Travel Insurance With Covid Cover 2024 has become an essential part of planning any trip, especially in the wake of the pandemic. As the world reopens and travel resumes, the need for comprehensive coverage has intensified, and understanding the specific benefits of COVID-19 related travel insurance is crucial.

Life insurance is a crucial part of financial planning. Life Insurance 2024 provides financial security for your loved ones in the event of your passing. It’s important to choose a plan that meets your needs.

Navigating travel regulations and potential disruptions caused by COVID-19 can be daunting, but with the right insurance, you can have peace of mind knowing you’re protected.

Choosing the right Personal Health Insurance 2024 is crucial. There are many factors to consider, like your health status, budget, and coverage needs. It’s important to shop around and compare plans.

This guide will delve into the key aspects of travel insurance with COVID-19 cover, exploring the benefits, considerations, and tips for selecting the right plan. We’ll also examine the evolving landscape of travel regulations and how insurance can help you navigate these challenges.

Driving safely is important, but accidents can happen. Affordable Car Insurance 2024 can help you find the right coverage at a price you can afford. Compare quotes from different providers.

Introduction to Travel Insurance with COVID Cover

In the wake of the COVID-19 pandemic, the travel landscape has undergone a significant transformation. The need for comprehensive travel insurance has become more crucial than ever, as travelers face uncertainties and potential disruptions related to the virus. This article explores the importance of travel insurance with COVID-19 coverage, providing insights into the evolving travel landscape and the unique challenges travelers face in 2024.

Looking for health insurance with extensive coverage? Blue Cross Health Insurance 2024 offers a variety of plans to suit different needs, including individual and family coverage. They are known for their strong network of healthcare providers.

Importance of Travel Insurance in the Post-Pandemic Era

Travel insurance has always been a valuable safety net for travelers, but its significance has amplified in the post-pandemic era. With ongoing concerns about COVID-19, travelers need comprehensive coverage to protect themselves from financial losses and unexpected medical expenses. Travel insurance provides peace of mind and financial security, allowing travelers to enjoy their trips with less worry.

Medicare can be complex, but Aarp Medicare Supplement 2024 can help you navigate the system. These supplemental plans help cover out-of-pocket costs and offer peace of mind for your healthcare needs.

Evolving Travel Landscape and the Increased Need for Comprehensive Coverage

The travel industry is constantly evolving, with new regulations, restrictions, and health protocols emerging. Travelers face a complex web of requirements, including vaccination mandates, testing procedures, and quarantine policies. Comprehensive travel insurance, with COVID-19 coverage, offers essential protection against these uncertainties.

Maintaining good oral health is essential. Cigna Dental Insurance 2024 offers plans that cover a variety of dental services, helping you manage your dental costs.

It can help travelers navigate changing travel regulations, cover unexpected medical expenses, and mitigate financial losses in case of trip disruptions.

Unforeseen home emergencies can be stressful and expensive. Home Emergency Cover 2024 can provide financial protection in case of unexpected events, giving you peace of mind.

Unique Challenges Travelers Face in 2024

Travelers in 2024 continue to face unique challenges related to COVID- 19. These include:

- Evolving Travel Restrictions:Countries are constantly adjusting their travel policies, leading to potential disruptions and last-minute changes to itineraries.

- COVID-19 Testing Requirements:Travelers may need to undergo multiple COVID-19 tests before, during, and after their trips, adding to the cost and complexity of travel.

- Quarantine Policies:Unexpected quarantine requirements can disrupt travel plans and incur additional expenses, such as accommodation and living costs.

- Medical Expenses:The potential for COVID-19-related medical expenses abroad can be significant, especially in countries with high healthcare costs.

Understanding COVID-19 Coverage in Travel Insurance

Travel insurance plans with COVID-19 coverage provide specific benefits to protect travelers from disruptions and financial losses related to the virus. These plans typically include a range of coverage options, addressing different aspects of travel.

Aetna is a well-known provider of Medicare Advantage plans. Aetna Medicare Advantage 2024 offers a range of plans, including those with prescription drug coverage and other benefits.

COVID-19 Related Benefits in Travel Insurance Plans

Travel insurance plans with COVID-19 coverage typically include the following benefits:

- Medical Expenses:Coverage for medical expenses incurred due to COVID-19, including hospitalization, treatment, and medication.

- Quarantine Costs:Reimbursement for accommodation and living expenses if travelers are required to quarantine due to a positive COVID-19 test.

- Trip Cancellation or Interruption:Coverage for trip cancellation or interruption due to COVID-19-related reasons, such as positive test results, travel restrictions, or illness.

- Emergency Evacuation:Assistance with medical evacuation if travelers require urgent medical care or hospitalization due to COVID-19.

- Lost Luggage:Coverage for lost or damaged luggage due to COVID-19-related disruptions, such as delays or cancellations.

Types of COVID-19 Coverage in Travel Insurance, Travel Insurance With Covid Cover 2024

Travel insurance plans with COVID-19 coverage can vary in the specific benefits they offer. Some plans provide comprehensive coverage, while others focus on specific aspects, such as medical expenses or trip cancellation. It’s essential to carefully compare different plans and choose one that aligns with your individual travel needs.

If you’re looking for a long-term financial safety net for your loved ones, Whole Life Insurance 2024 might be a good choice. It provides a death benefit and builds cash value over time.

Scenarios Where COVID-19 Coverage Would Be Crucial

Here are some scenarios where COVID-19 coverage in travel insurance would be crucial:

- Testing Positive for COVID-19:If you test positive for COVID-19 while traveling, travel insurance can cover medical expenses, quarantine costs, and trip cancellation or interruption.

- Travel Restrictions:If your destination country imposes new travel restrictions, such as quarantine requirements or flight cancellations, travel insurance can provide financial protection and assistance with rebooking flights or accommodation.

- Medical Emergency:If you require medical care due to COVID-19, travel insurance can cover hospitalization, treatment, and emergency evacuation costs.

- Trip Interruption:If you need to cut your trip short due to COVID-19-related reasons, travel insurance can reimburse you for unused travel expenses and provide assistance with returning home.

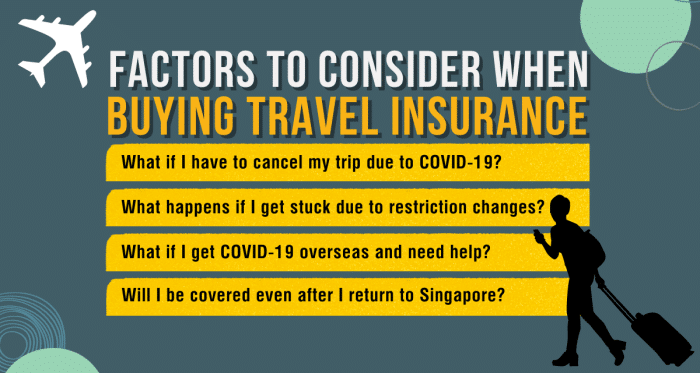

Key Considerations for Choosing Travel Insurance with COVID Cover

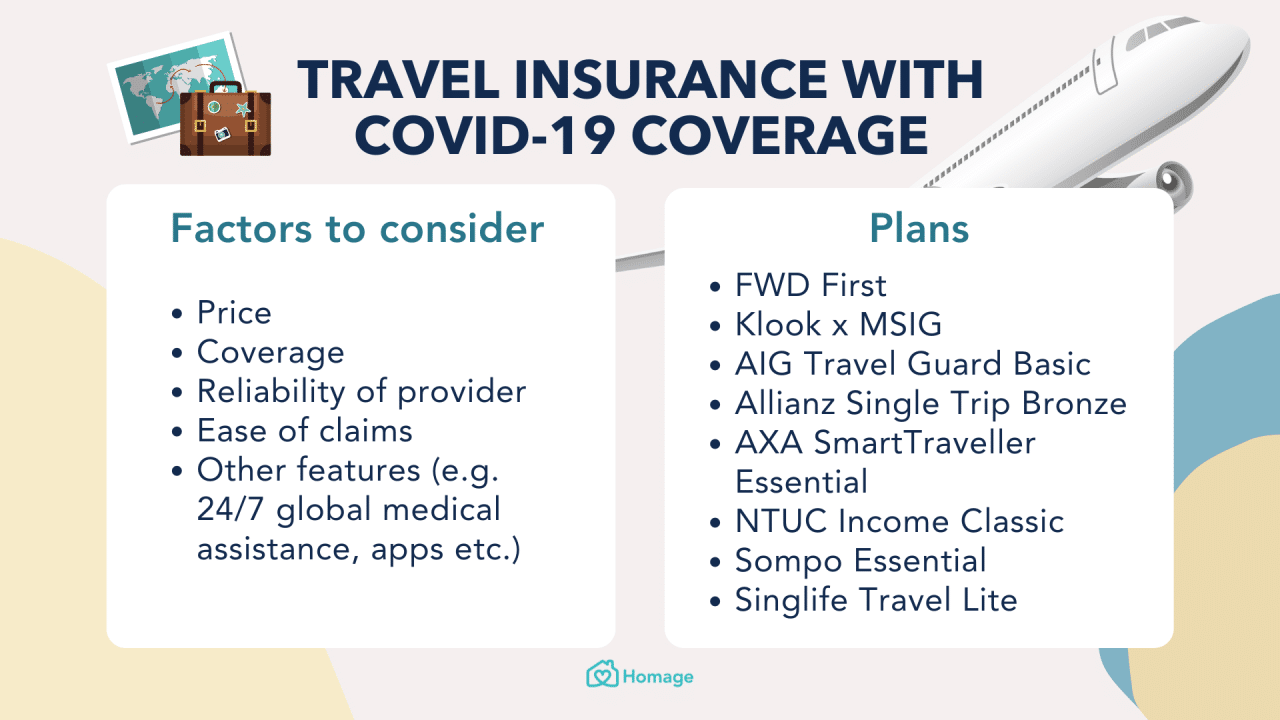

When selecting travel insurance with COVID-19 coverage, several factors are essential to consider. Understanding these factors can help you choose a plan that meets your specific travel needs and provides adequate protection.

New York Life is a reputable insurance provider, offering a wide range of financial products. To learn more about their offerings, visit their website: Newyorklife 2024.

Factors to Consider When Selecting a Travel Insurance Plan

Here are some key factors to consider when choosing a travel insurance plan with COVID-19 coverage:

- Coverage Limits:Check the coverage limits for different benefits, such as medical expenses, quarantine costs, and trip cancellation.

- Exclusions:Carefully review the policy’s exclusions, which are specific situations or conditions that are not covered. This could include pre-existing medical conditions, certain types of activities, or specific destinations.

- Pre-existing Conditions:If you have any pre-existing medical conditions, ensure that the plan covers them. Some plans may require additional medical underwriting or have specific limitations.

- Policy Terms and Conditions:Read the policy terms and conditions carefully to understand the coverage details, limitations, and claim procedures.

- Reputation of the Insurance Provider:Research the reputation of the insurance provider, checking customer reviews and ratings to ensure they have a good track record of handling claims fairly and efficiently.

Key Features to Look for in Travel Insurance with COVID Cover

When choosing travel insurance with COVID-19 coverage, look for these key features:

- Comprehensive Coverage:The plan should provide comprehensive coverage for medical expenses, quarantine costs, trip cancellation, and other COVID-19-related disruptions.

- Flexible Coverage Options:The plan should offer flexible coverage options, allowing you to customize it to meet your specific travel needs.

- Clear and Concise Policy Language:The policy terms and conditions should be clear and easy to understand, avoiding jargon or confusing language.

- Reliable Customer Service:The insurance provider should have a reliable customer service team available to answer questions and assist with claims.

Importance of Understanding Policy Terms and Conditions

Understanding the policy terms and conditions is crucial when choosing travel insurance. These documents Artikel the coverage details, limitations, and claim procedures. Carefully review the policy to ensure you understand the scope of coverage, any exclusions, and the process for filing claims.

Outcome Summary

In conclusion, Travel Insurance With Covid Cover 2024 provides essential protection for travelers in the post-pandemic world. By understanding the different coverage options, key considerations, and tips for choosing the right plan, you can embark on your travels with confidence and peace of mind.

Medicare Advantage plans can provide comprehensive coverage, and Uhc Medicare Advantage 2024 offers a variety of plans to choose from. You can compare plans and find one that suits your needs.

As the travel industry continues to adapt to the evolving COVID-19 situation, staying informed about travel insurance and its role in safeguarding your journey is paramount.

:

If you’ve recently lost your job, Cobra Health Insurance 2024 might be a good option for you. It allows you to continue your health insurance coverage for a limited time, giving you peace of mind during a transition period.

Expert Answers: Travel Insurance With Covid Cover 2024

What are the common COVID-19 related benefits included in travel insurance plans?

Common benefits include medical expenses related to COVID-19, quarantine costs, trip cancellation or interruption due to COVID-19, and emergency medical evacuation.

How do I know if my existing travel insurance policy covers COVID-19?

Review your policy documents carefully, specifically looking for clauses related to pandemics, infectious diseases, or COVID-19. Contact your insurance provider for clarification if you’re unsure.

What are some tips for finding the right travel insurance with COVID-19 coverage?

Compare plans from multiple reputable providers, consider your specific travel needs and destination, and read policy terms and conditions thoroughly before purchasing.

A whole life insurance policy provides lifelong coverage and cash value accumulation. To learn more about these policies, visit: Whole Life Insurance Policy 2024.

Geico is a popular insurance company known for its competitive rates and excellent customer service. To learn more about their offerings, visit: Geico Insurance Company 2024.

Traveling can be exciting, but it’s also important to be prepared for unexpected events. Travel Insurance Quote 2024 can help you get the right coverage for your trip, providing peace of mind during your travels.