Fixed Interest Rates 2024 are a crucial topic for individuals and businesses alike, as they directly impact borrowing costs, investment returns, and overall economic stability. Understanding the forces shaping these rates is essential for making informed financial decisions.

This comprehensive guide explores the current state of fixed interest rates in 2024, analyzing the factors driving their movements, and examining the implications for various stakeholders. We delve into the historical context, economic climate, and the role of central bank policies in influencing fixed interest rates.

VA loans are available to veterans and active-duty military personnel. Check out VA Loan Rates 2024 to see if you qualify for this type of loan.

Fixed Interest Rates in 2024: An Overview: Fixed Interest Rates 2024

Fixed interest rates play a crucial role in shaping economic activity and influencing financial decisions. In 2024, fixed interest rates are navigating a complex landscape influenced by a confluence of factors, including inflation, central bank policies, and global economic conditions.

This article provides an overview of the current state of fixed interest rates in 2024, exploring the factors that influence their movements and the impact they have on individuals and businesses.

Chase is a well-known name in the mortgage industry. Check out Chase Home Mortgage 2024 to see their current rates and offerings.

Current State of Fixed Interest Rates

As of the first quarter of 2024, fixed interest rates have shown a trend of gradual increase, reflecting the ongoing battle against inflation. Central banks around the world have been tightening monetary policy to curb rising prices, leading to higher borrowing costs for individuals and businesses.

This upward trend in fixed interest rates is expected to continue in the coming months, albeit at a slower pace, as central banks assess the effectiveness of their policies and the impact on economic growth.

A HELOC, or Home Equity Line of Credit, can be a flexible way to access your home’s equity. Get the latest information on Helocs 2024 and see if it’s the right choice for you.

Factors Influencing Fixed Interest Rates

Inflation

Inflation is a key driver of fixed interest rate movements. When inflation is high, central banks typically raise interest rates to cool down the economy and control price increases. This is because higher interest rates make it more expensive for businesses to borrow money, which can slow down economic activity and reduce demand.

As a result, fixed interest rates tend to rise in periods of high inflation.

Finding the best mortgage lender can be challenging, but it’s crucial for a smooth home buying process. Check out Best Mortgage Lenders 2024 to see which lenders are consistently rated highly.

Central Bank Policies

Central banks play a pivotal role in setting interest rate targets and influencing monetary policy. Their actions, such as raising or lowering interest rates, directly impact the cost of borrowing and lending. In 2024, central banks are focused on managing inflation and promoting sustainable economic growth.

Wells Fargo is another popular mortgage lender. You can find their current rates and offerings by visiting Wells Fargo Mortgage 2024.

Their decisions regarding interest rates will continue to shape the trajectory of fixed interest rates in the coming months and years.

Looking for the best deals? You can find Cheapest Home Loan Rates 2024 by comparing rates from different lenders. It’s worth shopping around to find the most competitive rates.

Global Economic Conditions

Global economic conditions also play a significant role in influencing fixed interest rates. Factors such as economic growth, unemployment rates, and geopolitical events can impact investor sentiment and borrowing costs. For instance, a global economic slowdown could lead to lower interest rates as central banks try to stimulate economic activity.

Conversely, a period of strong global growth might result in higher interest rates as central banks attempt to curb inflation.

Impact of Fixed Interest Rates

Mortgage Rates and Homeownership

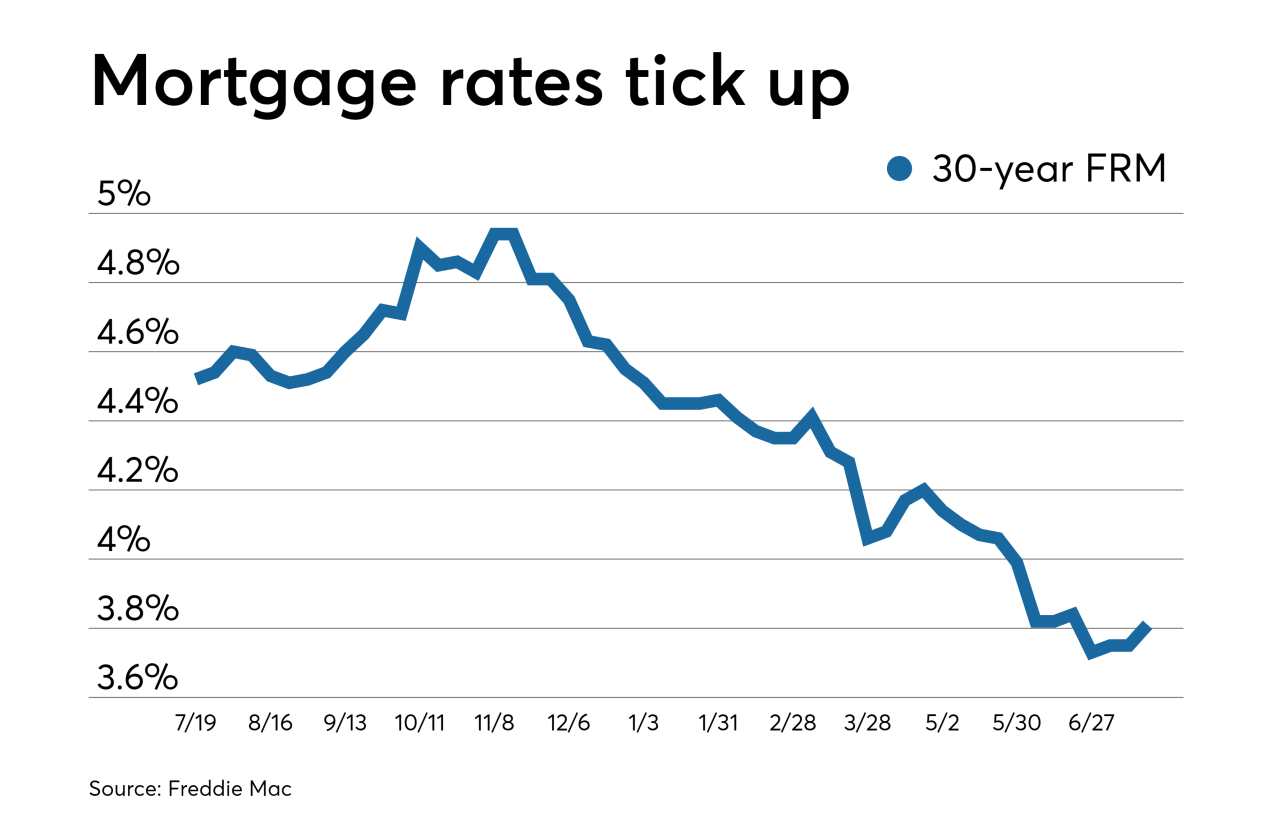

Fixed interest rates have a direct impact on mortgage rates, which in turn affect the affordability of homeownership. When fixed interest rates rise, mortgage rates also tend to increase, making it more expensive to borrow money for a home purchase.

This can reduce demand for housing and potentially slow down the real estate market. Conversely, lower fixed interest rates can lead to lower mortgage rates, making it more affordable to buy a home and potentially boosting housing demand.

Business Borrowing and Investment Decisions, Fixed Interest Rates 2024

Fixed interest rates significantly influence business borrowing and investment decisions. When interest rates are high, businesses may be less likely to borrow money for expansion or new projects. This is because the cost of borrowing is higher, making it less profitable to invest.

Conversely, lower interest rates can encourage businesses to borrow and invest, leading to economic growth. Businesses carefully consider the impact of fixed interest rates on their borrowing costs and investment returns.

Understanding mortgage options is essential for making informed decisions. Explore Mortgage 2024 to learn about the different types of mortgages available.

Savings and Investment Strategies

Fixed interest rates also impact savings and investment strategies. When interest rates are high, individuals may be more inclined to save money, as they can earn a higher return on their savings. This can lead to a decrease in spending and potentially slow down economic growth.

An equity home loan allows you to borrow against your home’s equity. Learn more about Equity Home Loan 2024 and see if it’s the right option for you.

Conversely, lower interest rates can encourage individuals to invest in other assets, such as stocks or real estate, in search of higher returns.

Fixed Interest Rates and Financial Markets

Bond Yields

Fixed interest rates have a close relationship with bond yields. When fixed interest rates rise, bond yields tend to increase as well. This is because investors demand a higher return on their investment to compensate for the higher cost of borrowing.

Conversely, lower fixed interest rates can lead to lower bond yields.

Asset Class Performance

Fixed interest rates can influence the performance of various asset classes. For example, rising interest rates can negatively impact the value of bonds, as their yields become less attractive compared to other investments. Conversely, lower interest rates can support the performance of stocks, as businesses can borrow money more cheaply and potentially increase their profits.

If you’re looking to lower your monthly payments or get a better interest rate, a refinance might be a good option. Explore Refinance Home Loan 2024 to see if it makes sense for you.

Opportunities and Risks

Fixed interest rates present both opportunities and risks in the financial markets. For example, investors may be able to capitalize on higher yields by investing in bonds during periods of rising interest rates. However, they should also be aware of the potential for capital losses if interest rates rise unexpectedly.

Similarly, businesses can benefit from lower borrowing costs during periods of low interest rates, but they need to be cautious about potential risks associated with increased debt levels.

Reverse mortgages can be a valuable option for seniors. Explore Reverse Mortgage Companies 2024 to learn more about how they work.

Fixed Interest Rates and the Future

Forecasting fixed interest rates is a complex endeavor, as it involves numerous economic and geopolitical factors. However, based on current trends and economic projections, fixed interest rates are expected to remain elevated in the coming months and years. Central banks are likely to continue their fight against inflation, potentially leading to further increases in interest rates.

Choosing the right mortgage can save you thousands in the long run. Explore Best Mortgage 2024 to find the best option for your unique situation.

Key factors that could influence future interest rate movements include the pace of inflation, global economic growth, and geopolitical stability.

Home interest rates can change daily, so it’s essential to stay up-to-date on the latest trends. You can find the latest information on Home Interest Rates 2024 to make informed decisions about your mortgage.

The future trajectory of fixed interest rates will have significant implications for individuals and businesses. Higher interest rates can make it more expensive to borrow money, potentially slowing down economic growth. However, they can also provide opportunities for savers and investors to earn higher returns.

It is essential to stay informed about the factors influencing fixed interest rates and to adjust financial strategies accordingly.

Ultimate Conclusion

Navigating the complex world of fixed interest rates requires a keen understanding of their underlying dynamics. By considering the factors discussed in this guide, individuals and businesses can make more informed decisions regarding borrowing, investing, and managing their finances in the ever-changing economic landscape.

General Inquiries

What are the key differences between fixed and variable interest rates?

If you’re looking to tap into your home equity, a cash-out refinance might be a good option. Learn more about FHA Cash Out Refinance 2024 and see if it fits your needs.

Fixed interest rates remain constant for the duration of a loan or investment, while variable interest rates fluctuate based on market conditions.

Rocket Mortgage is a popular choice for homebuyers. Check out Rocket Mortgage Interest Rates 2024 to see if their current rates align with your financial goals.

How do fixed interest rates affect the housing market?

Looking for a mortgage lender in your area? We can help! You can find a list of Mortgage Lenders Near Me 2024 by entering your zip code and seeing what lenders are available in your region. It’s quick and easy to get started.

Higher fixed interest rates lead to increased mortgage costs, potentially cooling the housing market by making homeownership less affordable.

What are the potential risks associated with fixed interest rates?

While fixed interest rates provide stability, they may offer lower returns than variable rates if interest rates fall significantly in the future.