Stimulus Check Payments for Married Couples vs. Single Filers: Understanding the Differences in Eligibility and Amounts. Navigating the complexities of government aid programs can be daunting, especially when it comes to stimulus checks. This guide delves into the specific rules and regulations surrounding stimulus check payments for married couples and single filers, highlighting the key differences in eligibility requirements and the amount of financial assistance received.

We’ll break down the income thresholds, filing statuses, and dependency considerations that impact the distribution of stimulus checks, providing a comprehensive overview to help you understand your potential benefits.

From filing status and income requirements to the impact of dependents, we’ll explore the intricacies of stimulus check eligibility for married couples and single filers. We’ll also delve into the varying amounts of stimulus checks received based on filing status and dependency, providing a clear understanding of the financial support available to different households.

Understanding these nuances is crucial for maximizing your potential benefits and navigating the complexities of government assistance programs.

Stimulus Check Eligibility for Married Couples vs. Single Filers

The stimulus checks, also known as Economic Impact Payments, were a series of payments issued by the U.S. government to individuals and families to help alleviate the economic hardship caused by the COVID-19 pandemic. Eligibility for these payments was based on several factors, including income, filing status, and dependency status.

This article will explore the specific eligibility requirements for married couples and single filers, highlighting the key differences between these two groups.

Income Thresholds for Stimulus Check Eligibility, Stimulus Check Payments for Married Couples vs. Single Filers

To qualify for a stimulus check, both married couples and single filers needed to meet certain income thresholds. These thresholds varied depending on filing status and the specific stimulus payment round. For instance, the first round of stimulus checks in 2020 had higher income limits than subsequent rounds.

The following table Artikels the general income thresholds for different filing statuses, providing a clear comparison between married couples and single filers:

| Filing Status | Income Threshold (2020) | Income Threshold (2021) |

|---|---|---|

| Married Filing Jointly | $150,000 | $150,000 |

| Married Filing Separately | $75,000 | $75,000 |

| Head of Household | $112,500 | $112,500 |

| Single | $75,000 | $75,000 |

It’s important to note that these income thresholds are general guidelines. The actual eligibility criteria might have varied slightly depending on the specific stimulus payment round and other factors. For accurate and up-to-date information, it’s always best to consult official government sources.

Stimulus Check Amounts for Married Couples vs. Single Filers

The amount of the stimulus check received was also dependent on filing status. Married couples filing jointly generally received a larger stimulus check compared to single filers, reflecting the fact that they are considered a larger household unit. Here’s a breakdown of the stimulus check amounts for different filing statuses:

| Filing Status | Stimulus Check Amount (2020) | Stimulus Check Amount (2021) |

|---|---|---|

| Married Filing Jointly | $2,400 | $1,400 |

| Married Filing Separately | $1,200 | $700 |

| Head of Household | $1,800 | $1,400 |

| Single | $1,200 | $1,400 |

As you can see, the stimulus check amounts for married couples filing jointly were significantly higher than those for single filers in 2020. However, in 2021, the amount for single filers increased to match the amount for those filing as head of household.

This change reflected a shift in policy aimed at providing more financial assistance to individuals who are not part of a married couple.

Dependency Status and Stimulus Check Payments

The number of dependents claimed on a tax return also influenced the amount of the stimulus check received. Both married couples and single filers received an additional payment for each qualifying dependent. This meant that families with children generally received larger stimulus checks compared to individuals without dependents.

The following table Artikels the additional stimulus check amounts received per dependent:

| Filing Status | Additional Stimulus Check Amount per Dependent (2020) | Additional Stimulus Check Amount per Dependent (2021) |

|---|---|---|

| Married Filing Jointly | $500 | $1,400 |

| Married Filing Separately | $500 | $1,400 |

| Head of Household | $500 | $1,400 |

| Single | $500 | $1,400 |

It’s important to note that the rules for claiming dependents on tax returns can be complex. The IRS provides specific guidelines regarding who qualifies as a dependent and how to claim them on your tax return. If you have questions about dependency status or stimulus check eligibility, it’s always best to consult with a tax professional.

Filing Status and Stimulus Check Distribution

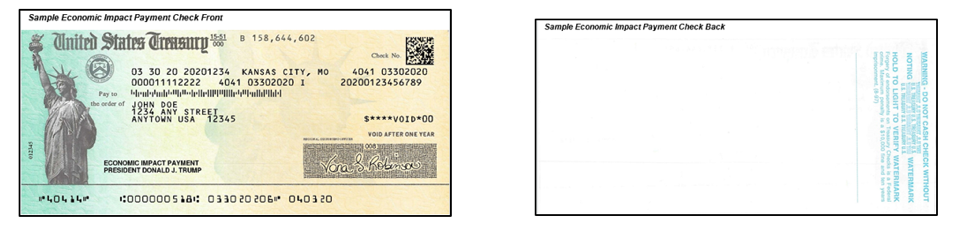

The method of receiving the stimulus check also varied depending on filing status. Most individuals received their stimulus checks through direct deposit, while others received paper checks or debit cards. The distribution method was largely determined by the information provided on the individual’s tax return.

Learn about more about the process of Stimulus Check Payment Amounts in the field.

For married couples filing jointly, the stimulus check was typically deposited into the joint bank account listed on their tax return. Single filers, on the other hand, received their stimulus check in the same manner as their tax refund, either through direct deposit, paper check, or debit card.

There were some instances where individuals experienced delays or complications in receiving their stimulus checks. These delays were often attributed to issues with bank account information, changes in address, or other administrative factors. While filing status did not directly influence these delays, it’s worth noting that married couples filing jointly may have faced additional challenges due to the need for both spouses to provide accurate bank account information.

In some cases, the IRS might have needed to verify the identity of both spouses before issuing the stimulus check.

Impact of Stimulus Checks on Married Couples vs. Single Filers

The economic impact of the stimulus checks varied depending on the individual’s financial situation. For married couples, the larger stimulus check amounts could have provided greater financial relief, especially for households with children. This additional income could have been used to cover essential expenses, reduce debt, or even make small investments.

Single filers, while receiving smaller stimulus checks, might have benefited from the payments by helping them maintain financial stability during a challenging economic period.

The stimulus checks likely influenced spending patterns and financial decisions for both married couples and single filers. Some individuals might have used the payments to make necessary purchases, such as groceries or utilities, while others might have saved the money for future needs or to pay down debt.

The overall economic impact of the stimulus checks on married couples and single filers was likely multifaceted, depending on factors such as household income, debt levels, and individual spending habits.

Epilogue: Stimulus Check Payments For Married Couples Vs. Single Filers

In conclusion, navigating the landscape of stimulus check payments for married couples and single filers requires careful consideration of various factors, including income thresholds, filing statuses, and dependency status. By understanding these key elements, individuals can ensure they receive the maximum amount of financial support available to them.

The intricacies of stimulus check distribution highlight the importance of staying informed and utilizing resources to make informed decisions about your finances. Whether you’re a married couple or a single filer, understanding the specific rules and regulations governing stimulus checks is essential for maximizing your potential benefits and navigating the complexities of government assistance programs.

Helpful Answers

What if I’m married but filing separately?

If you’re married but filing separately, you’ll be treated as a single filer for stimulus check purposes, meaning your eligibility and the amount you receive will be based on your individual income. However, it’s important to note that if your spouse also qualifies for a stimulus check, you may both be eligible for separate payments.

Can I claim my child as a dependent if I’m a single filer?

Yes, if you are a single filer and have a qualifying child, you can claim them as a dependent on your tax return and receive an additional stimulus check amount for each dependent. The specific requirements for claiming a dependent may vary, so it’s recommended to consult the IRS guidelines for more detailed information.

How do I know if I’m eligible for a stimulus check?

The best way to determine your eligibility for a stimulus check is to review the IRS guidelines and use their online tool to estimate your potential payment. You can also consult with a tax professional for personalized guidance. It’s important to note that eligibility requirements may change, so it’s always best to stay up-to-date on the latest information.