Stimulus Check Program and Consumer Spending Trends in Illinois explores the impact of government aid on the state’s economy. Illinois, heavily reliant on consumer spending, experienced a significant shift in spending patterns following the implementation of stimulus checks. This study delves into the program’s features, economic context, and its effects on various demographics and sectors within Illinois.

By analyzing consumer spending trends before, during, and after the stimulus program, we can gain valuable insights into the program’s effectiveness in stimulating economic activity. This research also examines the broader economic implications of the stimulus checks on Illinois’ GDP, employment, and unemployment rates, highlighting the potential for long-term economic impacts.

Introduction

Illinois, a state known for its diverse economy, heavily relies on consumer spending to fuel its growth. Consumer expenditures account for a significant portion of the state’s Gross Domestic Product (GDP), making it a crucial driver of economic activity. However, economic downturns and unexpected events, such as the COVID-19 pandemic, can significantly impact consumer confidence and spending habits, leading to economic instability.

To mitigate the effects of these challenges, government stimulus programs have been implemented, aiming to inject cash into the economy and encourage consumer spending.

Stimulus checks, a direct form of financial assistance, have been a key component of economic recovery efforts at the national level. These payments have provided much-needed relief to households, enabling them to cover essential expenses, reduce debt, and even make discretionary purchases.

The impact of stimulus checks on the national economy has been a subject of ongoing debate, with economists offering diverse perspectives on their effectiveness in stimulating economic growth.

In Illinois, the stimulus check program was designed to provide financial support to residents impacted by the COVID-19 pandemic. The program aimed to alleviate financial burdens, boost consumer confidence, and stimulate spending within the state’s economy. The effectiveness of the program in achieving these objectives will be examined in detail, along with an analysis of consumer spending trends before, during, and after its implementation.

Stimulus Check Program in Illinois: Stimulus Check Program And Consumer Spending Trends In Illinois

Key Features of the Illinois Stimulus Check Program

The Illinois stimulus check program, officially known as the “Illinois Emergency Relief and Recovery Program,” provided direct payments to eligible residents. The program’s key features included:

- Eligibility criteria: The program was open to individuals and families meeting specific income requirements and residency status. Details on the exact income thresholds and residency requirements are available on the official website of the Illinois Department of Revenue.

Obtain access to How the Illinois Stimulus Check Program is Funded to private resources that are additional.

- Payment amounts: The program provided varying payment amounts based on individual or household income levels. Higher income levels generally received lower payments, while lower income levels received larger payments.

- Distribution timelines: The program implemented a phased distribution approach, with payments being sent out in stages over a specific timeframe. This allowed for a more efficient allocation of funds and ensured a timely disbursement to eligible recipients.

Economic Context of the Stimulus Check Program

The implementation of the Illinois stimulus check program occurred during a period of economic uncertainty and hardship. The COVID-19 pandemic had significantly impacted various sectors of the Illinois economy, leading to job losses, business closures, and a decline in consumer spending.

The program aimed to address these challenges by providing financial relief to individuals and families, ultimately supporting economic recovery efforts.

Impact of the Program on Demographics and Sectors

The Illinois stimulus check program had a diverse impact on different demographics and sectors within the state. The program’s benefits were felt most acutely by low- and middle-income households, who were disproportionately affected by the economic downturn. The program’s financial assistance provided much-needed relief for these households, enabling them to cover essential expenses, reduce debt, and potentially increase their discretionary spending.

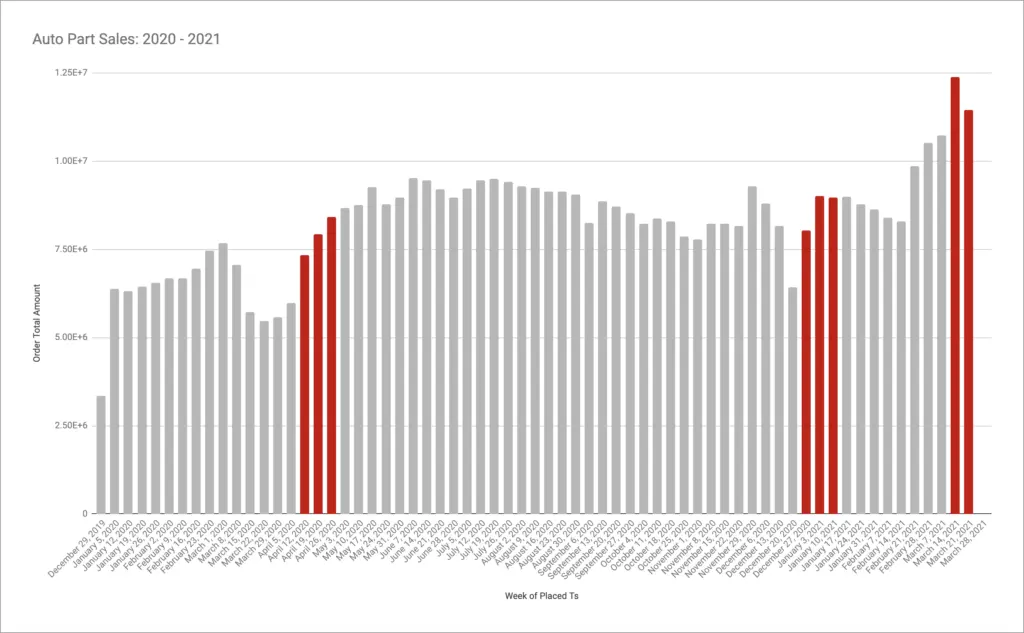

The program also had a ripple effect on various sectors of the Illinois economy. The increased consumer spending resulting from the stimulus payments likely boosted sales in sectors such as retail, hospitality, and entertainment. The program’s impact on specific sectors can be further analyzed by examining consumer spending trends before, during, and after its implementation.

Consumer Spending Trends in Illinois

Consumer Spending Patterns in Illinois

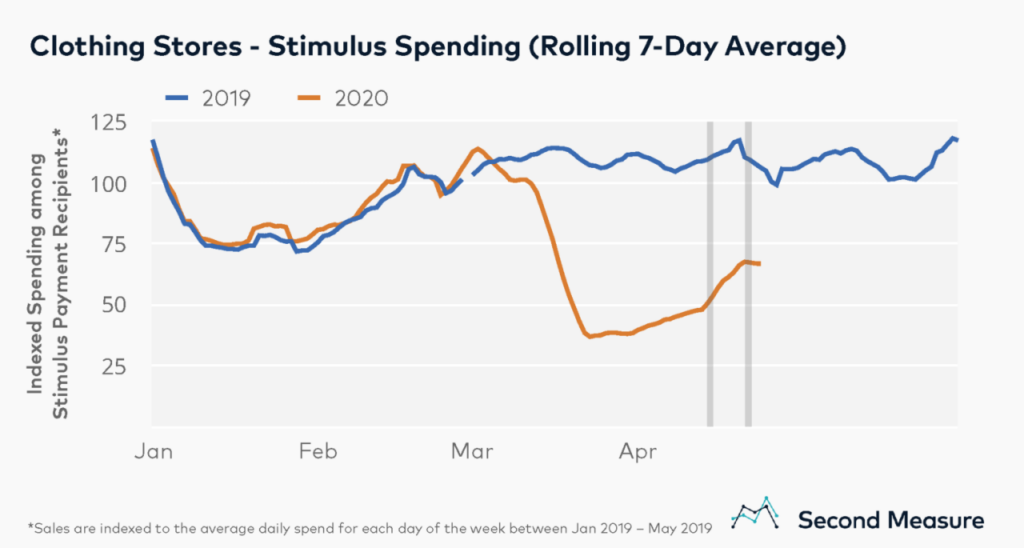

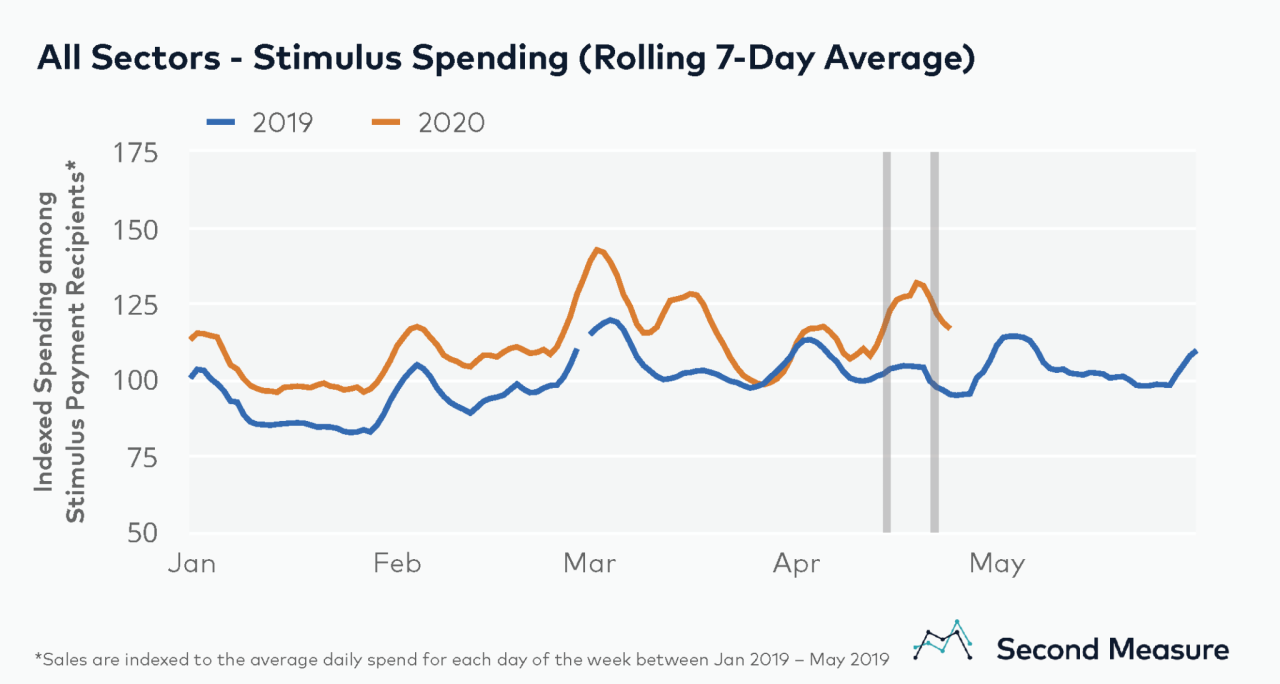

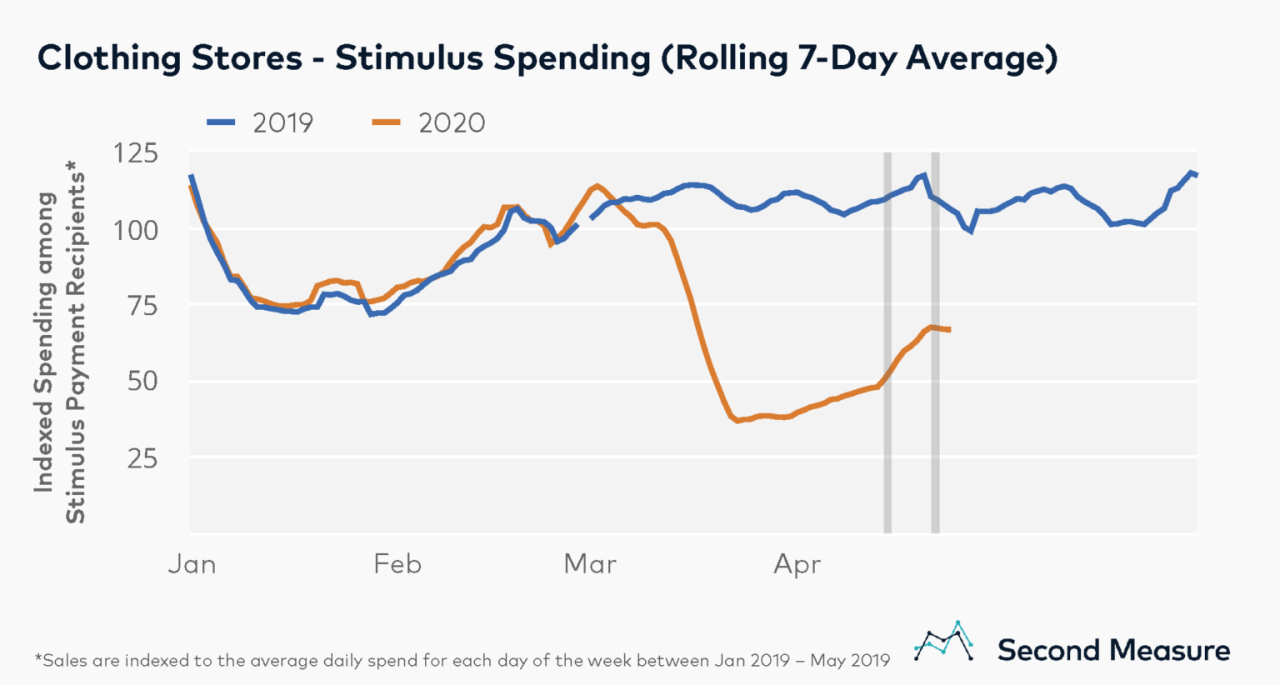

Analyzing consumer spending patterns in Illinois before, during, and after the stimulus check program provides valuable insights into the program’s effectiveness in stimulating economic activity. By comparing spending trends across different sectors, it is possible to identify areas where the stimulus program had a significant impact.

Prior to the program’s implementation, consumer spending in Illinois may have been impacted by the economic downturn caused by the pandemic. During the program’s implementation, spending patterns may have exhibited an increase due to the direct financial assistance provided to residents.

Post-program implementation, spending trends may have reflected the sustainability of the economic recovery efforts, with potential long-term effects on consumer behavior and spending habits.

Comparison with National Trends

Comparing consumer spending trends in Illinois with national trends provides a broader perspective on the program’s effectiveness. By examining spending patterns across different states, it is possible to determine if the Illinois program had a similar impact to national stimulus programs or if there were unique characteristics specific to the state’s economy.

For example, if consumer spending in Illinois experienced a more significant increase than the national average during the program’s implementation, it could suggest that the program was particularly effective in stimulating economic activity within the state. Conversely, if Illinois experienced a smaller increase than the national average, it could indicate that the program’s impact was more muted within the state.

Key Sectors Affected by Stimulus Program

Identifying key sectors that experienced significant changes in consumer spending due to the stimulus program is crucial for understanding the program’s overall impact. Analyzing spending trends in specific sectors can reveal which areas benefited most from the financial assistance provided by the program.

For example, the retail sector may have experienced a significant increase in sales due to the stimulus payments, reflecting increased consumer spending on goods. The hospitality sector may have also seen an uptick in spending, as consumers may have used the stimulus funds to dine out or travel.

By analyzing these sector-specific trends, it is possible to gain a more nuanced understanding of the program’s impact on the Illinois economy.

Economic Impact of Stimulus Checks

Impact on GDP, Employment, and Unemployment Rates

Analyzing the impact of stimulus checks on Illinois’ GDP, employment, and unemployment rates provides a comprehensive understanding of the program’s economic effects. By examining these key economic indicators, it is possible to determine the extent to which the stimulus program contributed to economic growth and job creation.

Further details about Eligibility for Students and Stimulus Checks in Illinois is accessible to provide you additional insights.

If Illinois experienced a positive change in GDP, employment, and unemployment rates following the program’s implementation, it could suggest that the stimulus program played a role in stimulating economic activity and improving labor market conditions. However, it is important to consider other factors that may have influenced these indicators, such as broader economic trends and government policies, to isolate the specific impact of the stimulus program.

Long-Term Economic Implications, Stimulus Check Program and Consumer Spending Trends in Illinois

Examining the long-term economic implications of the stimulus program on the state’s economy is crucial for understanding its lasting effects. The program’s impact on consumer confidence, investment, and entrepreneurship can have long-term implications for economic growth and stability.

If the stimulus program boosted consumer confidence and encouraged investment, it could lead to sustained economic growth in the long term. Conversely, if the program’s impact was temporary and did not lead to lasting changes in consumer behavior or investment patterns, its long-term economic benefits may be limited.

Potential for Investment and Entrepreneurship

The stimulus program’s potential to stimulate investment and entrepreneurship in Illinois is an important aspect to consider. By providing financial assistance to individuals and businesses, the program may have created opportunities for new investments and the creation of new businesses.

If the stimulus program encouraged individuals to invest in their businesses or start new ventures, it could lead to long-term economic benefits for the state. However, it is essential to analyze the actual impact of the program on investment and entrepreneurship to determine if it has lived up to its potential in this regard.

Obtain recommendations related to Will You Get a Illinois Stimulus Check if You Owe Taxes? that can assist you today.

Policy Implications

Effectiveness of the Stimulus Check Program

Examining the effectiveness of the stimulus check program in achieving its objectives is crucial for evaluating its success. The program’s effectiveness can be assessed by considering its impact on consumer spending, economic growth, employment, and other key economic indicators.

If the program successfully increased consumer spending, boosted economic growth, and reduced unemployment, it could be considered a successful policy intervention. However, if the program’s impact was limited or if it failed to achieve its intended objectives, it may require further evaluation and potential adjustments in future policy iterations.

Policy Recommendations for Future Stimulus Programs

Identifying potential policy recommendations for future stimulus programs in Illinois is important for ensuring that future interventions are more effective and targeted. Based on the lessons learned from the previous program, policymakers can consider adjustments to eligibility criteria, payment amounts, distribution mechanisms, and other aspects of the program design.

For example, policymakers could explore targeted approaches that provide financial assistance to specific sectors or demographics that are most impacted by economic downturns. They could also consider alternative mechanisms for distributing funds, such as direct payments to businesses or tax credits for consumers.

Obtain direct knowledge about the efficiency of Illinois Stimulus Check Program FAQs and Clarifications through case studies.

Alternative Economic Recovery Strategies

Discussing the potential for alternative economic recovery strategies in the state is essential for exploring a broader range of policy options. Beyond direct financial assistance, policymakers can consider other strategies for stimulating economic growth, such as infrastructure investments, tax incentives for businesses, and job training programs.

By exploring a diverse range of policy options, policymakers can develop a more comprehensive and effective approach to economic recovery in Illinois.

Last Point

The analysis of the stimulus check program in Illinois provides a comprehensive understanding of its impact on consumer spending and the state’s overall economy. By examining the program’s effectiveness, potential policy recommendations for future economic recovery strategies can be formulated.

The insights gained from this study offer valuable lessons for policymakers and economists alike, highlighting the complex interplay between government intervention and consumer behavior in shaping economic outcomes.

General Inquiries

What were the eligibility criteria for receiving a stimulus check in Illinois?

Discover the crucial elements that make Illinois Stimulus Check Distribution Current Status the top choice.

Eligibility criteria for stimulus checks in Illinois were based on income levels and residency status. Specific details on eligibility criteria can be found on the official Illinois Department of Revenue website.

How did the stimulus program impact different sectors of the Illinois economy?

The stimulus program had varying impacts on different sectors. Some sectors, such as retail and hospitality, experienced a surge in spending, while others, like manufacturing, saw more modest changes. The study provides a detailed analysis of these sector-specific impacts.

What are some potential alternative economic recovery strategies for Illinois?

Alternative economic recovery strategies for Illinois could include targeted tax breaks for businesses, infrastructure investments, and programs to support workforce development. The study explores these options and their potential effectiveness in promoting economic growth.