Current Mortgage Rates 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The year 2024 has brought about a dynamic shift in the mortgage landscape, with rates fluctuating in response to a complex interplay of economic forces.

Understanding these fluctuations is crucial for anyone considering buying a home, refinancing an existing mortgage, or simply navigating the financial implications of this evolving market.

This exploration delves into the current average mortgage rates for various loan types, including fixed-rate and adjustable-rate options. We’ll analyze historical trends, highlighting how rates have moved over the past year, and discuss the key factors driving these changes, such as economic conditions, inflation, and Federal Reserve policies.

We’ll also examine how individual factors, including credit score, loan amount, and loan term, influence your personal mortgage rate.

Current Mortgage Rates Overview

Mortgage rates are a crucial factor for anyone considering buying a home. They directly impact the affordability of a mortgage and can significantly influence the overall cost of homeownership. In 2024, mortgage rates have been fluctuating, creating both challenges and opportunities for prospective homebuyers.

This article provides a comprehensive overview of current mortgage rates, the factors influencing them, and the potential impact on the housing market.

Current Average Mortgage Rates, Current Mortgage Rates 2024

As of today, average mortgage rates for different loan types are:

- 30-year fixed-rate mortgages:Around 7.00% – 7.25%

- 15-year fixed-rate mortgages:Around 6.50% – 6.75%

- Adjustable-rate mortgages (ARMs):Starting at 6.00% – 6.25% with potential for future adjustments.

It’s important to note that these are just average rates and actual rates can vary depending on individual factors like credit score, loan amount, and lender.

Historical Trends and Influencing Factors

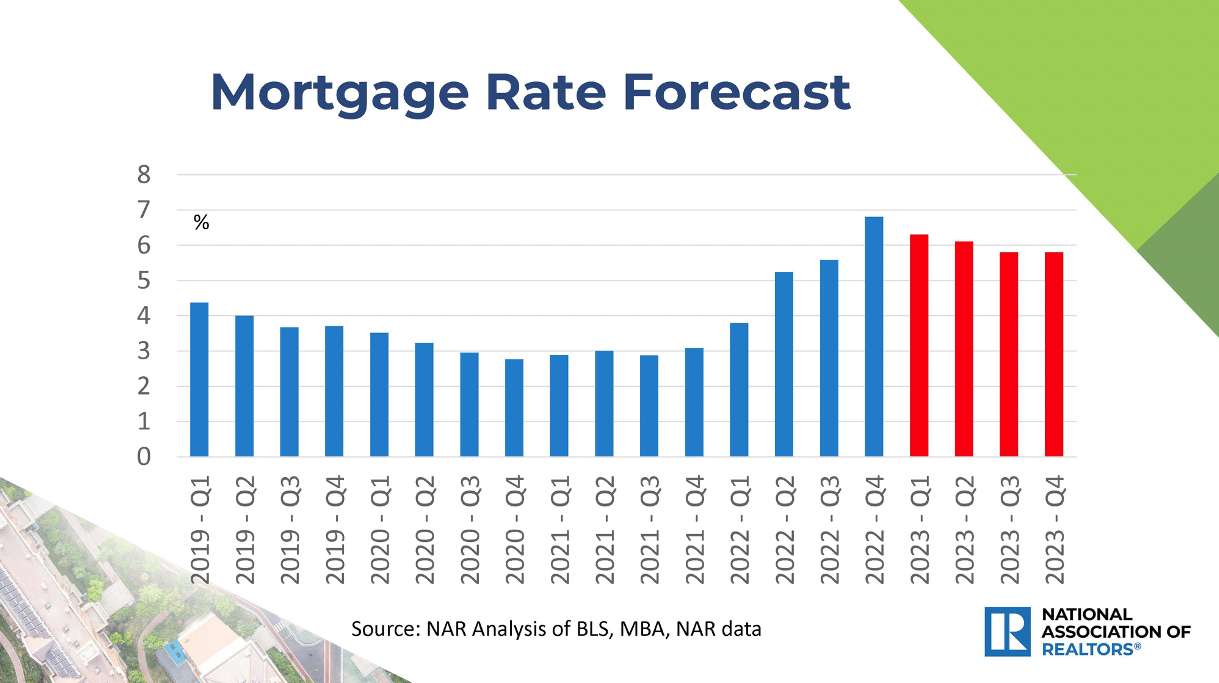

Over the past year, mortgage rates have experienced a significant upward trend, largely driven by the Federal Reserve’s efforts to combat inflation. The Fed’s aggressive interest rate hikes have made borrowing more expensive, impacting not only mortgage rates but also other forms of lending.

Other factors contributing to the current rate environment include economic uncertainty, geopolitical tensions, and the ongoing supply chain disruptions.

Understanding Mortgage Rate Factors

Beyond the broader economic conditions, several factors influence individual mortgage rates. These include:

- Credit Score:Borrowers with higher credit scores generally qualify for lower interest rates.

- Loan Amount:Larger loan amounts often come with higher interest rates due to increased risk for lenders.

- Loan Term:Shorter loan terms (e.g., 15-year mortgages) typically have lower interest rates than longer terms (e.g., 30-year mortgages).

- Loan Type:Different loan types, such as fixed-rate and adjustable-rate mortgages, carry different interest rates based on their specific features and risk profiles.

Impact of Current Rates on Homebuyers

Rising mortgage rates have a significant impact on homebuyers, primarily by affecting affordability and purchasing power.

- Reduced Affordability:Higher rates mean higher monthly mortgage payments, making it more challenging for buyers to qualify for loans and afford their desired homes.

- Lower Purchasing Power:Rising rates effectively reduce the amount of money buyers can borrow, limiting their purchasing power and potentially forcing them to consider less expensive properties.

- Potential Impact on Housing Market:The combination of reduced affordability and lower purchasing power can lead to a slowdown in housing demand, potentially affecting home prices and sales activity.

Strategies for Navigating Current Rates

Despite the challenges, there are strategies homebuyers can employ to navigate the current mortgage rate environment and secure the best possible rates.

- Shop Around for Lenders:Comparing offers from multiple lenders can help you find the most competitive rates and terms.

- Improve Credit Score:A higher credit score can qualify you for lower interest rates.

- Consider Alternative Loan Options:Explore options like FHA loans or VA loans, which may offer lower rates and more flexible requirements for certain borrowers.

Here’s a table comparing different mortgage options and their potential benefits and drawbacks:

| Mortgage Type | Benefits | Drawbacks |

|---|---|---|

| Fixed-Rate Mortgage | Predictable monthly payments, protection from interest rate fluctuations | Potentially higher initial interest rates compared to ARMs |

| Adjustable-Rate Mortgage (ARM) | Lower initial interest rates, potential for lower monthly payments | Interest rates can fluctuate, potentially leading to higher payments in the future |

| FHA Loan | Lower down payment requirements, more flexible credit score requirements | Higher mortgage insurance premiums, potential for higher interest rates |

| VA Loan | No down payment required for eligible veterans, lower interest rates | Limited to eligible veterans and active-duty military personnel |

Future Outlook for Mortgage Rates

Predicting future mortgage rates is inherently challenging, as they are influenced by a complex interplay of economic and policy factors. However, based on current economic forecasts and potential policy changes, several scenarios could emerge.

- Scenario 1: Continued Rate Hikes:If inflation remains high and the Fed continues its aggressive rate hike strategy, mortgage rates could continue to rise in the coming months.

- Scenario 2: Rate Stabilization:As inflation cools down and the Fed’s rate hike cycle slows, mortgage rates may stabilize or even decline slightly.

- Scenario 3: Rate Cuts:If the economy weakens significantly, the Fed could reverse course and begin cutting interest rates, potentially leading to a decline in mortgage rates.

It’s crucial for homebuyers to stay informed about current market trends and potential future scenarios. Consulting with a mortgage professional can provide valuable insights and guidance tailored to individual circumstances.

Closing Notes: Current Mortgage Rates 2024

Navigating the current mortgage rate environment requires a strategic approach. By understanding the factors that influence rates, homebuyers can position themselves to secure the best possible terms. This includes shopping around for lenders, improving credit scores, and exploring alternative loan options.

Ultimately, the future of mortgage rates remains uncertain, but by staying informed and adapting to changing market conditions, borrowers can make informed decisions that align with their financial goals.

FAQ Section

What are the current average mortgage rates for fixed-rate loans?

Current average fixed-rate mortgage rates vary depending on the loan term. For example, a 30-year fixed-rate mortgage might average around 6.5%, while a 15-year fixed-rate mortgage could average around 5.5%.

How do adjustable-rate mortgages (ARMs) work?

ARMs offer a lower initial interest rate that adjusts periodically based on a specific index, such as the London Interbank Offered Rate (LIBOR). This can result in lower payments initially, but the rate can increase over time, leading to higher payments.

What is the impact of a credit score on my mortgage rate?

A higher credit score generally leads to lower interest rates. Lenders view borrowers with strong credit history as less risky, allowing them to offer more favorable terms.

How do I improve my credit score?

To improve your credit score, focus on paying bills on time, keeping credit utilization low, and avoiding opening too many new accounts.