Lightstream Auto Loan offers a compelling alternative to traditional auto financing, catering to a wide range of borrowers with competitive rates and flexible terms. Whether you’re looking to purchase a new car, refinance an existing loan, or simply explore your options, Lightstream provides a comprehensive approach to auto financing.

If you’re looking for a mortgage with flexible terms and lower down payment requirements, an FHA loan might be a good option. Check out the latest FHA loan rates to see if they align with your financial goals.

Lightstream stands out for its user-friendly online platform, streamlined application process, and competitive interest rates. The company’s focus on transparency and clear communication ensures a smooth and straightforward borrowing experience. This comprehensive guide will delve into the key features of Lightstream Auto Loans, providing insights into eligibility criteria, loan terms, and the overall benefits of choosing Lightstream as your financing partner.

If you need a loan and prefer to work with a local lender, searching for “money lenders near me” can help you find options in your area. Money lenders near me can provide personalized service and local expertise.

Lightstream Auto Loan Overview

Lightstream is a well-known online lender that provides a range of financial products, including auto loans. Known for its competitive rates and streamlined application process, Lightstream offers a convenient option for borrowers looking to finance their next vehicle. This article will delve into the key aspects of Lightstream auto loans, including their features, eligibility requirements, loan terms, and overall value proposition.

Core Features of Lightstream Auto Loans

Lightstream auto loans offer a range of features designed to cater to diverse borrower needs. Some of the key features include:

- Competitive interest rates: Lightstream is known for its competitive interest rates, which can potentially save borrowers significant amounts of money over the life of their loan.

- Flexible loan terms: Lightstream offers flexible loan terms ranging from 12 to 84 months, allowing borrowers to choose a repayment schedule that aligns with their financial situation.

- No origination fees: Unlike some lenders, Lightstream does not charge origination fees, ensuring borrowers keep more of their hard-earned money.

- Fast funding: Lightstream is known for its quick funding process, with borrowers typically receiving their loan funds within a few business days.

- Online application and management: Lightstream provides a user-friendly online platform for applying, managing, and tracking loans, offering convenience and accessibility.

Eligibility Criteria for Lightstream Auto Loans

To qualify for a Lightstream auto loan, borrowers generally need to meet the following criteria:

- Credit score: Lightstream typically requires a minimum credit score of 660 for loan approval. However, borrowers with higher credit scores may qualify for lower interest rates.

- Income: Lightstream will assess your income to determine your ability to repay the loan. A stable income history is generally required.

- Debt-to-income ratio: Your debt-to-income ratio (DTI) is also considered. A lower DTI typically indicates a greater ability to manage debt obligations.

- Residency: You must be a U.S. resident to apply for a Lightstream auto loan.

Loan Terms and Interest Rates

Lightstream offers a range of loan terms and interest rates, depending on factors such as the borrower’s credit score, loan amount, and vehicle type.

- Loan terms: Lightstream auto loans typically range from 12 to 84 months, providing flexibility to borrowers.

- Interest rates: Lightstream’s interest rates vary based on individual creditworthiness. However, they are generally competitive compared to other lenders. You can use Lightstream’s online calculator to estimate potential interest rates.

Advantages and Disadvantages of Choosing Lightstream

Like any financial product, Lightstream auto loans have both advantages and disadvantages. It’s crucial to weigh these factors before making a decision.

For long-term financial commitments, like purchasing a home or investing in a business, long-term loans can provide the stability and affordability you need. Make sure to compare rates and terms from different lenders to find the best fit.

Advantages

- Competitive interest rates: Lightstream’s interest rates are often among the most competitive in the market, potentially saving borrowers significant amounts of money over the loan term.

- No origination fees: Lightstream does not charge origination fees, which can save borrowers hundreds of dollars upfront.

- Flexible loan terms: Lightstream offers a wide range of loan terms, allowing borrowers to choose a repayment schedule that aligns with their financial situation.

- Fast funding: Lightstream is known for its quick funding process, with borrowers typically receiving their loan funds within a few business days.

- Online application and management: Lightstream provides a user-friendly online platform for applying, managing, and tracking loans, offering convenience and accessibility.

Disadvantages

- Limited loan amounts: Lightstream may have limits on the maximum loan amounts it offers, which could be a drawback for borrowers seeking significant financing.

- Credit score requirements: Lightstream typically requires a minimum credit score of 660, which may exclude some borrowers with lower credit scores.

Loan Application and Approval Process

Applying for a Lightstream auto loan is a straightforward process, typically completed online. Here’s a breakdown of the steps involved:

Steps Involved in Applying for a Lightstream Auto Loan

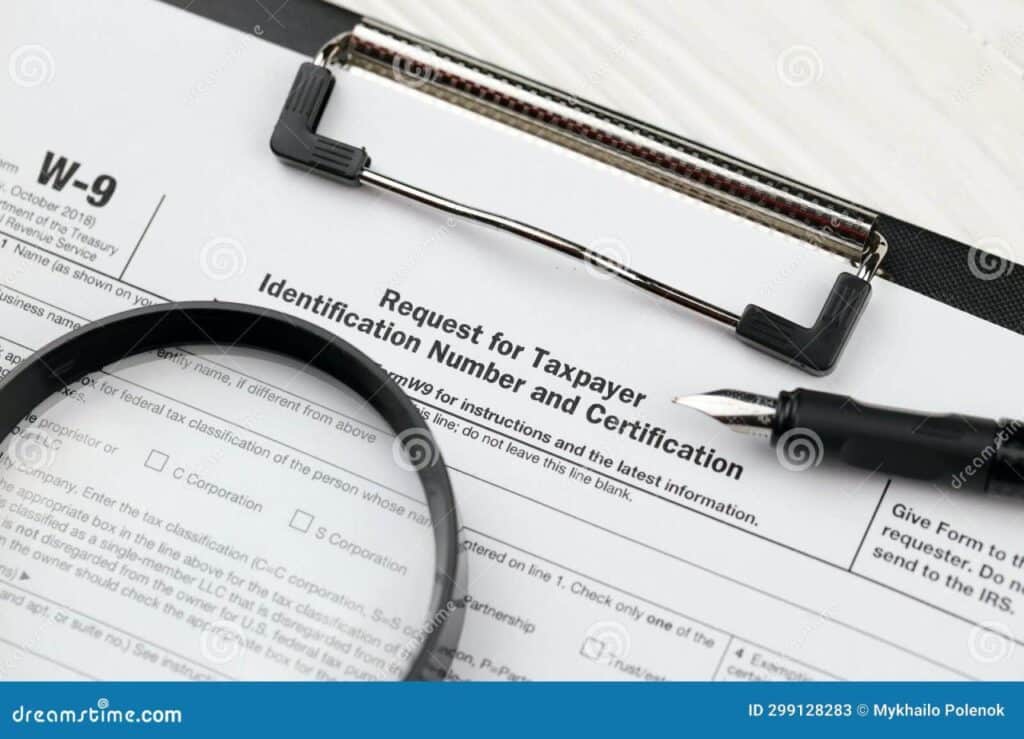

- Gather required documentation: This includes your Social Security number, driver’s license, proof of income, and recent bank statements.

- Complete the online application: Provide your personal and financial information, including details about the vehicle you’re financing.

- Submit the application: Once you’ve completed the application, submit it for review.

- Receive a loan decision: Lightstream will review your application and provide a loan decision, typically within a few business days.

- Finalize the loan: If approved, you’ll need to sign the loan documents electronically and provide any additional information required.

- Receive loan funds: Once the loan is finalized, Lightstream will typically deposit the funds into your bank account within a few business days.

Documentation Required for Loan Application

To apply for a Lightstream auto loan, you’ll generally need to provide the following documentation:

- Social Security number

- Driver’s license

- Proof of income (pay stubs, tax returns, or W-2s)

- Recent bank statements

- Vehicle information (VIN number, year, make, and model)

Loan Approval Process and Timeline

Lightstream’s loan approval process is typically fast and efficient. Here’s a breakdown of the timeline:

- Application review: Lightstream will review your application and credit history, which may take a few business days.

- Loan decision: Once the review is complete, Lightstream will notify you of their loan decision.

- Loan documentation: If approved, you’ll need to electronically sign the loan documents.

- Loan funding: Lightstream will typically deposit the loan funds into your bank account within a few business days of finalizing the loan.

Factors Influencing Loan Approval Decisions

Lightstream considers several factors when making loan approval decisions, including:

- Credit score: A higher credit score generally increases your chances of approval and can result in a lower interest rate.

- Income: A stable income history demonstrates your ability to repay the loan.

- Debt-to-income ratio: A lower DTI indicates that you have more financial flexibility.

- Loan amount: The amount you’re borrowing will also be considered.

- Vehicle information: Lightstream may assess the value and condition of the vehicle you’re financing.

Loan Rates and Financing Options

Lightstream offers competitive interest rates and a range of financing options to suit different borrower needs.

When you need cash fast, instant cash loans can provide a quick solution. However, be aware of high interest rates and potential fees associated with these loans.

Comparison of Lightstream’s Interest Rates

Lightstream’s interest rates are generally competitive compared to other auto loan providers. However, the specific rates offered will depend on factors such as your credit score, loan amount, and loan term. To get an accurate estimate of potential interest rates, it’s recommended to use Lightstream’s online calculator or contact them directly.

If you need a short-term loan to cover unexpected expenses, payday advance loans might seem like a quick solution. However, these loans typically have high interest rates and can create a debt cycle if not managed carefully.

Loan Terms and Repayment Options

Lightstream offers flexible loan terms ranging from 12 to 84 months. This allows borrowers to choose a repayment schedule that aligns with their financial situation and budget.

Impact of Credit Score on Interest Rates

Your credit score significantly impacts the interest rate you’ll receive on a Lightstream auto loan. Borrowers with higher credit scores typically qualify for lower interest rates, while those with lower credit scores may face higher rates. It’s essential to maintain a good credit score to secure the best possible financing terms.

Special Financing Options, Lightstream Auto Loan

Lightstream may offer special financing options, such as discounts for auto refinancing or promotions for specific vehicle types. It’s best to contact Lightstream directly to inquire about any current special financing programs.

Federal employees often have access to special loan programs. Explore the options available through loans for federal employees to potentially secure lower interest rates or more flexible repayment terms.

Customer Service and Support: Lightstream Auto Loan

Lightstream provides a range of customer service channels to assist borrowers with their loan needs.

Customer Service Channels

Lightstream offers several ways to contact customer support:

- Phone: You can call their customer service hotline during business hours.

- Email: You can send an email inquiry through their website.

- Live chat: Lightstream provides a live chat feature on its website for immediate assistance.

- Online resources: Their website features a comprehensive FAQ section and other resources to answer common questions.

Responsiveness and Helpfulness

Lightstream is generally known for its responsive and helpful customer support. However, the quality of service can vary depending on the specific issue and time of day.

Planning to purchase a home with a traditional mortgage? Understanding the current 30-year fixed mortgage rates can help you make informed decisions about your home financing.

Customer Reviews and Testimonials

Online reviews and testimonials can provide valuable insights into the customer service experiences of others. It’s recommended to read reviews from reputable sources to gauge the overall satisfaction of Lightstream customers.

Looking for a reputable lender? Rise Loans offers a variety of loan options, including personal loans and installment loans. Check out their website to learn more about their services and eligibility requirements.

Ease of Managing Loans Online

Lightstream offers a user-friendly online platform for managing and tracking loans. Borrowers can easily access their account information, make payments, and communicate with customer support through the platform.

For immediate financial assistance, consider exploring instant personal loan online options. These loans can be processed quickly, providing you with the funds you need in a pinch.

Comparison with Competitors

Lightstream auto loans compete with offerings from other major lenders, each with its own strengths and weaknesses.

Comparing Lightstream to Other Lenders

When comparing Lightstream to competitors, it’s essential to consider factors such as interest rates, loan terms, fees, and customer service.

Need cash quickly? Same day cash advance options can provide funds within a single business day. However, be aware of potential fees and high interest rates associated with these short-term loans.

Strengths of Lightstream

- Competitive interest rates: Lightstream is often known for its competitive interest rates.

- No origination fees: Lightstream does not charge origination fees, saving borrowers money.

- Fast funding: Lightstream is known for its quick funding process.

- User-friendly online platform: Lightstream provides a convenient online platform for managing loans.

Weaknesses of Lightstream

- Limited loan amounts: Lightstream may have limits on the maximum loan amounts offered.

- Credit score requirements: Lightstream typically requires a minimum credit score of 660.

Table of Key Features and Rates

To provide a comprehensive comparison, a table showcasing key features and rates from different lenders can be helpful. This table should include information on interest rates, loan terms, fees, and other relevant factors.

Before you apply for any loan, it’s essential to understand your loan eligibility. Factors like your credit history, income, and debt-to-income ratio play a significant role in determining whether you qualify.

Factors to Consider When Choosing a Lender

When deciding between Lightstream and other lenders, consider the following factors:

- Interest rates: Compare interest rates from different lenders to find the best deal.

- Loan terms: Choose a loan term that aligns with your financial situation.

- Fees: Be aware of any fees associated with the loan, such as origination fees or prepayment penalties.

- Customer service: Evaluate the lender’s customer service reputation and responsiveness.

- Online platform: Consider the ease of use and functionality of the lender’s online platform.

Potential Risks and Considerations

While Lightstream offers competitive auto loans, it’s crucial to be aware of potential risks and considerations before borrowing.

Are you struggling with student loan debt? Explore the options available through Studentaid Gov Debt Relief to potentially reduce your monthly payments or even qualify for loan forgiveness.

Potential Risks Associated with Lightstream Auto Loans

- High interest rates: If you have a lower credit score, you may face higher interest rates, which can increase the overall cost of the loan.

- Loan default: Failing to make loan payments on time can result in penalties, damage your credit score, and potentially lead to repossession of the vehicle.

Understanding Loan Terms and Conditions

Thoroughly review the loan terms and conditions before signing any loan documents. Pay attention to the interest rate, loan term, fees, and any other provisions that may affect your repayment obligations.

Implications of Defaulting on a Lightstream Auto Loan

Defaulting on a Lightstream auto loan can have serious consequences, including:

- Late fees and penalties: You may be charged late fees and penalties for missed payments.

- Damaged credit score: Defaulting on a loan can significantly damage your credit score, making it difficult to obtain future loans or credit.

- Repossession: If you fail to make payments, Lightstream may repossess the vehicle.

Responsible Borrowing and Managing Debt

Responsible borrowing involves carefully considering your financial situation and only borrowing what you can afford to repay. Here are some tips for managing debt:

- Create a budget: Track your income and expenses to understand your financial situation.

- Prioritize debt repayment: Make payments on time and focus on paying down high-interest debt first.

- Avoid unnecessary debt: Limit your borrowing to essential expenses and avoid taking on unnecessary debt.

- Seek professional help: If you’re struggling to manage debt, consider seeking advice from a financial advisor or credit counselor.

Ending Remarks

In conclusion, Lightstream Auto Loan presents a compelling option for borrowers seeking a convenient, transparent, and competitive auto financing solution. With its streamlined application process, competitive interest rates, and excellent customer service, Lightstream empowers borrowers to make informed decisions and secure the best possible financing terms.

Need a quick cash infusion? Quick personal loans can provide fast access to funds, but be sure to compare interest rates and repayment terms to avoid getting caught in a debt cycle.

By understanding the key features, eligibility criteria, and potential benefits of Lightstream Auto Loans, individuals can navigate the auto financing landscape with confidence and find the right loan to meet their specific needs.

Commonly Asked Questions

What is the minimum credit score required for a Lightstream Auto Loan?

Shopping for a mortgage? Finding the best mortgage rates is crucial to keeping your monthly payments affordable. Use online tools and compare offers from different lenders to secure the most competitive terms.

While Lightstream doesn’t publicly disclose a minimum credit score requirement, having a good credit history is generally recommended for loan approval and competitive interest rates.

How long does it take to get approved for a Lightstream Auto Loan?

The loan approval process can vary depending on individual circumstances, but Lightstream aims to provide a quick and efficient experience. Many borrowers receive a decision within minutes of submitting their application.

Does Lightstream offer pre-approval for auto loans?

Yes, Lightstream offers pre-approval for auto loans, allowing borrowers to get an estimate of their potential loan terms and interest rates before applying for financing.

Are you planning a new home construction project? You’ll need to secure financing, and understanding construction loan rates is crucial. These rates can vary depending on factors like your credit score, the loan amount, and the location of your project.

Can I use a Lightstream Auto Loan to finance a used car?

Yes, Lightstream offers financing options for both new and used cars.