Impact of Filing Status on California Stimulus Check Qualification plays a significant role in determining who qualifies for financial assistance and how much they receive. Understanding your filing status is crucial for navigating the California Stimulus Check program, as it influences income thresholds, payment amounts, and even the timing of your payment.

This guide will explore how your filing status impacts your eligibility for California Stimulus Checks, covering aspects like income requirements, payment amounts, and the process for claiming your check. We’ll delve into the specific requirements for each filing status, providing clear and concise information to help you understand your potential eligibility.

California Stimulus Check Eligibility: Impact Of Filing Status On California Stimulus Check Qualification

The California Stimulus Check program, formally known as the Golden State Stimulus, was designed to provide financial relief to eligible California residents. The program, which was active in 2021, offered payments to individuals and families based on their income, filing status, and other factors.

To be eligible for the stimulus check, individuals needed to meet certain criteria, including income thresholds and residency requirements. The filing status played a significant role in determining eligibility, with different income limits applying to each filing status.

Let’s delve into the specific eligibility criteria and how filing status impacts your chances of receiving a California Stimulus Check.

Further details about Maximum Stimulus Check Payment You Can Receive is accessible to provide you additional insights.

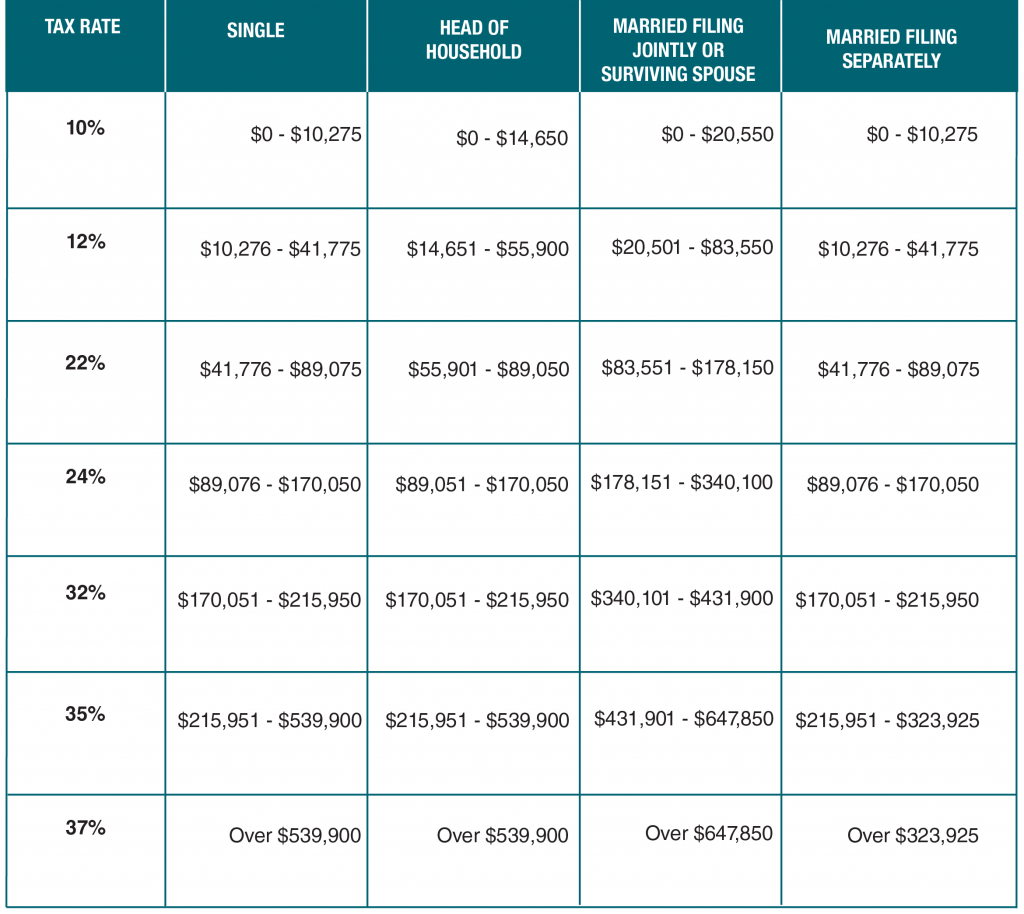

Income Thresholds for Different Filing Statuses

The California Stimulus Check program had specific income thresholds based on filing status. These thresholds were designed to ensure that the payments reached those who were most in need. Here’s a breakdown of the income thresholds for different filing statuses:

- Single Filers:Individuals filing as single had to have an adjusted gross income (AGI) of $75,000 or less to be eligible for the full stimulus payment.

- Head of Household:Head of household filers with an AGI of $112,500 or less qualified for the full stimulus amount.

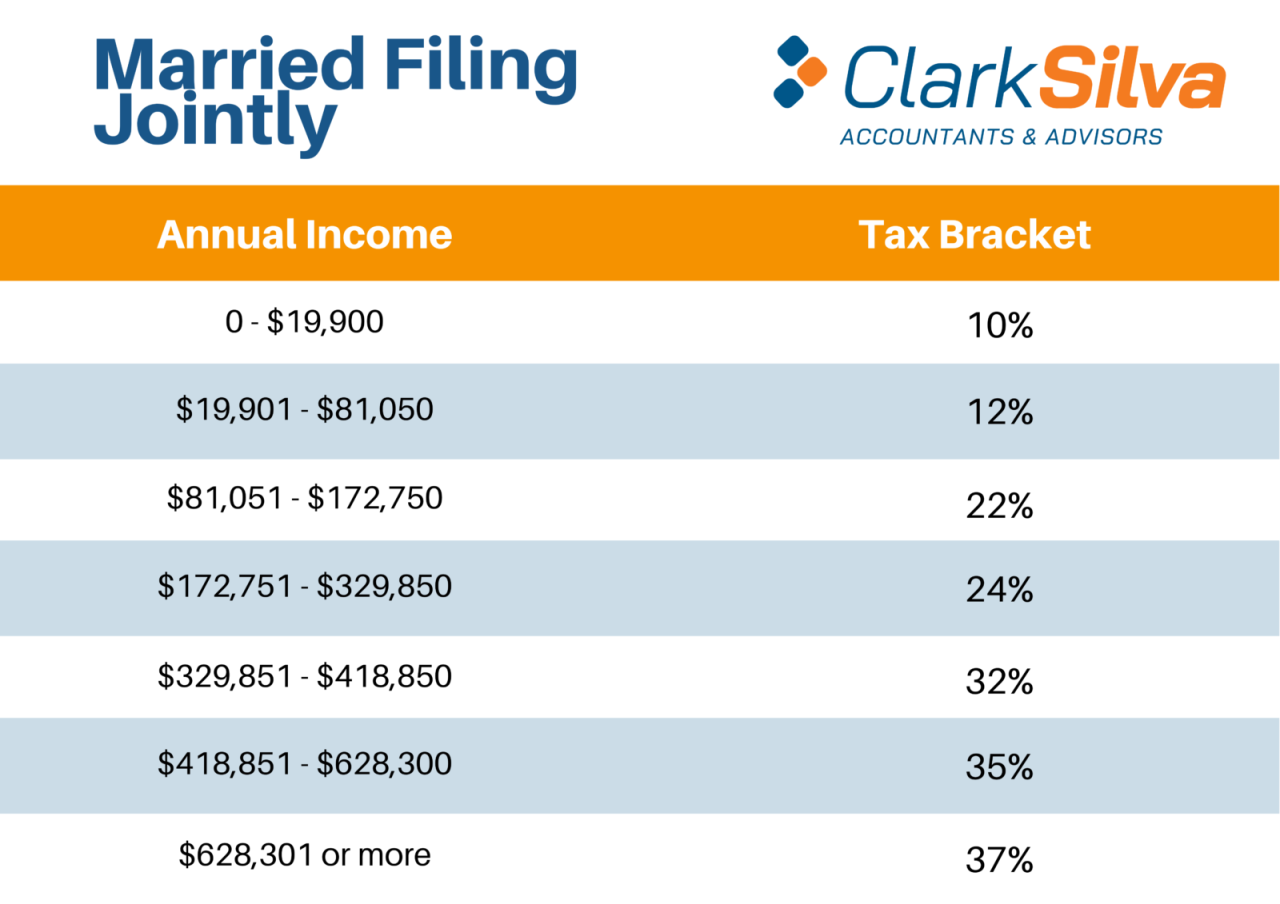

- Married Filing Jointly:Married couples filing jointly needed to have an AGI of $150,000 or less to be eligible for the full payment.

- Qualifying Widow(er):This filing status also had an income threshold of $150,000 or less for the full stimulus amount.

Impact of Dependents on Eligibility

The presence of dependents could influence eligibility for the California Stimulus Check. The program included additional income thresholds for individuals with dependents. For instance, single filers with dependents had a higher income limit than single filers without dependents. This provision ensured that families with children received greater financial support.

- Single Filers with Dependents:Individuals filing as single with dependents had to have an AGI of $112,500 or less to be eligible for the full stimulus payment.

- Head of Household with Dependents:Head of household filers with dependents had an AGI limit of $150,000 or less for the full stimulus amount.

- Married Filing Jointly with Dependents:Married couples filing jointly with dependents had an AGI limit of $200,000 or less for the full stimulus amount.

Filing Status and Payment Amounts

The California Stimulus Check program provided different payment amounts based on the filing status and income level. The payment amounts were designed to provide a greater level of support to those with lower incomes and those with dependents. Let’s explore the payment amounts for each filing status and income bracket.

Discover how Comparing Stimulus Check Payment Amounts in New York & California has transformed methods in this topic.

Payment Amounts for Different Filing Statuses and Income Brackets

| Filing Status | Income Bracket | Payment Amount |

|---|---|---|

| Single | $0

|

$600 |

| Single | $75,001

|

$0 |

| Head of Household | $0

|

$600 |

| Head of Household | $112,501

|

$0 |

| Married Filing Jointly | $0

|

$1,200 |

| Married Filing Jointly | $150,001

|

$0 |

| Qualifying Widow(er) | $0

|

$1,200 |

| Qualifying Widow(er) | $150,001

|

$0 |

Maximum Stimulus Check Amount for Each Filing Status

| Filing Status | Maximum Stimulus Check Amount |

|---|---|

| Single | $600 |

| Head of Household | $600 |

| Married Filing Jointly | $1,200 |

| Qualifying Widow(er) | $1,200 |

Filing Status and Tax Filing Requirements

To receive a California Stimulus Check, individuals were required to file a 2020 California tax return.

When investigating detailed guidance, check out Understanding the Timeline for Stimulus Check Payments now.

The filing status chosen on the tax return played a crucial role in determining eligibility and the amount of the stimulus payment. Let’s delve into the specific tax filing requirements for each filing status.

Tax Filing Requirements for Different Filing Statuses

The California Franchise Tax Board (FTB) used the filing status declared on the 2020 California tax return to determine eligibility for the Golden State Stimulus. Individuals who had not filed a tax return by the deadline had to file one to claim the stimulus payment.

Obtain access to Stimulus Check Payments and Child Support Obligations to private resources that are additional.

The specific forms and documentation required varied based on the filing status.

- Single Filers:Single filers had to file Form 540, the California Individual Income Tax Return, and provide their Social Security number, address, and income information.

- Head of Household:Head of household filers also filed Form 540 and provided the same information as single filers, including documentation supporting their status as head of household.

- Married Filing Jointly:Married couples filing jointly had to file Form 540, providing both spouses’ Social Security numbers, addresses, and income information.

- Qualifying Widow(er):Qualifying widow(er) filers filed Form 540 and provided documentation supporting their status, such as a death certificate of their spouse.

Filing Status and Payment Method

The California Stimulus Check program offered different payment methods, with the chosen method often influenced by the filing status. The FTB typically used the payment method provided on the individual’s 2020 tax return. Let’s explore the payment methods available for each filing status.

Payment Methods for Different Filing Statuses

| Filing Status | Payment Methods |

|---|---|

| Single | Direct Deposit, Debit Card, Paper Check |

| Head of Household | Direct Deposit, Debit Card, Paper Check |

| Married Filing Jointly | Direct Deposit, Debit Card, Paper Check |

| Qualifying Widow(er) | Direct Deposit, Debit Card, Paper Check |

Impact of Filing Status on Eligibility Timeline

The filing status could impact the timeline for receiving a California Stimulus Check. The FTB processed payments based on the filing status and the date the tax return was filed. Let’s explore how filing status affected the payment timeline.

Timeline for Different Filing Statuses, Impact of Filing Status on California Stimulus Check Qualification

The California Stimulus Check program had a staggered payment schedule, with payments issued in phases based on the filing status and the date the tax return was filed. Generally, individuals who filed their tax returns earlier received their payments sooner.

The FTB provided updates on the payment schedule, outlining the expected payment dates for various filing statuses.

- Single Filers:Single filers who filed their tax returns early in the tax season typically received their payments sooner than those who filed later.

- Head of Household:Head of household filers followed a similar payment schedule, with earlier filers receiving their payments first.

- Married Filing Jointly:Married couples filing jointly also had a staggered payment schedule based on their filing date.

- Qualifying Widow(er):Qualifying widow(er) filers followed the same payment schedule as other filing statuses.

Understanding Filing Status Options

Choosing the correct filing status for tax purposes is crucial, as it can impact eligibility for various tax benefits, including stimulus checks. Understanding the different filing status options available in California is essential for maximizing your tax benefits.

Filing Status Options in California

California offers several filing status options, each with its own set of rules and benefits. The filing status chosen can affect the amount of taxes owed, the eligibility for certain deductions and credits, and the amount of any stimulus payments received.

- Single:This status is for unmarried individuals who are not legally separated or divorced.

- Married Filing Jointly:This status is for married couples who choose to file their taxes together.

- Married Filing Separately:This status is for married couples who choose to file their taxes separately.

- Head of Household:This status is for unmarried individuals who pay more than half the cost of keeping up a home for a qualifying child or dependent.

- Qualifying Widow(er):This status is available for two years after the death of a spouse if the surviving spouse meets certain criteria.

Filing Status and Stimulus Check Updates

The California Stimulus Check program has been updated and amended over time. These updates may impact eligibility based on filing status, so it’s crucial to stay informed about any changes to the program. Let’s explore some recent updates and their implications.

Investigate the pros of accepting Stimulus Checks Eligibility Requirements in California in your business strategies.

Recent Updates and Changes

The California Stimulus Check program is no longer active. However, it’s important to note that tax laws and stimulus programs are subject to change. Therefore, it’s essential to stay updated on any new regulations or guidelines related to filing status and stimulus checks.

Wrap-Up

Navigating the California Stimulus Check program requires understanding the intricacies of filing status. From determining your eligibility to claiming your payment, your filing status plays a pivotal role in the process. By carefully reviewing your options and understanding the requirements for each status, you can ensure you receive the financial assistance you are entitled to.

Remember to file your taxes accurately and timely to maximize your chances of receiving your stimulus check.

FAQ Corner

What if I’m married but filing separately?

Explore the different advantages of Latest News & Updates on California Stimulus Checks that can change the way you view this issue.

If you’re married filing separately, your eligibility and payment amount will be determined based on your individual income, not your combined income with your spouse.

How do I know if I qualify for a California Stimulus Check?

The best way to determine your eligibility is to visit the California Franchise Tax Board website or consult a tax professional. They can provide personalized guidance based on your specific circumstances.

What happens if I missed the deadline to file my taxes?

If you missed the tax filing deadline, you may still be eligible for a stimulus check, but you’ll need to file your taxes as soon as possible. Contact the California Franchise Tax Board for guidance on late filing.