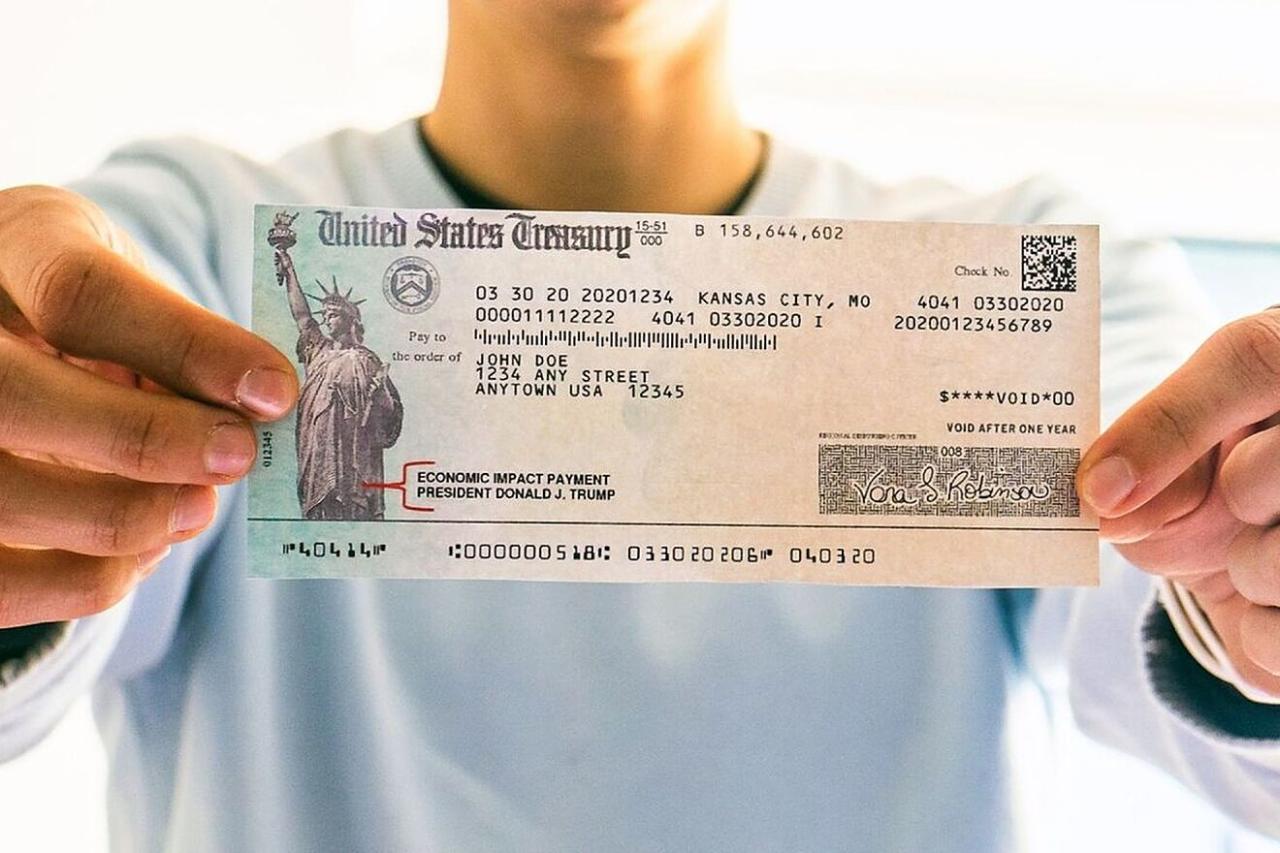

Stimulus Checks Payment Amounts in Illinois were a significant part of the federal government’s response to the economic fallout of the COVID-19 pandemic. These payments aimed to provide financial relief to individuals and families struggling with job losses and reduced income.

This article explores the details of these payments, including eligibility criteria, payment amounts, and the impact on the Illinois economy.

The stimulus checks were distributed in multiple rounds, each with its own set of eligibility requirements and payment amounts. The amount received depended on factors such as individual income, filing status, and the number of dependents. The distribution of these checks had a noticeable impact on the Illinois economy, influencing consumer spending, business activity, and employment.

Timeline of Stimulus Check Distribution in Illinois

Illinois residents received stimulus checks during the COVID-19 pandemic, as part of federal economic relief efforts. These payments were distributed in three rounds, each with its own timeline and specific characteristics.

Do not overlook explore the latest data about Stimulus Check Payment Amounts for Families with Children in Florida.

Timeline of Stimulus Check Distribution

The following timeline Artikels the key dates for the distribution of stimulus checks in Illinois:

- Round 1 (CARES Act):The first round of stimulus checks, authorized by the CARES Act, was distributed in April 2020. The payments were based on 2019 tax returns and amounted to $1,200 per adult and $500 per child.

- Round 2 (Consolidated Appropriations Act):The second round of stimulus checks, authorized by the Consolidated Appropriations Act, was distributed in December 2020. These payments were based on 2019 or 2020 tax returns and amounted to $600 per adult and $600 per child.

- Round 3 (American Rescue Plan Act):The third and final round of stimulus checks, authorized by the American Rescue Plan Act, was distributed in March 2021. These payments were based on 2019, 2020, or 2021 tax returns and amounted to $1,400 per adult and $1,400 per child.

Check what professionals state about How Stimulus Check Amounts Vary by Income Level in Florida and its benefits for the industry.

Delays and Challenges, Stimulus Checks Payment Amounts in Illinois

While the stimulus checks were generally distributed efficiently, some delays and challenges were encountered in Illinois, as in other states. These included:

- Processing delays:The sheer volume of applications and the complexity of eligibility requirements led to processing delays, particularly during the initial phases of each round.

- Technical issues:Some individuals experienced technical issues with the online portals used to claim their stimulus checks, leading to frustration and delays.

- Incorrect or incomplete information:In some cases, incorrect or incomplete information on tax returns resulted in delays or the issuance of incorrect payment amounts.

Comparison with Other States

The timeline for stimulus check distribution in Illinois generally mirrored that of other states, with the majority of payments being disbursed within a few weeks of the legislation’s passage. However, variations in processing times and the prevalence of challenges could have differed across states due to factors such as the size and complexity of their tax systems.

Enhance your insight with the methods and methods of Impact of Dependents on Stimulus Check Payment Amounts in Florida.

Last Recap

The stimulus checks in Illinois provided much-needed financial relief to residents during a challenging time. While the immediate impact of these payments is clear, the long-term effects on the state’s economy remain to be fully understood. As the economy continues to recover, it will be important to assess the effectiveness of these programs and consider potential future stimulus measures to address any lingering economic challenges.

Question & Answer Hub: Stimulus Checks Payment Amounts In Illinois

How long did it take to receive the stimulus checks in Illinois?

The timeline for receiving stimulus checks varied depending on the distribution method and individual circumstances. Some individuals received their payments within a few weeks, while others experienced delays.

What if I didn’t receive a stimulus check, but I think I was eligible?

If you believe you were eligible for a stimulus check but did not receive one, you can contact the IRS for information on how to claim your payment.

Can I still receive a stimulus check if I didn’t file taxes?

In most cases, you need to file a tax return to receive a stimulus check. However, there may be exceptions, such as for individuals who receive Social Security benefits or certain other government payments.

Are there any plans for future stimulus payments in Illinois?

The possibility of future stimulus payments is uncertain. It depends on factors such as the state of the economy, government policy, and the availability of funding.

When investigating detailed guidance, check out Understanding the Florida Stimulus Check Payment Formula now.

Discover how Stimulus Check Payments for Married Couples vs. Single Filers in Florida has transformed methods in this topic.

You also will receive the benefits of visiting Stimulus Checks Payment Amounts in Florida today.