highlighting key differences and similarities:

| Program Name | Residency Requirement | Income Threshold | Other Eligibility Criteria |

|---|---|---|---|

| Michigan Stimulus Payment (2021) | Michigan resident in 2020 | AGI below $75,000 for single filers, $150,000 for joint filers. | Filed 2020 Michigan income tax return. |

| Michigan Economic Recovery Plan (2020) | Michigan resident and business owner/individual experiencing financial hardship due to COVID-19. | Varied based on program type and eligibility criteria. | Proof of financial hardship due to COVID-19. |

| Michigan Unemployment Benefits (Ongoing) | Michigan resident who is unemployed and meets eligibility requirements. | Not applicable. | Proof of unemployment, work history, and availability for work. |

Impact of Previous Stimulus Payments

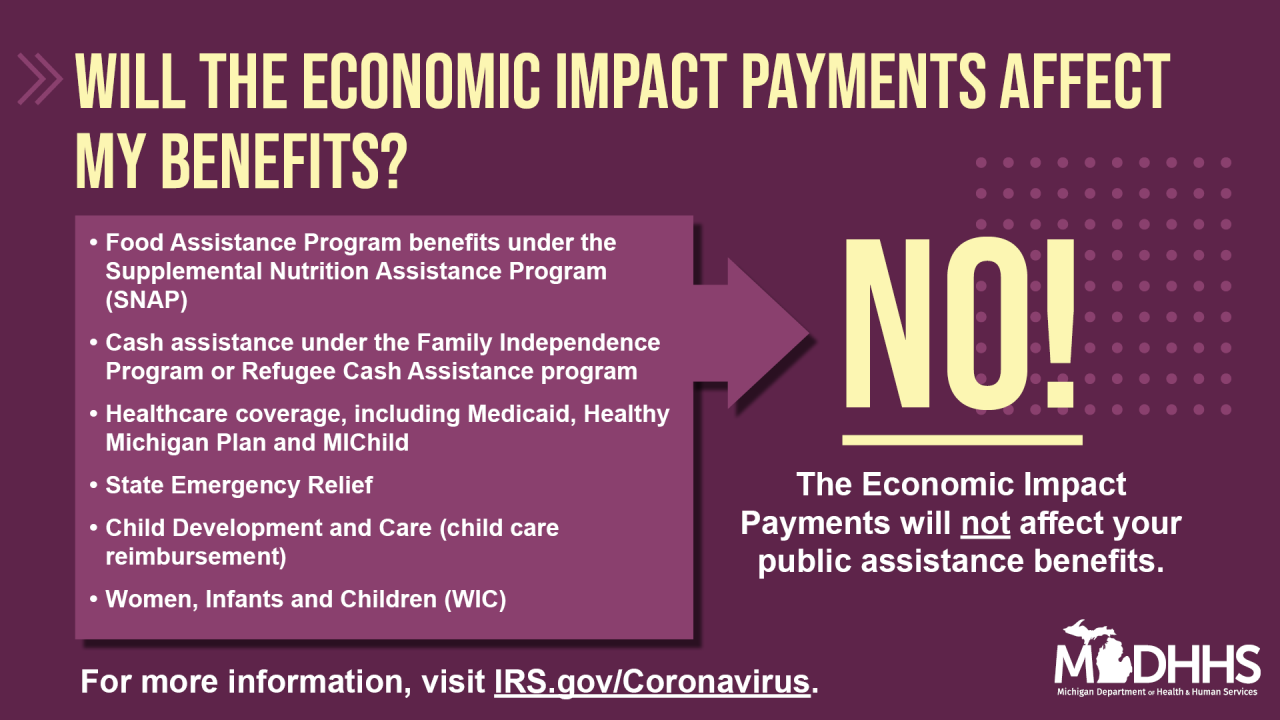

Previous stimulus payments, both federal and state, can potentially affect eligibility for subsequent Michigan stimulus programs. While the specific rules and regulations may vary depending on the program, it’s important to understand how prior payments could influence eligibility.

Potential Impact of Previous Stimulus Payments

The impact of previous stimulus payments on eligibility for future programs can be multifaceted. Here are some potential scenarios:

- Income Thresholds:Previous stimulus payments may be considered as income when determining eligibility for future programs. If the total income, including previous payments, exceeds the income threshold, it could disqualify individuals from receiving additional stimulus assistance.

- Eligibility Criteria:Some programs may have specific rules regarding the receipt of prior stimulus payments. For example, a program might require individuals to have experienced a significant financial hardship due to a specific event, such as a job loss, to be eligible.

Receiving prior stimulus payments could potentially impact this requirement.

- Duplicate Payments:Generally, individuals are not eligible for duplicate stimulus payments for the same qualifying period. If someone has already received a stimulus payment for a specific period, they may not be eligible for another payment for that same period, even if they meet other eligibility criteria.

Rules and Regulations Regarding Prior Stimulus Payments

It’s essential to consult the specific program guidelines and rules for each Michigan stimulus program to understand the precise impact of prior stimulus payments on eligibility. These guidelines may provide clarity on how previous payments are considered and how they may affect current eligibility.

It’s also advisable to contact the relevant government agencies or organizations for personalized guidance and clarification.

Factors Affecting Eligibility: How Previous Stimulus Payments Affect Eligibility In Michigan

Several factors play a crucial role in determining eligibility for Michigan stimulus payments. Understanding these factors can help individuals assess their potential eligibility and gather necessary documentation.

Income and Dependents

Income is a primary factor influencing eligibility for most stimulus programs. Income thresholds are often based on adjusted gross income (AGI) reported on federal tax returns. Individuals and families exceeding these income limits may not qualify for assistance. The number of dependents in a household can also affect eligibility, as some programs may have different income thresholds based on household size.

Changes in Income, Marital Status, or Household Composition

Significant changes in income, marital status, or household composition can potentially impact eligibility for stimulus payments. For instance, a job loss or a decrease in income could make individuals eligible for programs they were previously ineligible for. Similarly, changes in marital status or the addition or removal of dependents could alter income thresholds and eligibility criteria.

It’s essential to inform relevant agencies of any significant changes that could affect eligibility.

Verifying Income and Other Eligibility Criteria

To verify income and other eligibility criteria, individuals may need to provide documentation such as:

- Federal tax returns

- Pay stubs

- Proof of residency

- Social Security cards

- Other relevant documentation as specified by the program guidelines

The specific documentation requirements may vary depending on the program. It’s crucial to review the program guidelines and submit all necessary documentation to ensure timely processing and accurate eligibility determination.

Learn about more about the process of Stimulus Checks Application Process in Michigan in the field.

Resources and Assistance

For Michigan residents seeking information about stimulus payment eligibility, various resources and assistance are available. These resources can provide guidance, answer questions, and assist with the application process.

When investigating detailed guidance, check out Stimulus Checks Eligibility Requirements in Michigan now.

Government Agencies and Organizations

The following government agencies and organizations offer support and guidance regarding stimulus payment eligibility:

- Michigan Department of Treasury:Provides information on state stimulus programs and other financial assistance. Contact: [Contact Information]

- Michigan Unemployment Insurance Agency:Provides information and assistance related to unemployment benefits. Contact: [Contact Information]

- Michigan Economic Development Corporation:Offers resources and programs to support businesses and individuals. Contact: [Contact Information]

Common Questions and Answers

| Question | Answer |

|---|---|

| What are the eligibility requirements for the Michigan Stimulus Payment (2021)? | To be eligible for the Michigan Stimulus Payment (2021), you must have been a Michigan resident in 2020, filed your 2020 Michigan income tax return, and had an adjusted gross income (AGI) below $75,000 for single filers or $150,000 for joint filers. |

| How do I apply for Michigan Unemployment Benefits? | You can apply for Michigan Unemployment Benefits online through the Michigan Unemployment Insurance Agency website. You will need to provide information about your work history, availability for work, and reason for unemployment. |

| What documentation do I need to provide to verify my income? | The required documentation for income verification may vary depending on the specific program. However, common documents include federal tax returns, pay stubs, and proof of residency. |

Key Considerations for Eligibility

Understanding the specific eligibility requirements for each Michigan stimulus program is crucial for residents seeking assistance. Accurate and complete information is essential when applying for stimulus payments.

Importance of Understanding Eligibility Requirements

Each stimulus program has unique eligibility criteria. Failing to meet these criteria could result in a denied application or delayed processing. Thoroughly reviewing the program guidelines and ensuring compliance with all requirements is vital.

Accurate and Complete Information

Providing accurate and complete information is essential for a successful application. Incorrect or incomplete information can lead to delays, denials, or even penalties. It’s advisable to double-check all details before submitting an application.

Step-by-Step Guide for Applying for Stimulus Payments

The application process for stimulus payments may vary depending on the program. However, a general step-by-step guide is as follows:

- Review Program Guidelines:Thoroughly read and understand the specific eligibility criteria and application procedures for the chosen stimulus program.

- Gather Required Documentation:Collect all necessary documentation, such as tax returns, pay stubs, proof of residency, and Social Security cards.

- Complete Application:Fill out the application form accurately and completely, ensuring all required information is provided.

- Submit Application:Submit the completed application and supporting documentation through the designated channels, such as online, mail, or in person.

- Track Application Status:Monitor the status of your application and contact the relevant agency if you have any questions or concerns.

Conclusive Thoughts

In conclusion, understanding the intricacies of how previous stimulus payments affect eligibility in Michigan is vital for residents seeking financial assistance. By carefully considering the impact of past payments, income thresholds, and other eligibility criteria, individuals can navigate the application process effectively and increase their chances of receiving much-needed support.

Remember to utilize the available resources, contact relevant agencies for guidance, and gather the necessary documentation to ensure a successful application.

Helpful Answers

What if I received a stimulus payment in a previous year, but my income has decreased since then?

Get the entire information you require about Stimulus Checks Payment Amounts in Michigan on this page.

A decrease in income might make you eligible for additional stimulus payments, but it’s crucial to review the specific program guidelines for current eligibility criteria. Contact the relevant agency to confirm your current eligibility status.

If I received a federal stimulus payment, am I still eligible for a Michigan stimulus payment?

Receiving a federal stimulus payment does not automatically disqualify you from receiving a Michigan stimulus payment. Eligibility for each program is determined independently based on individual circumstances and program guidelines.

Where can I find more information about Michigan stimulus payments?

You can find comprehensive information on the Michigan government website, specifically the Department of Treasury website, which provides details on eligibility criteria, application procedures, and available resources.