National Mortgage 2024 presents a dynamic landscape shaped by evolving interest rates, economic trends, and innovative technologies. This year, navigating the mortgage market requires a keen understanding of factors influencing affordability, the emergence of new mortgage products, and the impact of regulatory changes on lenders and borrowers alike.

US Bank is a well-known lender offering various mortgage options. To explore US Bank’s mortgage products and rates for 2024, visit Us Bank Mortgage 2024.

From analyzing the current interest rate environment and its impact on mortgage affordability to exploring the rise of digital closings and alternative mortgage products, this exploration delves into the key considerations for both lenders and borrowers in 2024.

Looking to lower your monthly mortgage payments? Consider refinancing your FHA loan. You can find information on current FHA refinance rates and eligibility requirements for 2024 by checking out Fha Refinance 2024.

The Current State of the Mortgage Market in 2024

The mortgage market in 2024 is navigating a complex landscape shaped by rising interest rates, persistent inflation, and an evolving economic outlook. These factors have a significant impact on mortgage affordability and the overall housing market. Understanding the current state of the mortgage market is crucial for both prospective homebuyers and lenders.

Rocket Mortgage is a popular online mortgage lender. You can manage your Rocket Mortgage account and find information about their services for 2024 at My Rocket Mortgage 2024.

Interest Rate Environment and Affordability

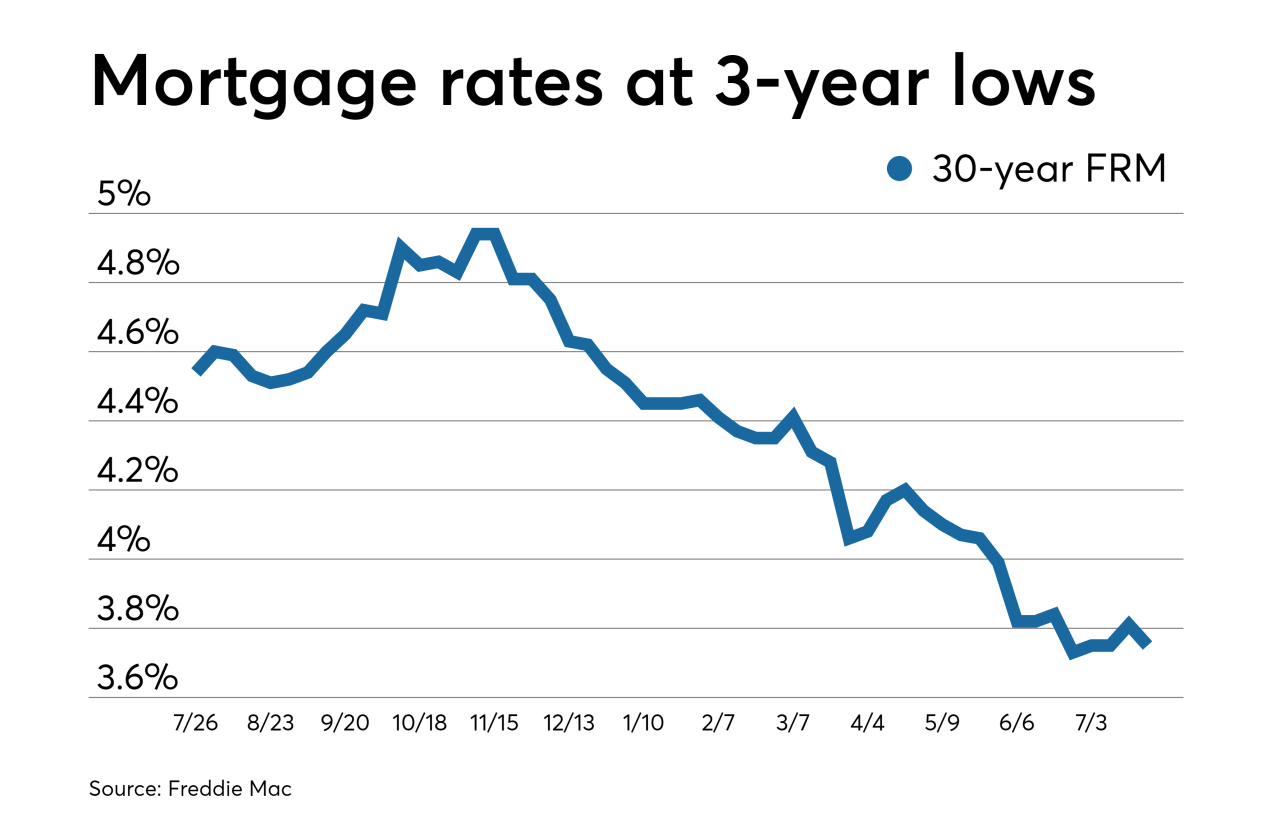

Interest rates have been on an upward trajectory in recent months, driven by the Federal Reserve’s efforts to combat inflation. This has led to higher borrowing costs for homebuyers, making mortgages less affordable. The impact of rising interest rates on affordability is particularly pronounced for first-time homebuyers and those with limited budgets.

If you’re planning to buy a home with a mortgage of $400,000, it’s essential to understand your monthly payment obligations. 400k Mortgage Payment 2024 can help you estimate your monthly payments and explore different mortgage options.

Inflation and Economic Growth

Inflation remains a key concern for the mortgage market. High inflation erodes purchasing power and can lead to increased borrowing costs. Economic growth is another factor that influences mortgage demand. A strong economy typically leads to increased demand for housing, while a weak economy can dampen demand.

Stay informed about current mortgage loan rates to make the best financial decisions for your home purchase. You can find up-to-date mortgage loan rates for 2024 at Mortgage Loan Rates Today 2024.

Comparison with Previous Years

The current mortgage market is significantly different from the market in previous years. In recent years, interest rates were historically low, making homeownership more accessible. However, the current environment of rising interest rates has shifted the landscape, making affordability a greater challenge.

The interest rates on housing loans are constantly fluctuating, so it’s important to stay up-to-date on the latest trends. You can find current housing loan interest rates for 2024 at Housing Loan Interest 2024.

Key Trends Shaping the National Mortgage Landscape

The national mortgage landscape is being reshaped by emerging trends in technology, product innovation, and regulatory changes. These trends are transforming the way mortgages are originated, underwritten, and serviced. Understanding these trends is essential for both lenders and borrowers.

It’s helpful to understand the average down payment for a house. You can find information on average down payment amounts for 2024 at Average Down Payment On A House 2024.

Mortgage Technology

The mortgage industry is embracing technological advancements that streamline processes and enhance the borrower experience. Online applications, digital closings, and automated underwriting systems are becoming increasingly common. These technologies reduce paperwork, expedite transactions, and improve transparency.

Chase Bank is another major lender offering mortgage products. Learn about Chase mortgage rates for 2024 at Chase Mortgage Rates 2024.

Alternative Mortgage Products

The popularity of alternative mortgage products is on the rise. Adjustable-rate mortgages (ARMs) offer lower initial interest rates than fixed-rate mortgages but carry the risk of higher rates in the future. Jumbo loans are designed for borrowers with higher credit scores and larger down payments and can offer more favorable terms.

Rocket Mortgage is a popular online lender that offers refinance options. To explore Rocket Mortgage refinance rates for 2024, visit Rocket Mortgage Refinance Rates 2024.

Regulatory Changes

Regulatory changes continue to impact the mortgage industry. Recent regulations have focused on improving consumer protections, enhancing transparency, and ensuring responsible lending practices. These regulations can influence lending standards, eligibility requirements, and the types of mortgage products offered.

A home equity line of credit (HELOC) can be a helpful financing option. You can find information on HELOC interest rates for 2024 at Home Equity Line Of Credit Interest Rates 2024.

Homebuyer Considerations in 2024: National Mortgage 2024

Obtaining a mortgage is a significant financial decision that requires careful planning and consideration. Homebuyers should be aware of key factors that can impact their mortgage options and affordability.

The prime mortgage rate is a benchmark rate used to determine other mortgage rates. Find the current prime mortgage rate for 2024 at Prime Mortgage Rate 2024.

Factors to Consider, National Mortgage 2024

- Credit Score:A higher credit score typically results in lower interest rates and better loan terms.

- Debt-to-Income Ratio:Lenders use this ratio to assess your ability to repay debt. A lower ratio generally leads to more favorable mortgage terms.

- Down Payment:A larger down payment can reduce the amount of money you need to borrow and potentially lower your monthly payments.

- Interest Rates:Interest rates can fluctuate, so it’s essential to shop around and compare rates from different lenders.

- Mortgage Type:Choose a mortgage type that aligns with your financial goals and risk tolerance.

Homebuyer Checklist

A comprehensive checklist can help ensure that you are prepared for the mortgage process.

If you’re eligible for a VA loan, it’s important to know the current interest rates. You can find up-to-date VA interest rates for 2024 at Va Interest Rates Today 2024.

- Review your credit report and score.

- Calculate your debt-to-income ratio.

- Save for a down payment.

- Shop around for mortgage rates and lenders.

- Get pre-approved for a mortgage.

- Review the loan documents carefully.

Importance of Credit Scores and Debt-to-Income Ratios

Credit scores and debt-to-income ratios are crucial factors in mortgage qualification. Lenders use these metrics to assess your creditworthiness and ability to repay debt. A strong credit score and a low debt-to-income ratio can improve your chances of getting approved for a mortgage and securing favorable terms.

VA loans offer unique benefits for eligible veterans and active-duty military personnel. Learn about VA loan interest rates for 2024 at Va Loan Interest Rate 2024.

Mortgage Lenders and their Offerings

A variety of mortgage lenders operate in the market, each with its own strengths and weaknesses. Understanding the differences between these lenders can help you choose the best option for your needs.

Getting pre-approved for a mortgage can make the home buying process smoother and more efficient. Learn more about getting pre-approved for a mortgage in 2024 at Get Preapproved For A Mortgage 2024.

Types of Lenders

- Banks:Banks are traditional mortgage lenders with extensive resources and a wide range of products.

- Credit Unions:Credit unions are member-owned financial institutions that often offer competitive rates and personalized service.

- Mortgage Brokers:Mortgage brokers act as intermediaries, connecting borrowers with multiple lenders to find the best rates and terms.

Comparison of Lender Offerings

| Lender Type | Interest Rates | Fees | Customer Service |

|---|---|---|---|

| Banks | Competitive rates | Potentially higher fees | May vary depending on the bank |

| Credit Unions | Often competitive rates | Lower fees | Typically personalized and responsive |

| Mortgage Brokers | Access to a wider range of lenders | Fees may vary depending on the broker | Can provide expert guidance |

Finding a Reputable Mortgage Lender

Choosing a reputable mortgage lender is crucial for a smooth and successful homebuying experience.

- Research and compare lenders.

- Read reviews and testimonials.

- Ask for referrals from trusted sources.

- Consider the lender’s track record and reputation.

The Future of National Mortgages

The national mortgage market is expected to continue evolving in the coming years, driven by technological advancements, economic conditions, and regulatory changes. Understanding the potential trends and challenges is crucial for stakeholders in the mortgage industry.

Impact of Rising Interest Rates

Rising interest rates are likely to continue impacting the mortgage market. Higher borrowing costs could lead to reduced demand for housing and potentially slower home price appreciation.

Role of Technology

Technology will continue to play a transformative role in the mortgage industry. Artificial intelligence (AI), blockchain, and other technologies are expected to further streamline processes, improve efficiency, and enhance the borrower experience.

Are you planning to buy a home with an FHA loan? Knowing the required down payment is crucial. You can find information on FHA down payment requirements for 2024 at Fha Down Payment 2024.

Challenges and Opportunities

The national mortgage market faces a number of challenges, including rising interest rates, economic uncertainty, and regulatory changes. However, there are also opportunities for growth, such as the expansion of alternative mortgage products, the increasing use of technology, and the growing demand for affordable housing.

Conclusive Thoughts

As we look ahead, the future of national mortgages is poised for further innovation, with technology playing a pivotal role in shaping the industry. Navigating this evolving landscape requires staying informed about market trends, understanding lender offerings, and making well-informed decisions to achieve your homeownership goals.

Questions Often Asked

What are the biggest challenges facing the mortgage market in 2024?

Rising interest rates, economic uncertainty, and potential regulatory changes are some of the key challenges facing the mortgage market in 2024.

What are the most popular alternative mortgage products available today?

Adjustable-rate mortgages (ARMs) and jumbo loans are gaining popularity as alternative mortgage products, offering potential benefits in certain situations.

How can I improve my chances of getting approved for a mortgage?

Maintaining a good credit score, managing debt-to-income ratio, and having a stable income are crucial for mortgage approval.